Seagate Technologies (STX Stock) with a strong balance sheet and shareholder friendly management (with a generous dividend and share buybacks), is poised for a good upside with the forecasted need for data storage solutions. In the heated stock market for Cloud company stocks, going unnoticed are the suppliers of the components for data centers. During the 1849 California Gold Rush, few prospectors struck it rich. Most of the people who made money back then were those who sold shovels and other supplies to the prospectors.

Summary

- GAAP operating margin of 12.4%

- Cash flow from operations of $1.7 billion and free cash flow of $1.1 billion

- Shares outstanding reduced by 20 million year over year

- Dividend yield of 5.72% and a competitive PE ratio of 12

- Returned $1.5 billion to shareholders through dividends and share repurchases

- Revenue from mass capacity storage markets increased 25% year-over-year and represented 57% of annual HDD revenue

Company Overview

Seagate Technology PLC is a leading provider of data storage technology and solutions. The primary products are hard disk drives (HDDs), solid state drives (SSDs) and solid state hybrid drives (SSHDs). The enterprise data solutions (EDS) portfolio includes storage subsystems for enterprises and cloud service providers.

The primary markets served are the Mass Capacity storage markets. This is the growing market and its impact is reflected in the revenue growth. Legacy markets include the consumer serving needs like desktop, DVR and gaming applications. These are fading markets and its reflected as being a smaller percentage of the total revenue.

Industry Overview

The data storage industry includes companies that manufacture components designed for data storage devices. Storage solutions, software and services for enterprise cloud, big data, computing platforms and consumer markets are also an important segment of the industry. More data is being created everyday at various endpoints outside the traditional data centers. These use cases include autonomous vehicles, smart manufacturing systems and smart cities. The proliferation of media-rich digital content will further be augmented by the fifth-generation wireless (5G), the Internet of Things (IoT) and Artificial Intelligence (AI). This will increase the demand for the storage of data.

The digital transformation has contributed to an increase of the applications that need faster and secure access to data.

- The growth of media-rich content (high-resolution photos and high definition videos)

- The increasing use of video and imaging sensors in surveillance systems and traffic cameras.

- Development and evolution of IoT ecosystem and big data analytics.

- Cloud migration initiatives by the enterprises to migrate from on-site data centers into the cloud.

The International Data Corporation (“IDC”) forecasts in the Data Age 2025 study that the global datasphere should grow from 59 zettabytes in 2020 to 175 zettabytes by 2025.

Competitors

- Toshiba Corporation

- Western Digital Corporation

Key Financial Metrics

For fiscal year 2020 ending July 3, 2020

| Market Cap | $11.756 billion |

| Cash | $1.72 billion |

| Long term debt | $4.16 billion |

| Revenue | $10.51 billion |

| Net Income | $1.3 billion |

| PE Ratio | 12 |

| Dividend yield | 5.72% |

| Free cash flow | $1.1 billion |

Risks

- COVID-19 related lockdowns have impacted the supply chain and manufacturing facilities.

- Operating in a commodity type market due to the industry standards may not give a competitive advantage to any particular company, Seagate Technology included.

- Failure to predict the demand may result in the oversupply of the products.

- Legacy market conditions are very volatile due to technological advances in the NAND flash memory. These markets are still an important part of the business.

- Debt service takes a large chunk of the free cash flow.

- A significant portion of manufacturing is overseas. So the company is more subject to fluctuations in currency exchange rates, tariffs and disruptions in supply chain due to political factors.

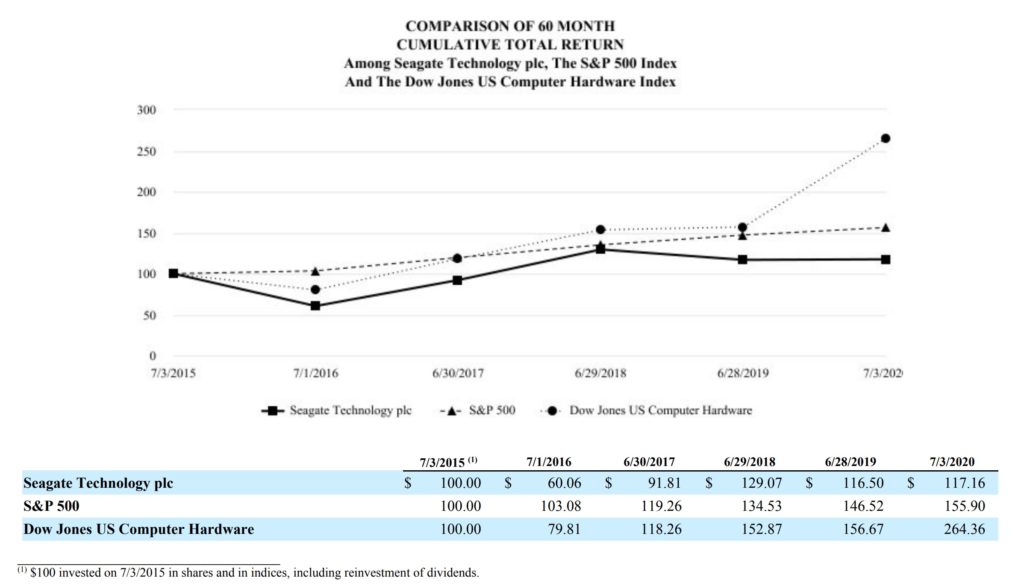

Charts