Three big IPOs came up this week. Doordash, Airbnb, and C3 AI. Before the retail investors could even get their hands on the shares, the prices doubled. C3 AI was priced at $42 per share but opened at $110 per share.

Time will tell if the investors who purchased at these prices can make a long-term return or not.

Key highlights

- Founder and CEO Thomas M. Siebel was the founder of Siebel Systems, which later merged with Oracle. He grew the company to generate an annual revenue of greater than $2 billion.

- Microsoft is an investor in the IPO. Satya Nadella’s company purchased 50M worth of C3 AI’s shares at the IPO. Microsoft is following Salesforce’s practice. The CRM Salesforce company had bought shares in Dropbox, Zoom, and Snowflake just before they went public.

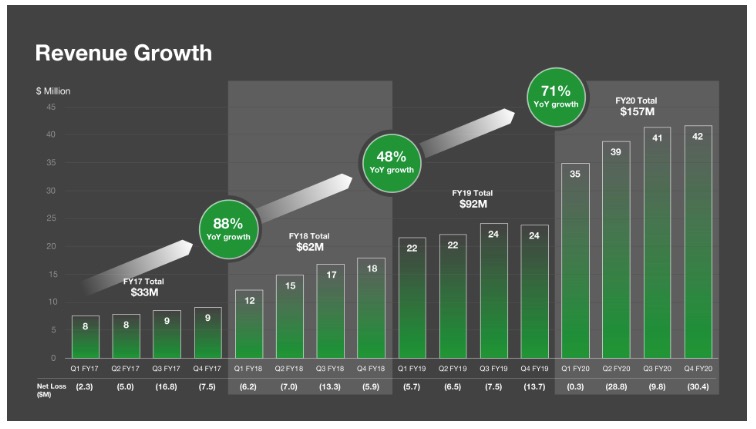

- 71% YoY revenue growth.

- 86% subscription revenue, which means predictable revenue every year.

- 1.1 billion AI predictions per day.

- $271 billion addressable market estimated by 2024.

- Penetration across Finance, Healthcare, and Oil and gas markets.

- Compatible across all cloud vendors like AWS, Azure, Google, and IBM.

C3 AI Stock Company Background

C3.ai is an Enterprise AI software company. The C3 AI Suite, with its proprietary model-driven architecture, addresses the requirements for the digital transformation software stack, providing a low-code/no-code AI and Internet of Things, or IoT, platform. This platform accelerates software development, reduces cost and risk, and delivers applications that are flexible enough to meet evolving needs.

C3 CEO Tom Siebel, who sold his company Siebel Systems to Oracle for $6.1 billion in 2006, founded C3 in 2009. Mr. Siebel joined Larry Ellison at Oracle in 1983. He saw the huge market for the Relational databases before the Information technology revolution started. After Oracle was positioned to take advantage of this boom, he saw another opportunity for automation of business processes of sales, marketing, and customer service.

In 1993, he founded Siebel Systems. He literally invented the CRM market, which is a $60+ billion software industry. After riding this wave, Mr. Siebel envisioned a step function of technologies like elastic cloud computing, big data, the internet of things, and AI. The confluence of these technologies would usher in an era of digital transformation like none other. This is what C3 AI is positioned to capture now.

There are two primary families of software solutions:

- The C3 AI Suite, is the core technology, is a comprehensive application development and runtime environment that is designed to allow customers to rapidly design, develop, and deploy Enterprise AI applications of any type.

- C3 AI Applications, built using the C3 AI Suite, include a large and growing family of industry-specific and application-specific turnkey AI solutions that can be immediately installed and deployed.

Revenue Model

- The bulk of the revenue is generated from subscriptions to the AI software, accounting for roughly 86% of the total revenue.

- Term subscriptions of the C3 AI Suite and C3 AI Applications, are usually three years in duration.

- Monthly runtime fees of the C3 AI Applications and customer-developed applications built using the C3 AI Suite, usage-based upon CPU-hour consumption.

- Professional services fees associated with training and assisting our customers.

- 22% International revenue.

Competitive advantages for the C3 AI

The market-entry strategy has been to establish high-value customer engagements with large global early adopters, or lighthouse customers, in Europe, Asia, and the United States across a range of industries. These lighthouse customers serve as proof points for other potential customers in their particular industries.

