The hot stock market has generated a rush for private companies to go public using the route of SPACs. The latest to join the bandwagon is Aeva Inc., a maker of LiDAR Sensors. The company was founded in 2017 by former Apple engineers Soroush Salehian and Mina Rezk. This is after the two other LiDAR stocks Velodyne went public and GMHI (Luminar Technologies) announced its merger.

InterPrivate Acquisition Corp (NYSE: IPV), a special purpose acquisition company, announced that it has entered into a definitive agreement for a business combination with Aeva, Inc. Upon closing of the transaction, the combined company will be renamed “Aeva, Inc.” and is expected to continue to be listed on the New York Stock Exchange and trade under the ticker symbol “AEVA.”

AEVA Stock company background

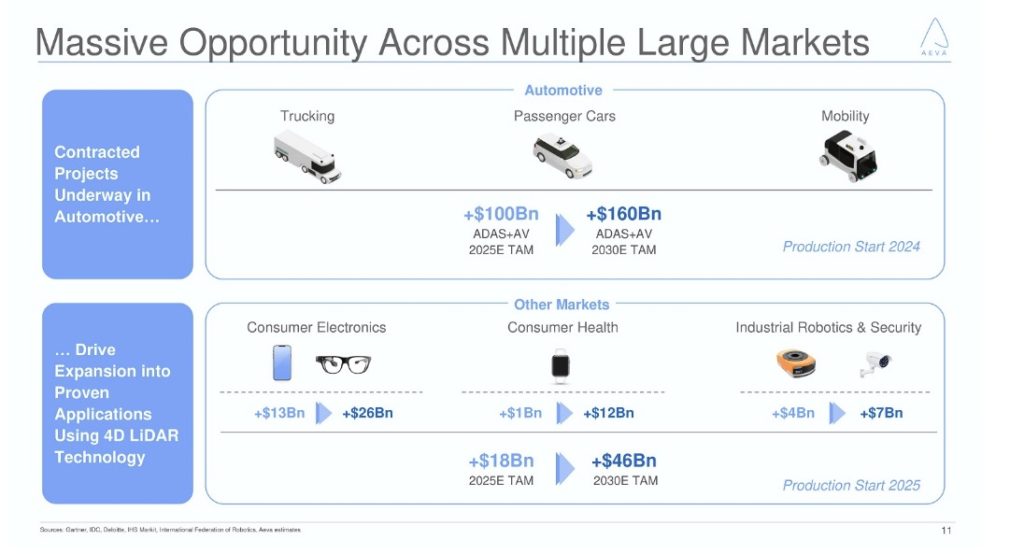

Aeva Inc. is the maker of the first 4D LiDAR on a Chip. With its powerful software stack, Aeva plans to bring its perception platform to a range of industries beyond automotive, including consumer electronics, consumer health, industrial robotics, and security.

Founded by former Apple engineers and led by a multidisciplinary team of over 100 experienced leaders, engineers, and operators, Aeva is actively engaged with thirty of the top players in automated and autonomous driving across passenger, trucking and mobility.

The following are the important partnerships that the company has announced:

- Aeva has received strategic investments from Porsche SE, the major shareholder of VW Group.

- In 2019, Aeva announced a partnership with Audi’s Autonomous Intelligent Driving entity. Aeva has also partnered with multiple other passenger car, trucking and mobility platforms to further adoption of ADAS and autonomous applications.

- Aeva is in a production partnership with ZF, one of the world’s largest automotive Tier 1 manufacturers to top OEMs, to supply the first automotive grade 4D LiDAR from select ZF production plants. The partnership — Aeva’s expertise in FMCW LiDAR technology combined with ZF’s experience in industrialization of automotive grade sensors — represents a key commitment to accelerate mass production of safe and scalable 4D LiDAR technology.

Merger Transaction details

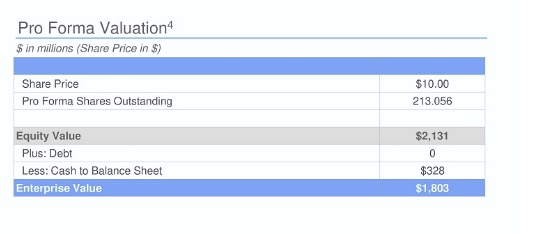

- Pro forma implied enterprise value of approximately $1.8 billion and market capitalization of approximately $2.1 billion.

- $328 million cash to balance sheet to fund the growth of the company.

- Transaction includes $243 million of cash held in trust and an immediate $120 million financing through a fully committed private placement including investments from Adage Capital and Porsche SE.

- The deal is set to complete in the first quarter of 2021.

- Following completion of the transaction, Aeva will retain its experienced management team.

