XL Fleet (XL), an industry leader in fleet electrification solutions merged with Pivotal Investment Corporation II (NYSE:PIC), a publicly listed Special Purpose Acquisition Company. The combined company got listed on the NYSE as “XL”. I listened to Jim Cramer about his XL Stock analysis and he gave a bull’s eye viewpoint on what sets this company apart from the other SPAC mergers. XL Fleet has tangible revenue and a proven track record. Its fleet electrification solutions are used by state and local governments already.

Company background

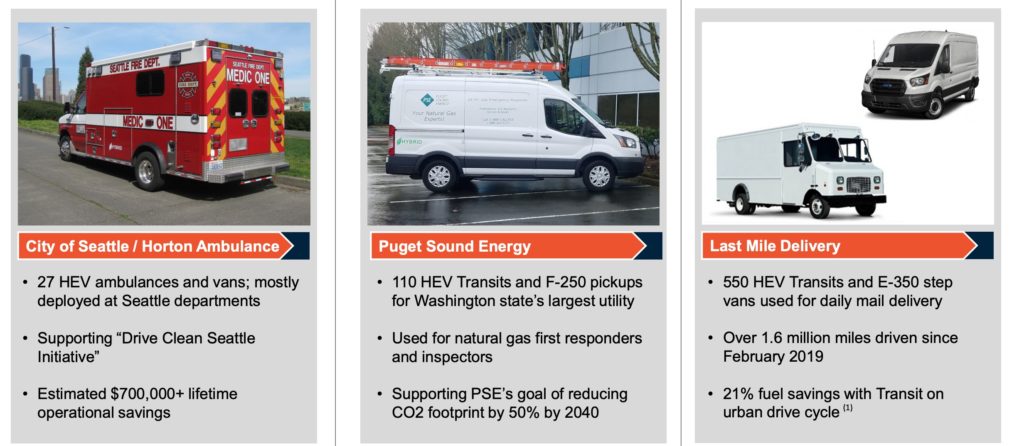

- Trusted by over 200 fleet customers with 3,000+ systems deployed, 130+ million customer driven miles.

- 3x revenue growth in 2020.

- Current production capacity of ~6,000/yr.

- Established production can scale to 100,000+ units annually and XL’s capital efficient operating model is ready to scale and drive profitability.

- Uniquely positioned to deliver on “Electrification-as-a-Service” and turbocharge growth as the market evolves.

- $220+ million sales pipeline for next 12 months, 2020F 95% booked.

- Increasing TAM through transition to all-electric and launch of class 7/8 by 2023.

- Multichannel sales funnel (XL Fleet, OEM Partners, Upfit partners and FMC Partners)

What problem is XL trying to solve?

Vehicles need to reduce emissions now, but virtually all fleet vehicles today are powered by fossil fuel. Fully-EV production capacity has barely started and will take decades to supply the whole market. To fill this vacuum, XL offers powertrain solutions that enable the vehicle go hybrid with at least a 30% savings in fuel.

