Faraday Future, a California-based luxury EV car and intelligent mobility ecosystem company and Property Solutions Acquisition Corp. (NASDAQ: PSAC), a special purpose acquisition company, announced they have entered into a definitive agreement for a business combination. Following the closing, the combined company will be listed on the Nasdaq Stock Market under the ticker symbol “FFIE”.

FF’s flagship product offering will be the FF 91, featuring industry leading 1,050 HP, 0-60 mph in less than 2.4 seconds, zero gravity seats with the largest 60-degree reclining angles and a revolutionary user experience designed to create a mobile, connected, and luxurious third Internet living space. FF 91 is targeted to launch within twelve months after closing of the merger.

Company Background

Faraday Future was founded by Chinese businessman Jia Yueting in April 2014 and is headquartered in Los Angeles, California. The company went through many financial issues. The CFO and CTO departed the company and started the Canoo EV company. Nevertheless Faraday Future has the first product, the ultra luxury FF91 ready to launch within an year of closing of the transaction. The following are the key highlights:

- 300+ employees led by CEO Dr. Carsten Breitfeld and a highly experienced management team.

- Targeting deployment in major cities in the US, Europe and China.

- Battery, drivetrain and related technology competitiveness supported by approximately 880 filed or issued utility and design patents and independently validated by EV experts, Roland Berger.

- 1050 HP, less than 2.4 seconds 0–60 mph luxury EV.

The Variable Platform Architecture is a modular skateboard-like platform which can be sized to accommodate various motor and powertrain configurations. This flexible modular design supports a range of consumer and commercial vehicles and facilitates rapid development of multiple vehicle programs to reduce cost and time to market. FF’s propulsion system includes industry-leading inverter design, battery pack gravimetric energy density and propulsion system gravimetric power density.

Internet, Autonomous driving and intelligence technology offers high-performance computing, high-speed Internet connectivity, Over-The-Air updates, an open ecosystem for third party application integration, in addition to several other proprietary innovations that enable the company to build advanced highly personalized experiences for users.

Faraday Future Manufacturing capabilities

The company has a USA Manufacturing facility in Hanford, CA. Only $90mm of capital required to complete the plant renovation for the start of production. SOP is expected within less than 9 months post Equity funding. The plant has a capacity of producing 10,000 vehicles per year.

FF has contracted the manufacturing to a partner in South Korea. The company has signed an agreement with Myoung Shin for additional capacity to manufacture vehicles. Myoung Shin has significant experience in automotive production. Production capacity of up to ~270,000 vehicles per year.

FF is contemplating a JV among FF, Geely Holding and a Tier 1 Chinese City to support FF China production and FF China headquarters. Total annual expected production capacity of 100,000–250,000 units estimated starting in 2025 and an additional 150,000 units estimated in 2026.

Faraday Future Products

Luxury passenger cars

Faraday Future FF91 ultra luxury car has received 14,000+ reservations. The FF 91 is expected to launch inside of 12 months of equity funding.

- 378 miles EPA / 700 km NEDC range from 130 kWh battery(1)

- DC fast charging capability among industry leaders

- 0–60 mph in less than 2.40 seconds

- 1050 HP powered by 3 high performance electric motors

- All-wheel drive, all-wheel steer and rear-wheel torque vectoring

- Truly mobile connectivity with fixed broadband Internet speed

- Over 100” of high-resolution viewing area across 11 displays

- Fully certified to meet US and China government regulations

- Named one of the Best Cars of CES 2020

- Expected to cost over $100,000

FF81 is the premium mass market EV expected to go into production in Q3 2023. The cost is expected to be between $60,000 and $95,000.

FF71 is the premium mass market EV with leading technology and connectivity expected to go into production in Q4 2024. The cost is expected to be between $45,000 and $65,000.

Smart Last Mile delivery vehicles

FF LMD is expected to launch Q4 2023. The target customers in Last Mile Delivery and distribution segments in Europe, China and US. Strong expected market growth driven by increasing e-commerce, tightening emissions regulations and lower total cost of ownership.

- 3 size configurations, all built on one VPA platform enabling fast launch

- Customizable cargo van capacity of up to 500 ft3

- Flexible range options from 110 to 330 miles

- High cargo efficiency

- Estimated charging from 20% to 80% within 25 minutes

Faraday Future Stock Merger Details

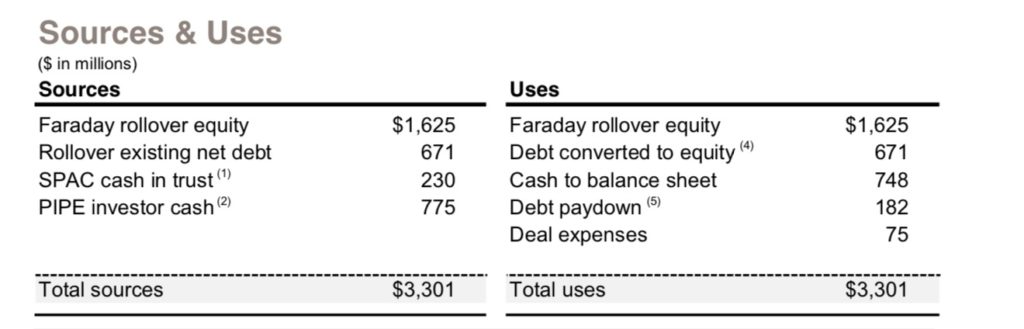

- Pro forma implied equity value of approximately $3.37 billion.

- $748 million cash to balance sheet to fund the growth.

- Transaction includes $230 million of cash held in trust and $775 million PIPE.

- The deal is expected to close in the second half of 2021.

- Vendors have agreed to convert their debt obligations to equity. Founder YT Jia’s creditors have also agreed to this equity conversion.