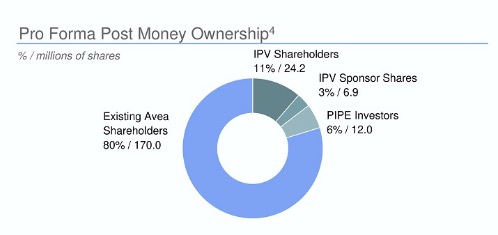

Share count

- Total shares 213 million

- 80% existing Aeva shareholders

- 11% IPV SPAC shareholders

- 6% PIPE Investors

- 3% IPV Sponsor Shares

AEVA Stock Bull case

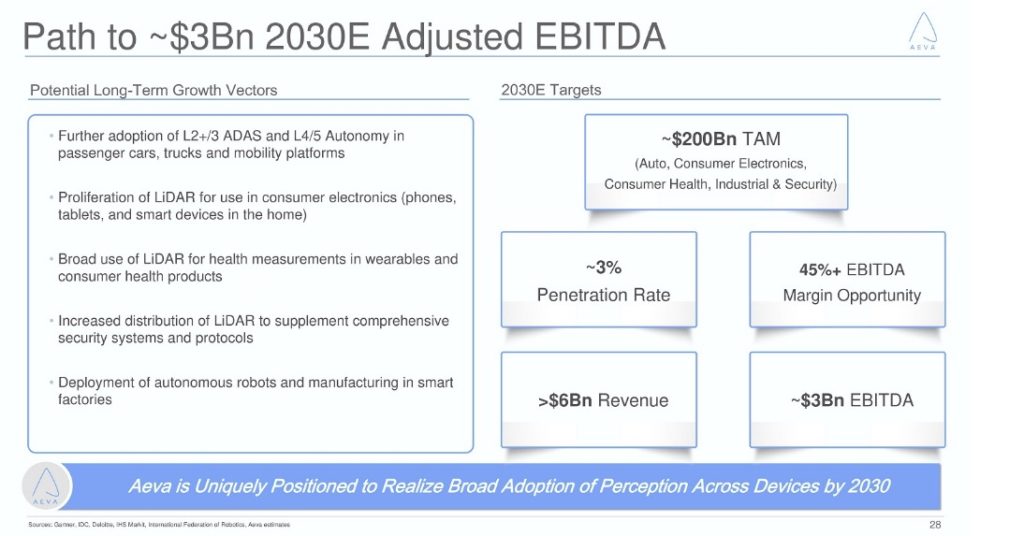

TAM of $200B by 2030. If the company has a 3% penetration rate, that gives the company a $6B revenue. Put a 45% margin and it results in $3B EBITDA. The industry standard of 30 times EBITDA gives a market cap of $90B. That puts the share price assuming no further dilution at $90B/ 213M = $422 per share in 2030. This is according to the calculation we did on the investor presentation slide.

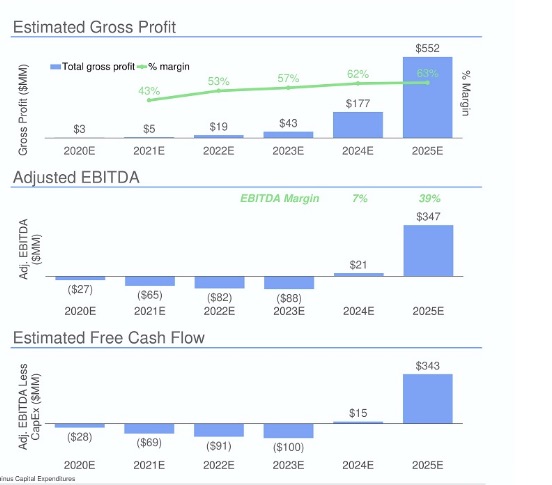

If we look at the 2025 valuation, it’s giving an EBITDA of $550M. Again a 30 times EBITDA multiple gives it a market cap of $16.5B. Divide again by the number of shares of 213M, $16.5B/213M = $77 per share in 2025.

AEVA Stock Bear Case

- Since many of the markets in which AEVA Stock competes are new and rapidly evolving, it is difficult to forecast long-term end-customer adoption rates and demand for its products. Hence many of the financial projections may not actually realize tangible revenues. Currently the company is burning about 30 million cash per year.

- The profit margins are very high of 45% to 50%, which is the main driver of the high valuation. Say we assume that the company does not grow at the rate predicted and grows to only about $1.5B in revenue, with a margin of 30%. That translates to $45M in revenue. That should give the company a market cap of $1.35B. Divide again by shares outstanding, gives $6.30 a share in 2025.

Conclusion

So there we go, a bull case scenario expecting everything rosy and executed to perfection, a valuation of $73 per share by 2025 and $422 per share by 2030. A bear case scenario of $6.30 per share.

Again, a lot of things can change as you can see if we start varying a few parameters like profit margins, revenue growth rate, valuation multiple of 30 times EBITDA. That is why, valuation is an art not a science that can be coded.