Morgan Stanley’s Space Team estimates that the roughly $350 billion global space industry could surge to over $1 trillion by 2040. Spire Global, Inc. is a leading global provider of space-based data and analytics. The company’s proprietary data and solutions help customers solve some of earth’s greatest challenges, including Net Zero and Climate Change adaptation. The company has more than 100 satellites orbiting earth in low orbit.

Spire Global’s merger with special-purpose acquisition company NavSight values the company at $1.6 billion. The deal gives Spire about $475 million in cash to accelerate data-gathering and analysis operations across maritime, aviation, weather, climate and other markets. The company is valued at 6 times the 2023E revenue.The transaction is estimated to be completed in Q2 2021, and the combined company will trade on the NYSE ticker symbol SPIR.

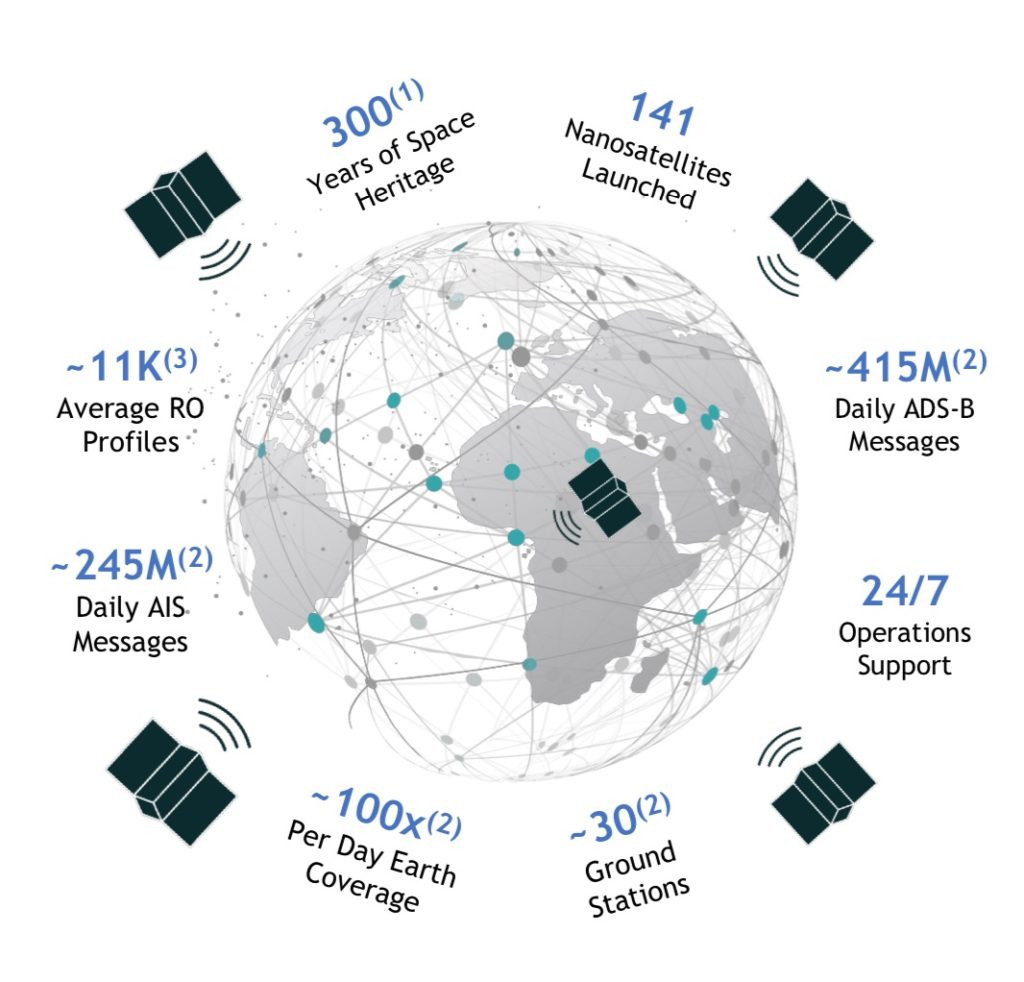

Spire global key highlights

- Founded in 2012 with ~$180 million of capital invested to-date from high quality strategic partners and investors.

- 141 Nanosatellites Launched and 25+ Spacecraft iterations.

- 30+ ground stations and 100x earth coverage per day.

- Highly technical workforce of ~250 employees, including ~140 engineers and scientists.

- Hire additional sales personnel and increase external marketing.

- Establish presence in Latin America and the Middle east.

