Innoviz Technologies, a Global Leader in LiDAR Sensors and Perception Software for Autonomous Driving, to be Listed on Nasdaq Through Business Combination with Collective Growth Corporation (NASDAQ: CGRO). The new ticker symbol for the combined company (Innoviz Stock) will be “INVZ”. The transaction is sponsored by Antara Capital LP and Perception Capital Partners LLC.

The hot stock market has generated a rush for private companies to go public using the route of SPACs. Innoviz will join the ranks of market leader Velodyne, recent blockbuster Luminar Technologies and upcoming Aeva as another LiDAR company to be listed.

Company background

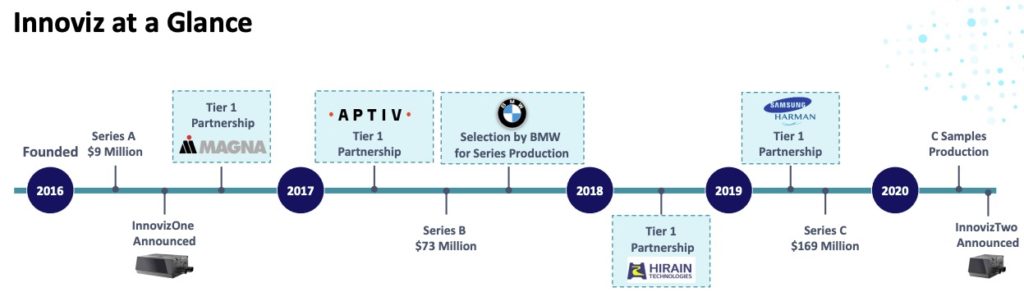

Innoviz was founded in 2016 by a group of Israeli Intelligence Corps veterans from Unit 81. This is the most prestigious technological unit in the Israeli Defence Forces. Co-founder and CEO Omer Keilaf has grown the company to 280 employees globally and raised $251 million funding to date. Innoviz is a global developer of high-performance, solid-state LiDAR sensors and perception software for autonomous vehicles.

The company is trying to bring the LiDAR sensors along with the perception software at a price that will be conducive for mass production of consumer autonomous vehicles. The perception software complements the hardware with advanced AI and machine learning-based classification, detection and tracking features. Innoviz is headquartered in Tel Aviv, Israel.

Manufacturing Partners of Innoviz

Innoviz partnered with Magna International to bring the LiDAR to market. This meets the stringent requirements of automotive OEMs, robotaxi companies and the Tier 1 suppliers. In addition to Magna International, Innoviz has established several partnerships with other world leading Tier 1 automotive suppliers, such as HARMAN, Aptiv and HiRain, which is active in China. These partners are some of the most influential companies in the automotive industry and have extensive experience with driver assistance and autonomous driving systems.

