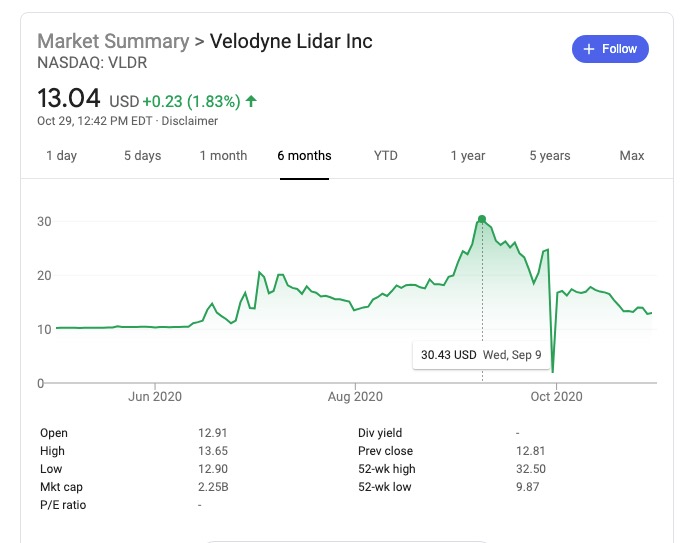

Velodyne, the manufacturer of Light Detection and Ranging (Lidar) remote sensing devices has recently merged with Graf Industrial. VLDR Stock is rocked by heightened volatility following the closure of the much-anticipated business combination event. The stock had hit the $30 mark, before crashing back to the $13 mark as of today.

History of the Velodyne Company

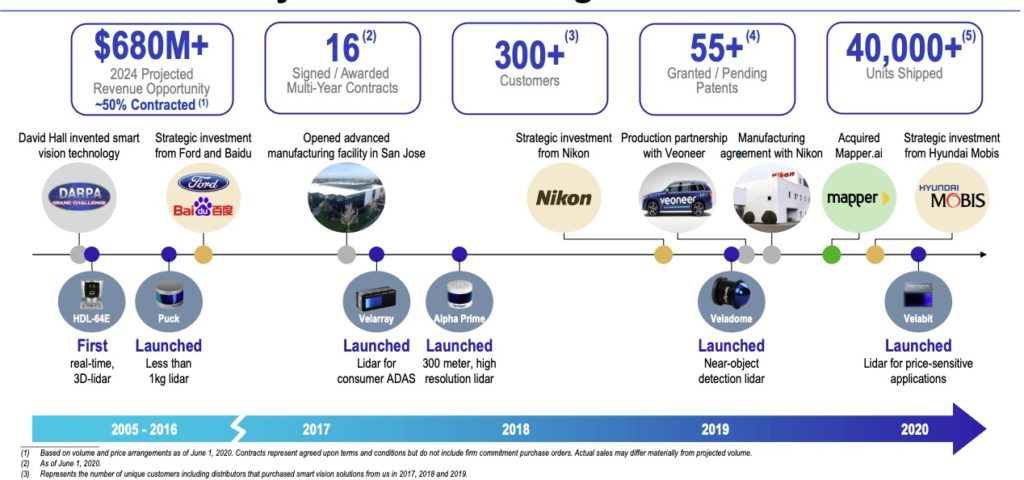

Velodyne Lidar is a Silicon Valley-based LiDAR technology company. David Hall founded Velodyne in 1983 as an audio company and named it Velodyne Acoustics. In 2005, David Hall and his brother Bruce entered a vehicle in a driverless car race called DARPA Grand Challenge. They developed a new system that produced one million data points per second, while earlier systems produced 5,000 data points per second.

In 2016, Velodyne’s Lidar department was spun off from Velodyne Acoustics as Velodyne Lidar, Inc. On August 16, 2016, Velodyne announced a $150M investment from Ford and Baidu. In 2017, the company opened their fully automated mega factory in San Jose, California, to speed up production while reducing the cost of sensors. Velodyne also has a production facility in Morgan Hill, California, and an R&D center in Alameda, California.

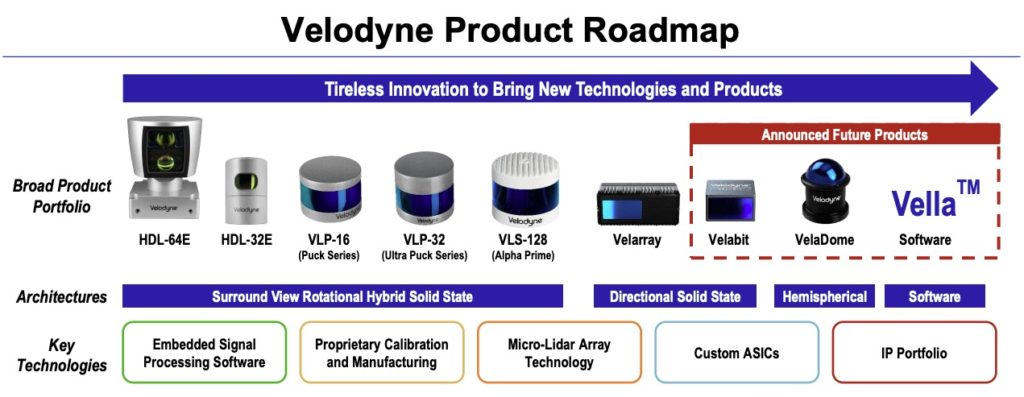

Alpha Puck, Velarray and VelaDome are the company’s main products. In 2018, Velodyne signed agreements to collaborate with Nikon and Veoneer for manufacturing and mass production.

