BlackSky Holdings, a leading provider of real-time geospatial intelligence and global monitoring services, and Osprey Technology Acquisition Corp. (NYSE: SFTW), a special purpose acquisition company, announced they have entered into a definitive agreement for a business combination that would result in BlackSky stock becoming a publicly listed company. BlackSky will be listed on the NYSE with the ticker symbol “BKSY”. The transaction will help BlackSky expand the company’s small satellite constellation and to accelerate penetration of the commercial market.

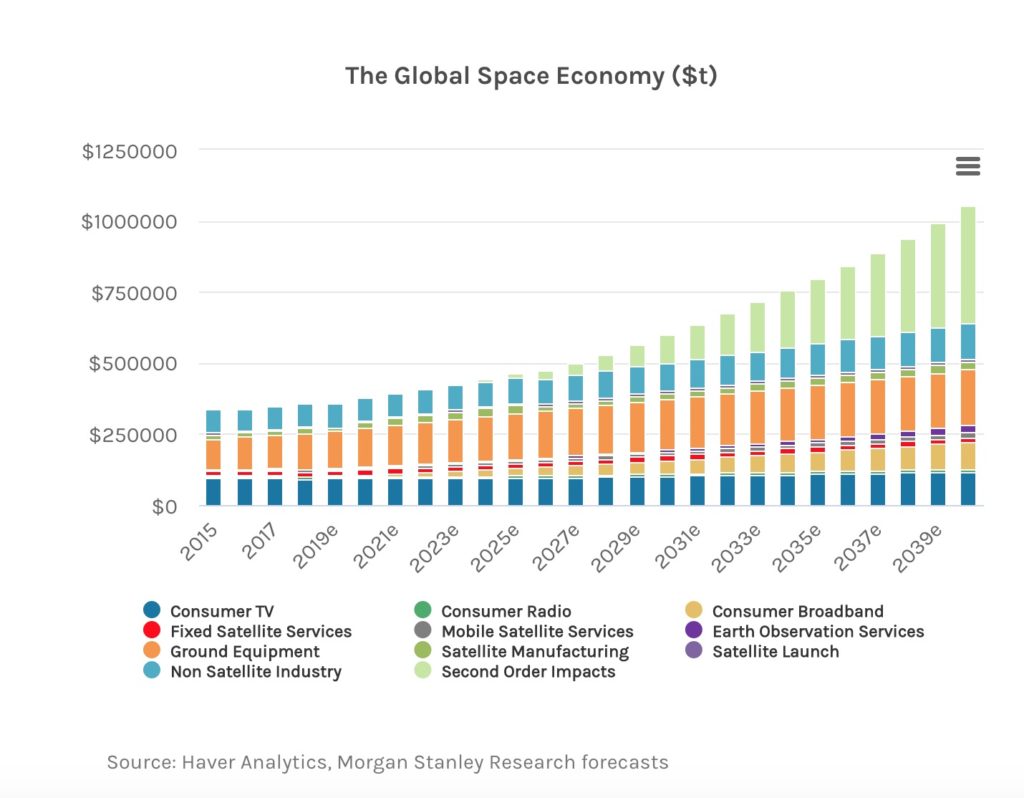

Morgan Stanley estimates that the global space industry could generate revenue of more than $1 trillion or more in 2040, up from $350 billion, currently. The market will serve broadband internet, delivery of packages, and ofcourse the most exciting of all, space travel. BlackSky is a space data capture and analytics company, that has a first mover advantage and a great SaaS platform to complement its space imagery. It is the lowest cost provider of space images among its peers.

BlackSky Company Background

BlackSky was founded in 2014 and is headquartered at Herndon, VA. Brian O’Toole is the CEO of BlackSky. He has over 30 years of experience in the geospatial intelligence industry. Brian founded several successful start-ups and served as the CTO of GeoEye. Prior to joining BlackSky, he founded OpenWhere, a company that developed the software that is now the basis for BlackSky’s software capabilities.