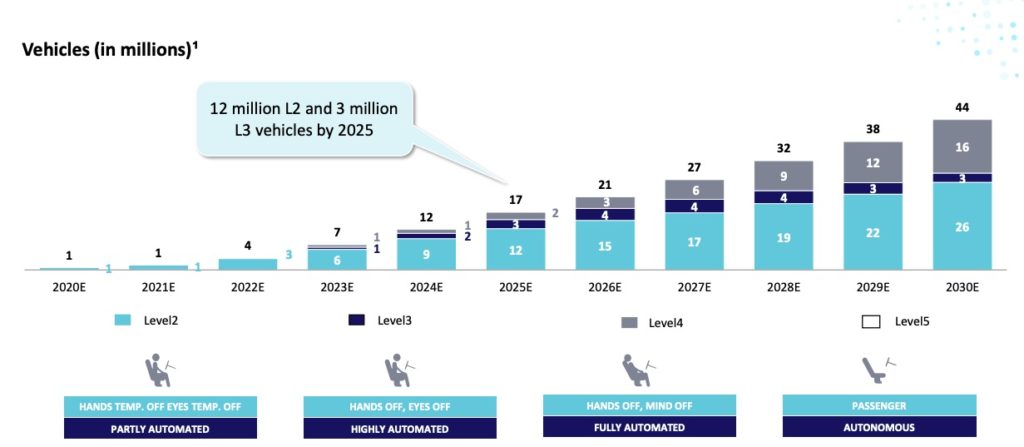

The company has focused on the consumer vehicle market. This will account for two-thirds of the Total Addressable Market (TAM) for LiDAR. The use of autonomous driving like Robotaxis and Delivery drones are at least 8 to 10 years away. So the LiDAR companies have to target Type 1 and Type 2 ADAS (Automated Driver Assistance Systems) to sort of navigate their way until full autonomous use cases hit the market.

BMW chose Innoviz’s solid-state LiDAR sensor, InnovizOne, sourced and manufactured by Magna International, to develop its LiDAR for series production. Their products are certified by Tier 1 partners as well for their superior performance.

The company has 17 granted patents and 66 in process. These are in the areas of system architecture, LiDAR algorithms, Perception algorithms, Lasers, etc.

SPAC Sponsors

Mr. Bruce Linton is the CEO of Collective Growth Corporation. He was the Founder and former Chairman of Canopy Growth Corporation, where he led over 31 acquisitions and $6 bn of capital raises.

Mr. Himanshu Gulati is the Founder and CIO of Antara Capital LP. They are a Hedge fund that specialize in event driven credit and special situation investing.

Perception Capital Partners are led by Scott Honour and James Sheridan who have more than 30 years experience in investing in technology companies.

Innoviz Products

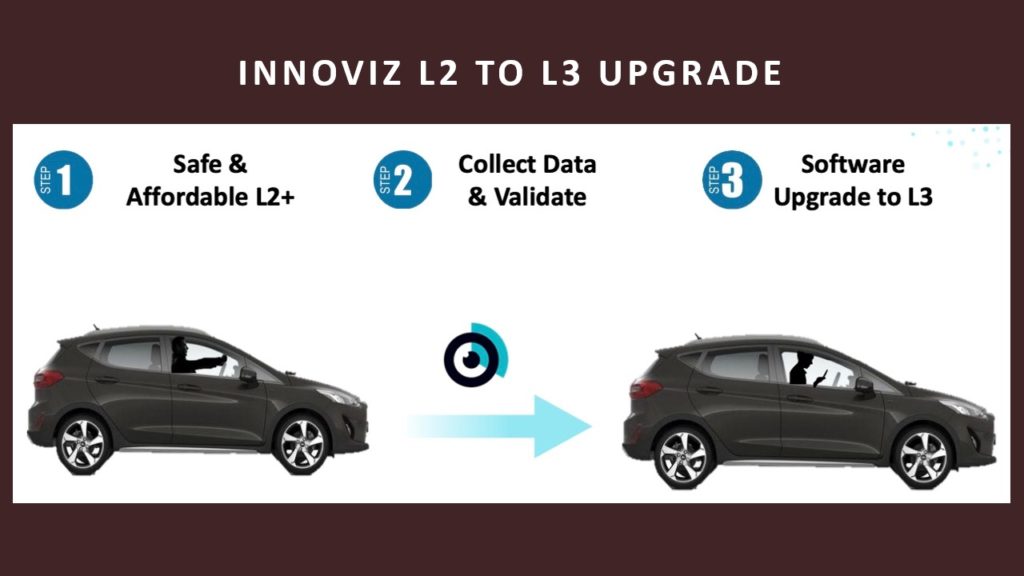

InnovizOne is their first offering of the LiDAR sensor. The price level of this sensor is fit for Level 3 through 5. However, the company came up with a next generation InnovizTwo sensor, which realizes 70% cost reduction. This price level is suitable for Level 2 through 5. This will result in mass adoption of the InnovizTwo sensor, since auto manufacturers will be able to add it as an extension package and upsell to customers.

