Rocket Lab, a global leader in launch and space systems, and Vector Acquisition Corporation (Nasdaq: VACQ) , a special purpose acquisition company backed by leading technology investor Vector Capital, announced today that they have entered into a definitive merger agreement that will result in Rocket Lab stock becoming a publicly traded company. The transaction is estimated to be completed in Q2 2021, and the combined company will trade under the Nasdaq ticker symbol RKLB.

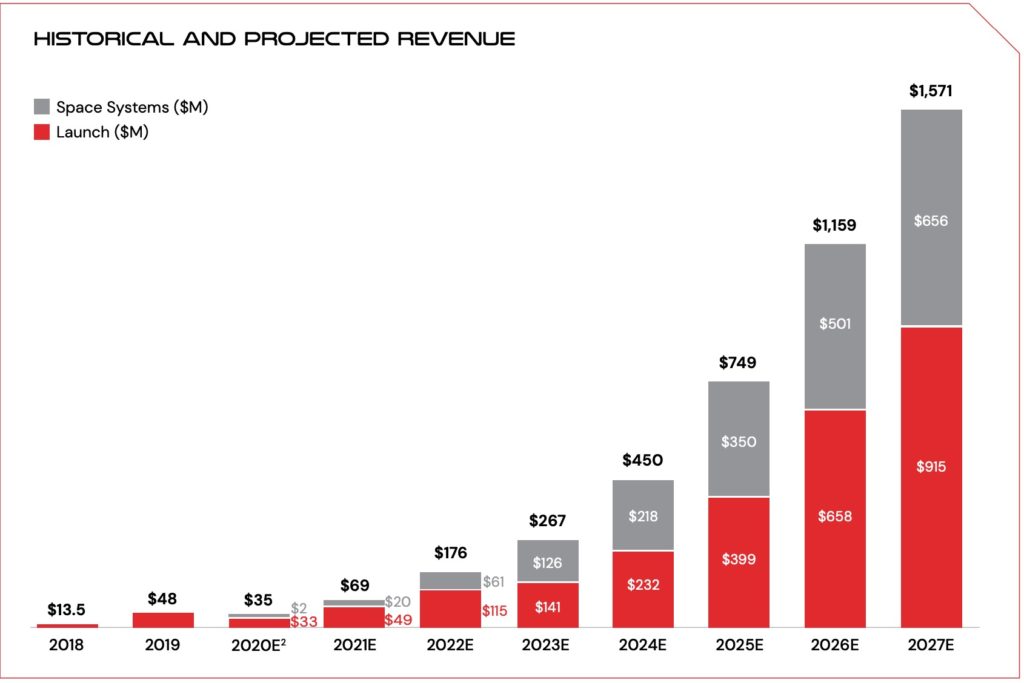

Rocket Lab’s forecast that the Company will be adjusted EBITDA positive in 2023, cash flow positive in 2024 and cross $1 billion in revenue in 2026. This is supported by a strong backlog and opportunity pipeline. Morgan Stanley’s Space Team estimates that the roughly $350 billion global space industry could surge to over $1 trillion by 2040.

