Microvast stock is a leading global provider of next-generation battery technologies for commercial and specialty electric vehicles. The total addressable market for commercial EV is expected to be $30 billion.

Finding an EV play SPAC that brings in revenue and has more than a decade of track record is very rare. Microvast’s field-proven technologies generated over $100 million in 2020 revenue, and have been deployed worldwide in nearly 30K vehicles across many EV types, with over 3.8 billion miles traveled to date.

Microvast and Tuscan Holdings Corp. (Nasdaq: THCB), a publicly-traded special purpose acquisition company, announced that they have entered into a definitive merger agreement that will result in Microvast becoming a publicly listed company. Upon the closing of the transaction, the combined company will be named Microvast Holdings, Inc. and is expected to be listed on the Nasdaq Stock Market under the new ticker symbol “MVST.”

Company Background

Founded in 2006, Microvast is a market leader in the development and manufacturing of ultra-fast charging, long-life lithium-ion battery systems. The batteries have been in operation without any fire accidents since inception. Microvast is headquartered in Stafford, Texas (USA) and Zhejiang, China, with offices in the UK and Germany.

President Biden announced that the U.S. government would replace the entire federal fleet of cars, trucks and SUVs with electric vehicles manufactured in the U.S. That’s 645,047 vehicles. That’s going to mean a lot of new batteries need to be made to supply OEMs.

The Chinese market for electric vehicles is one of the world’s largest and one where policy is significantly ahead of the rest of the world.

The tailwinds from China’s EV market is likely one reason for the significant investment into Microvast by investors including the Oshkosh Corp., a 100-year-old industrial vehicles manufacturer; BlackRock; Koch Strategic Platforms; and InterPrivate, a private equity fund manager.

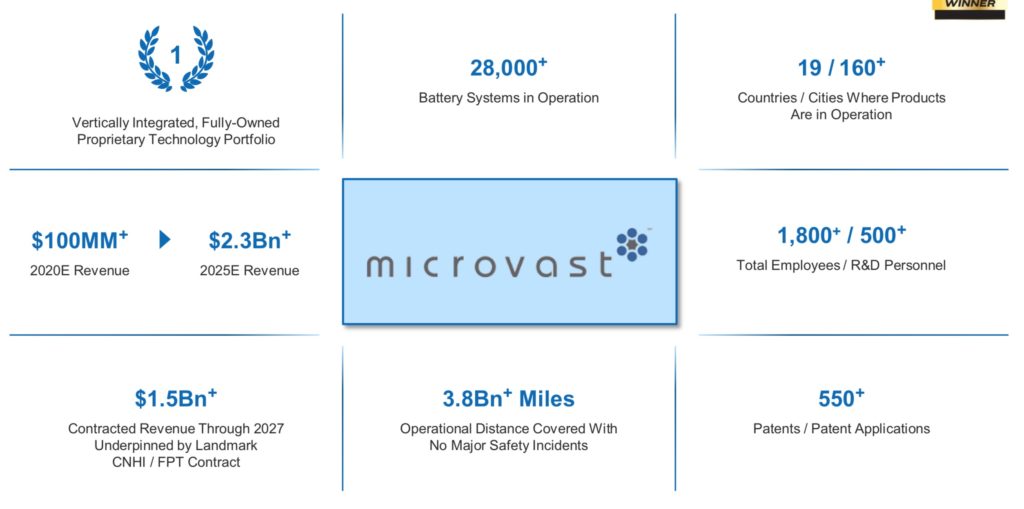

Microvast Key Highlights

The company launched its electric and hybrid bus business battery systems in 2010, focusing primarily on Europe and China. At the end of 2016, it had over 15,000 Microvast battery-powered buses operating in public transport networks in China, as well as in five European countries. In 2016, it delivered over 7,500 all-electric and hybrid-electric buses for metro transit use worldwide.

The following are the key highlights:

- The total number of vehicles in commercial operation with Microvast battery systems has reached 30,000 units worldwide, and accumulated over 3.8B miles traveled with zero operation accidents.

- The company’s battery products are in operation in 19 countries and 160 cities.

- The company has 1800 employees with 550+ patents granted or pending worldwide.

- Microvast successfully served the 2018 Winter Olympic Games. Dongcheng Bus Company, the largest bus company in South Korea, where the Olympics was held, introduced electric buses powered by Microvast LpTO fast charging batteries for daily commute operation during the event. The buses were fully charged within 10-15 minutes and served 18-hour days in extremely cold weather conditions.

- In May 2014, Microvast won the NBfL hybrid electric bus battery system ordered with more than 800 units.

- In November 2014, a fleet of full electric buses with Microvast Ultra-Fast Charging technology started its operation for the APEC China 2014 Summit.

Microvast contracts and manufacturing capabilities

The Clean City Transit plan, or the CCT plan, is Microvast’s primary business strategy. The CCT plan aims to assist in the electrification of urban transportation systems by progressively introducing Microvast’s power battery systems, first to city buses, then to taxis and finally to passenger cars. Microvast has a 1.72M sq. ft. gigafactory in China.

