REE Automotive is an Israel-based inventor of the next generation EV platform which is completely flat, scalable and modular. 10X is a Special purpose acquisition company listed on the NASDAQ under the ticker “VCVC” with $201M cash in trust. REE Automotive and 10X have entered into a business combination agreement. The transaction is expected to close by the end of Q2 2021. Following the closing, the combined company will be listed on the Nasdaq Stock Market under the ticker symbol “REE”.

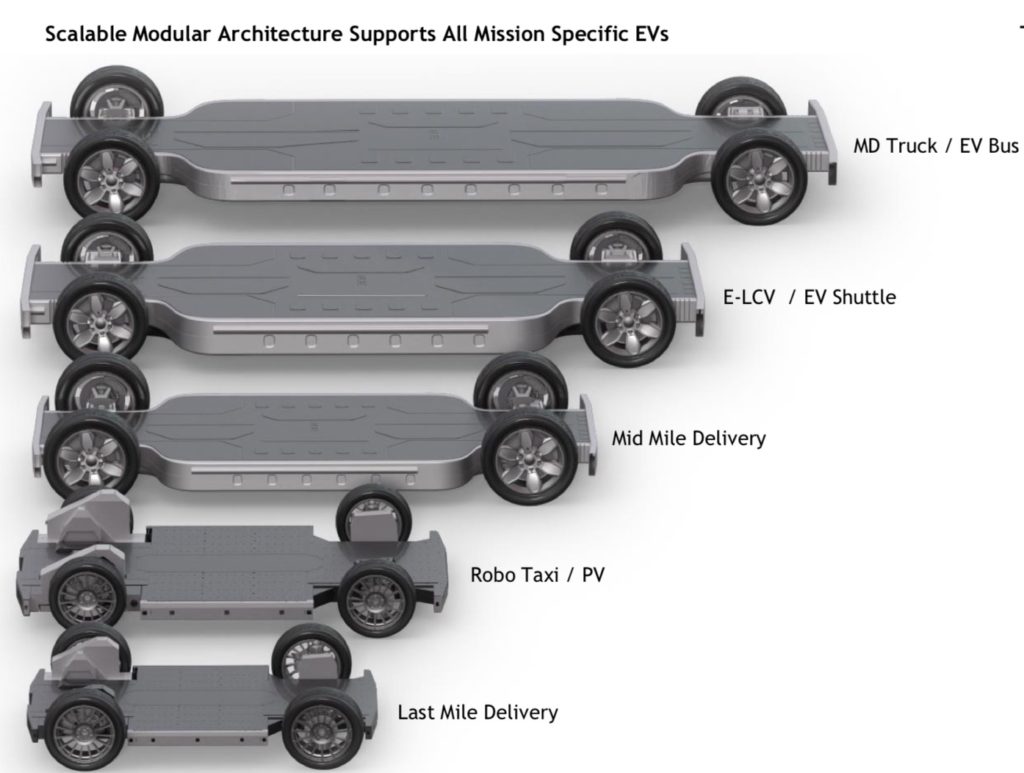

REE’s disruptive corner technology enables a completely flat and modular chassis that supports all mission-specific EVs from class 1 to class 6. REE’s EV platforms provide maximum room for passengers, cargo and batteries with the smallest footprint.

Company Background

REE’s technology is ideal for mission-specific EVs in all shapes and sizes, and the company has already used this technology to build electric vehicle platforms ranging from class 1 all the way through class 6, which means as small as short-range delivery vehicles or autonomous passenger vehicles on one end of the spectrum, up to as large as a long-range delivery truck or a mid-size shuttle bus on the other end.

This is all made possible by REE’s groundbreaking x-by-wire technology. That means drive by wire, brake by wire, and steer by wire, independently on every single wheel. Their technology lets REE and its partners build vehicle platforms in multiple sizes, for multiple mission-specific use cases, at a fraction of the cost, in a fraction of the time, and it allows REE’s customers to enjoy substantially lower total cost of ownership, which is a key driver in commercial and fleet applications. It also allows tremendous flexibility. REE-based vehicles can be powered by batteries or fuel cells and operated by human or autonomous drivers. REE’s technology and business model are completely agnostic to how the industry develops, which is a key differentiator.

