Lucid Motors and Churchill Capital Corp IV (NYSE: CCIV), a special purpose acquisition company, announced that they have entered into a definitive merger agreement. CCIV and Lucid are combining at a transaction equity value of $11.75 billion. The deal is the largest in a series of SPAC deals involving electric vehicle companies and blank-check firms. Lucid is led by ex-Tesla engineering executive and automotive veteran Peter Rawlinson.

The transaction provides additional growth capital as Lucid brings the over 500-mile range Lucid Air luxury electric sedan to market and expands rapidly to offer a broad range of electric vehicle products powered by Lucid’s proprietary electric powertrain technology.

The CCIV deal has been subjected to extreme market euphoria. The $10 SPAC was up above $60 before the merger was announced. CCIV stock was expected to hit $100 at one time. What is so special about the company and is it really worth $100 a share?

Lucid Air car features

The 500-mile, 1,080-horsepower 2021 Lucid Air electric sedan is the flagship product of Lucid Motors. With an all-wheel-drive architecture, the Lucid Air is able to achieve quarter-mile times as quick as 9.9 seconds. To date, it is the only electric sedan able to achieve a quarter-mile time under 10 seconds. The power of the Lucid Air is complemented by an available extended-range capability that achieves an estimated EPA range of up to 517 miles on a single charge.

Lucid Air will also be the fastest charging electric vehicle ever, 300 miles of range in just 20 minutes of charging. Lucid Motors drew upon 10 years of experience and over 20 million miles of real-world testing in creating its in-house developed, compact 113 kWh extended-range battery pack.

The car comes with all the bells and whistles expected of a luxury sedan. With glass canopy ceilings, most advanced infotainment systems, and an in-house developed microlens lighting technology.

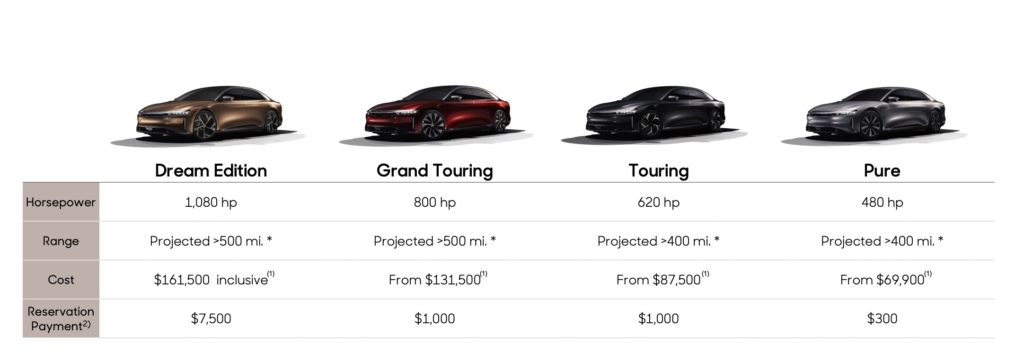

The Lucid Air will be available initially in North America, offered in four model ranges:

- The all-inclusive, limited-volume Air Dream Edition, available spring 2021, at $169,000

- The fully equipped Air Grand Touring, available mid 2021, from $139,000

- The well-equipped Air Touring model, available late 2021, from $95,000

- The Air Pure, the starting point for the lineup, available in 2022, from $77,400

The prices include $7,500 federal credit.

Lucid Motors Key Features

- Lucid Motors is headquartered in the heart of Silicon Valley in Newark, California. The company currently employs nearly 2,000 people, with 3,000 employees expected to be added in the U.S. domestically by the end of 2022.

- The existing reservations signify $650 million of anticipated sales.

- Lucid has 403 patent applications filed out of which 80% have been granted. These patents are in critical areas of powertrain, battery packs, and infotainment systems.

- The company has 10 years of experience in battery packs and BMS. These batteries are used to power 100% of the vehicles in the World premier EV racing series.

- Lucid Air has 32 sensors. The company is planning to launch Level 2 autonomous driving functionality with over-the-air update capabilities.

- The company has a partnership with Electrify America to provide DC fast charging. First year is included free with the purchase. The vehicles are also compatible with ChargePoint and EVGo networks.

