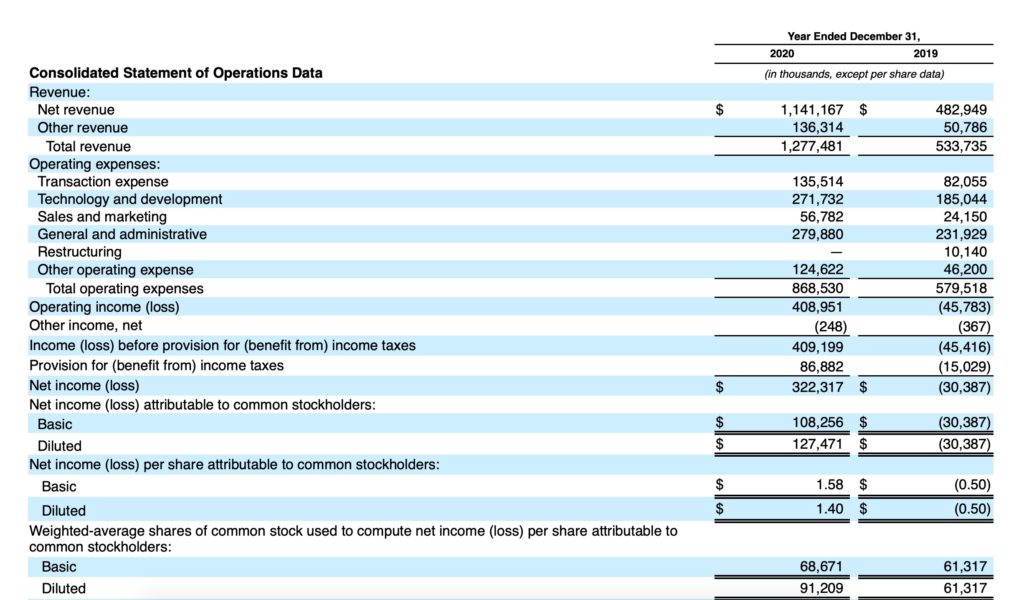

Coinbase stock IPO went through a direct listing rather than a traditional IPO. The company is targeting an initial valuation of $100 billion. The company had a 126% increase of revenue from $533 million in 2019 to $1.3 billion in 2020.

These are the results from the first quarter of 2021.

- Verified Users of 56 million.

- Monthly Transacting Users or MTUs of 6.1 million.

- Assets on Platform of $223 billion, which represents 11.3% crypto asset market share.

- This includes $122 billion of Assets on Platform from Institutions.

- And lastly, a Trading Volume of $335 billion within the quarter.

Turning to the financial performance for the first quarter:

- Coinbase generated Total Revenue of approximately $1.8 billion

- Net Income between $730 million – $800 million

- And Adjusted EBITDA of approximately $1.1 billion

Coinbase stock key highlights

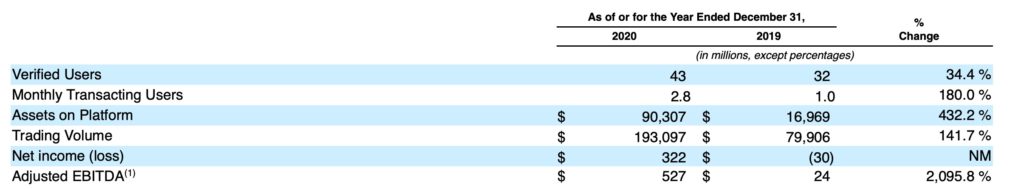

- There are 43 million verified users in 2020 up from 32 million in 2019.

- There are 2.8 million monthly transacting users on the platform.

- A significant growth in the number of institutions on the platform, increasing from over 1,000 as of December 31, 2017 to 7,000 as of December 31, 2020.

- Revenue for the year 2020 was $1.1 billion dollars.

- 96% of the revenue is derived from the trading volume on the platform. Historically the trading volume has been tied to the price of Bitcoin and other crypto assets.

- Coinbase was profitable in 2020 with a Net income of $322 million.

- The customers had traded over $456 billion on the platform since inception and stored over $90 billion worth of assets across the platform.