REE Automotive Strategic Partners

- Mahindra is one of the largest EV manufacturers with a unique cost structure and global footprint. MOU to explore strategic collaboration of jointly developed all-electric commercial vehicles for global markets. The collaboration is expected to target producing 250,000 vehicles.

- Hino Motors is the medium and heavy-duty truck arm of Toyota, and a leader in MaaS & electrification. Announced cooperation at the Tokyo Motor Show 2019.

- KYB is a top 5 Tier-1 supplier of shock absorbers, air suspension and power steering systems. Partnership to develop suspension capabilities.

- Maxion Wheels is one of the world’s largest wheel manufacturers and a leader in truck chassis systems. Partnership to co-develop and manufacture exclusive wheel design and chassis solutions.

VCVC SPAC Management Team

The 10X team has a track record of investing in high growth technology companies going back to the 1990s. Their portfolio companies have gone public recently, including DraftKings, Palantir, Wish, and Compass Therapeutics. The members of the team were also early investors in Cruise, an autonomous driving startup which was acquired by GM.

Long-term strategic investors in the PIPE include Koch Strategic Platforms, Mahindra & Mahindra and Magna International.

REE Products

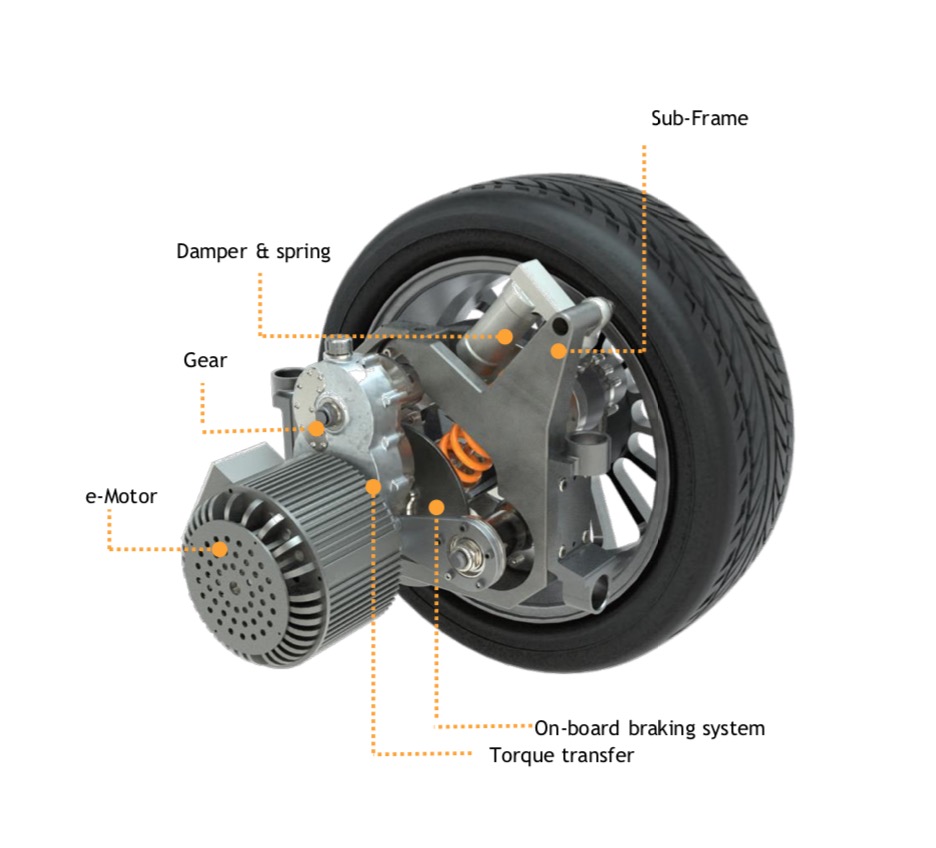

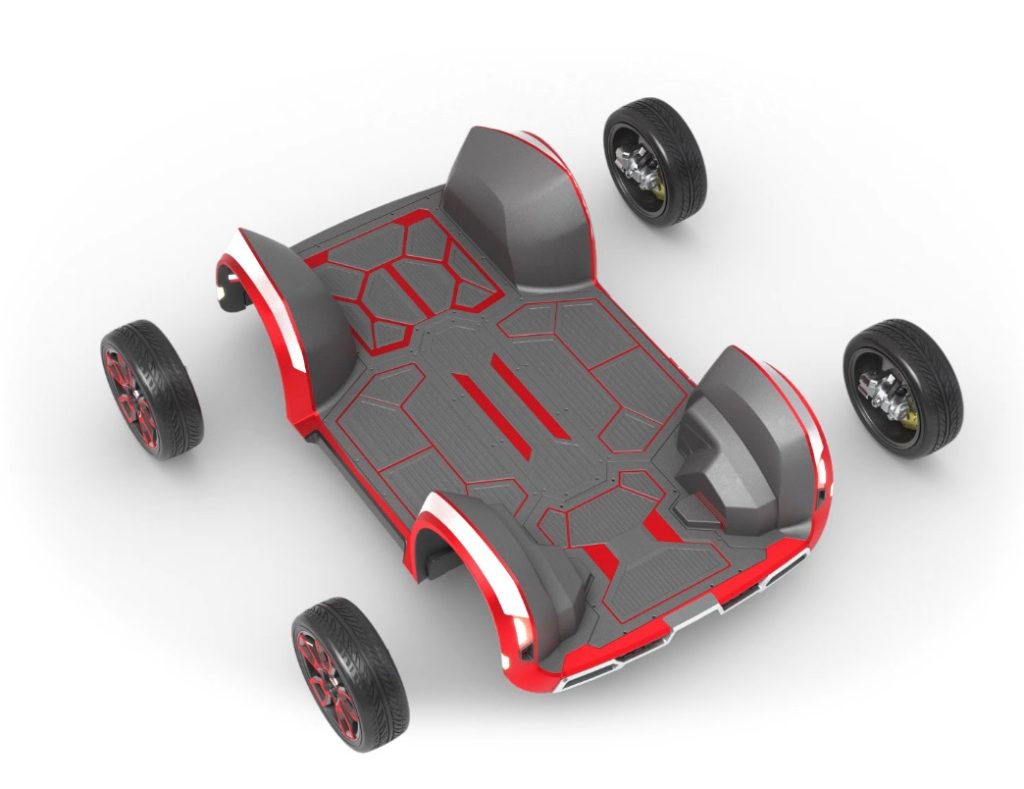

REE has developed two core innovations: the REEcorner integrates all traditional vehicle components into the arch of the wheel and thus carrying the REEboard – a completely flat and modular electric platform. The technology is agnostic to major current and future market trends such as vehicle size and design, power source and driver. Vehicles powered by REE are flatter and lower, allowing them to carry more batteries or fuel cells, as well as more packages, than vehicles built on conventional electric or internal combustion architecture.