Share Structure

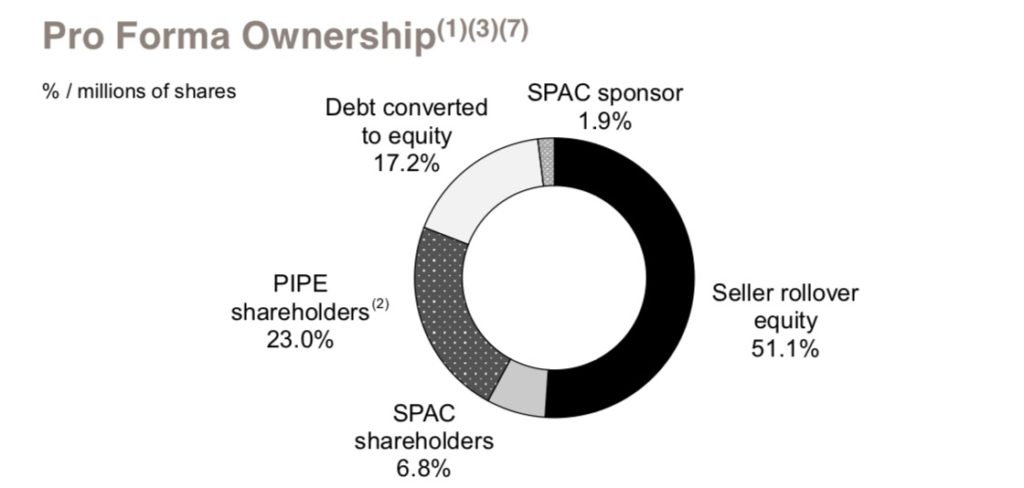

- Total shares outstanding of 337 million

- 51.1% Seller rollover equity

- 17.2% Debt converted to equity

- 6.8% SPAC shareholders

- 1.9% SPAC Sponsor shareholders

- 23% PIPE investors

Faraday Future Stock Valuation

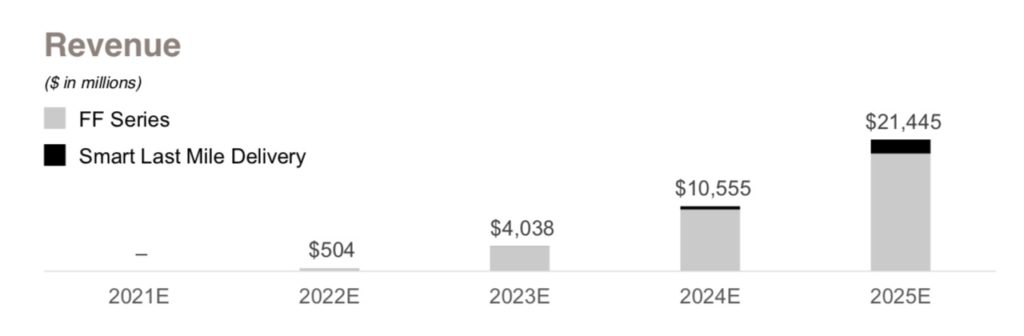

- FF is targeting EV vehicle sales in two major markets of the U.S. and China.

- Production launch of FF 91 complete in 2021E and deliveries begin Q1 2022E.

- Ramp of FF 81 and FF 71 starting in 2023E and 2024E, respectively.

- Smart Last Mile Delivery engagements today entering production in 2023E and ramping volumes in 2024E.

- Implied market share of ~3% in electric vehicles and ~7% in Last Mile Delivery by 2025.

- Revenue, expected to grow to $20bn+ by 2025E.

Management Valuation for 2025

- $21.445B revenue and an EBITDA of $2.312B by the end of 2025.

- Valuation multiple of EV/EBITDA of 10. That gives an EV of $23.12B.

- Divide $23.12B EV by the 337M Shares outstanding. This gives a valuation of $68 per share in 2025 estimated.

Conservative Valuation for 2025

- For a conservative estimate, we will discount management estimates by 50%.

- $10.5B revenue and an EBITDA of $1.1B by the end of 2025.

- Valuation multiple of EV/EBITDA of 10. That gives an EV of $11B.

- Divide $11B EV by the 337M Shares outstanding. This gives a valuation of $32 per share in 2025 estimated.

Risk Factors

- Faraday Future is a company with no revenue. It’s basically starting from the ground floor with a valuation of over $3B. The valuations and revenue estimates given by the management are extremely generous. There are a lot of EVs entering the market. Current ICE vehicle holders are not yet ready to upgrade at the price levels being offered even after the government subsidies. The real money in the EVs is in the commercial sector, but FF has only one vehicle that does not enter production until 2023.

- The market for ultra luxury EVs is still very nascent. The company is depending on revenues from this segment in the near future, until the mass market EVs go into production in late 2023 and early 2024.

- There are a lot of high capital expenditure activities like completing the factory in CA, setting up the sales and distribution networks, building the brand etc. This will result in a lot of operating costs, which ultimately will eat into the margins.

- Founder Yueting Jia is closely associated with the image and brand of Faraday Future. In 2020, Mr. Jia was determined by the Shenzhen Stock Exchange of China to be unsuitable for a position as director, supervisor or executive officer of public listed companies in China as a result of violation by a public company founded and controlled by Mr. Jia in China of several listing rules of Shenzhen Stock Exchange, including illegal provision of funding and guarantees of by the company to other affiliated companies founded by Mr. Jia, discrepancies in the company’s forecast and financials, and improper use of proceeds in from company’s public offering. While Mr. Jia completed his a Chapter 11 restructuring plan with respect to his personal debts and debt claims in June 2020, he remains on China’s “debtor blacklist”.