The interesting thing to note is that the path from Level 2 to Level 3 LiDAR is just through software update. This does not require any hardware update. This can be done over the air. The way this works is that the LiDAR sensor is fitted as an L2 sensor. As the vehicle is driven, the data is collected and validated. This helps Innoviz to mature their perception software. As the miles driven collectively reach more than a billion, they can get certified by their Tier 1 and Automotive partners and switch to an L3 sensor through a software update.

Merger Transaction Details

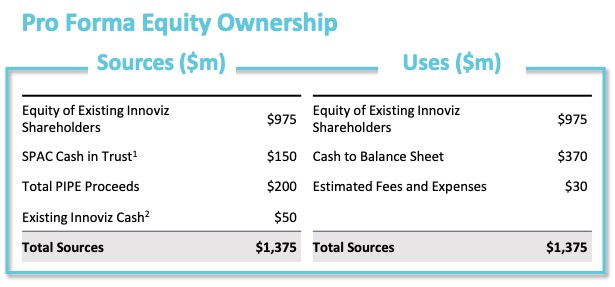

- Pro forma implied equity value of approximately $1.4 billion.

- $350 million cash to balance sheet to fund the growth of the company.

- Transaction includes $150 million of cash held in trust and an immediate $200 million financing through a fully committed private placement led by Antara Capital and includes strategic investments from Magna International, Innoviz’s Tier-1 partner, Phoenix Insurance and other institutional investors

- The deal is set to complete in the first quarter of 2021.

- Following completion of the transaction, all Innoviz existing shareholders retain stake in the company

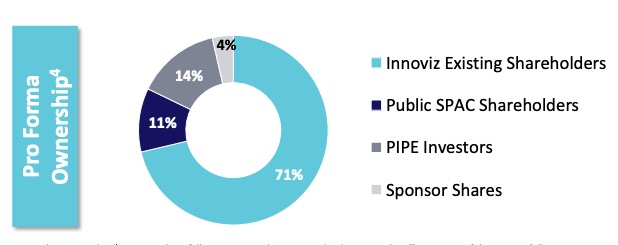

Share Structure

- Total shares outstanding of 140 million

- 71% existing Innoviz shareholders

- 11% CRGR SPAC shareholders

- 14% PIPE Investors

- 4% CRGR Sponsor Shares

Valuation

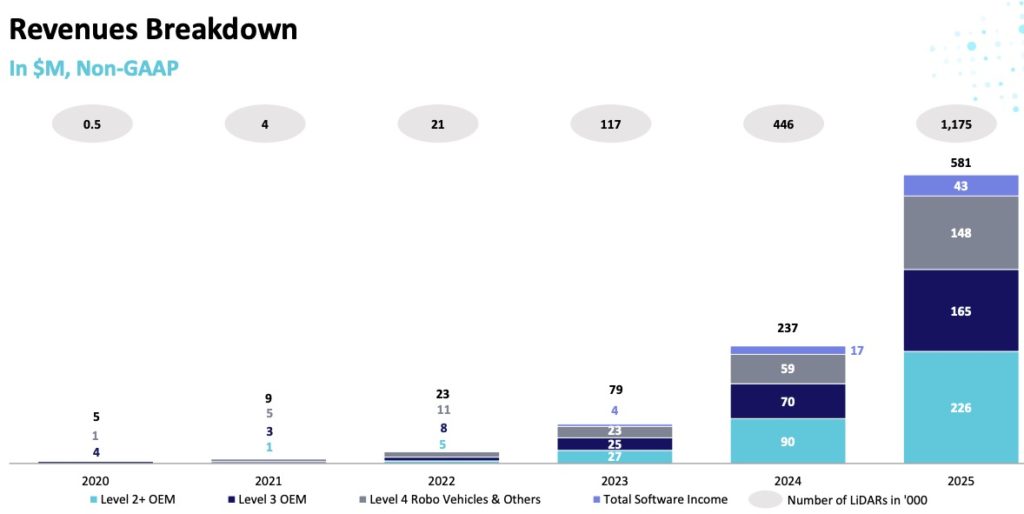

The company is targeting to sell around 581,000 LiDAR sensors of Level 2 through 4 until 2025. The company is expected to be EBITDA and FCF positive as well at that time.