The goal is for REE to be like Intel Inside, the same way that Intel chips power the lion’s share of computers, REEs corners and controls are uniquely positioned to be integrated in a wide range of EVs. No matter which path the industry takes, in terms of power sources or who’s driving, REE is making it happen. This is a key differentiator, and positions REE as an excellent risk adjusted opportunity to capture the growth of the mobility space more broadly.

REEcorner

REECorner integrates critical vehicle components such as steering, braking, suspension, powertrain, and control into the arch of the wheel. The x-by-wire technology controls the steering, braking and propulsion, all by wire, all on a single wheel assembly with no mechanical connection between the corners. x-by-wire technology enables lower total cost of ownership through fast REEcorner replacement in under an hour, over the air updates and hardware upgrades.

REE’s data harvesting capabilities can be used to further reduce TCO via intelligent preventative maintenance features. The Chassis is power agnostic. It can be powered either by Battery or Fuel cells. The body can be rebuilt without changing corners and the power source upgradeable over time

REEboard

The board is a completely flat, scalable and modular platform enabling limitless body configurations with complete design freedom and greater efficiency of space at a fraction of the cost. Since the REEboard does not store any drive components it can be designed to take any shape making it the ultimate mission specific vehicle. The REEboard provides more volume on a smaller footprint with more capacity for batteries or fuel cells within the chassis.