CNH Industrial designs, produces and sells commercial vehicles, buses and specialty vehicles, in addition to a broad portfolio of powertrain applications. FPT Industrial is CNHI’s powertrain subsidiary. IVECO is CNHI’s Commercial vehicle subsidiary. Microvast has a 7-year global cooperation agreement with FPT to be their exclusive supplier for the “New Daily Electric battery” solution. Microvast and FPT Industrial will start a joint new e-platform to develop and industrialize complete electrified powertrain systems. This contract will bring in $1.5B of contracted revenue until 2027.

Microvast and FPT Industrial built a battery manufacturing gigawatt factory in Germany to serve the EMEA region. The Central Plant can deliver a total volume of 1.5 GWh battery modules and systems at the initial stage and will achieve up to 6 GWh in the next few years.

The company signed a purchase agreement for 2 GWh facility in Clarksville, TN in 2020. The production is expected to start in 2022.

Microvast Technology and advantage

Microvast currently provides three lines of fast-charging lithium-ion battery solutions, with different chemistries and performance characteristics as required by the diverse markets for high-performance batteries. These characteristics include ultra-fast charge capability – fully charging in 10-15 minutes; high cycle life – exceeding 20,000 full-depth charge cycles; thermal performance – able to operate in a wide range of temperatures; or high energy density. Microvast batteries are also extremely safe, thanks to the company’s patented Smart Thermal Liquid (STL) protection system.

The company is vertically integrated. It sources all the materials and chemicals and manufactures battery systems from scratch. There are 4 steps of the manufacturing process.

- The continuous innovation of material technology enables the mass production of various raw materials including cathode, anode, electrolyte and separator.

- The individual cells that power the battery system are built with the raw materials.

- The Module, which is a configurable and scalable building block onto which the cells are assembled.

- The Battery pack and BMS. The BMS provides the complete solution for monitoring and controlling complex battery systems for automotive applications.

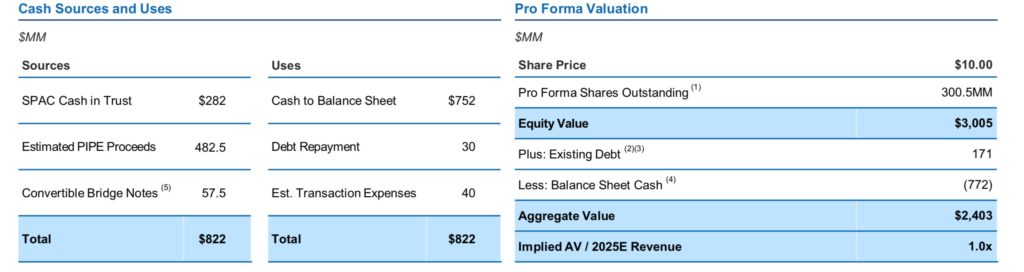

THCB Stock Merger Details

- Pro forma implied equity value of approximately $3.005 billion.

- $772 million cash to balance sheet to fund the growth.

- Transaction includes $282 million of cash held in trust and $482.5 million PIPE.

- Cash will be used to build and expand production lines in U.S., Germany, and China.

- The deal is expected to close in the second half of 2021.