Company background

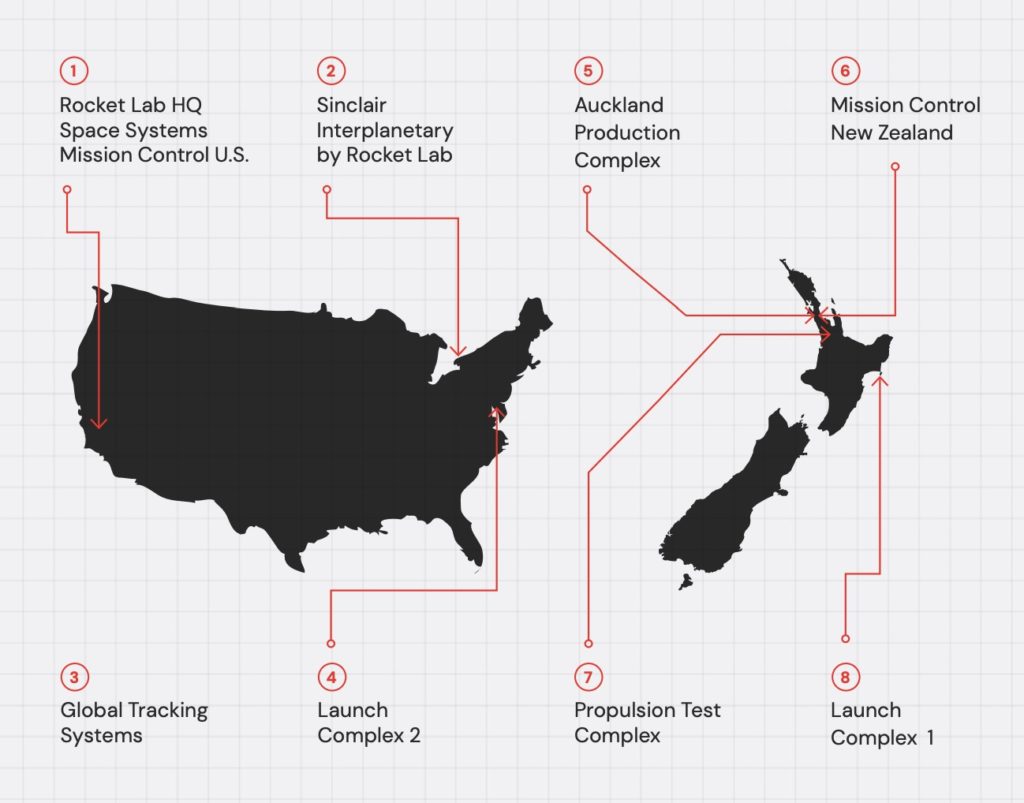

Rocket Lab is headquartered in Long Beach, California. The company designs and manufactures the Electron and Neutron launch vehicles and Photon satellite platform. The first orbital was launched in January 2018. Rocket Lab’s Electron launch vehicle has become the second most frequently launched U.S. rocket annually and has delivered 97 satellites to orbit for private and public sector organizations, enabling operations in national security, scientific research, space debris mitigation, Earth observation, climate monitoring, and communications. The company operates two launch sites, including the world’s only private orbital launch site located in New Zealand, and a second launch site in Virginia, USA.

Rocket Lab market

Rocket Lab delivers the first dedicated ride to orbit for small satellites, providing customers control over launch schedule and enabling tailored orbits that cannot be matched by large rocket rideshare. Small satellites face costly delays when flying rideshare on large rockets due to low launch frequency. More than 50% of small satellites launched in the past 5 years were delayed from 4 months to 2 years. Large rockets do not provide adequate control for many small satellite orbital destinations.

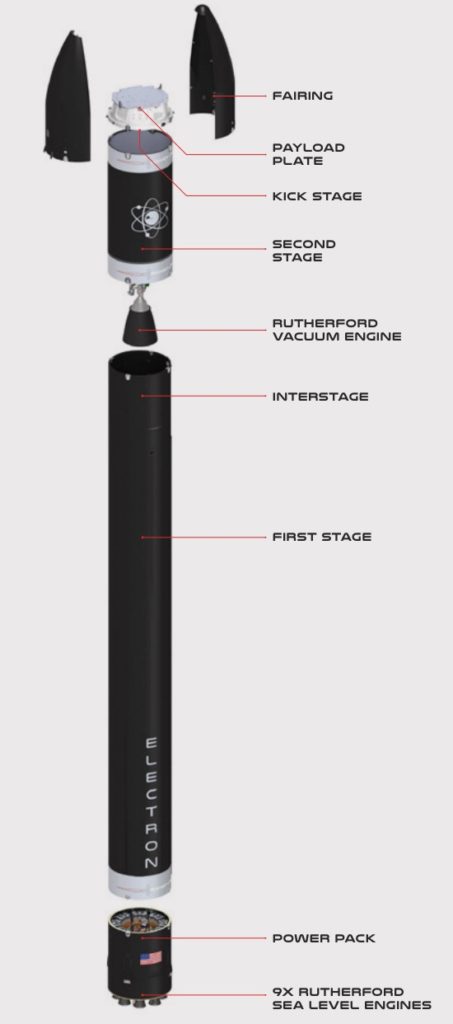

Electron

Electron is the only reusable orbital-class small rocket. Capturing and reflying Electron’s first stage enables higher launch frequency without expanding production and lowers launch costs. The rocket’s unique Kick Stage is designed to deliver small satellites to precise and unique orbits, whether flying as dedicated or rideshare. The Electron is the second most frequently launched rocket in the U.S.

