President elect Joe Biden will make a $2 trillion accelerated investment, with a plan to achieve a clean energy future. These investments will be across the energy sector, electric vehicles and mass transportation, weatherizing old buildings, and building new homes with zero energy costs. On his website, the president elect has laid out his vision in the form of a clean energy plan.

Highlights of the clean energy plan

- Provide every American city with 100,000 or more residents with high-quality, zero-emissions public transportation options

- Move ambitiously to generate clean, American-made electricity to achieve a carbon pollution-free power sector by 2035.

- Create 1 million new jobs in the American auto industry, domestic auto supply chains, and auto infrastructure, from parts to materials to electric vehicle charging stations

Ground rules for Stock picking

Using this as a starting point, I have analyzed the energy and EV stocks to pick out the clean energy growth stocks, that have great long term prospects. The 3 ground rules that I have taken into consideration, while selecting these companies, are as follows

- The companies should have earnings (not just revenues). There has been an infusion of EV companies with zero revenues and no production ready products. These companies were demanding sky high valuations. I have excluded all these companies.

- The companies should not be highly levered, meaning they should have manageable debt on their balance sheet. This is very important because as the interest rates rise in the future, these companies have enough capital to fund their growth.

- The management should be shareholder friendly and be willing to give out dividends. If they are not giving dividends, they should at least be investing their capital in opportunities that provide a very high return.

NextEra Energy (NEE)

NextEra Energy operates rate-regulated electric utilities that distribute power to consumers and businesses. The company also generates electricity and transports natural gas under long-term, fixed-fee agreements. NextEra Energy produces more energy from the wind and sun than any other company in the world. There is a secured dividend and growth potential available with renewable energy.

NextEra has a very good relationship with the regulators in Florida because it sells electricity 20% cheaper than its nearest rival. That let it spend about $60 billion dollars for growth. They have acquired other utilities, cut the operating costs by 50% and passed those savings to the consumers.

The company also controls the yieldco “NextEra Energy Partners” (NEP). This yieldco sells contracted clean energy assets to its affiliate for cash to reinvest in new opportunities.

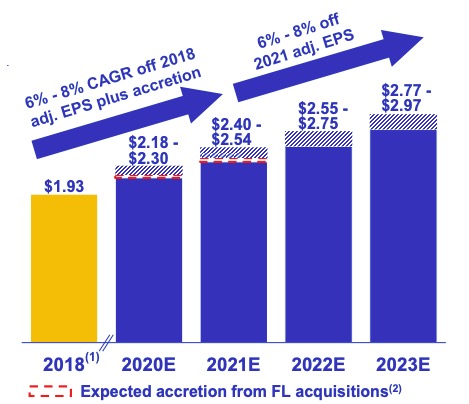

Between 2004 and 2019, NextEra’s adjusted EPS grew at a compound annual growth rate (CAGR) of 8.4% while dividends grew at a CAGR of 9.4%.

NextEra Energy’s board of directors has approved a 4-for-1 stock split in a bid to “make stock ownership more accessible to a broader base of investors.” With a stock split lowering the absolute price of each share, more investors could find the stock affordable.

At the same time, the stock price will reduce accordingly. So NextEra stock trading at $296 will trade at $74 post-split. Effectively, your investment’s value will remain the same.

Tesla (TSLA)

Tesla is getting better and better with each quarter. The recent quarter was the fifth consecutive quarter with positive cash flow. Tesla is not just an EV car company but it is a growth technology company. It has planted 4 to 5 seed businesses within its business. These have the potential to grow into huge trees bearing fruit.