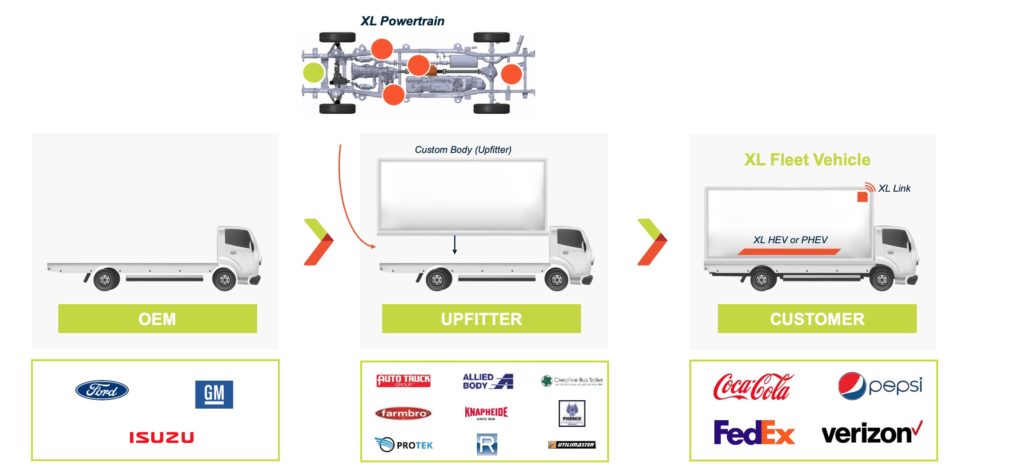

Fleet manufacturing process

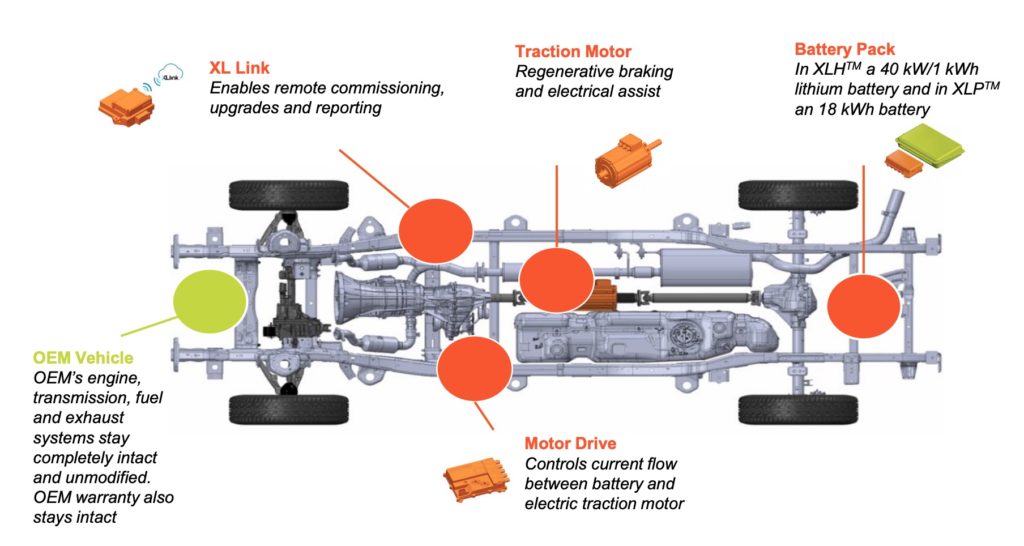

There is a 2-step process currently for manufacturing fleet vehicles. The OEMs (Ford, ISuzu, GM) manufacture the bare vehicle. Then the upfitters (AutoTruck group, Allied Body, Protek etc) fit the custom body on top of the OEM vehicle.

This is where XL Fleet’s solutions come into play. Through manufacturing partnerships with different upfitters and OEM, XL’s powertrain is fitted on top of the OEM vehicle. This includes components like the Battery pack, the Traction motor, Motor drive and the XL Link (which helps in remote monitoring).

XL Fleet Offerings

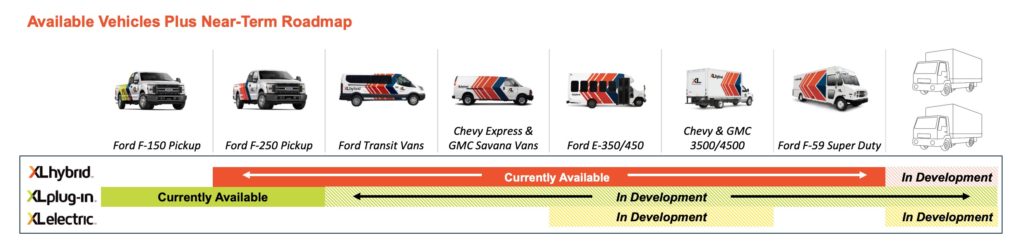

XL has 3 product offerings. Two of them are already in use across different vehicles classes and the XL electric powertrain is under development.

XL Hybrid

• Improve MPG (~25%) & meet sustainability goals without compromising performance

• No operational risk or infrastructure required for fleet operators

XL Plug-in

• Innovative plug-in hybrid system that is revolutionary in its simplicity

• Highly-efficient – capable of driving up to 50% savings in MPG

XL Electric

• Zero emissions offering

• XL propulsion systems will enable fast-to market, very competitive EV offerings

The following is their product offering roadmap

Electrification-as-a-Service platform

XL is Creating a Fully Integrated Platform for Fleet Electrification. The following are the core components

- Real Time Data Monitoring & Analytics (XL Link)

- Proprietary Electric Powertrain Platform (XL Hybrid, XL Plug-in, and XL Electric)

- Power Management, Charging & Storage (XL Grid)

