AbCellera is a technology company that searches, decodes, and analyzes natural immune systems to find antibodies that its partners can develop into drugs to prevent and treat disease. AbCellera partners with drug developers of all sizes, from large pharmaceutical to small biotechnology companies, empowering them to move quickly, reduce costs, and tackle the toughest problems in drug development.

AbCellera Biologics Inc. was founded in 2012 and is headquartered in Vancouver, Canada. The company’s founder is Dr. Carl Hensen who is also a professor at University of British Columbia. The company is backed by the Bill & Melinda Gates Foundation, early facebook investor Peter Thiel and DARPA.

ABCL stock IPO and background

The company had its IPO in December and sold 23 million shares priced between $15 to $17 a share. It planned to raise about $380 million during the IPO. By the time the shares opened, they jumped to $60. The Nasdaq was making big moves during that time. With the recent sell off in Nasdaq due to rising treasury yields, the stock has been beaten up and is trading in the $25 a share range. This is offering a decent entry point into the ABCL stock. The company will announce its fourth-quarter and full-year 2020 financial results on Monday, March 29, 2021 after the U.S. stock markets close

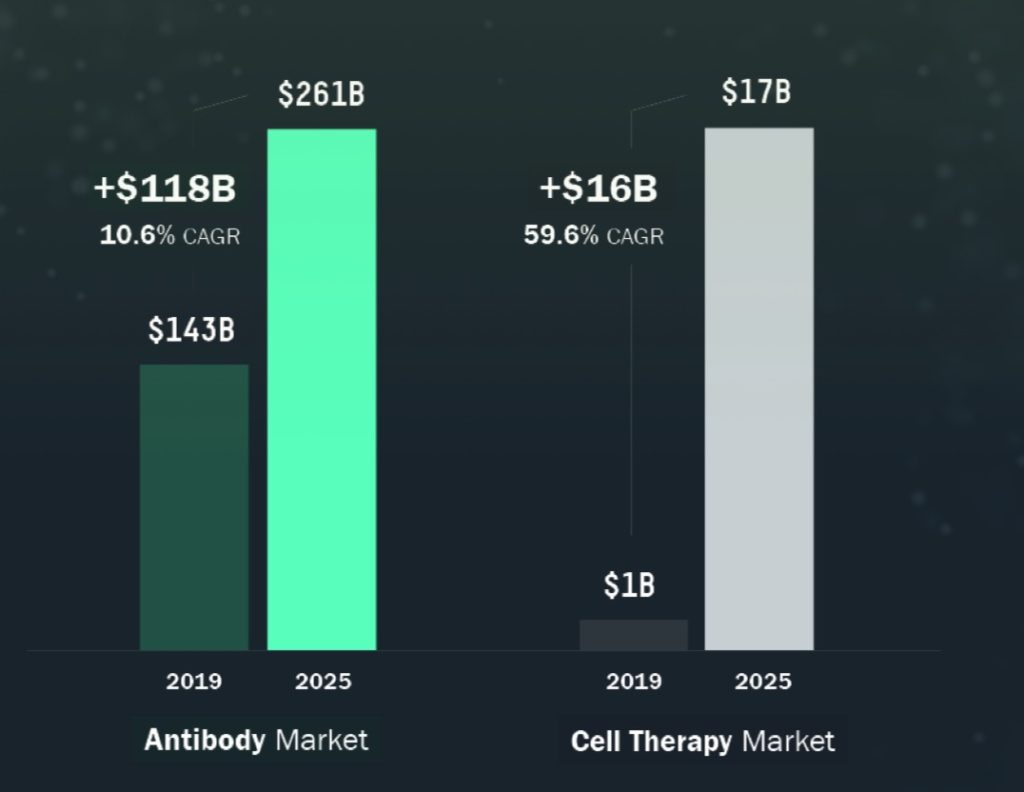

AbCellera operates in two key markets, the antibody development market and the cell therapy market. Both of the company’s target markets are expected to grow at breakneck speed over the next five years. Antibodies are the fastest growing class of drugs and are used across multiple therapeutic areas, including oncology, inflammation, neurodegeneration and many more. In 2019, antibody-based therapeutics accounted for over $140 billion in sales and represented five of the top 10 selling therapeutics worldwide. The antibody-based therapeutics market is expected to reach approximately $260.0 billion in size by 2025, representing a CAGR of approximately 11% for the period from 2019 to 2025. The more nascent cell therapy market is expected to grow from $1.0 billion in 2019 to over $17.0 billion in 2025, reflecting a CAGR of around 60%.

