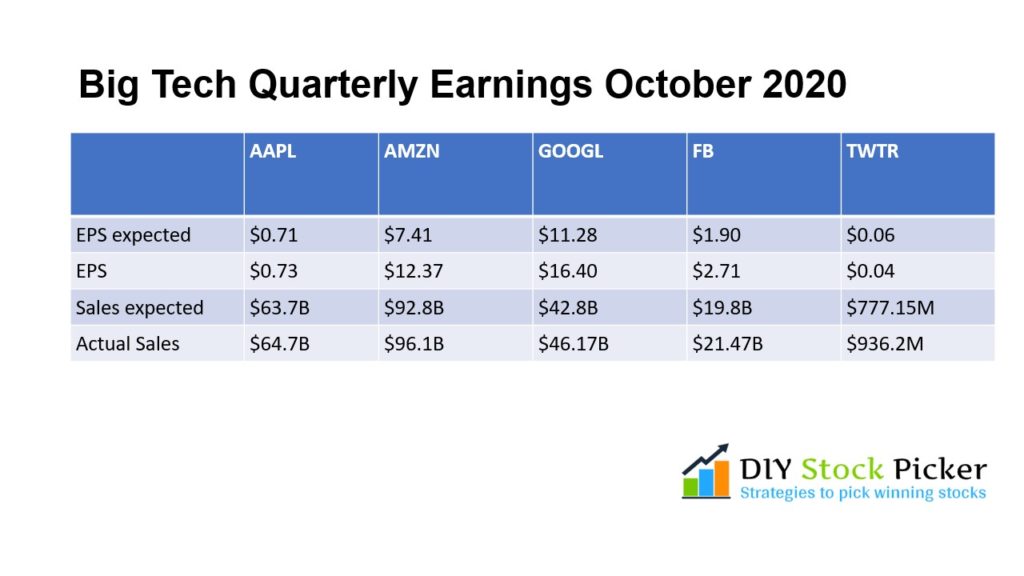

Big Tech stocks have reported their quarterly earnings in October, 2020. All of them have exceeded earning expectations. However the stock price has not followed earnings but has fallen down for all except Google stock. Here is a summary of the big tech stocks earnings:

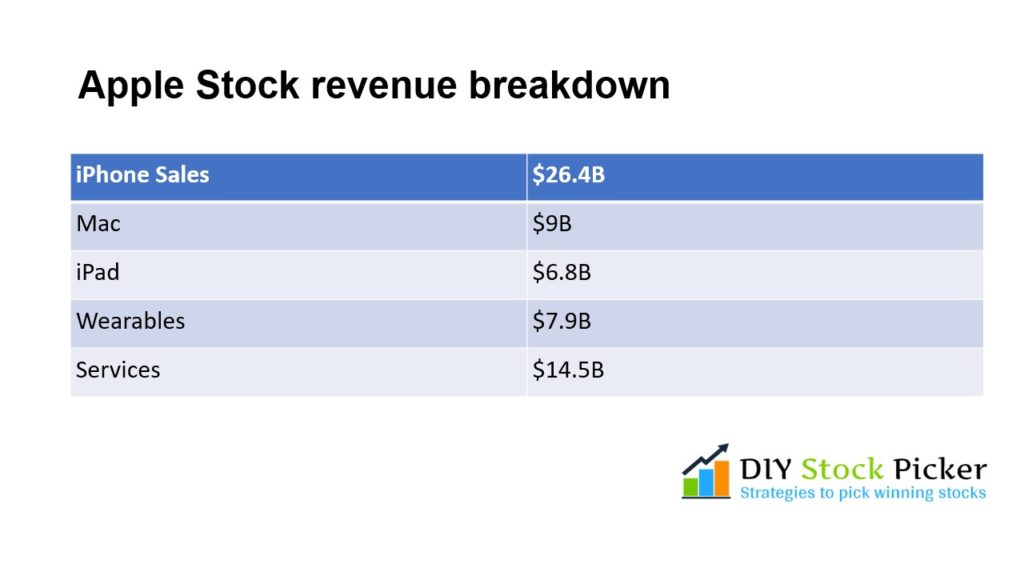

AAPL Stock Q4 2020 earnings Highlights

- $64.7B sales with an EPS of $0.73. YoY growth of 1%.

- International sales accounted for 59% of the quarter’s revenue.

- $18B spent in Stock buybacks.

- Net Cash of $98B.

- Apple’s Board of Directors has declared a cash dividend of $0.205 per share of the Company’s common stock.

- $22B returned to shareholders in the form of dividends and stock buybacks.

AAPL Stock Concerns

- No guidance issued on the expected sales for iPhone 12. This generation of iPhones are 5G enabled.

