ChargePoint, the world’s largest provider of electric-vehicle charging stations will go public with a reverse-merger agreement. ChargePoint is using the special purpose acquisition company (SPAC), Switchback Energy (SBE) for its IPO. The deal is worth $2.4 billion. The combined company will take the name ChargePoint Holding and list on the NYSE. ChargePoint Stock allows the retail investor to get onto the Electric vehicle bandwagon.

ChargePoint Stock Business Model

Founded in 2007, ChargePoint is a category creator in EV charging, helping to make the mass adoption of electric mobility a reality. ChargePoint has created one of the world’s largest charging networks with a capital-light model by selling individual organizations and businesses, known as site hosts, everything they need to electrify their parking spaces – networked charging hardware, software subscriptions and associated support services.

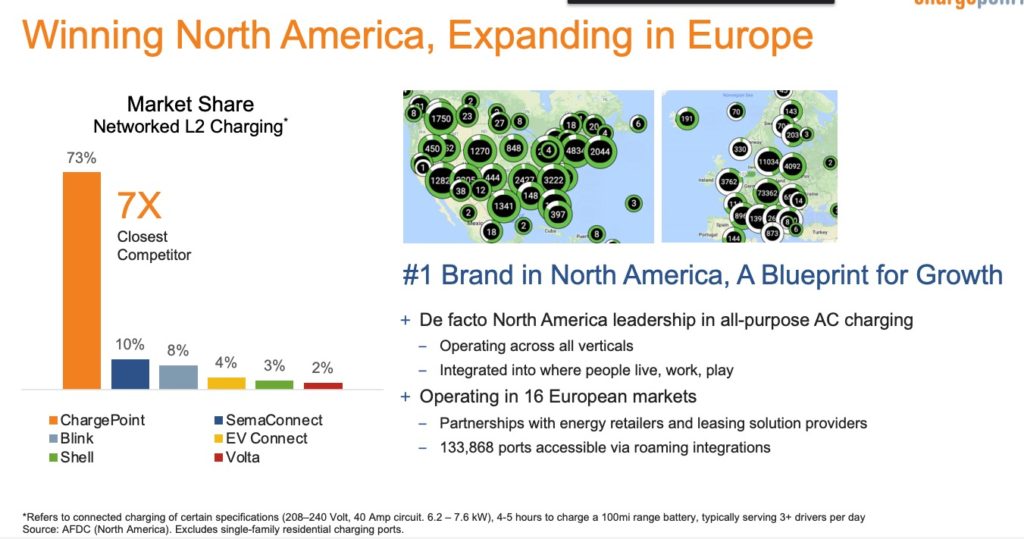

ChargePoint’s offerings have attracted a growing customer base of more than 4,000 organizations and businesses, building a network of more than 115,000 public and private places to charge. ChargePoint also offers access to an additional 133,000 public places to charge through network roaming integrations across North America and Europe.

Today, one ChargePoint account provides access to hundreds-of-thousands of places to charge in North America and Europe. Drivers plug into the ChargePoint network approximately every two seconds and have completed more than 82 million charging sessions to date.

Upon the transaction closing, ChargePoint will continue to be led by President and CEO, Pasquale Romano and the existing management team.

Advantages

- Massive Total Addressable Market

- Winning Business Model

- Strong Competitive Moats

- Strong Capital-Light Growth

“The EV charging industry is accelerating and it is expected that charging infrastructure investment will be $190 billion by 2030”