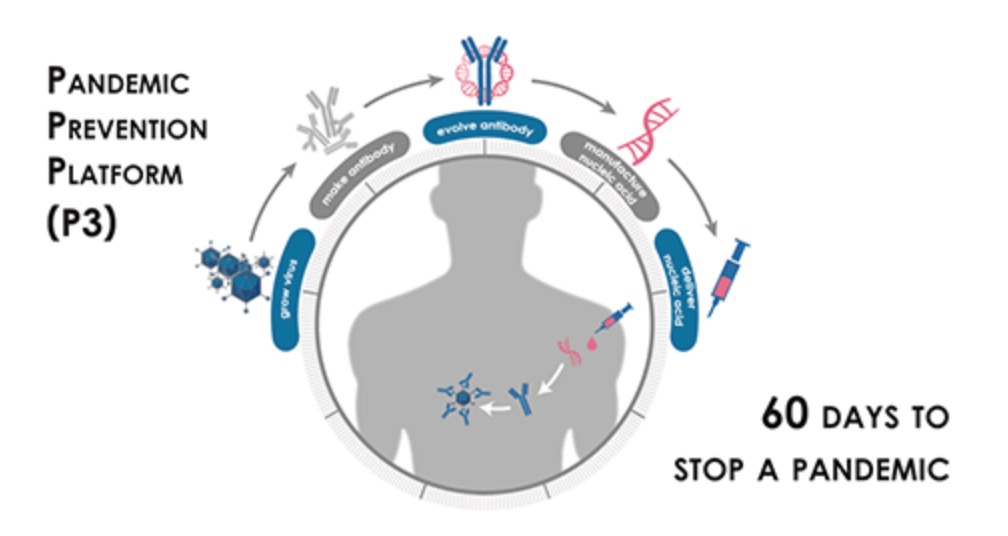

DARPA contract for the Pandemic Prevention Platform

AbCellera Biologics Inc. was awarded a contract from the Defense Advanced Research Projects Agency (DARPA) to develop rapid countermeasures against viral outbreaks in 2018. Over the four-year contract, AbCellera will receive up to USD $30 million in funding to establish an end-to-end platform for rapid pandemic response, and will lead an internationally recognized team of experts in virology, antibody discovery, and gene therapy.

The project is part of the Pandemic Prevention Platform (P3), a high-priority initiative of DARPA’s Biological Technology Office. The P3 program seeks to develop a robust technology platform for pandemic response capable of developing field-ready medical countermeasures within 60 days of isolation of a viral pathogen.