Velodyne goes public with reverse merger

On July 2, 2020, Velodyne LiDAR announced that it would combine with Graf Industrial, a Special Purpose Acquisition Company. The combined company became publicly tradable on NASDAQ with ticker VLDR.

VLDR Stock Valuation

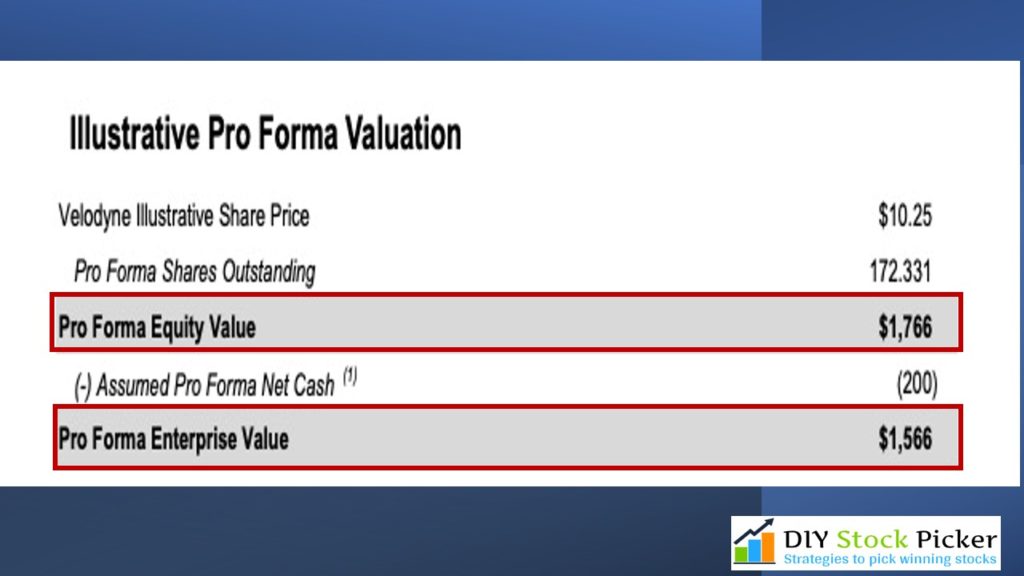

- Valuation implies a pro forma enterprise value of $1.6 billion and equity value of $1.8 billion.

- Existing Velodyne stockholders will receive 83% of the pro forma equity and $50 million in cash

- Fully committed PIPE of $150 million

- Transaction will result in approximately $192 million cash to the balance sheet to fund growth

VLDR Stock Pro Forma ownership

- Velodyne shareholders get 83.3% stake

- SPAC Shares 6.6%

- PIPE Shares of 8.7%

- Founder Shares 1.3%

- There is a clause in the contract that Velodyne owners and SPAC founders will be granted additional shares if the stock trades higher than $15 per share for 20 out of 30 trading days 6 months following the completion of the business transaction.

VLDR Stock Bull Case

- Estimated contracted revenue of up to $800 million through 2024. Since its contracted revenue, there is some guarantee that the revenue will be realized.

- 300 plus customers with $570 million of cumulative revenue so far since 2010.

- There is an opportunity of 60% cumulative revenue growth until 2024. This may sound a bit exaggerated but a safe number would be between 35 to 40% growth.

- Once a company signs a contract to use Velodyne LIDAR, it is locked into the system since the switching costs to another LIDAR provider are high. This gives a moat to the business in realizing recurring revenues.

- The barriers to entry LIDAR field are high preventing competition from poorly funded companies.

- The company is backed by investors including and not limited to Ford and Baidu.

VLDR Stock Bear Case

- Since many of the markets in which Velodyne competes are new and rapidly evolving, it is difficult to forecast long-term end-customer adoption rates and demand for Velodyne’s products. Hence many of the financial projections may not actually realize tangible revenues. Currently the company is burning about 50 million cash per year.

- Velodyne’s LIDAR sensors are costly. Estimated at $75,000 per sensor. The newer camera technology sensors used in the Tesla AutoPilot are more cheaper.

- The market conditions in the future may not be conducive for Velodyne to market its products especially if the pandemic lingers on affecting the world economy.

- The shares held by PIPE investors are freely tradable without any lock-in periods. This may be one of the reasons why there is so much pressure on the stock right now with all the selling happening.

Conclusion

Looking at the valuation, it does look the stock is overvalued even at the current price and the reason is that future growth has already been priced into the stock price. If the market downturn occurs, then that will result in contraction of the valuation. Looking at the volatility, there may be a chance of further contraction since the market is very volatile right now. I would say if you can get in at an enterprise value of $1 billion which will be about $7 per share, that would give you upside in the future.