- 18 Launches to date

- 97 Satellites successfully deployed

- Only reusable small launch vehicle

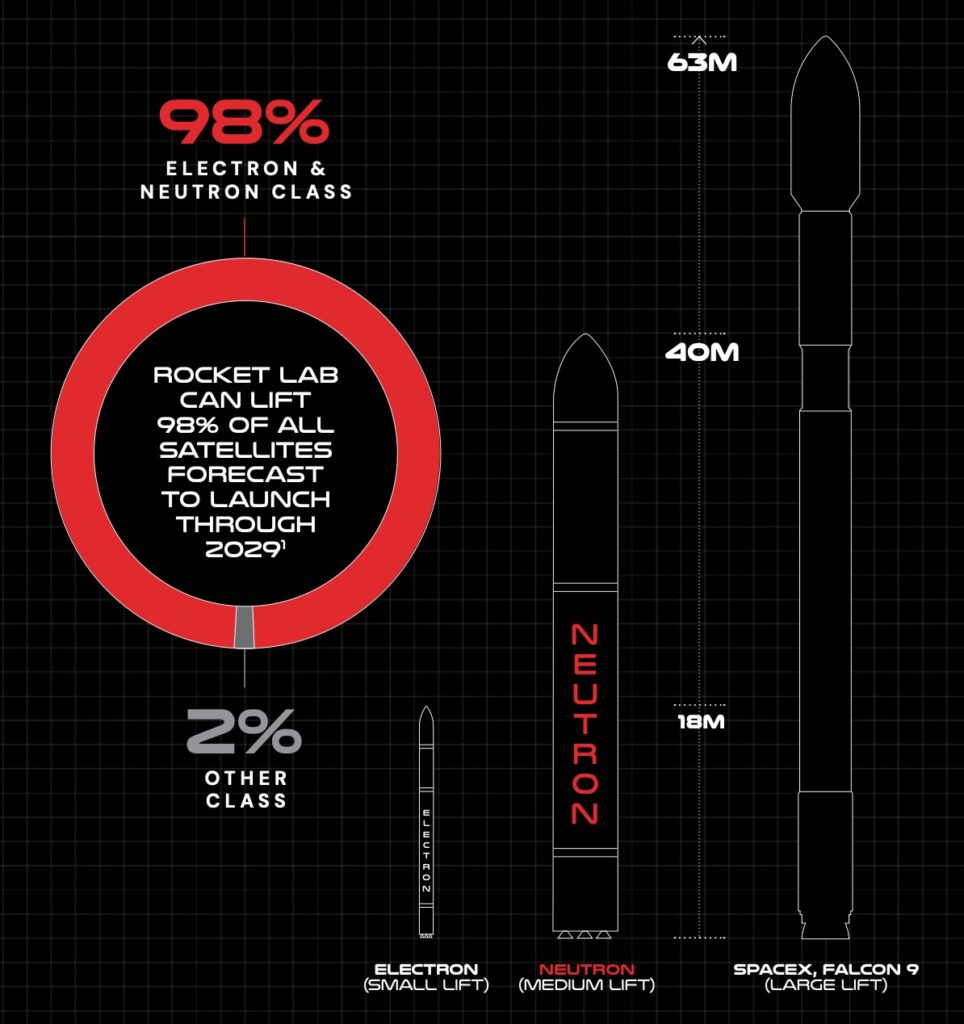

Neutron

Rocket Lab is working on its medium-lift Neutron rocket. Neutron is an advanced new generation reusable launch vehicle with an 8-ton payload lift capacity tailored for mega constellations, deep space missions and human spaceflight. Neutron will be able to lift more than 90% of all satellites forecast to launch through 2029 and introduce highly disruptive lower costs to the high-growth constellation market by leveraging Electron’s heritage, launch sites and architecture. The Neutron will be a direct alternative to SpaceX Falcon 9.

Photon

Rocket Lab’s Photon spacecraft family delivers a satellite-as-a-service solution that eliminates the typical high cost, time and complexity customers face when building their own satellites. With Rocket Lab, customers can buy a launch, satellite, ground services and on-orbit management as a turn-key package, resulting in a disruptive reduction in cost and time to orbit. Rocket Lab has an operational Photon in orbit, with additional missions to the Moon, Mars and Venus planned.

In 2021, Rocket Lab will employ Electron and Photon to launch a satellite to lunar orbit for NASA to serve as a precursor for Gateway, a Moon-orbiting outpost that is part of NASA’s Artemis program to return humans to the lunar surface. The CAPSTONE mission will lift-off less than two years after the project’s inception, and at a launch cost of less than $10 million.