- 29% decline of sales in Greater China

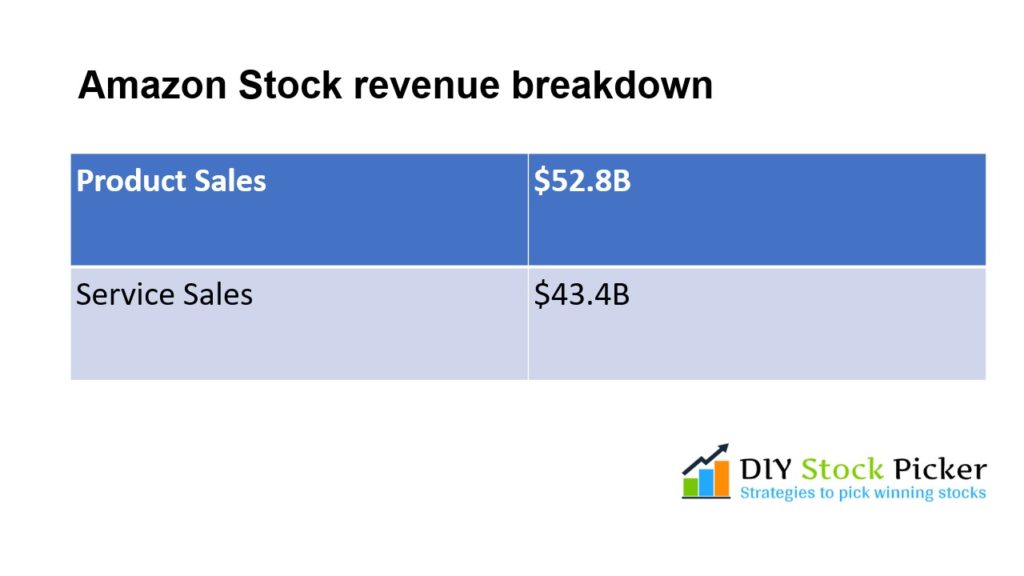

AMZN Stock Q3 2020 Earnings Highlights

- $96.1B sales with an EPS of $12.37

- Free Cash Flow of TTM (Trailing Twelve Months) is $29.5B (26% increase YoY)

- Hundreds of thousands of jobs created worldwide

- Amazon Prime Day on October 13-14 and Amazon India’s Great Indian Festival on October 17 to kick off the holiday season sales.

- Announcement of the Prime gaming service

- New generation of Echo devices, Fire sticks, AI updates to Alexa.

- AWS has contracts going with Moderna, Global Payments, Jack in the Box and Best Western Hotels

AMZN Stock Concerns

Reason for shares being down is the $4B expected costs related to the Covid-19 pandemic. This cost will be reflected in the next quarter financial results.

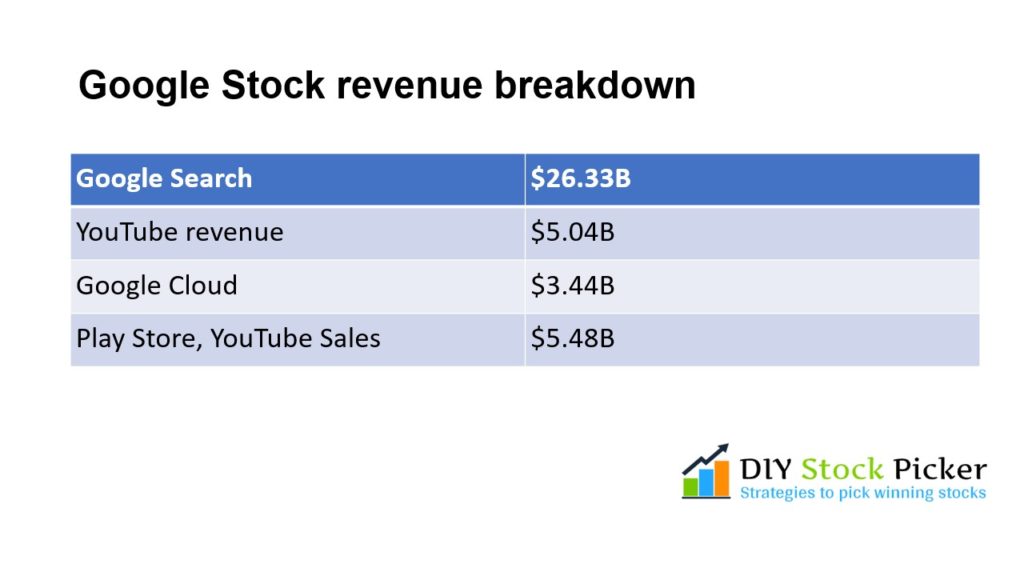

GOOGL Stock Q3 2020 Earnings Highlights

- $46.17B revenue for the quarter, representing a 14% YoY increase with an EPS of $16.40

- Huge investments in Google Search technology for AI and natural language processing.

- 30 million premium subscribers on YouTube

- Google Cloud has won big contracts with the U.S. Defense and Nokia

- Google Meet saw a peak of 235 million daily meeting participants in Q3

- Waymo, the fully autonomous ride-hailing service in suburban Phoenix will open to the public. Waymo also entered into a global partnership with Daimler Trucks to enable fully autonomous trucking.

GOOGL Stock Concerns

- Antitrust litigation has been filed by the Justice Department and the company plans to vigorously defend itself.

Facebook Stock Q3 2020 Earnings Highlights

- $21.47B total revenue for the quarter with an EPS of $2.71

- Cash and cash equivalents of $55.62B

- Daily Active users of 1.82B and Monthly Active Users of $2.74B (12% YoY increase)

- The number of people who use Facebook’s various platforms (Facebook App, WhatsApp, Instagram), rose 15% to 3.21B

- Effective tax rate of 4% for the quarter. This was due to an income tax benefit fo $913 million related to capitalizing R&D expenses.

FB Stock Concerns

- Apple is making changes to its platform. This will result in difficulties for Facebook to target its Ads.

- The regulatory developments in Europe may result in obstacles for trans-Atlantic data transfers.

- Advertising boycott by more than 1,000 advertisers, organized by civil rights groups.

TWTR Stock Q3 2020 Earnings Highlights

- $936.2M total revenue for the quarter with an EPS of $0.04, a 14% YoY increase

- $808M in Ad revenue, a 15% YoY increase

- 14% rise in total revenue.

- Ad sales rose due to the return of events and sports in the third quarter.

- 187 million daily active users (up 29% from last year, but only 1 million up from the previous quarter). This parameter fell short of expectations.

- Uncertainty in the next quarter surrounding earnings due to the U.S. Presidential election.

- $7.7B in Cash and cash equivalents

- $2B announced stock buyback in March this year has not yet been initiated due to uncertain economic environment.

- Stock based compensation of $116M which is 12% of the total revenue