A lot of fundamentals have changed for Roblox since it decided to go public and filed its S-1 last year. It was a somewhat attractive investment when it was thinking of going IPO. Roblox was planning to go IPO during December 2020. The huge success of AirBnb and DoorDash IPOs caused the company to change plans.

Roblox had a private round of funding this January and decided to go the direct listing route instead of IPO. The current valuation poses more risks for long term investors who want to invest in the video game platform company. Roblox got listed on the NYSE under the ticker symbol “RBLX”.

Roblox key highlights

The following are the key highlights:

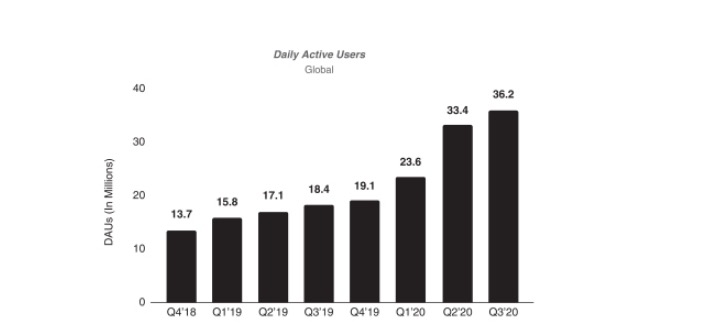

- 36.2 million Daily Active Users (DAU) and 7 million Developers.

- Hours engaged on Roblox grew 122%, from 10 billion in the nine months ended September 30, 2019 to 22.2 billion in the nine months ended September 30, 2020.

- Revenue grew 56%, from $312.8 million in 2018 to $488.2 million in 2019, and grew 68%, from $349.9 million in the nine months ended September 30, 2019 to $588.7 million in the nine months ended September 30, 2020.

- In the nine months ended September 30, 2020, developers and creators earned $209.2 million.

- Free cash flow was $292.6 million in the nine months ending September 30, 2020.

- $810 million cash on the balance sheet.

- Net loss was $203.2 million in the nine months ended September 30, 2020.

China Opportunity for Roblox stock

Through a joint venture with Chinese gaming giant Tencent, Roblox made its first entry in China, one of the largest online gaming markets, in 2019. The San Mateo-headquartered company holds a 51% controlling stake in the partnership, while Songhua, a subsidiary of Tencent, owns the remaining shares. The Chinese version of the Roblox platform was launched recently.

In order to expand footprints into China and obtain long-term stable development, cooperation with Tencent, a Chinese company, has been essential for Roblox, as Chinese authorities require foreign game companies to cooperate with local publishing and operating partners. Tencent, being the world’s largest gaming company by revenue, also publishes games from other top developers and publishers worldwide, including Riot Games, Ubisoft, Activision Blizzard, and Nintendo. Unlike other countries, China has strict rules regarding games and requires companies to obtain government licenses before publishing titles in the country, a process that can take months to begin with, or even years in even more cases.

By working with Roblox, Tencent said it will present Chinese youngsters with dedicated coding tools and provide teachers with basic tool kits to customize their curriculum through digital means. The Chinese company is planning to partner with educational institutions and individual teachers to pilot such usage. The program is expected to draw some 40 million to 50 million users in China, which would be more than Roblox’s 31.1 million daily active users as of October last year.

Roblox stock risks

The following are the 3 Reasons I think money cannot be made for long term for investors in the Roblox stock.

Inflated valuation after private funding

In February 2020, the company had a private funding round. During that time, it was valued at $4 billion. During December 2020, Roblox was looking to IPO at a $8 billion valuation. So if you divide the valuation $8 billion by the number of shares outstanding of 522 million, that gives an IPO price of $15 per share. Then the company had a private funding round in January 2021.

Roblox was privately valued at $29.5 billion after raising more than a half-billion dollars of funding from private investors such as Altimeter Capital and Dragoneer Investment Group. It then decided to go the direct listing route. That gives a value of $45 per share. But when the trading started, the stock opened at $64.50 per share, giving a valuation of $42 billion. So we see the valuation was $4 billion last February and it is at a staggering 10X increase at $42 billion when it has listed publicly. The revenues have increased no doubt, but in no way can this valuation be justified on the fundamentals.

Decreased user engagement due to easing pandemic restrictions

The pandemic gave a huge boost to the bookings and customer spending on the Roblox platform. People were locked down and they were going big on playing Roblox. With the vaccines rolling out, the lockdowns have ended and life is returning to a normal. This may have an effect on the finances of the company as the new bookings may reduce. Ultimately, that affects the revenue and profits down the line over a period of 25 months.

The bookings are the money that users pay when they purchase Robux. The company realizes these bookings over a period of 25 months. This is the usual turnover for users of the platform. This means that usually around the 25 month timeframe, users leave the platform. The success of the company therefore depends on finding new users and getting them becoming premium subscription members or making purchases.

Growing treasury yields hammer growth stocks

The Federal Reserve monitors the state of the economy and adjusts the interest rates. The Fed has pledged to keep the rates as low as possible, for as long as possible. However, the 10-year treasury yield has increased to 1.41% from 1.1% in February. This has spooked investors leading to the selloff in the Tech sector. Investors need to understand the correlation between stock prices and interest rates.

As interest rates rise, the stock prices fall down. This is because the rising rates will increase the cost of borrowing money for corporations. Consumers will also spend less as they will look to conserve capital. This leads to a spiral effect and puts the economy in a recession. This is especially true for technology and growth stocks which have been the hardest hit.