Rocket Lab launch sites and manufacturing facility

Launch Complex 1 in Mahia, New Zealand

This FAA compliant site can accommodate a launch rate of 120 flights per year and is licensed for a launch to occur every 72 hours. From the site it is possible to reach orbital inclinations from sun-synchronous through to 39 degrees. This enables a lower-cost launch option with a wide spectrum of orbital inclinations. Construction is currently underway on a second launch pad at Launch Complex 1. Work on Pad B will be completed in late 2020, with concurrent launches from Launch Complex 1 possible within the next 12 months.

Launch Complex 2 on Wallops Island, USA

Rocket Lab’s Launch Complex 2 represents a new responsive launch capability for the United States on home soil. Launch Complex 2 can support up to 12 missions per year. This is tailored specifically for U.S. government small satellite missions.

Rocket Lab recently opened a new headquarters and manufacturing complex in Long Beach, California, for the rapid production of Photons. The facility is also home to payload integration facilities for Photon missions, as well as a state-of-the-art mission operations center. The production complex is already home to extensive production lines delivering more than 130 Rutherford engines for the Electron launch vehicle every year, along with guidance and avionics hardware.

Merger Transaction Details

- Fully diluted pro forma enterprise value of $4.1B, representing 5.4x 2025E revenue of $749M.

- Transaction will result in $745M of cash to the balance sheet to fund growth.

- Transaction includes $320 million of cash held in trust and $467 million PIPE.

- The PIPE is led by Vector Capital, and includes BlackRock and Neuberger Berman.

- The deal is expected to close by the end of second quarter, 2021.

- VACQ ticker will change to RKLB upon closing.

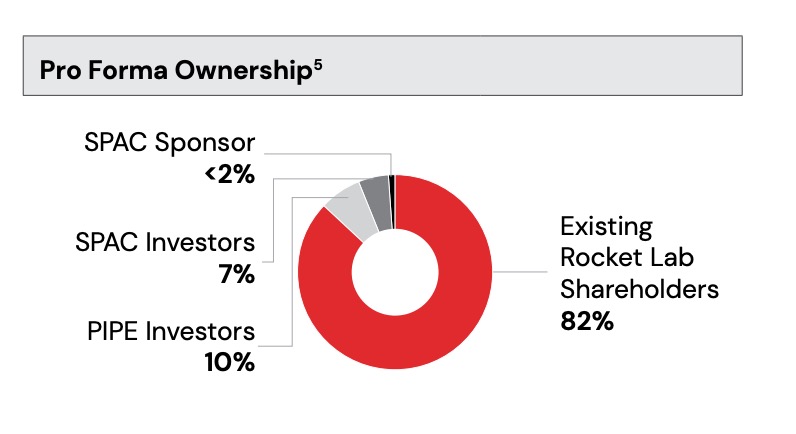

Share Structure

- Total shares outstanding of approximately 482.7 million.

- 82% existing Rocket Lab shareholders.

- 10% PIPE investors.

- 7% VACQ SPAC shareholders.

- 2% SPAC sponsors.

Rocket Lab Stock Valuation

- Rocket Lab’s in-house launch and space systems capabilities provide significant competitive advantage.

- The high-growth space applications market that comprises approximately $320 billion of the current $350+ billion space industry TAM.

- The global space market is forecast to grow to $1.4T by 2040.

- The company has the first-mover advantage for small satellite launches.

- The current bookings for 2021 represent 90% of $69M forecast revenue (96% Y/Y growth).

Management Valuation for 2025

- $749 million revenue and an EBITDA of $168 million by the end of 2025.

- The company is expected to be cash flow positive by 2023 with $149 million FCF by 2025.

- Valuation multiple of EV/Revenue of 10. That gives an EV of $7.49 billion.

- Divide $7.49 billion EV by the 482.7 million Shares outstanding. This gives a valuation of $15.50 per share in 2025 estimated.

Risk Factors

- The real meat of the revenue in the space market is in space applications. The TAM for the analytics market is expected to be $320 billion. Using the data from constellations to develop analytics and intelligent insights for customers. However, Rocket Lab does not have an analytics platform to tap into this market. BlackSky has very good analytics solutions and a constellation of satellites. This puts the TAM for Rocket Lab for the launch and space systems market of $30 billion.