- Direct sales strategy by opening Lucid Studios. These increase brand awareness among customers. Six are already open with multiple others under construction. The entry into Europe and Middle East markets is expected by the first half of 2022.

- Lucid has built the first greenfield EV manufacturing facility at Casa Grande, AZ. The first phase is complete with a manufacturing capacity of 34,000 vehicles per year. The second phase is currently implemented which increases the capacity to 90,000 vehicles per year. At full capacity, a total of 365k units could be produced per year.

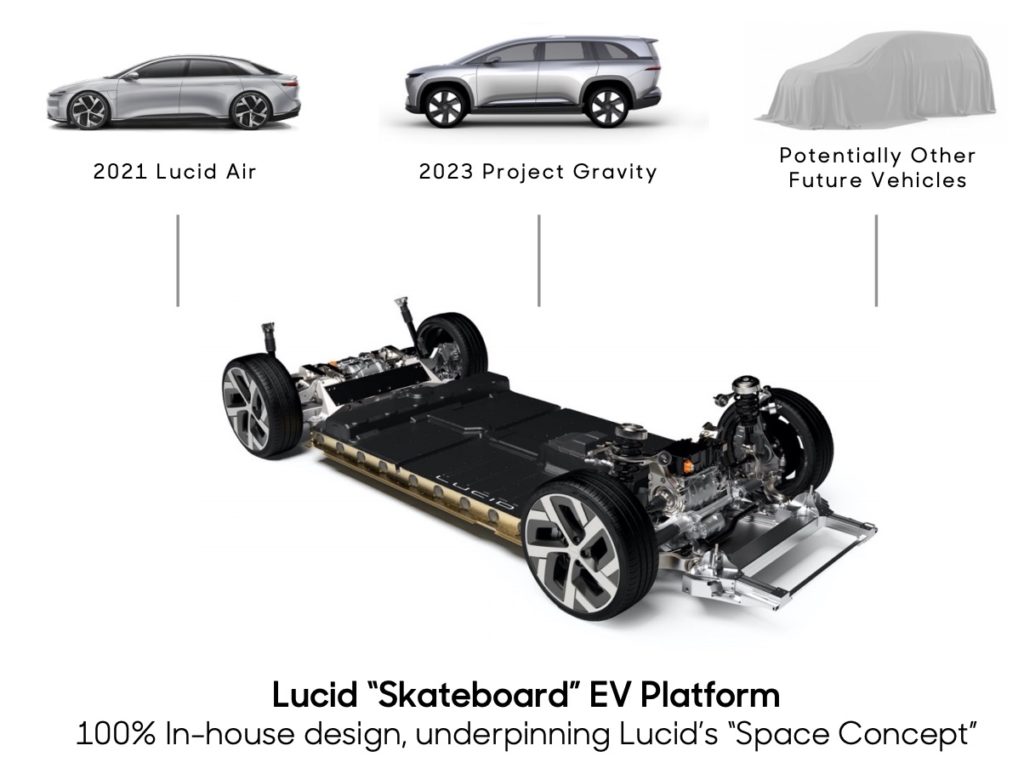

Lucid Electric Advanced Platform (LEAP)

The LEAP platform is Lucid’s Skateboard EV platform. This incorporates 6 key components leading to a modular design. The platform helps increase the speed to market for different vehicle variants. The Gravity SUV which is planned to launch in 2023 will use the same core LEAP platform. As will all other future vehicles. This is similar to Canoo’s Skateboard chassis and Faraday Future’s Variable platform architecture. Tesla also employs a modular skateboard design.

Lucid future growth opportunities

Just a few miles away from AMP-1 is Lucid’s Powertrain Manufacturing Plant, LPM-1, where Lucid produces battery packs, integrated drive units and Wunderbox two-way chargers. These present significant opportunities in energy-capture technology. In addition to its in-house technological and manufacturing capabilities, Lucid has established strong relationships with core suppliers for key materials like battery cells, including a development and supply agreement with LG Chem.

The company also has plans to venture into the energy storage solutions for commercial and utility scale energy storage markets. The battery packs can be sold separately to a variety of industries like aircrafts, eVTOLS, military, agriculture, etc.