FDA approved COVID-19 treatment

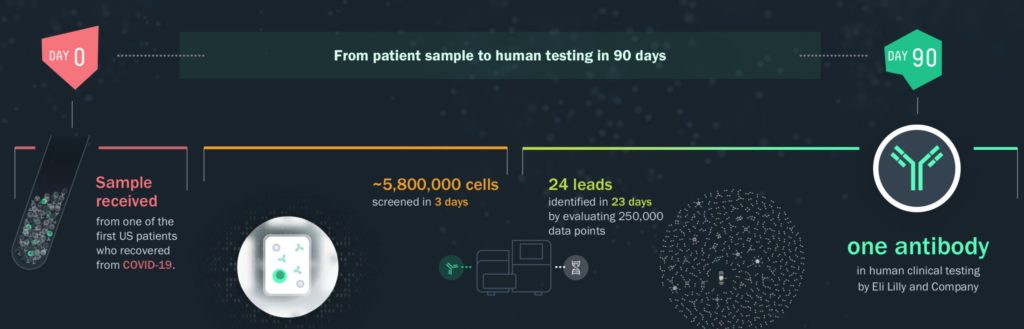

Much of the recent focus given to the company in the media has been in the world record time the company achieved its antibody therapy approval for COVID-19 in partnership with Eli Lilly. Bamlanivimab (LY-CoV555) 700 mg, a human antibody discovered by AbCellera and developed with Eli Lilly and Company (Lilly), administered with a second Lilly antibody, etesevimab (LY-CoV016) 1400 mg, has received Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration (FDA) for the treatment of mild to moderate COVID-19 in patients aged 12 and older who are at high risk for progressing to severe COVID-19 and/or hospitalization.

AbCellera began work on the therapy in late March of 2020 and the FDA approval of the drug was announced in December. This speedy discovery validates the P3 Platform potential. Lilly plans to manufacture more than 250,000 doses of the bamlanivimab and etesevimab therapy throughout Q1 2021, and up to a million doses by mid-2021.

Business Flywheel effect

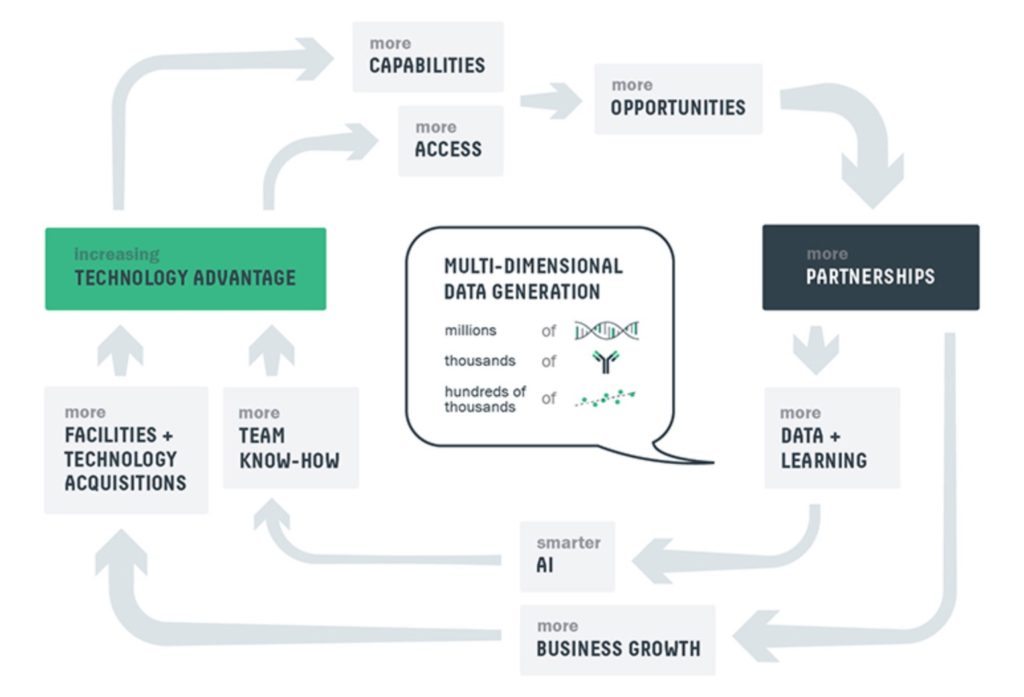

The utilization of advanced data collection and computation creates a flywheel effect that enhances AbCellera’s technology. As it increases the partnership discovery business, it is amassing unique, multi-dimensional data sets that link measurements at the level of single immune cells with the properties of the antibodies they make and the DNA sequences that encode their function.

As this dataset expands, the capabilities and opportunities with the platform increase which in turn result in more partnerships. This creates a virtuous cycle of business for the company. The key to success with AbCellera is that with each completed partnership and discovery process, the company’s library of data grows and multiplies.

