AvePoint Inc., the largest data management solutions provider for the Microsoft cloud, announced that it has entered into a definitive business combination agreement with Apex Technology Acquisition Corporation (NASDAQ: APXT Stock), a publicly traded special purpose acquisition company. The combined company will be named AvePoint and will be listed on the Nasdaq under the new ticker symbol “AVPT”.

“We have seen two years’ worth of digital transformation in two months.”

Satya Nadella, Microsoft CEO

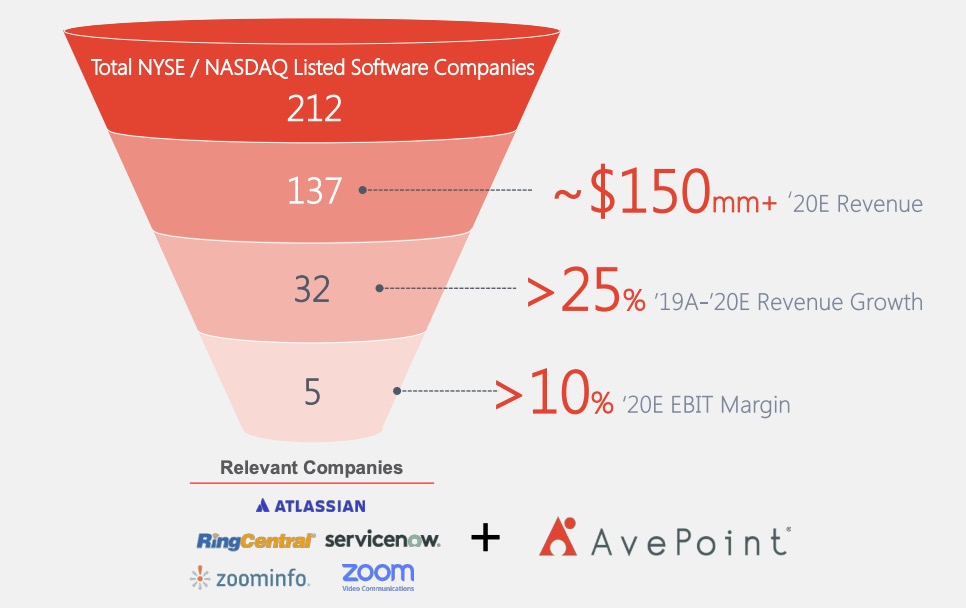

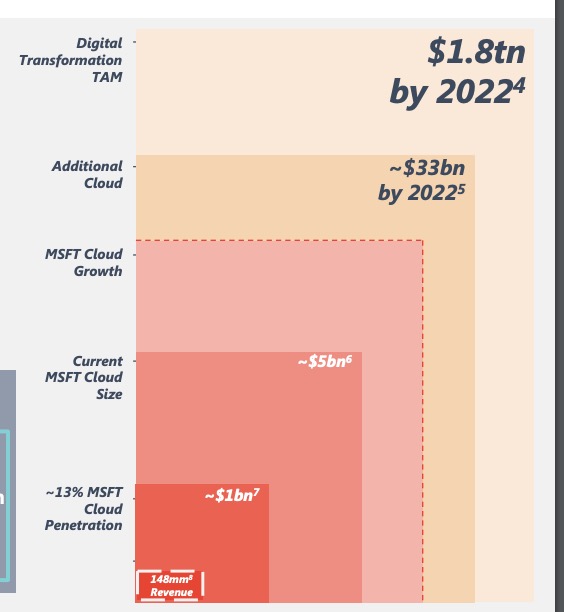

Of over 200 public cloud companies, AvePoint is one of only five with 2020 estimated revenue in the $150 million range, 2020 estimated year-over-year growth above 25%, and 2020 estimated EBIT Margin over 10%. In this heated stock market, this is indeed a rare find that is solid on fundamentals. The total addressable market is estimated to be $33 billion by 2020.

Company background

AvePoint was started by two programmers in a New Jersey Library. From this modest beginning, the company has grown to serve the largest software-as-a-service (“SaaS”) user base in the Microsoft 365 ecosystem. AvePoint is a five-time Global Microsoft Partner of the Year and boasts one of the largest Microsoft 365 development teams outside of Microsoft itself.

As of September 2020, the company has 7 million cloud users and 16k accounts. The Company sells directly to large and mid-market enterprises, and its solutions are also available to managed services providers on more than 100 cloud marketplaces globally.