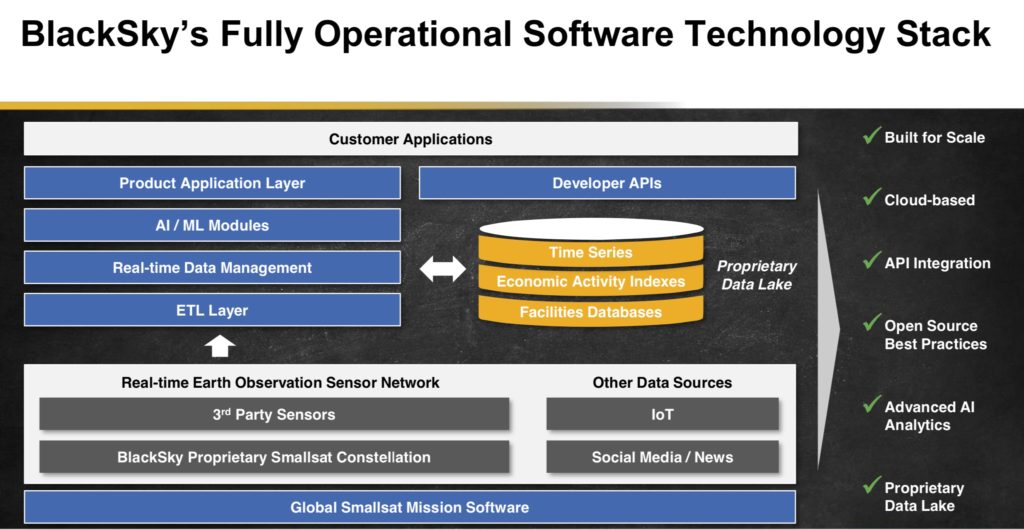

The company has developed a fully integrated proprietary technology stack that includes a constellation of high-resolution small satellites that monitor global events and activities at high revisit rates. It has an AI and machine learning enabled software platform that tasks the constellation and translates data into actionable insights. There is a proprietary database that continually captures information on global changes, and an application layer that delivers on-demand solutions directly to the customer.

The company plans to invest to expand the space network to ultimately achieve a constellation of 30-high resolution multi-spectral satellites by the 2023/2024 timeframe. This will enable it to monitor locations on earth every 30 minutes, day or night, in multiple spectrums.

The completion of a $180 million PIPE is led by world-class technology and growth investors, including Tiger Global and Hedosophia. All current shareholders are rolling, and in fact, some are participating in the PIPE, including Peter Thiel and Ajay Royan, Mithril Capital.

BlackSky Business model

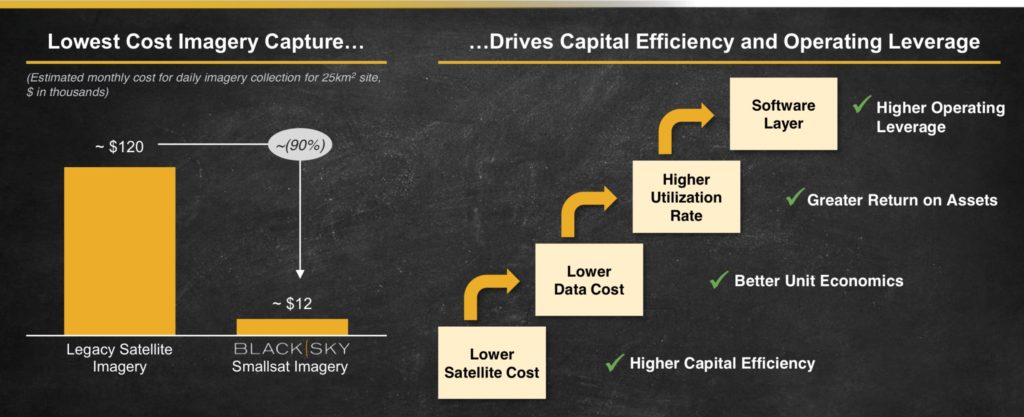

The moat starts with low-cost small satellites. BlackSky can deliver global monitoring imaging capability at a cost that is an order of magnitude lower than traditional solutions. The on-orbit satellite costs are 10x less than legacy architectures. This means BlackSky can put more sensors on orbit, giving the ability to see the earth more frequently from dusk to dawn, day, or night. In the end, it means more information and insights for the customers.

