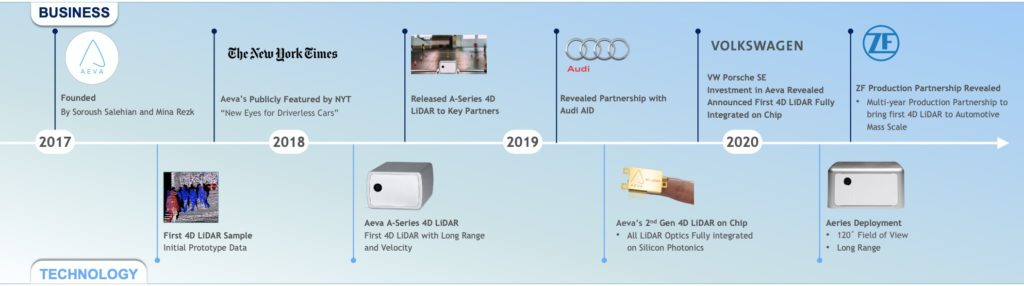

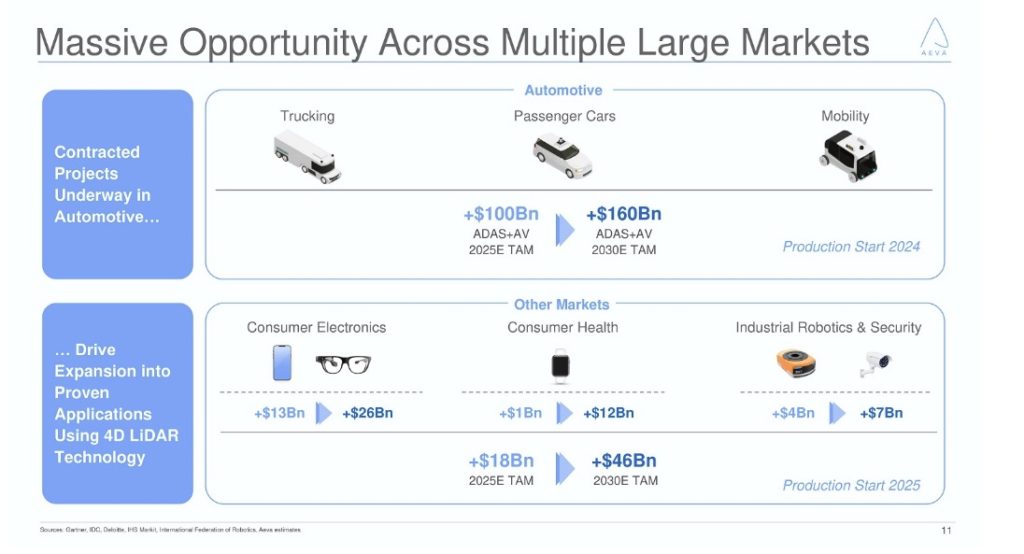

Aeva Inc., a maker of LiDAR Sensors. The company was founded in 2017 by former Apple engineers Soroush Salehian and Mina Rezk. The company has developed a powerful software stack. Aeva stock brings its perception platform to a range of industries beyond automotive, including consumer electronics, consumer health, industrial robotics, and security.

This is after the two other LiDAR stocks Velodyne and GMHI (Luminar Technologies) went public. Other entrants into the market include Innoviz Technologies and Ouster, which are still pre-merger. The market is placing a premium for LiDAR stocks. When LAZR went public, it’s stock price touched $45 at its peak after the merger completed.

InterPrivate Acquisition Corp (NYSE: IPV), a special purpose acquisition company, announced that it has entered into a definitive agreement for a business combination with Aeva, Inc. Upon closing of the transaction, the combined company will be renamed “Aeva, Inc.” and is expected to continue to be listed on the New York Stock Exchange and trade under the ticker symbol “AEVA.”

Mad Money appearance

AEVA’s CEO made an appearance on Jim Cramer’s show Mad Money. He spoke about the technological advantage of AEVA. Jim Cramer was highly impressed and he asked for a case for other LiDAR manufacturers. That created a pump for the Stock and it has reached close to $20. The merger is expected to close at the end of the first quarter or the beginning of the second quarter 2021.

Aeva Stock Technology advantage

“Achieving high performance is table stakes” for lidar sensors, Soroush Salehian, Aeva’s CEO, told in an interview. “Achieving high performance at an affordable cost is the holy grail.”