REE competitive advantage

For OEMs, incorporating REEcorner technology into their EV product portfolios enables fast and efficient entry into EV markets. Mobility service providers can leverage REEcorner technology to build mission-specific EVs based on their exact needs and specifications, while no longer being constrained to purely “off-the shelf” offerings.

REE Integration Centers

REE will utilize a CapEx-light manufacturing model, with globally located integration centers, which creates scalable and agile unit economics. The company plans to utilize manufacturing capacity via a secured and exclusive global network of Tier 1 partners in over 30 countries, with point-of-sale assembly.

REE will assemble components at its integration centers, thus reducing Capex requirements. The company expects to have a network of 15 integration centers by 2026 with annual capacity of ~600k units.

Merger Transaction Details

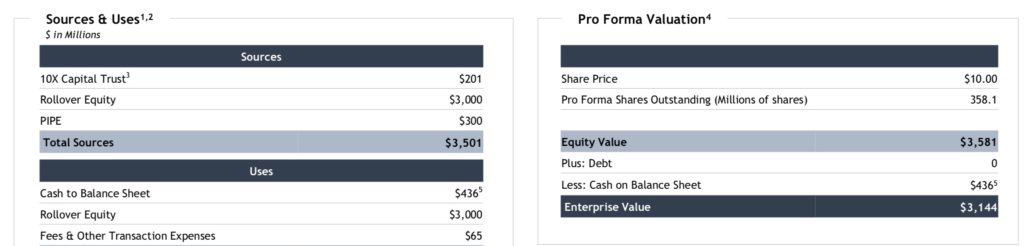

- Pro forma implied equity value of approximately $3.581 billion.

- $436 million cash to balance sheet to fund the building of integration centers and working capital needs.

- Transaction includes $201 million of cash held in trust and $300 million PIPE.

- The deal is expected to close by the end of second quarter, 2021.

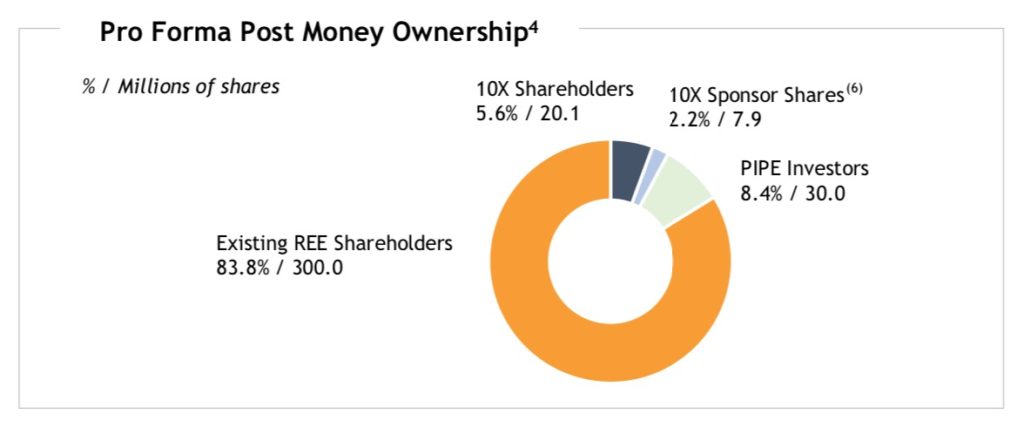

Share Structure

- Total shares outstanding of 358.1 million

- 83.8% existing REE shareholders

- 8.4% PIPE investors

- 5.6% 10X SPAC shareholders

- 2.2% 10X SPAC Sponsor shareholders

VCVC Stock Valuation

- A diverse and advanced pipeline representing indications of interest from various strategic partners totaling $19.1 billion through 2026, of which $5.1 billion is signed MOUs.

- The CapEx-light production capacity will reach 40,000 EV platforms by the end of 2021, with a goal of ramping to approximately 600,000 EV platforms by the end of 2026.