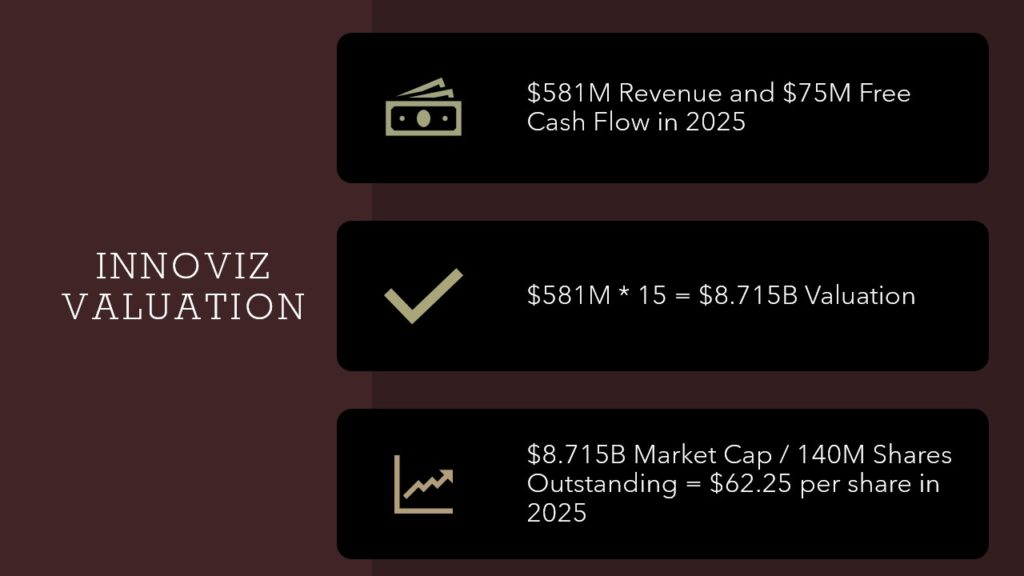

They are targeting a revenue of $581M and a FCF of $75M. If the company is able to achieve this level of growth until 2025, then the market will stop looking at Innoviz as just a LiDAR company but more of an Autonomous leader. The valuation multiples would definitely be very generous. This is especially true since Level 4 and 5 autonomy would be on the cusp of realizing with all the data collected and the advances in the Perception software and Solid state LiDAR sensors.

So if they are evaluated at revenue multiple of 15, that would give the company a valuation of $581 * 15 = $8.715B. Divide it by the shares outstanding of 140M.

$8.715B / 140M = $62.25 per share by 2025.

There are a few risks that need to be pointed out here. Since many of the markets in which Innoviz Stock competes are new and rapidly evolving, it is difficult to forecast long-term end-customer adoption rates and demand for its products. Hence many of the financial projections may not actually realize tangible revenues. Currently the company is burning about 68 million cash per year.

The LiDAR technology is not seen as a game changer by Tesla and GM. They are pioneering Camera and Radar sensor technologies. There is also an influx by other LiDAR sensor companies intent on capturing the market share. The only way the sensor will not become a commodity is the Perception software. The company that can capture the most data by driving billions of miles and refining the Machine learning algorithms, will ultimately be the winner of the Autonomous vehicle market.

Ahmed,

In your valuation of Innoviz how did

you determine the revenue multiple

of 15 used to value the company in

2025 ? This is great work. But I can

not put my finger on how you got the

15 rev multiple. Many thanks for a

reply if you can fit in it

Robert Rohrberg