The low-cost approach means they can deliver data and analytics to the market at a lower price point. This is a very important advantage as the growth in the commercial sector has been limited due to cost, frequency, and accessibility of data. The flexible architecture enables higher utilization of the assets. The satellites combined with a real-time software layer enables them to deliver data and analytics to an expanding customer base for on demand geospatial intelligence.

The company has built the business around three key elements.

- A constellation of high-resolution small satellites that can monitor global activity at high revisit rates, day or night, in multiple spectrum.

- A software platform that combines data from the satellites with a myriad of other data sources, such as IoT sensors, news and social media, and other satellites to analyze and transform raw data into actionable intelligence.

- A database of global activity that will power the customers’ ability to detect, understand, and predict global change.

BlackSky SaaS and AI platform

BlackSky has a fully operational enterprise grade software stack. They built the software from the ground up specifically to enable the delivery of real-time geospatial intelligence on demand. The company is expanding the platform every day with new data and analytics. Powered by AWS, the architecture that is built to scale. A key feature of the software architecture is a global intelligence database that will be accessible to developers through an API framework.

The system can formulate event clusters over time, which power the ability to detect and track location specific changes and anomalies. With this capability, they can formulate unique recommendations for the users on relevant changes that might impact their business. Over time, as the company continues to build a time series of global activity, this software will enable the customers to predict, forecast, model, and plan for the future by learning from the past.

The geospatial imagery, data, and analytics market that is growing from $13 billion to $40 billion over the next five years. This rapid growth is driven by an expanding commercial market and the demand for real-time solutions. The geospatial data and analytics market is one of the largest opportunities in the new space economy.

BlackSky joint venture with Thales Alenia Space

Thales Alenia Space is a large, public French aerospace company that is one of the leaders in the design and development of large satellites. Thales invested in BlackSky as part of Series C financing. Prior to their investment, they did significant technical diligence on the space capabilities. LeoStella is a fully operational joint venture company between Thales and BlackSky, that specializes in the design and production of small satellites. BlackSky owns 50% of that business.

BlackSky has five satellites in commercial operation and is scheduled to add an additional nine satellites to its constellation in 2021. Ultimately, BlackSky seeks to establish a constellation of 30 high resolution multi-spectral satellites capable of monitoring locations on Earth every 30 minutes, day or night. The manufacturing facility has a capacity of producing 40 satellites per year. BlackSky is producing 16 of its own satellites at this facility currently.

BlackSky stock merger

- Pro forma implied enterprise value of approximately $1.1 billion.

- $445 million cash to balance sheet to fund the growth.

- Transaction includes $318 million of cash held in trust and $180 million PIPE.

- The deal is expected to close by the end of second quarter, 2021.