Lidar, light detection and ranging radar, measures distance using laser light to generate a highly accurate 3D map of the world around the car. Aeva’s founders Salehian and Mina Rezk developed what they call “4D lidar,” which can measure distance as well as instant velocity without losing range, all while preventing interference from the sun or other sensors.

Aeva’s sensor works on a principle called frequency modulated continuous wave, or FMCW, which is different from rivals such as Velodyne Lidar and Luminar Technologies. Breakthrough core technology in FMCW LiDAR that provides superior performance compared to legacy Time of Flight LiDAR. FMCW technology also uses less power, allowing it to fold in perception software.

In short, AEVA is the first sensing platform to provide groundbreaking 4D LiDAR On Chip combining instant velocity measurements, long range performance at affordable costs for commercialization at scale.

Manufacturing partners and Investors

- Aeva has received strategic investments from Porsche SE, the major shareholder of VW Group. Aeva is engaged with VW Group on LiDAR for “Next Generation Vehicle Platforms” targeted for 2024 Production. VW CEO expects autonomous cars on market starting from 2025.

- In 2019, Aeva announced a partnership with Audi’s Autonomous Intelligent Driving entity. Aeva has also partnered with multiple other passenger car, trucking and mobility platforms to further adoption of ADAS and autonomous applications.

- Aeva is in a production partnership with ZF, one of the world’s largest automotive Tier 1 manufacturers to top OEMs, to supply the first automotive grade 4D LiDAR from select ZF production plants. The partnership — Aeva’s expertise in FMCW LiDAR technology combined with ZF’s experience in industrialization of automotive grade sensors — represents a key commitment to accelerate mass production of safe and scalable 4D LiDAR technology. ZF is a public company with more than $40 billion annual revenue.

- Denso is the world’s second-largest automotive supplier, working closely with automakers such as Toyota, which owns nearly a quarter of the company. The automotive supplier company plans on collaborating with Aeva “to further develop FMCW lidar, bring it to the mass market and create a society free from traffic accidents.”

Company Valuation and PIPE Financing

- Transaction includes $243 million of cash held in trust and an immediate $120 million financing through a fully committed private placement including investments from Adage Capital and Porsche SE.

- IPV has raised an additional $200 million in private investment from Hong Kong hedge fund Sylebra Capital. Sylebra has also entered into a one-year lock-up agreement on the majority of its investment and will vote all eligible shares in favor of the transaction.

- A total $528 million cash to balance sheet to further invest into R&D and scale up its programs across key verticals in automotive, consumer electronics and industrial applications.

Aeva stock Valuation update

- The TAM is expected to be $200 billion by 2030. LiDAR is going to be used mostly for Level 2 and 3 autonomy until 2025. The real growth is expected starting 2026 when Level 4 and 5 autonomy will be targeted in the automotive sector.

- The consumer electronics like cell phones and tablets will also have LiDAR sensors. Apple’s iPAD already has a built-in digital LiDAR.

- There are other applications like medical imaging, wearables, surveillance systems where LiDAR will play a big role.

- Industrial robotics and advanced machinery will operate in an autonomous way in the future.

- AEVA’s LiDAR is on a chip. This gives it an advantage over LAZR and Innoviz, which are other auto-first

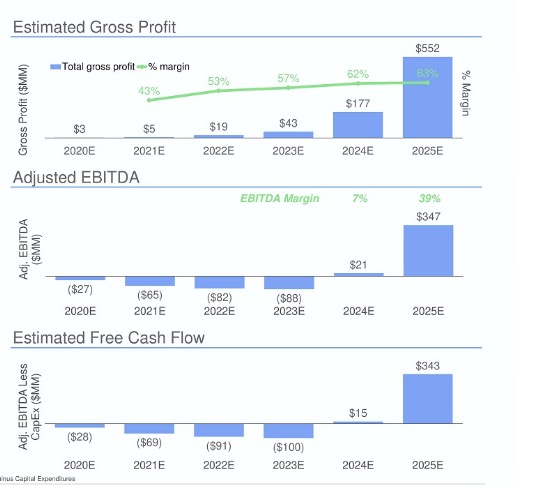

- If we look at the 2025 valuation, the management expects an EBITDA of $347M.

- We will use a multiple of 15 times EV/EBITDA. This gives it a market cap of $5.205B.

- Divide valuation by the number of shares of 213M, $5.205B/213M = $24 per share in 2025.