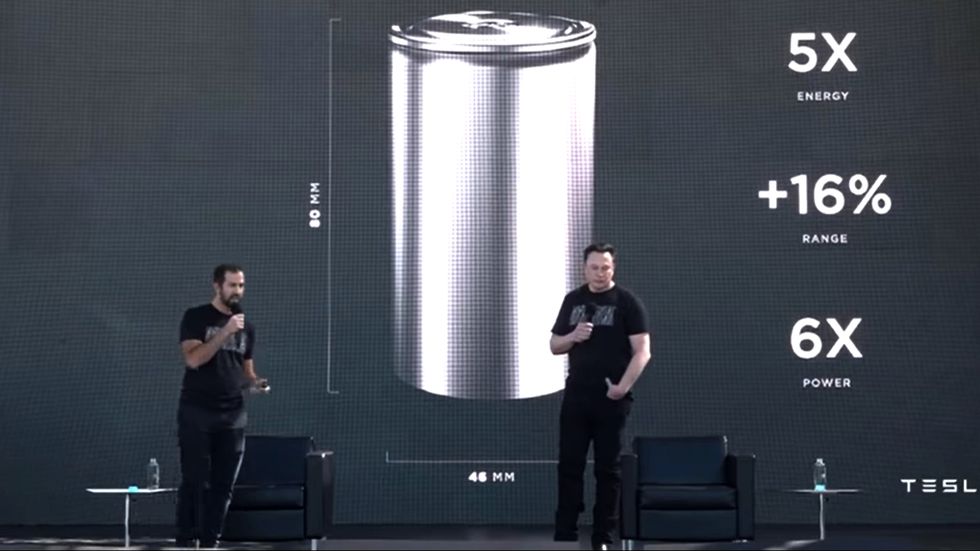

- Tesla battery day was held. Tesla plans to manufacture its own “tabless” batteries, which will improve its vehicles’ range and power. The new batteries will be produced in-house, which Musk says will reduce costs and bring the sale price of Tesla electric cars closer to gasoline-powered cars. Musk has said Tesla will make a $25,000 car.

- Quarter-end cash and cash equivalents increased by $5.9B QoQ to $14.5B, driven mainly by our recent capital raise of $5.0B (average price of this offering was ~$449/share) combined with free cash flow of $1.4B. This was a very smart strategy of raising capital in equity without adding debt. When the stock price is high, smart capital allocation dictates raising capital by issuing more stock. Since the investors are so exuberant, they hardly notice this dilution.

- Fremont gigafactory producing 500,000 units per year.

- Shanghai gigafactory production capacity increased to 250,000 units. Model 3 is currently the lowest priced premium midsize sedan in China.

- Construction of the Gigafactory in Berlin continues to progress rapidly. Production is expected to start in 2021.

- Full self driving module has been released recently.

ChargePoint (SBE)

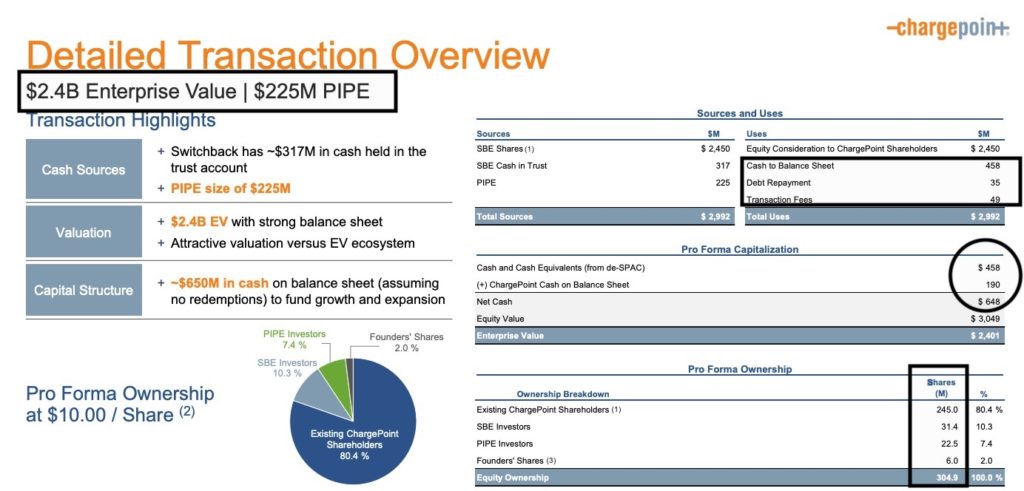

ChargePoint, the world’s largest provider of electric-vehicle charging stations will go public with a reverse-merger agreement. The company is using the special purpose acquisition company (SPAC), Switchback Energy (SBE) for its IPO. The deal is worth $2.4 billion.