Spire Global stock technology

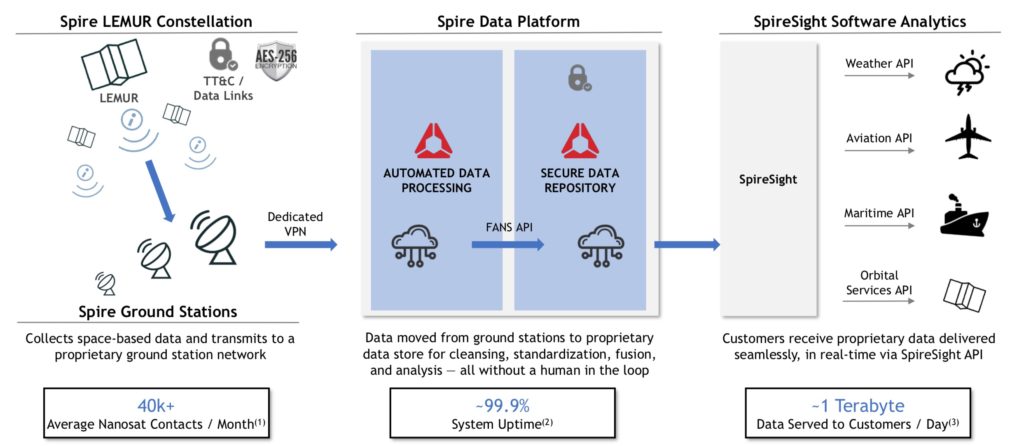

Spire collects space-based data using a proprietary constellation of multi-purpose nanosatellites called LEMUR (Low Earth Multi-Use Receiver). LEMUR is a standard, mature nanosatellite bus, which is used to host all of Spire’s data products. Multiple sensors are hosted on each LEMUR nanosatellite, reducing the production cost for each data type and allowing optimization of data production across the entire fleet. Spire owns the IP for its nanosatellite, allowing continuous improvements to the capability of both the bus as well as the hosted sensors. All LEMURs are manufactured in-house by Spire in its end-to-end manufacturing facility. This in turn increases nanosatellite build quality and speed while lowering cost. The company has a full license to operate on a commercial basis in multiple jurisdictions.

The Company’s software analytics generate proprietary data, insights and predictive analytics for its global customers through a subscription model. Spire monetizes this information across a broad and growing number of industries including weather, aviation, maritime, and government, with global coverage and near real-time data that can be easily integrated into customer business operations.

Spire Global use cases

The company operates in 4 different domains for providing Space data APIs.

1) Spire Maritime

- Tracking vessels around the globe

- Optimizing fuel efficiencies

- Monitoring illegal activities and compliances

- Analyzing commodity trading

Vesselbot improved their Voyage Optimization system by including Spire Maritime products, achieving 10-15% increase in TCE and 30% reduction in GHG emissions.

2) Spire Aviation

- Regulatory compliance

- Flight tracking

- Estimated time of arrival and on-time performance

- Overflight fee

- Search and rescue

Manage risks and logistics of reopening air travel during COVID-19. Delivers comprehensive air traffic data that SATAVIA utilizes to enable live monitoring and live updates on virus importation risk.

3) Spire Weather

- Protect physical assets like power lines from storm damage

- Maximize crop yields with optimal farm operations based on weather

- Minimize losses and enhance customer experience in insurance with advanced warning systems of inclement weather

Spire Weather uses the growing constellation of LEMUR Satellites to create a unique global- observation network. By continuously collecting and processing GPS and GNSS signals as they pass through the earth’s atmosphere, these satellites can measure temperature, pressure and humidity over 7000 times per day on average worldwide. Flights have sensors on them that observe weather. When the flights were grounded in 2020 due to Covid-19 restrictions, weather agencies used Spire’s proprietary data to build weather forecasting models. The improved efficiency earned praise from leading weather organizations worldwide.

4) Spire Orbital Services

There are two offerings. The first is Space-as-a-service. Build customer’s application on top of the global space platform, using one of the world’s largest networks of sensors, software-defined radios and high performance computers. The second is the Payload-as-a-service. The company provides custom designed payloads for specific mission requirements.

Spire’s consistent launch schedule and in-house nanosat design and assembly allows customer sensors to go from design to launch-ready in 3 to 6 months.

