Video Game company Roblox is going public. The bookings at the company surged 171% amid the pandemic spending. Roblox IPO follows after gaming engine Unity went public earlier this year. The revenue and free cash flow numbers are through the roof. The stock market is at all time highs. There has never been a better time to go public for Roblox. Roblox will be listed on the NYSE under the ticker symbol “RBLX”.

Key highlights

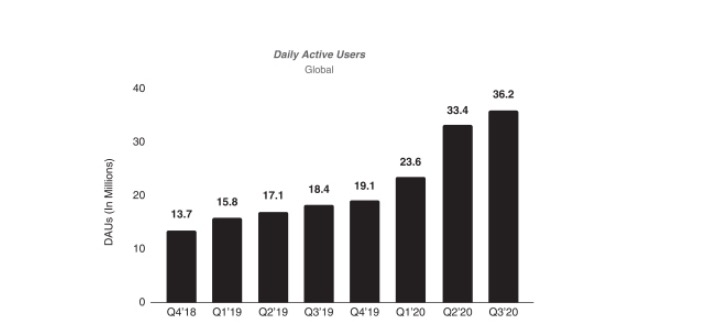

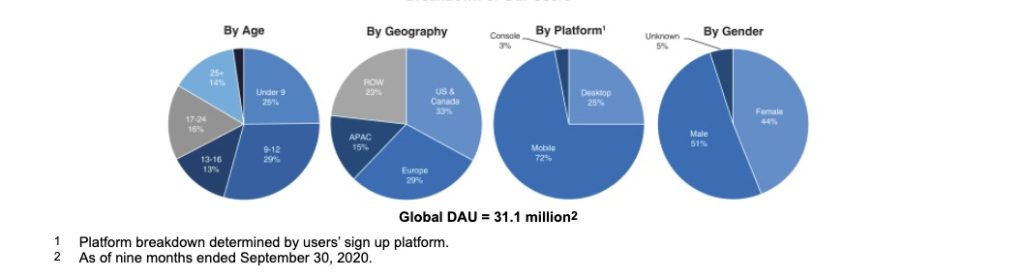

- 36.2 million Daily Active Users (DAU) and 7 million Developers.

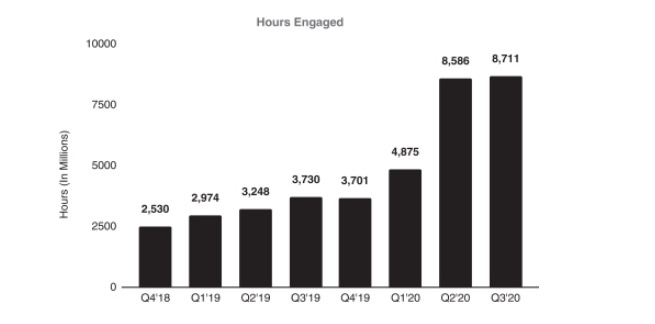

- Hours engaged on Roblox grew 122%, from 10 billion in the nine months ended September 30, 2019 to 22.2 billion in the nine months ended September 30, 2020.

- Revenue grew 56%, from $312.8 million in 2018 to $488.2 million in 2019, and grew 68%, from $349.9 million in the nine months ended September 30, 2019 to $588.7 million in the nine months ended September 30, 2020.

- In the nine months ended September 30, 2020, developers and creators earned $209.2 million.

- Free cash flow was $292.6 million in the nine months ending September 30, 2020.

- $810 million cash on the balance sheet.

- Net loss was $203.2 million in the nine months ended September 30, 2020.

China Opportunity for Roblox stock

In February 2019, Roblox entered into a joint venture agreement with an affiliate of Tencent Holdings Ltd., a leading internet company in China and one of the world’s largest gaming companies. Under the joint venture agreement, it created Roblox China Holding Corp., with a 51% ownership interest. Through a wholly-owned subsidiary based in Shenzhen branded “Luobu,” the China JV is engaged in the development, localization and licensing to creators of a Chinese version of the Roblox Studio and also develops and oversees relations with local Chinese developers.

Tencent currently intends to publish and operate a localized version of the Roblox Platform as a game in China under the name “Luobulesi.” Prior to publishing “Luobulesi”, Tencent must receive a publishing license from the National Radio and Television Administration of the Chinese government that entails a review of the content of Luobulesi to confirm that such content is not in contravention with the requirements of Chinese law. This publishing license has not yet been issued. Luobu’s focus is on creating opportunities for local Chinese developers to learn Roblox Studio for building and publishing experiences and content.

This gives Roblox a huge opportunity to tap into the Chinese market. If the Roblox platform is served localized in the Chinese market, it will be able to tap into a huge local user base. That will result in an increase of bookings and revenue. Ultimately, things will start flowing down to the bottom line.

Share Structure

- 522 million outstanding shares

- 477.4 million Class A stock

- 57 million Class B stock

- Class A stock has 1 vote per share

- Class B common stock has 20 votes per share.

- Altos Ventures holds 21.3% of the company, the executive team owns 16.4%.

- The chief executive holds 100% of Roblox’s 57.3 million Class B shares.

Key Financial Metrics

- $810 million cash on the balance sheet.

- Bookings grew 39%, from $499.0 million in 2018 to $694.3 million in 2019, and grew 171%, from $458.0 million in the nine months ended September 30, 2019 to $1,240.2 million in the nine months ended September 30, 2020.

- Revenue grew 56%, from 2018 to 2019, and grew 68%, in the nine months ended September 30, 2019 to the nine months ended September 30, 2020.

- Net loss was $97.2 million and $86.0 million in 2018 and 2019, respectively, and $46.3 million and $203.2 million in the nine months ended September 30, 2019 and September 30, 2020, respectively.

- Free cash flow was $35.0 million and $14.5 million in 2018 and 2019, respectively and $292.6 million in the nine months ending September 30, 2020.

Risk Factors

- The pandemic has given a huge boost to the bookings and customer spending. People were locked down and they were going big on playing Roblox. Once the pandemic goes away and normalcy returns, that may have an effect on the finances of the company as the new bookings may reduce. Ultimately, that affects the revenue and profits down the line over a period of 25 months.The bookings are the money that users pay when they purchase Robux. The company realizes these bookings over a period of 25 months. This is the usual turnover for users of the platform. This means that usually around the 25 month timeframe, users leave the platform. The success of the company therefore depends on finding new users and getting them becoming premium subscription members or making purchases.

- Despite approximately 67% of the DAUs being outside the U.S. and Canada for the nine months ended September 30, 2020, the monetization is largely concentrated in users in the U.S. and Canada. For the nine months ended September 30, 2020, 68% of bookings were from the U.S. and Canada. The company needs to diversify its revenue streams into other markets. That is why, the Chinese opportunity is a huge deal for the Roblox stock.

- Since the platform is serving young users especially those under 15, there is always the risk of criminal offenders luring children into off-platform traps. This has happened in the first and is a risk that will always be present. How well the management addresses it will result in the success of the company.

Roblox IPO Valuation

In February, the company had a private funding round. During that time, it was valued at $4 billion. Sources close to the company say, Roblox may be eyeing a $8 billion valuation at the IPO. So if divide the valuation $8 billion by the number of shares outstanding of 522 million, gives an IPO price of $15 per share. So the ballpark range may be between $12 to $17 per share based on the valuation.

DoorDash also has filed for IPO and you can find all the details at the following link: