The digital LiDAR company Ouster is looking to go public through the SPAC route. Ouster Stock has patented digital lidar architecture that delivers an unmatched combination of performance, reliability, and cost. They have transformed lidar from an analog device with thousands of components to an elegant digital device powered by one chip-scale laser array and one CMOS sensor. The result is a full range of high-resolution lidar sensors that deliver superior imaging at a dramatically lower price. In the LiDAR market, cost is definitely the holy grail for mass adoption.

Colonnade Acquisition Corp (NYSE: CLA) is a publicly listed special acquisition company with $200M in trust. The SPAC has entered into a definitive merger agreement with Ouster. Upon closing of the business combination, the combined company will operate as Ouster, Inc., and is expected to remain listed on the NYSE under the ticker symbol “OUST”.

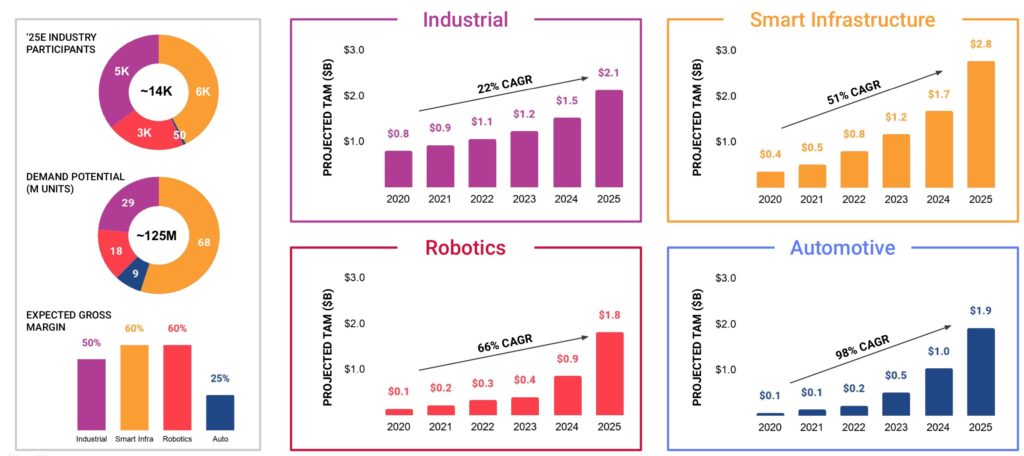

The automotive LiDAR market is expected to grow at a compounded rate of 98% while the Robotics and smart infrastructure market is expected to grow more than 50% between 2020 and 2025.

Company background

Angus Pacala is the CEO and co-founder of Ouster. Previously, he was the Director of Engineering and co-founder at Quanergy Systems, Inc. and a battery engineer at Amprius, Inc. Since its founding in 2015, Ouster has secured about $140M in funding from private market investors, including Cox , Silicon Valley Bank and Fontinalis, which is co-owned by Ford Motor Executive Chairman Bill Ford.

Ouster builds high-resolution lidar sensors for the transportation, robotics, industrial automation, and smart infrastructure industries. Using a patented digital lidar architecture, Ouster’s sensors are reliable, compact and affordable, while delivering camera-like image quality.

For light emission, Ouster’s LiDAR relies on vertical-cavity surface-emitting lasers (VCSEL). For light detection, Ouster’s LiDAR relies on single-photon avalanche diode (SPAD). These are digital components which can be assembled at a lower cost with less moving parts. Apple has used a similar concept in its LiDARs fitted onto the iPads. The demand for the components for Apple’s sensors will drive down the prices for building digital LiDARs. This would be advantageous for Ouster.

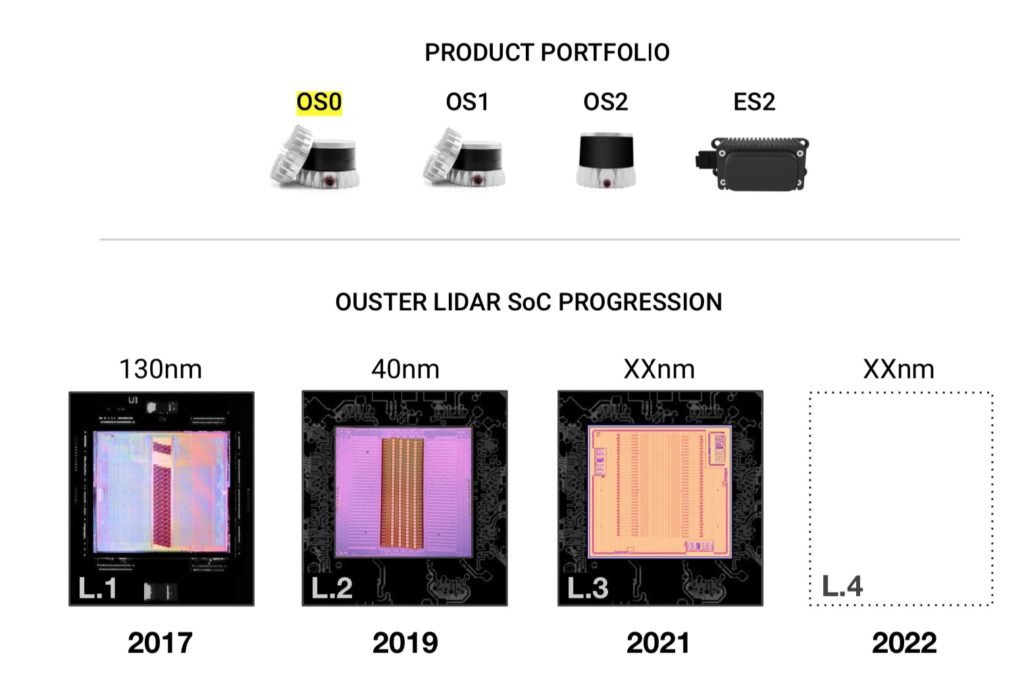

All products share a common architecture. There are two platforms – one mechanical and the other solid state. Single operating system across all products allows over-the-air updates for additional customizations.

The differentiating factor between Ouster and other recent LiDAR entrants like Velodyne, Luminar and Innoviz is the target markets. The other LiDARs are more focused on the Auto industry whereas Outster targets manufacturing, smart infrastructure, and robotics and only 15% revenue is from Auto markets. One point to note here is that the AEVA LiDAR has the same focus of targeting markets other than auto and it’s also the only 4-D LiDAR.

Ouster key highlights

- The LiDAR market is projected to reach ~$9B by 2025E and ~$50B by 2030E across 4 key industries, driven by Smart Infrastructure and Industrial today, Auto and Robotics projected to explode in ‘25E+

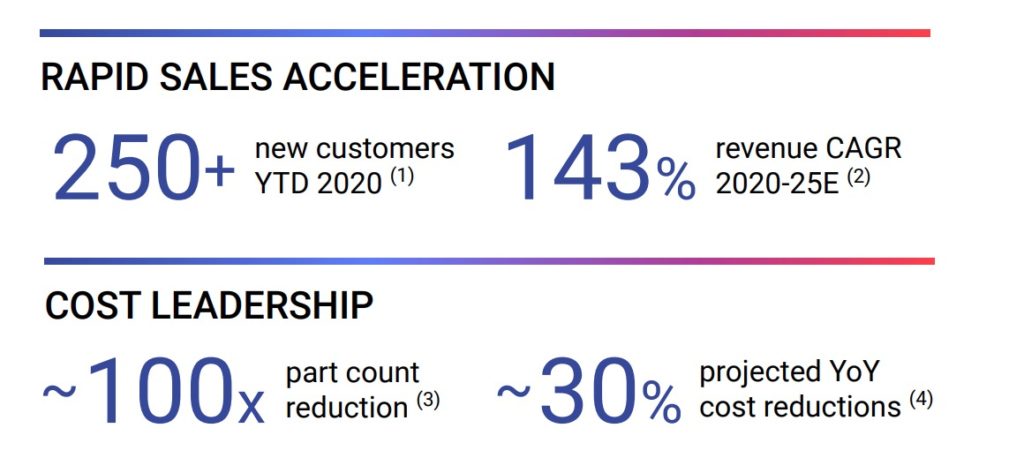

- The company has a high performance, low cost solution with 4 new digital lidar products launched since 2018. Their patented solid-state technology is capable of meeting auto and non-auto requirements

- 450+ customers (250+ new YTD 2020) with no customer accounting for >5% of projected revenue

- Non-automotive customers account for ~85% of 2020-25E projected revenue

- 29 patents granted and 100+ applications pending worldwide

- The shift to digital drives a step-change reduction in costs. The simplified architecture is designed for manufacturability with orders of magnitude fewer parts

Product Offerings

LiDAR is being used by many of the companies developing autonomous taxis and commercial vehicles, such as Waymo, as well as by government agencies like DARPA and NASA for applications ranging from robotic ground vehicles to aerial and space navigation. For consumer applications however, size, cost, power, and reliability are all critical issues. Ouster is looking to address all of these with partner Xilinx. Xilinx Field Programmable Gate Array (FPGA) chip is used for processing. Having all the processing in digital chips allows the company to scale in both accuracy and performance without significant increases in size, power, or cost.

OS0, OS1 and OS2 are the current product offerings. These range from mid-range to wide-range sensors. ES2 is Ouster’s automotive-grade solid-state lidar capable of detecting objects at a distance of more than 200 meters.

Ouster’s current platform supports 128 channels, weighs less than 500 grams (about a pound), and consumes 20W or less. While the list prices of the Ouster OS0, OS1, and OS2 range from $3,500 to $16,000, the CEO Angus Pacala, admits that volume pricing could be closer to $1,000. However, the company hopes to bring that down to $100 or less over the next decade with further technical advancements and integration as the auto industry ramps up development and production of autonomous vehicles.

Ouster Merger Details

- Pro forma implied enterprise value of approximately $1.57 billion.

- $265 million cash to balance sheet to fund the growth.

- Transaction includes $200 million of cash held in trust and an immediate $100 million financing through a PIPE.

- The deal is expected to close in the first quarter of 2021.

- All Ouster existing shareholders retain equity in the company and are not paid any cash.

Ouster Share Structure

- Total shares outstanding of 185 million

- 81% Ouster existing shareholders

- 11% existing CLA Public shareholders

- 3% CLA Sponsor

- 5% PIPE Investors

Ouster Stock Valuation

Bull Case Valuation

- $10B sales opportunity between now and 2025. Estimated revenue of $1.56B.

- $569M of EBITDA expected in 2025.

- Valuation multiple of EV/EBITDA of 10. That gives an EV of $5.69B.

- Divide $5.69B EV by the 185M Shares outstanding. This gives a valuation of $30 per share in 2025 estimated.

Conservative Valuation

- For a conservative estimation, we will assume that Ouster will penetrate a market share of 1%.

- That will translate to $1B revenue and $250M EBITDA by 2025.

- Valuation multiple of EV/EBITDA of 10. That gives an EV of $2.5B.

- Divide $2.5B EV by the 185M Shares outstanding. This gives a valuation of $13.50 per share in 2025 estimated.

Risk Factors

- The LiDAR market is crowded with so many new entrants into the public markets like Velodyne, Luminar, Aeva, Innoviz etc. If we look at autonomous driving as a whole, a LiDAR is a very small component and may be commoditized with new entries.

- The management plans to invest in the perception software to customize the platform so it can be deployed across multiple use cases. I think the perception software will be the secret sauce that may decide the winning LiDAR company. A more accurate and customizable software will result in a more efficient and safe autonomous vehicle.

- There is always the risk of the SPAC merger not going through. At this price point, I think it’s a risk worth taking since there is nothing much to lose.