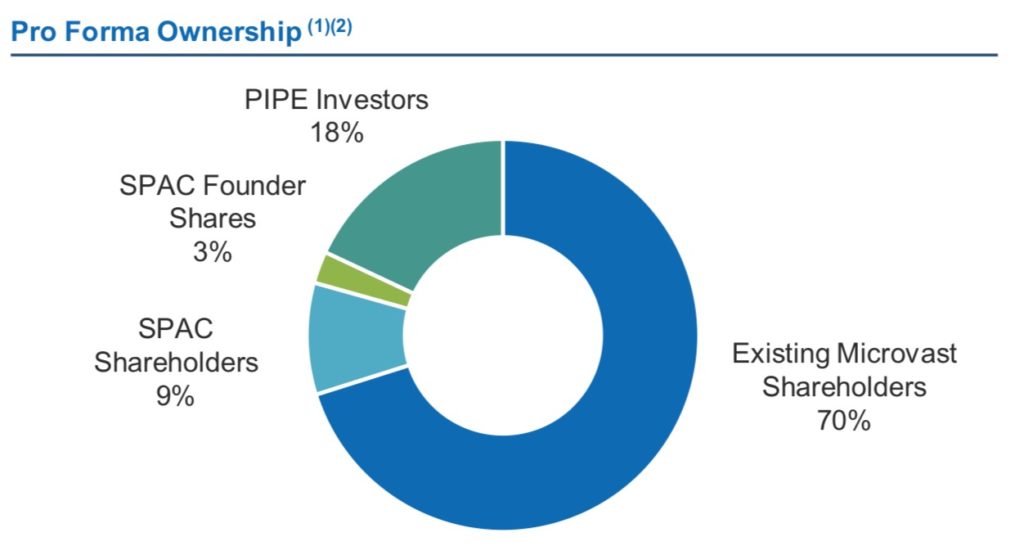

Microvast Stock Structure

- Total shares outstanding of 300.5 million

- 70% Microvast Shareholders

- 18% PIPE investors

- 9% SPAC shareholders

- 3% SPAC Sponsor shareholders

Microvast Stock Valuation

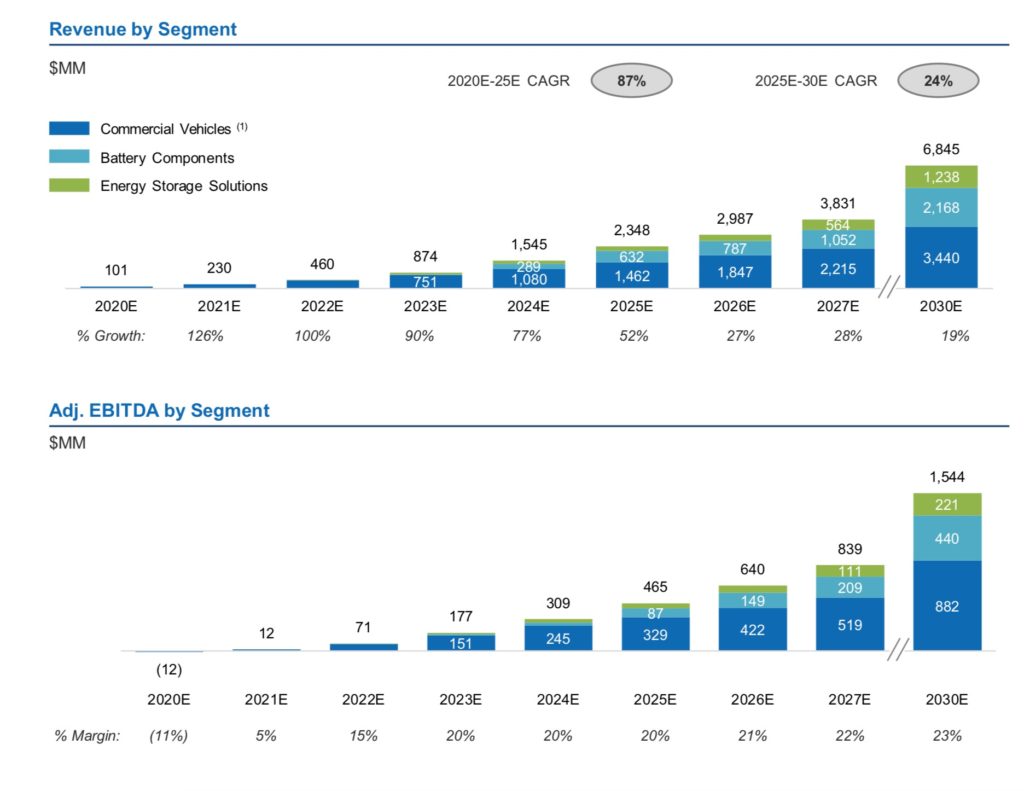

- Three main segments are Commercial vehicles, battery components, and energy storage solutions.

- 1.5Bn+ of contracted revenue provides significant forward visibility.

- Local U.S. manufacturing presence upon completion of Clarksville production facility should accelerate market share gains at attractive margins.

- Revenue growth expected 87% until 2025.

- An opportunity in the consumer electronics market provides additional revenue opportunities.

Management Valuation

- $2.348B revenue and an EBITDA of $465M by the end of 2025.

- Valuation multiple of EV/EBITDA of 15. That gives an EV of $6.975B.

- Divide $6.975B EV by the 300.5M Shares outstanding. This gives a valuation of $23 per share in 2025 estimated.

Conservative Valuation

- For a conservative estimate, we will discount the revenue that is in the pipeline by 50%.

- $1.25B revenue and an EBITDA of $240M by the end of 2025.

- Valuation multiple of EV/EBITDA of 15. That gives an EV of $3.6B.

- Divide $3.6B EV by the 300.5M Shares outstanding. This gives a valuation of $12 per share in 2025 estimated.

Risk Factors

- Even though the battery solutions for EV vehicles is a huge market with growth potential, there are a lot of competitors. These include Romeo Power, QuantumScape, CATL battery and other Tier-1 companies. The success of a company in this space depends on the partnerships with OEMs.

- The stock price for the THCB already took a huge jump. It is trading at more than $20. As the merger approaches, it may even go to $30. But if we look at what happened to the Romeo Power stock price, the stock reached a maximum above $35 just before the merger. But after the merger, a huge pump and dump happened. The stock is still trying to find a resistance above $18. This will be a huge risk for Microvast stock as well.

- The definitive merger agreement took a long time to be announced. InterPrivate was brought in to assist with the process. So there is a risk here of the final merger going through.