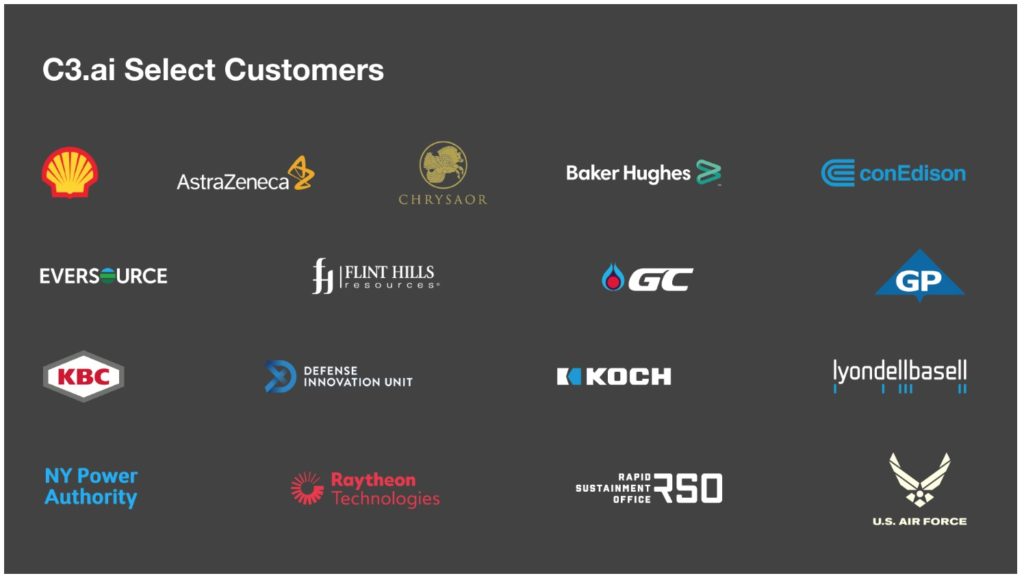

The company has established strategic relationships with the customers that include many of the world’s iconic organizations, demonstrating the utility of the Enterprise AI software solutions. The company, which lists AstraZeneca and the Air Force as customers, recently announced a partnership with Microsoft and Adobe to take on Salesforce in the customer-relations management software space.

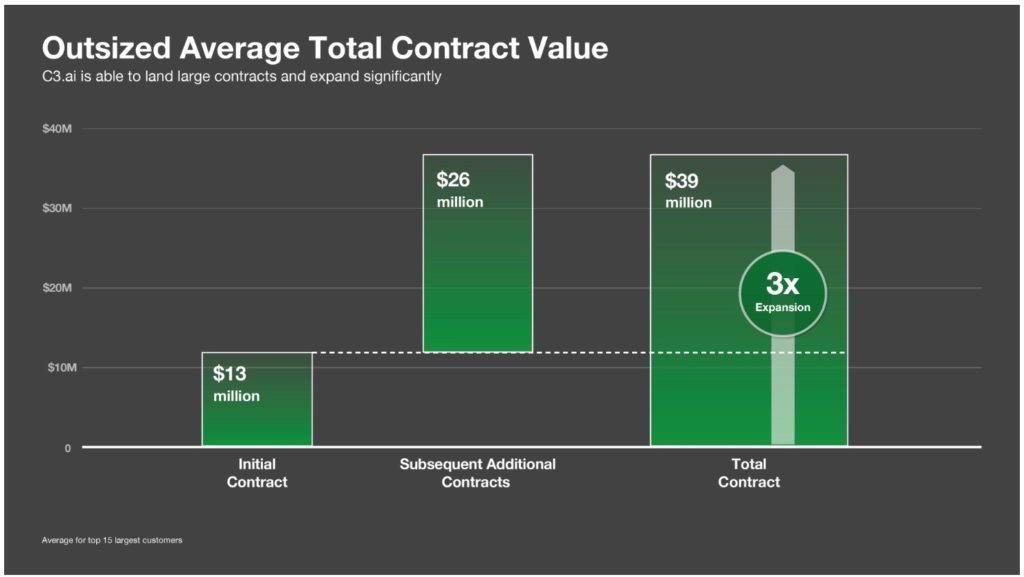

High value outcomes enable outsized average contract value. $10.8 million, $16.2 million, and $12.1 million, respectively for 2018, 2019, 2020.

After the initial contract, customers tend to expand the use of their products. As a result, they may purchase additional applications, additional developer seats, additional software products, additional runtime usage, and additional services. The average initial contract value with the largest 15 customers was $12.8 million. On average, each of these customers has purchased an additional $26.1 million in product subscriptions and services as they expanded existing use cases and added additional use cases to their roadmaps.

C3 AI Stock Share Structure

- 96.4M total shares outstanding

- 21M class B Shares with 50 votes per share

- $155M cash on the balance sheet

C3 AI Risk Factors

- The company has a limited operating history. So how well it executes its growth strategy is yet to be validated.

- A limited number of customers have accounted for a substantial portion of the revenue. If existing customers do not renew their contracts, the revenue could decline significantly.

- The enterprise AI company is not yet profitable and may not be profitable for at least 3 to 4 years.

- Long sales cycle due to large subscription expenses. This will result in a greater turnaround time for the customer to pass through the sales funnel and actually contribute to the revenue and the bottom line.

- There are millions of options that are convertible to common stock of the company after the IPO. This will result in dilution of existing shareholders equity.

Valuation

The company achieved a revenue growth of 71% YoY. The revenue is $157M with a net loss of about $70M in the year ending April 2020. The gross margin is greater than 60%. The bulk of costs are around Sales and Marketing, R&D, and General and administrative expenses.

RPO (Remaining Performance Obligation) is a key metric to measure the health of the company. This refers to the future non cancelable contracted revenue that is expected from the customers. The monthly usage runtime charges and hosting charges

As of July 2020, the RPO amount is $275.10 million. The average contract duration is 35 months. This shows that there are contracts in place guaranteeing the RPO amount. The trend has been increasing each quarter, meaning the company is signing new customers as well as realizing its subscription revenue each quarter.

For a 3 year valuation, let’s assume a growth rate of 50%. $157M revenue compounded over 3 years at 50% results in $530M. We are not sure if the company can be profitable during that time, so we can eliminate the net income calculation. Since this is priced as a growth company, a multiple of 15 could be applied to the revenue. That gives it a $7.95B valuation. Divide by the shares outstanding of 96.4M, this gives $7.95B / 96.4M = $82 per share. Unfortunately, the company is already valued at $12B and trading at around $117 per share as of today.

One caveat here is that as the lock-in periods end, the employees will have their options converted into shares and more shares will flood the market.

Conclusion

This shows that there may not be any upside left fundamentally in the stock, the growth story of 3 years and more is already priced at this point. However in the short term, anything can happen. The stock may be in for a lot of volatility as the investors start taking their profits.