Scott McNeill, CEO Switchback Energy

Transaction Overview

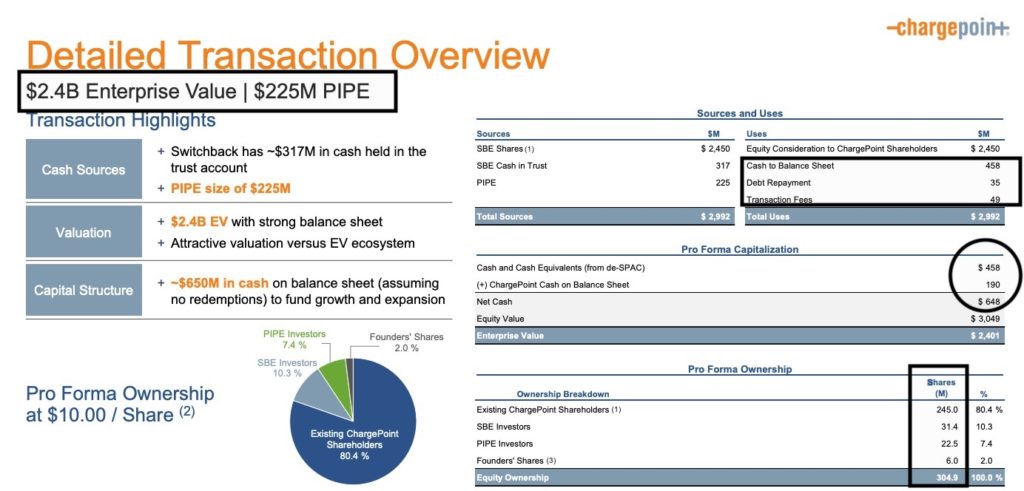

The business combination values ChargePoint at an implied $2.4 billion enterprise value. Upon transaction closing, and assuming no redemptions by Switchback stockholders. Switchback has approximately $317 million cash in trust, and a $225 million PIPE of common stock valued at $10.00 per share led by institutional investors including Baillie Gifford and funds managed by Neuberger Berman Alternatives Advisors. ChargePoint has $190 million on its balance sheet. The cash raised will be used to pay off the debt of $35 million and $49 million transaction costs.

ChargePoint will be completely debt-free and have approximately $648 million in cash, resulting in a total pro forma equity value of approximately $3.0 billion.

In addition, Switchback’s sponsor and certain other of its founder stockholders have agreed that a portion of their equity will vest only if following the closing the share price of ChargePoint exceeds $12.00 per share for any ten trading days within any twenty consecutive trading day period prior to the fifth anniversary of the closing of the transaction.

Long-term Financial Summary

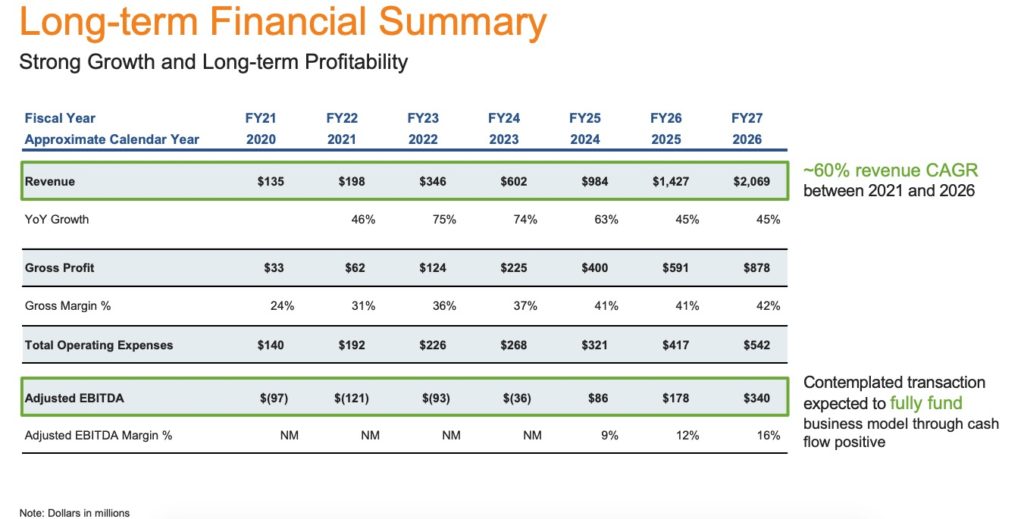

These are forward looking statements and should be taken in with a grain of salt.

EV charging infrastructure investment projected to be $190B by 2030

In this financial model, the revenue is expected to grow each year at 60% between 2021 and 2026. Towards fiscal year 2024, the adjusted EBITDA is expected to turn cash flow positive. If we look at the cash burned until that point, it is around $350 million which is much less than the available cash on hand. ChargePoint is simply trying to say that it has enough cash on hand to operate, until it starts bringing in cash from its operations.

Conclusion

The bottom line is that this is a bet on the future of EV charging infrastructure. The market is very bullish right now on companies getting on the EV bandwagon. But there were many instances in the past where the market was very bullish on trends like 3D printers, Solar companies etc.

There is no guarantee this EV trend may last long. So investing on trends is not a good idea. One key thing to consider is that the cash flows are not available until 2024. It is valued at 17 times the revenue. If one plans to invest in the ChargePoint Stock, understand very well that you have to be in for the long term to realize the benefits. This article is for informational purposes and not a recommendation. Please do your due diligence before making any investment decisions.