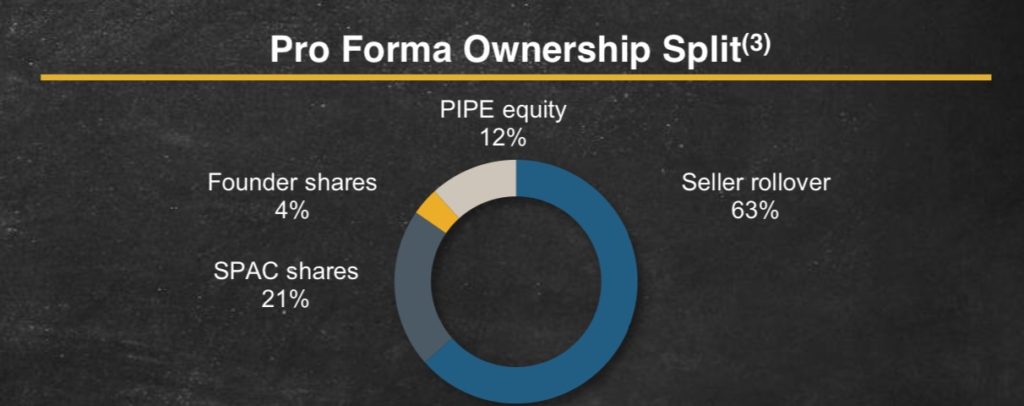

SFTW Stock Share Structure

- Total shares outstanding of 147.7 million

- 63% existing BlackSky shareholders

- 12% PIPE investors

- 21% SFTW SPAC shareholders

- 4% SFTW SPAC Sponsor shareholders

BlackSky Stock Valuation

- BlackSky has a first mover advantage in real-time earth observation.

- The proprietary software stack gives an opportunity for recurring revenue through the selling of SaaS services.

- There is a huge growth opportunity in the commercial sector. Sectors like energy, insurance, utilities, etc have a potential value of using BlackSky’s data and analytics.

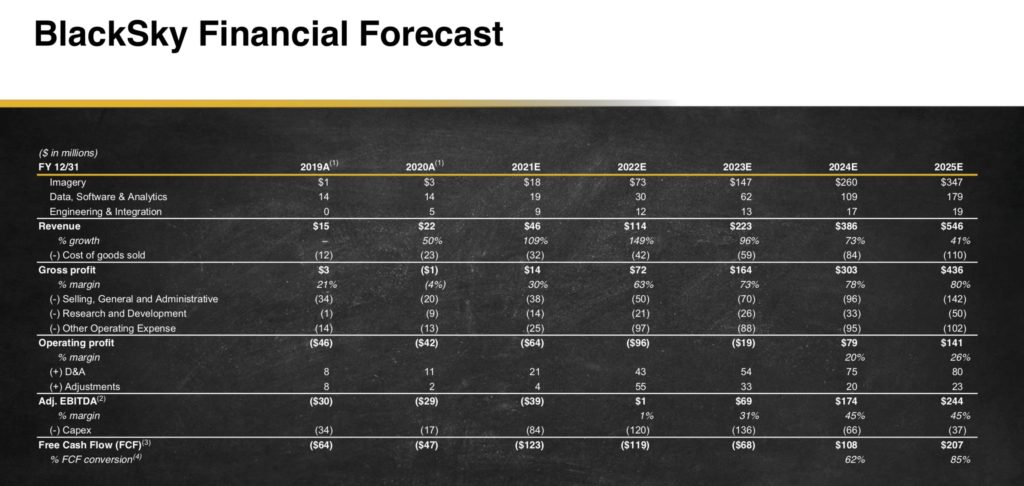

- The company is expected to be cash flow positive by the end of 2024.

- The gross margins are expected to be 75%.

Management Valuation for 2025

- $546M revenue and an EBITDA of $244M by the end of 2025.

- Valuation multiple of EV/EBITDA of 15. That gives an EV of $3.66B.

- Divide $3.66B EV by the 147.7M Shares outstanding. This gives a valuation of $25 per share in 2025 estimated.

- According to the management estimates, BlackSky is currently valued at 15 to 19X of 2022 revenue.

SFTW Stock Risk Factors

- The race to the space is a new market. There are a lot of peers, who are competing in this space. BlackSky is an emerging company. The advantage is that it already has a minute revenue stream. The other companies do not have any revenue so far. But the success of BlackSky depends on how large the Space market grows.

- There are a lot of proven data analytics platforms in the market. These companies are well funded and have exceptional AI and Machine learning capabilities. The distinct advantage for BlackSky is owning the proprietary data. There are a lot of other smallsat companies and ultimately space data may become a commodity. At this stage, the SaaS platform may not give the monetary benefits that BlackSky is expecting.

- This is a SPAC transaction and there is a chance the merger may not go through.

Other space stocks

- Will Rocket Lab stock take your portfolio to the moon?

- Astra stock going public after successful rocket launch