- REE only needs to assemble components at its Integration Centers, reducing Capex requirements

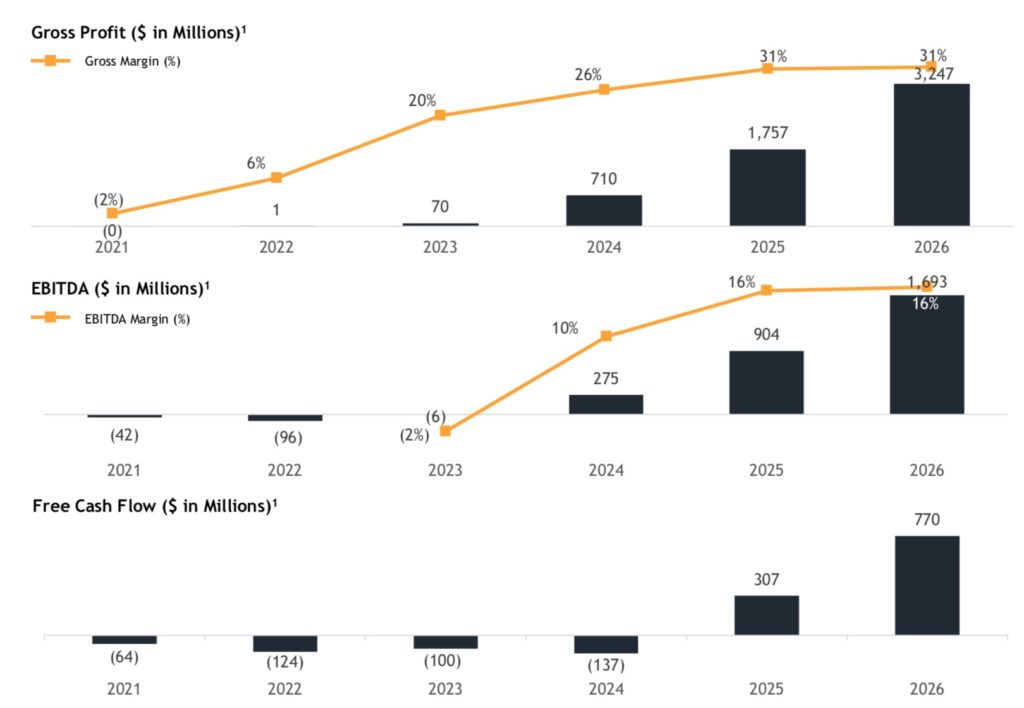

- The management is expecting to be cash flow positive by 2025

REE Stock Valuation for 2025

- $5.7B revenue and an EBITDA of $1.757B by the end of 2025.

- Valuation multiple of EV/EBITDA of 10. That gives an EV of $17.57B.

- Divide $17.57B EV by the 358.1M Shares outstanding. This gives a valuation of $49 per share in 2025 estimated.

Conservative Valuation for 2025

- For a conservative estimate, we will discount management estimates by 50%.

- $2.75B revenue and an EBITDA of $878M by the end of 2025.

- Valuation multiple of EV/EBITDA of 10. That gives an EV of $8.78B.

- Divide $8.78B EV by the 358.1M Shares outstanding. This gives a valuation of $24 per share in 2025 estimated.

REE Risk Factors

- There is intense competition in the e-mobility space, including with competitors who have significantly more resources. The success of REE depends on the ability to grow and scale REE’s manufacturing capacity through new relationships with Tier 1 suppliers, maintain relationships with current Tier 1 suppliers and strategic partners.

- The company just finished the proof of concept and the design validation is still in progress. The integration centers have not yet been established. I think the company is still nascent both in terms of technology and validation. The current rush of SPAC mergers with EV startups getting sky-high valuations definitely weighed on the decision to go public.

- The management projections of future revenues seem extremely inflated. The company has no revenue.

- Canoo is another EV platform company with more mature technology and exceptional vendor relationships with Hyundai and Kia. If an Apple car goes into production with tie ups with Hyundai, Canoo would greatly benefit. Personally, I prefer to invest in Canoo stock rather than the REE stock.