The new IPO on the block, Palantir Technologies is expected to start trading on Sep 29, 2020. Palantir Technologies was founded in 2003. The company specializes in big data analytics. It was co-founded by Peter Thiel. Mr. Thiel is also the co-founder of PayPal and he was the first investor in Facebook. His $500k early investment in Facebook, fetched $1 billion when he sold off in 2012.

Palantir started building software for the intelligence community in the United States to assist in counterterrorism investigations and operations. They later started working with commercial enterprises. According to their prospects, the total addressable market (“TAM”) across the commercial and government sectors is approximately $119 billion. The TAM for the government sector is $63 billion and TAM for the commercial sector is $56 billion. The company is investing a lot in their sales force thereby tapping into a lot of new customer bases.

Direct listing and not an IPO

Palantir technologies is going public using direct listing and not an IPO.

In an IPO, new blocks of shares are created. An underwriter helps through the listing process, navigating the regulatory requirements, setting an IPO price, and buying the available shares from the company. The underwriter then sells these shares through their distribution network to investment banks, mutual funds, and insurance companies. Prior to the IPO, the company executives and the underwrite conduct a roadshow to drum up interest among institutional holders. The underwriter will take between 3 to 8 % commission from the IPO proceeds.

In a direct listing, registered shareholders will be selling shares. These shareholders are the existing investors, promoters, employees etc. No new shares will be created. There will be no lockup periods. As there is no middle man (the underwriter) involved, there are no underwriting fees involved. No capital will be raised by the company since no new securities are created.

Classes of Shares

Three classes of shares focusing on founder-led governance, with founders having most of the voting rights.

- Class A shares with one vote per share (496 million shares held by 2,794 stockholders)

- Class B shares with 10 votes per share (1.09 billion shares held by 738 stockholders)

- Class F shares are held by a voting trust that will control upto 49.999999% of voting power. (1 billion shares held by one stockholder)

- No preferred stock.

Business and Products

Palantir technologies have 2 main products:

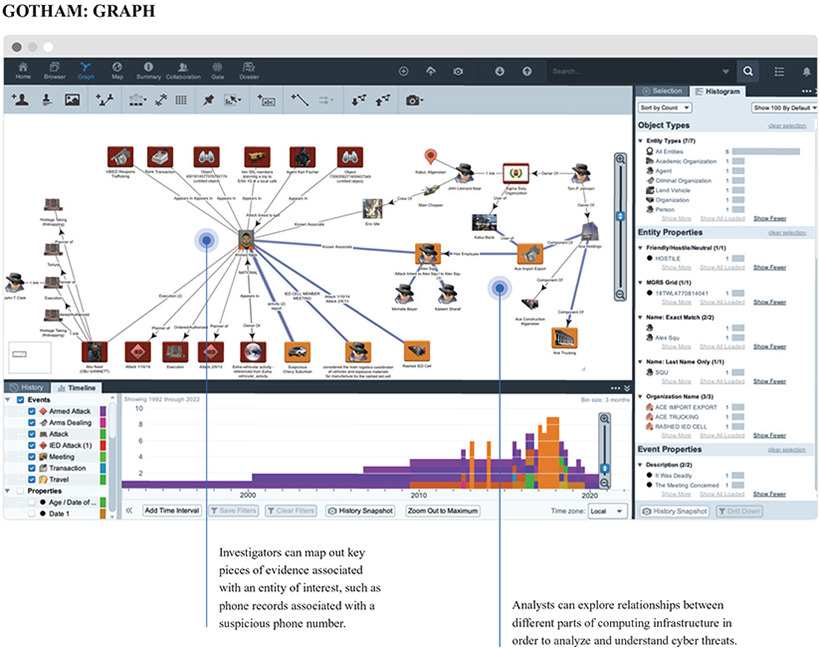

Palantir Gotham: Gotham was constructed for analysts at defense and intelligence agencies. It enables users to identify patterns hidden deep within datasets. The input sources are signals from intelligence sources, reports from confidential informants. These patterns were used to map networks of insurgents and makers of roadside bombs.