ABCL stock partnerships

As of September 30, 2020, AbCellera had 94 discovery programs that were either in progress or under contract. Some of the publicly disclosed partnerships include:

- IgM Biosciences. Multi-target, multi-year partnership focused on oncology and immunology and announced on September 24, 2020.

- Lilly (LLY). Multi-year partnership with 9 targets focused on COVID-19 and additional indications and announced on May 22, 2020.

- Gilead Sciences (GILD). Single target partnership focused on infectious disease and announced on June 13, 2019.

- Denali (DNLI). Multi-year partnership with eight targets focused on neurological diseases and announced on February 28, 2019.

- Novartis (NVS). Multi-year partnership with up to 10 targets and announced on February 14, 2019.

- Bill & Melinda Gates Foundation. Two-year agreement focused on high-priority infectious diseases including HIV, malaria and tuberculosis and announced on March 14, 2019.

- The company is currently partnered with over 26 companies in structured royalty partnerships with the majority choosing to remain anonymous for competitive reasons.

Fundamental analysis

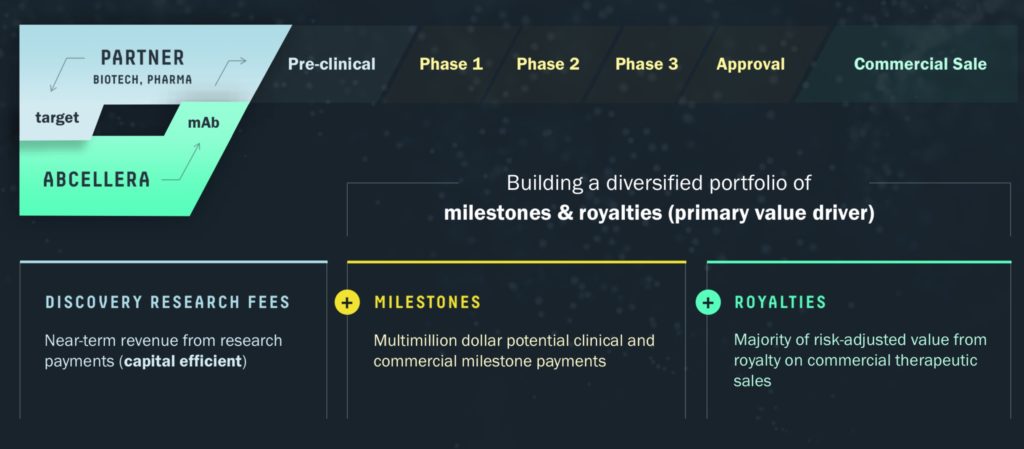

Instead of selling its software in a suite for a set fee, it looks to be locked in going forward on a strategy to partner with its customers for milestones and royalties. We forge partnerships with large cap pharmaceutical companies, biotechnology companies of all sizes and non-profit and government organizations. Our partners select a target and define the antibody properties needed for therapeutic development. We provide discovery solutions to partners that have a range of discovery capabilities, from the highly enabled to the less enabled. We enable discovery against targets that have traditionally been intractable, and we accelerate programs against less difficult targets.

“Our deals emphasize participation in the success and upside of future antibody therapeutics. Our partnership agreements include near-term payments for technology access, research and intellectual property rights, and downstream payments in the form of clinical and commercial milestones, and royalties on net sales.” – Dr. Carl Hensen

AbCellera charges a technology fee to its partners. if a program fails to reach the market, AbCellera will likely just break even for its efforts. The company is forgoing profits in the discovery phase of a drug, with the goal of an expense free revenue stream for potentially decades of pure profit if its target is approved. If they do, the company stands to make potentially billions of dollars from royalties, but if they fail, the company is left with very little for its efforts.

The company had a revenue of around $25 million by the end of third quarter 2020. However, the fourth quarter should see tangible revenues from the sale of the COVID-19 drug. Lilly pharmaceuticals had sales of $770 million. If Abcellera gets a cut of 15%, that would translate to about $115 million in revenue for the fourth quarter. I expect the fourth quarter earnings to be a homerun.