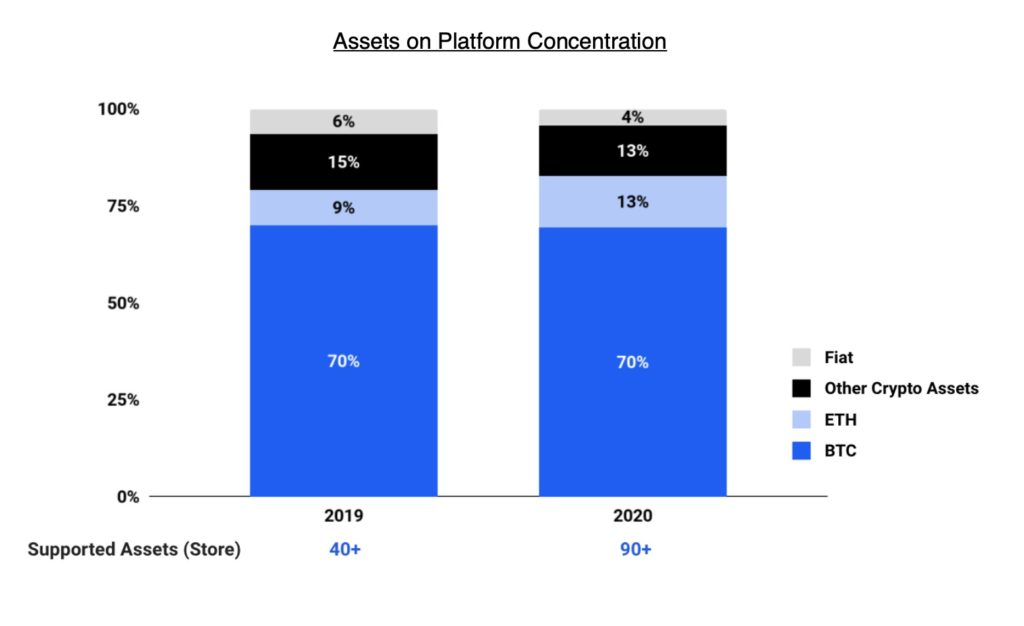

- Bitcoin and Ethereum represented 83% of Assets on Platform. The remaining balance consisted of other crypto coins and fiat currencies.

- The company is introducing subscription based value added services on the platform. The strategy is to diversify and reach revenues that are not tied to the volatility in the crypto market.

Crypto exclusive platform

The platform is powered by a robust backend technology system. This enables them to develop, launch, and market new products and services. The following are the key elements on the platform:

- 15+ native blockchain integrations and counting. The company has developed custom technology and processes to directly integrate with over 15 blockchain protocols and efficiently support new protocols.

- Coinbase is the market leading brand exclusively focused on the crypto economy. It is a financial technology provider that offers services to customers in over 100 countries, and is one of the longest running crypto platforms

- The customers have never lost funds due to a security breach of the platform. Coinbase is also licensed to engage in money transmission and virtual currency business in almost all U.S. states and they continue to pursue licensing in select jurisdictions internationally.

- Coinbase is the default platform where new users go to in order to buy Bitcoin and other assets. They have grown organically by the word of mouth rather than by marketing.

- Coinbase has a significant scale, securely storing over $90 billion in total assets. This gives a good foundation to growing with the customers and upselling new products and services.

- Coinbase has a robust technology platform that is built to deal with the real-time, global and 24/7/365 nature of crypto asset markets. Thus they can rapidly research, develop, and launch new products and features.

- The company operates a marketplace with one of the deepest pools of liquidity and a network effect. This deep pool of liquidity for exchanging a wide range of crypto assets is supported by a healthy mix of retail and institutional activity.

Coinbase stock Financials

The company has cash or cash equivalents of $1.1 billion on its balance sheet. The revenue for the year 2020 was $1.1 billion. The company is profitable with a net income of $322 million.

The shares outstanding is 146 million class A and 186 million class B shares. These include all the stock based compensation and conversion of the RSUs into common shares. If we value the company at 100 billion at IPO, then divide by the 332 million shares outstanding. That gives the IPO price of $300 per share.

Risk factors

- The net revenue is substantially dependent on the prices of crypto assets and volume of transactions conducted on the platform. If such price or volume declines, the business, operating results, and financial condition would be adversely affected. The company derives majority of the revenue from transactions in Bitcoin and Ethereum. If demand for these crypto assets declines, the financial condition could be adversely affected.

- There is always a risk of cyberattacks and security breaches of the platform. To their credit, Coinbase maintains the highest security standards and is compliant with all regulations.

- The crypto economy is a highly competitive industry and they compete against unregulated companies and companies with greater financial and other resources. The crypto exchanges are turning into a commodity. New companies are entering the market every day.

- The valuation of $100 billion is extremely high for a company producing $1 billion revenue in 2020. Agreed the company is growing exponentially and it may produce $8 billion revenue, but there is already too much growth that is priced into the Coinbase right now. Since it’s a highly anticipated IPO, the price may start with a 10 to 15% jump by the time the ticker shows up in retail accounts. If your time horizon is small, then by all means go for swing trades. Coinbase stock is a very risky bet for long term investors.