AvePoint provides critical data management solutions that enable organizations to make their digital collaboration systems more productive, secure and compliant. The company has launched many digital collaboration technologies on the Microsoft 365 platform. It was the first to market a security solution, to prevent oversharing on the platform and enforce security policies.

Apex is led by former Oracle CFO Jeff Epstein and former Goldman Sachs Head of Technology Investment Banking Brad Koenig. Their combined experience includes more than 100 technology IPOs and mergers involving companies such as Microsoft, Oracle, Booking Holdings and Twilio.

Merger Transaction details

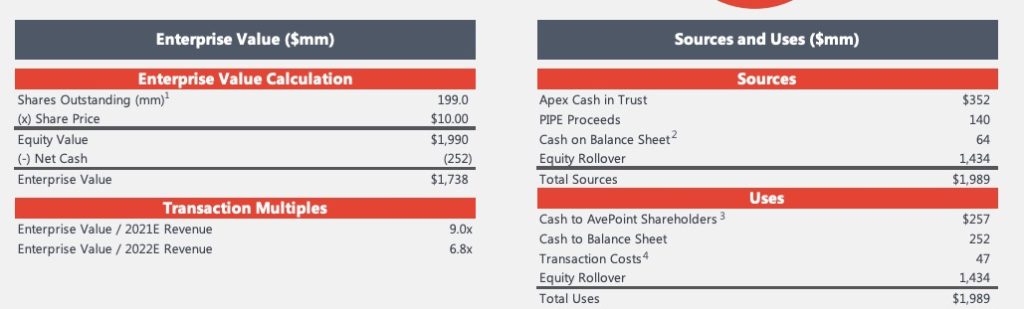

- Pro forma implied enterprise value of approximately $2 billion.

- Transaction includes $352 million of cash held in Apex’s trust account and an immediate $140 million financing through a fully committed private placement including investments from Sixth street. The global investment firm led a $200 million growth equity investment in AvePoint in 2019.

- $252 million cash to balance sheet to fund the growth of the company.

- The deal is set to complete in the first quarter of 2021.

Share count

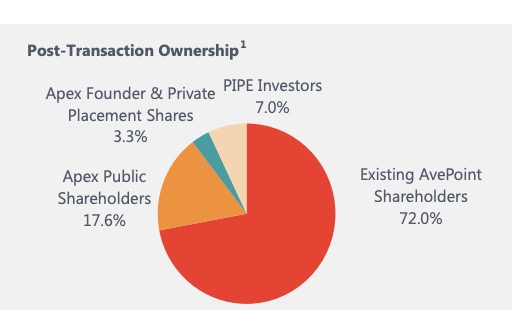

- 199 million shares outstanding.

- 72% AvePoint shareholders.

- 21% Apex public shareholders and founder shares.

- 7% PIPE investors.

Valuation

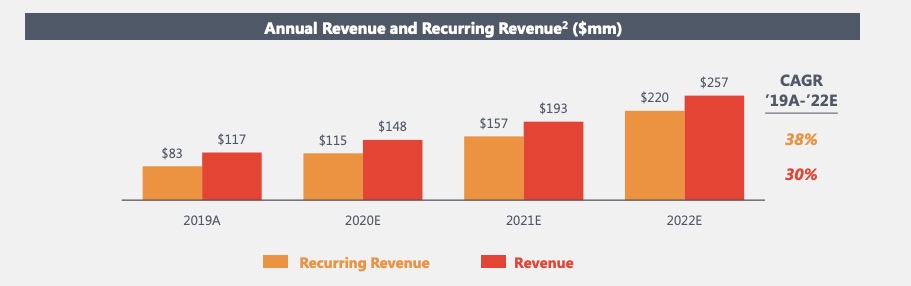

The company has an estimated revenue of $148 million in 2020. The revenue growth is 30% and the EBIT margin is 14%. Currently, AvePoint has 3% share of M365 users. In a couple of years, the user base is expected to double and AvePoint plans to capture 10% share with the available funding from the transaction.

If we look at the revenue for 2020, on a 7 million customer base, the company has a revenue of $148M. That is about $21 per customer average.

If the company grows at a 30% CAGR, the expected revenue is $257M in 2022. It is now trading at 13 times revenue. If we apply the same multiple, the valuation would be $3.5B in 2022. Divide it by the shares outstanding of 199M, that would give a share price of $17 in 2022.