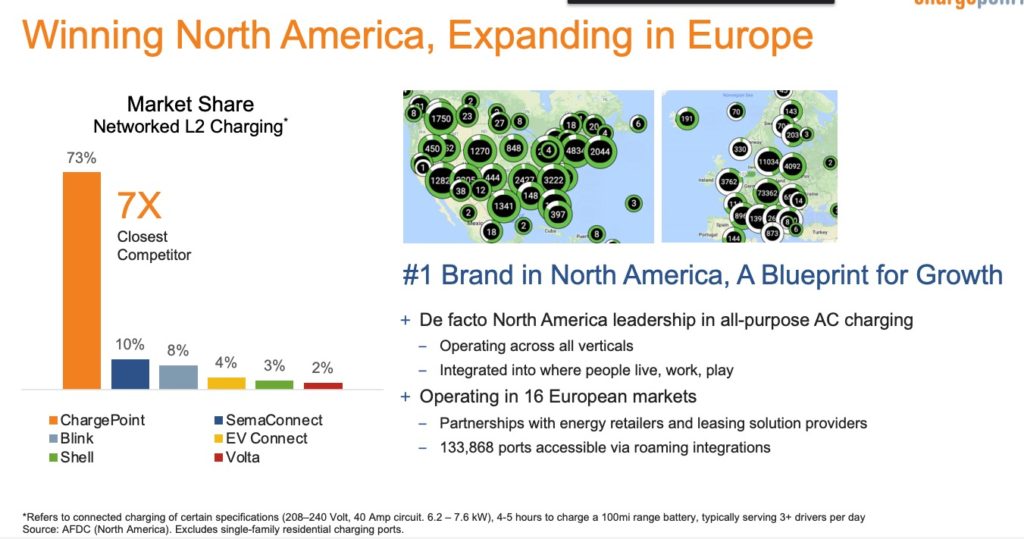

Founded in 2007, ChargePoint is a category creator in EV charging, helping to make the mass adoption of electric mobility a reality. It operates in every segment, from commercial to fleet to residential. ChargePoint has created one of the world’s largest charging networks with a capital-light model by selling individual organizations and businesses, known as site hosts, everything they need to electrify their parking spaces – networked charging hardware, software subscriptions and associated support services.

The parking spaces owned by ChargePoint’s site hosts are seamlessly integrated into one network available to the driver in a top-rated mobile app. ChargePoint’s winning operating model and high-quality solutions foster loyal site hosts who expand their charging footprint as EV penetration rises, creating a virtuous loop of brand awareness, satisfied drivers, organic networked charging hardware and recurring SaaS revenue.

ChargePoint’s offerings have attracted a growing customer base of more than 4,000 organizations and businesses, building a network of more than 115,000 public and private places to charge. ChargePoint also offers access to an additional 133,000 public places to charge through network roaming integrations across North America and Europe.

Today, one ChargePoint account provides access to hundreds-of-thousands of places to charge in North America and Europe. Drivers plug into the ChargePoint network approximately every two seconds and have completed more than 82 million charging sessions to date.

EV charging infrastructure investment projected to be $190B by 2030

First Solar (FSLR)

First Solar is an all American company. The company manufactures solar modules with an advanced semiconductor technology. By constantly decreasing manufacturing costs, First Solar is creating an affordable and environmentally responsible alternative to fossil-fuel generation. First Solar has shifted away from existing markets that are heavily dependent on government subsidies and toward providing utility-scale PV systems in sustainable markets with immediate need.

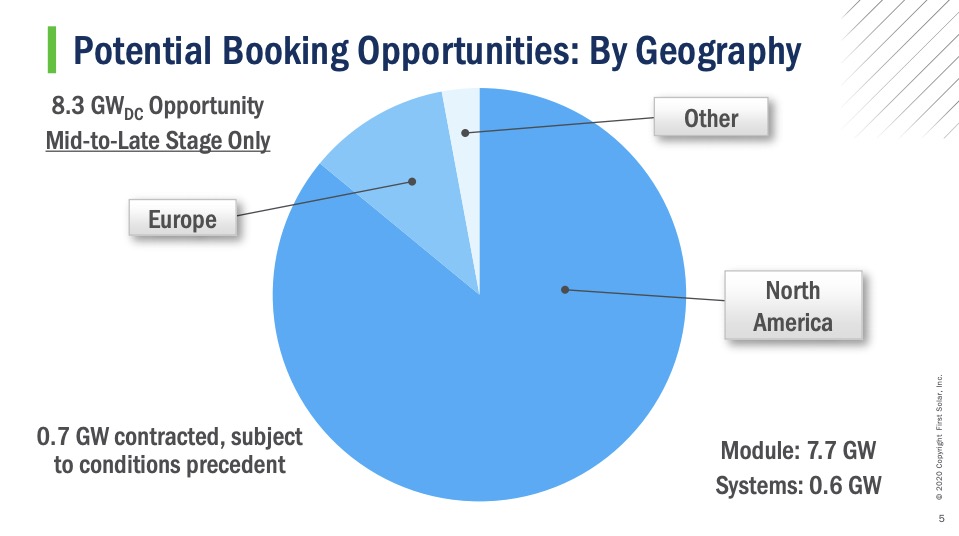

First Solar has shipped over 25GW of solar modules worldwide. There are about 12 GW of contracted backlog for deliveries in 2020 through 2023. The capacity of installed solar globally is expected to double in the next 5 years and the company has a great balance sheet with $1.64B cash and a very low debt of only $261 million. Thus it is positioned to take advantage of any growth opportunities.

All the factories are 100% utilized capacity wise. The manufacturing process is vertically integrated thereby reducing any impacts from supply chain distributions. This is one of the reasons why the company came out of the pandemic lockdowns with minimal impact.

First Solar is also getting away from the low return business of operations and maintenance by selling its O&M business to NovaSource Power Services. It is also evaluating strategic options for the U.S. project development business.

In the third quarter of 2020, First Solar blew past analyst expectations. The company had $928 million of sales. The revenue grew 70% over last year. It has EPS of $1.45 more than doubling analyst expectations of $0.62. The shareholders equity keeps growing every quarter, year over year, which is a very good indicator of the company health.