Merger Transaction Details

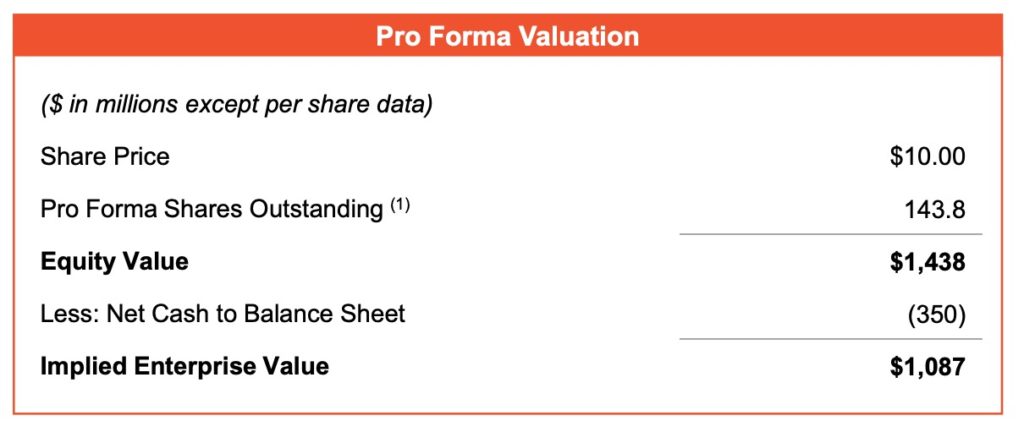

- Pro forma implied equity value of approximately $1.438 billion.

- $350 million cash to balance sheet to fund the growth. The company has a detailed capital allocation plan unlike the previous SPACs.

- Transaction includes $232 million of cash held in trust and an immediate $150 million financing through a fully committed PIPE.

- The deal has been completed successfully.

- All XL existing shareholders retain equity in the company and are not paid any cash.

- Pivotal Chairman and CEO Jon Ledecky and Pivotal Directors will join the merged company’s Board of Directors upon completion of the transaction.

Share Structure

- Total shares outstanding of 143.8 million

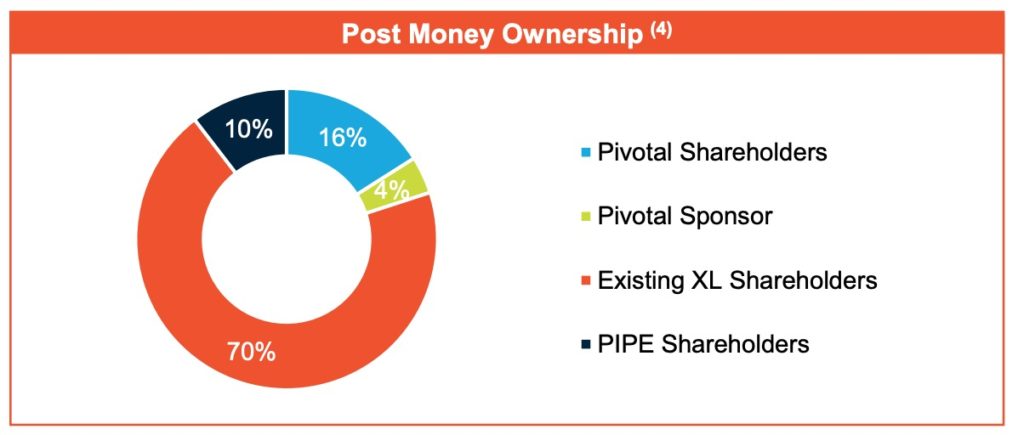

- 70% existing XL shareholders

- 16% Pivotal shareholders

- 4% Pivotal Sponsor shareholders

- 10% PIPE Investors

XL Stock Valuation

Bull Case Valuation

- $1.377B revenue and $308M EBITDA expected by 2024. (Implying a 6% penetration of the EV market)

- Valuation multiple of EV/Revenue of 10. $13.77B Valuation.

- Divide $13.77B EV by the 143.8M Shares outstanding. This gives a valuation of $95 per share in 2024 estimated.

Conservative Valuation

- $650M revenue and $117.3M EBITDA expected by 2024. (Implying a 3% penetration of the EV market)

- Valuation multiple of EV/Revenue of 5. $3.5B Valuation.

- Divide $3.5B EV by the 143.8M Shares outstanding. This gives a valuation of $24 per share in 2024 estimated.

Risk Factors

- The OEM manufacturers are all working to roll out their own EV models in the Fleet sector. This includes Ford and GM. It will be interesting how this will play out since that will eat into the market share of XL. Agreed there is a huge inventory of Fleet vehicles on the road currently and they are ICE (Internal Combustible Engine). Thus, the Fleet companies may not have the budget to go completely electric and still may leave ample room for XL solutions to be adopted.

- XL may not be able to achieve the level of penetration it is looking for in the Fleet markets. A conservative penetration of 3% shows how much it affects the share price. What if 3% is not even achieved? That may put the stock in the bear mode and it may affect the share prices drastically.

However I think there is still a huge role for XL to play. It may get into manufacturing agreements in OEMs to get them the Powertrains. That will be a win-win because it would drastically reduce the time to get on the road for OEMs for their EVs.