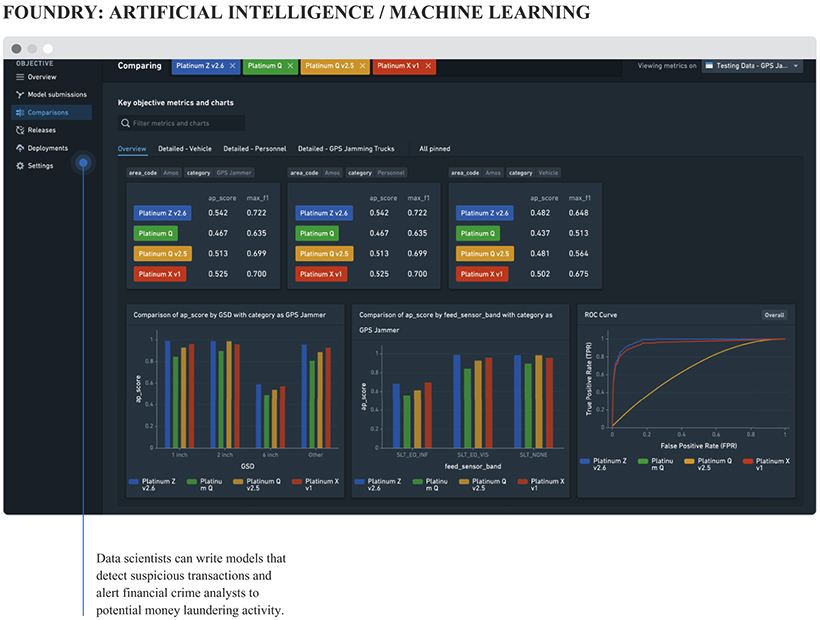

Palantir Foundry: Foundry transforms the ways organizations operate by creating a central operating system for their data. Individual users can integrate and analyze the data they need in one place. Foundry is used by many commercial enterprises as well as the government customers.

Financials

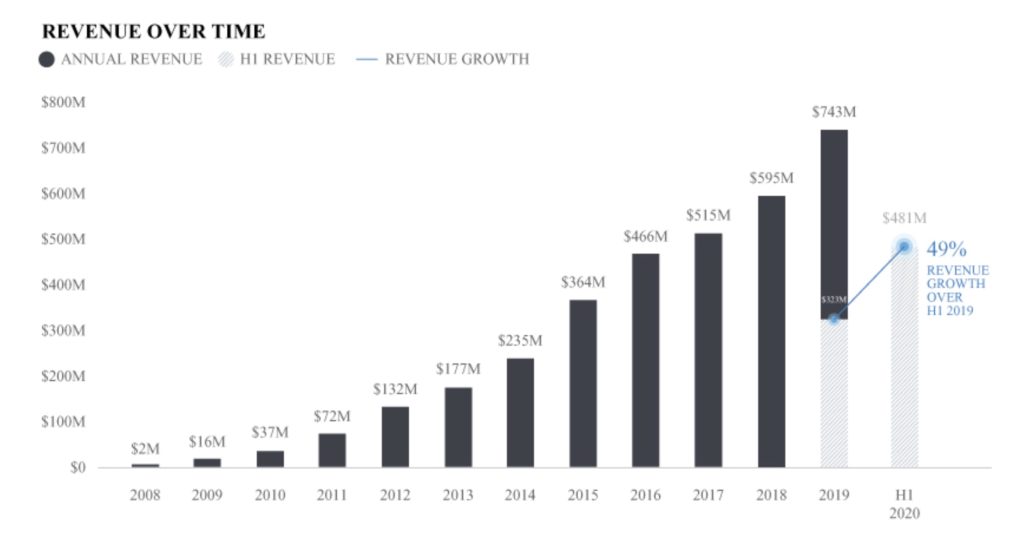

| 2019 | 2018 | |

| Revenue | $742 million | $595 million |

| Net Loss | ($580) million | ($567) million |

Cash and cash equivalents $1.497 billion (as of June 30, 2020)

Advantages

- The product has a wide moat, it has a high barrier of entry and serves a niche market.

- Good working capital on hand to conduct operations for the next 3 to 5 years.

- Revenue growing at a decent rate of 49 percent year-over-year.

Risks

- No profits so far from the business and no earnings expected in the next 2 to 3 years.

- Business is subject to a lot of regulations like data protection laws, international laws etc.

- A huge chunk of revenue is from the government sector. The government contracts are subject to a number of challenges and risks based on economic health.

- Leadership does not work with the Chinese government due to privacy concerns. That takes away a big market for the product.

- Huge sale of Class A stock by executive officers, directors, and record holders. The shares issued upon exercise of outstanding stock options can also be sold in the direct listing.

- Very complex platform and takes a lot of time to get it running.

Valuation and IPO Price

Snowflake that had its IPO recently surged to as much as 100 times its revenue. Palantir Technologies may not generate the same level of hype but if we look at the exuberance investors have for technology stocks, it may be a multiple of at least 50 times revenue. This values the company around $37 billion. Given there are around 2.5 billion shares outstanding, that should put the IPO price around $15 to $17 per share.