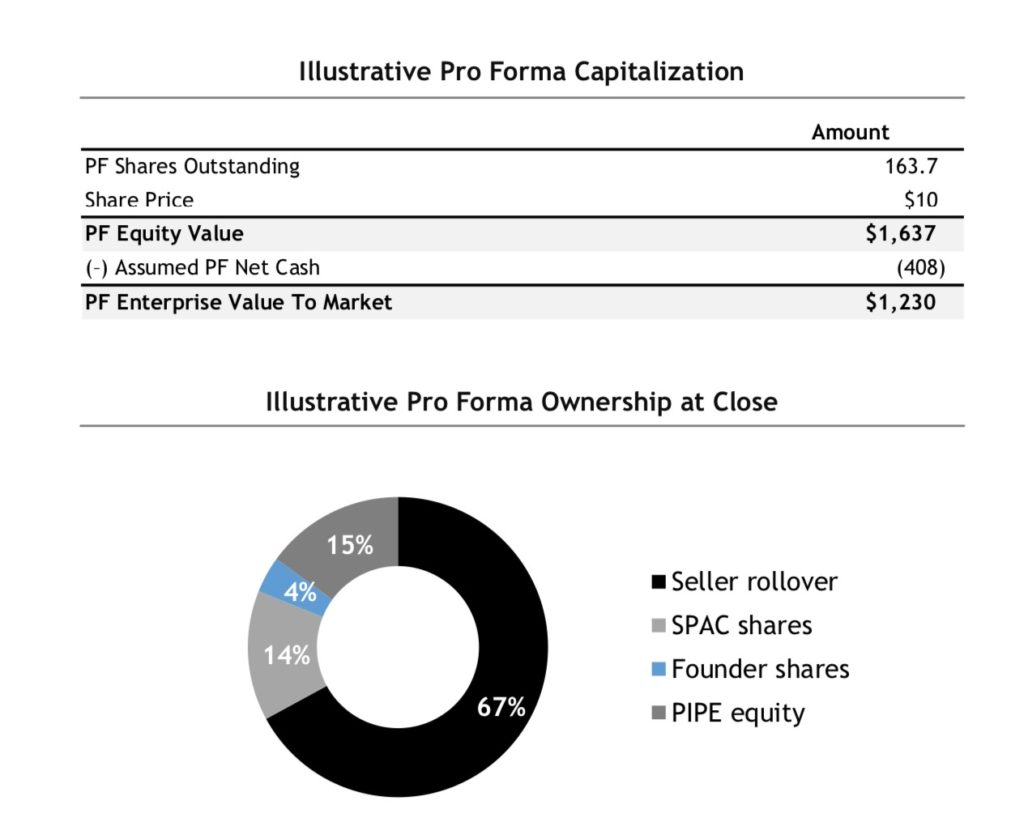

NSH Stock Merger Details

- Fully diluted post-money equity value of $1.6B.

- Transaction will result in $408M of cash to the balance sheet to fund growth.

- Transaction includes $230 million of cash held in trust and $245 million PIPE, anchored by Tiger Global Management, funds and accounts managed by BlackRock, Hedosophia.

- The deal is expected to close by the second half of 2021.

- NSH ticker symbol will change to “SPIR” upon closing and listed on the NYSE.

Share Structure

- Total shares outstanding of approximately 163.7 million.

- 67% existing Spire global shareholders.

- 15% PIPE investors.

- 14% NSH SPAC shareholders.

- 4% SPAC sponsors.

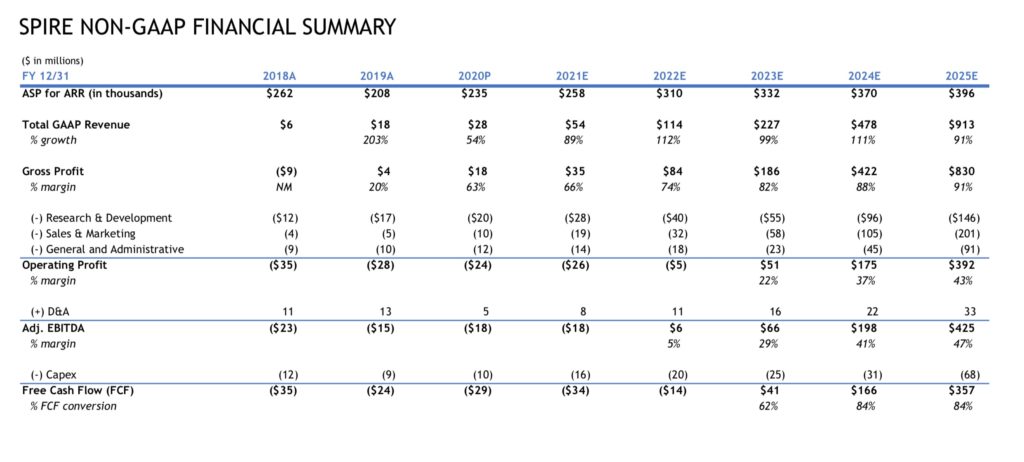

Spire Global Stock Valuation

- Spire Global has a recurring revenue model with exceptional SaaS KPIs.

- Land and Expand strategy drives revenue visibility and NRR (~145% in 2020P).

- Strong growth in ARR Drives top line momentum.

- Highly scalable model with 90%+ gross margins and 80%+ FCF conversion by 2025E.

- <7 Months Time to Payback Customer Acquisition cost (2020P).

- 145%+ customer net retention rate.

Management Valuation for 2025

- $913 million revenue and an EBITDA of $425 million by the end of 2025.

- The company is expected to be cash flow positive by 2023 with $41 million FCF.

- Valuation multiple of EV/EBITDA of 10. That gives an EV of $4.25 billion.

- Divide $4.25 billion EV by the 163.7 million shares outstanding. This gives a valuation of $26 per share in 2025 estimated.

Risk Factors

- The race to the space is a new market. There are a lot of peers, who are competing in this space. Spire global is an emerging company. The advantage is that it already has a revenue of $28 million. The other companies do not have any revenue so far. But the success of Spire global depends on how large the Space market grows and how well it can grow it’s recurring revenue.

- There are a lot of proven data analytics platforms in the market. These companies are well funded and have exceptional AI and Machine learning capabilities. There are other space players that also sell data. These AI players can integrate that data into their platform and compete with Spire global on that front.

- The growing treasury yields and rotation of big money from growth to value stocks has put a lot of selling pressure on SPACs. Be ready for a lot of volatility in the stock once the merger completes.