Merger Transaction Details

- $11.75B Acquisition value.

- $4.5 billion cash to balance sheet to fund the growth.

- Transaction includes $2.07 billion of cash held in trust and $2.5 billion PIPE.

- The deal is expected to close by the end of second quarter, 2021.

- CCIV ticker will change to LCID upon closing.

- PIPE investment is anchored by the Public Investment Fund (PIF) as well as funds and accounts managed by BlackRock, Fidelity Management & Research LLC, Franklin Templeton, Neuberger Berman, Wellington Management and Winslow Capital Management, LLC.

- This transaction includes the largest ever SPAC-related common stock PIPE.

- The PIPE is priced at $15.00 per share (a 50% premium to CCIVs net asset value) with an implied pro forma equity value of $24 billion.

Share Structure

- Total shares outstanding of approximately 1.6 billion

- 73.5% existing Lucid shareholders

- 10% PIPE investors

- 16.1% CCIV SPAC shareholders

Lucid Motors Stock Valuation

- The global luxury car market is expected to grow at a 5% rate. It was $495 billion in 2018 and projected to reach $733 billion by 2026.

- The EV vehicles represent 5% of total vehicles sold in 2020. The incentives and regulations by the government and the desire for clean energy vehicles has fueled this surge in the adoption.

- Lucid aims to capture 2% of the luxury car market by 2021 and 4% market share by 2030. That will be 500,000 units of the total 15 million units sold.

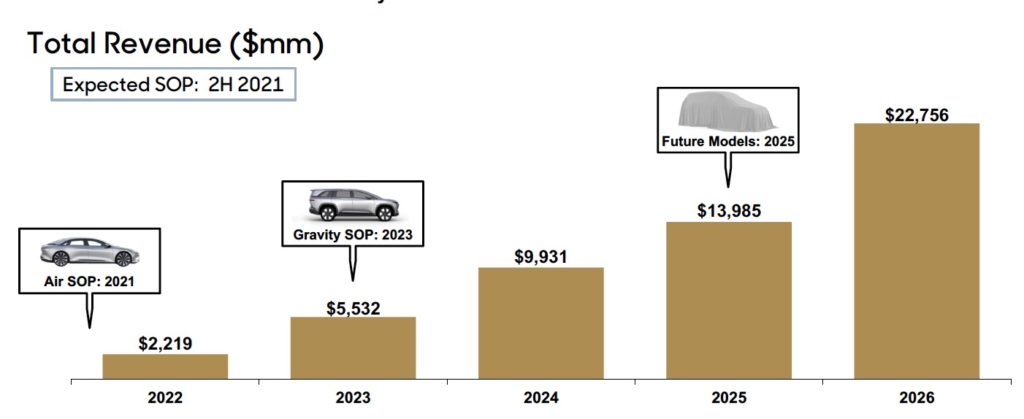

- North America deliveries are expected in the second half of 2021. The EMEA and China deliveries are expected to begin in 2022 and 2023 respectively.

Management Valuation for 2025

- $14 billion revenue and an EBITDA of $1.67 billion by the end of 2025.

- The company is expected to be cash flow positive by 2025 with $321 million FCF.

- Valuation multiple of EV/EBITDA of 20. That gives an EV of $33.4 billion.

- Divide $33.4 billion EV by the 1.6 billion Shares outstanding. This gives a valuation of $21 per share in 2025 estimated.

Risk Factors

- Lucid is just entering the production phase. This when the rubber meets the road literally. The success of the company depends on how well it tools up the factories, sources the materials, sales and distribution channels etc. There was so much hype generated for the company and the expectations are very high. Any slip in the delivery targets could mean lots of negativity and selling pressure for the stock.

- If the vehicles fail to perform, the production of future vehicles will take a hit. This in turn will lead to lower than expected revenues. Tesla had to go through so many hardships before it turned cash flow positive and able to monetize its other revenue streams. The same goes for Lucid Motors as well.

- Manufacturing and selling cars is a very capital intensive business. Agreed the luxury car market is a niche with higher margins. The economic environment and world economy will play a huge role in the luxury car sales.