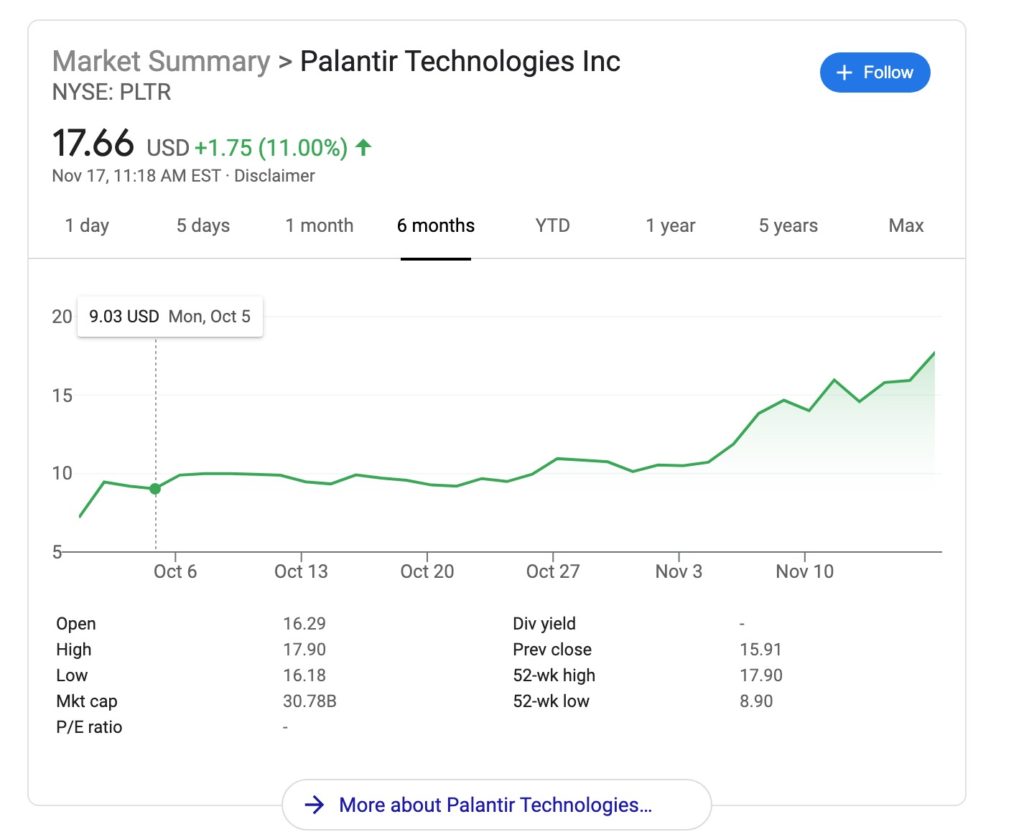

Palantir technologies (PLTR Stock), went public on Sep 29, 2020. It started trading at $10 a share, and for a brief period, it fell to $9 levels. This was expected because there was heavy selling of the share by its founders and employees. Then the stock came to life and popped 50%.

The first quarterly earnings of the company showed some exciting things happening for the company. Even though the stock initially fell after earnings, the market quickly realized the potential for this stock. We will try to come up with a valuation and a price target for the company in the next 2 years.

Key highlights of the first Quarterly Earnings report

Palantir had its first earnings call as a public company. Here are the main highlights:

- $289.4 million in revenue in the third quarter, up 52% year-over-year.

- Full-year 2020 revenue guidance raised to a range of $1.070 billion to $1.072 billion, up 44% year-over-year.

- Adjusted operating income in 2020 is expected to be $130 million to $136 million. This excluded the stock based compensation and expenses related to the direct listing filing.

- The company closed 15 deals with new and existing customers.

- New contracts in the third quarter include U.S. Army ($91 million), National Institutes of Health ($36 million), and $300 million renewal, 5-year contract, one of the world’s largest aerospace companies.

- Cash and cash equivalents of $1.8 billion on the balance sheet.

Here is a look at the 3 main sectors of operation for Palantir Technologies stock

Government

- In September 2020, the company was awarded a $91 million contract with the U.S. Army Research Laboratory to provide artificial intelligence and machine learning capabilities for military planning and defense operations.

- The Coronavirus pandemic has opened new areas of operations for Palantir. A federal research organization operating under the National Institute of Health (NIH), awarded a $36 million contract. The software will be used for cancer and coronavirus research.

- National COVID Cohort Collaborative (N3C), a program run under the NIH that maintains the largest clinical data asset in the world regarding the development of the coronavirus is using the Palantir software. The software was used to integrate clinical data from more than one million patients in the United States in a matter of weeks.

Commercial

- In the commercial sector, Palantir’s software is being used by industries, including the automotive, manufacturing, aviation, healthcare, and banking sectors,

- Palantir closed a $300 million renewal, 5-year contract, one of the world’s largest aerospace companies.

- An oil and gas customer, one of the largest energy companies in the world, identified $315 million in cost savings opportunities using Palantir software, and the company’s management is currently targeting $1 billion in total savings in the coming year through the use of our platform.

- Consumer goods companies are using the software to address disruptions in the supply chain due to the pandemic.

International

- Sompo Holdings, Inc. is one the significant shareholders of Palantir. The Tokyo-based insurance company and Japan’s leading nursing care provider, was selected as the strategic partner in June 2020. This gives Palantir a huge reach in Japan and expands into other markets in Asia.

- U.K. National Health Services, used the software to distribute more than 2.7 billion items of personal protective equipment across the country.

- The company also has a significant presence in markets outside North America, including in Europe, the Middle East, and South America.

Palantir Technologies Stock Analysis

The main advantages for Palantir are the complexity of the software it operates. New companies will find it extremely difficult to penetrate into the markets that Palantir is capturing. Also existing software which could not fulfill demands by customers are being replaced by Palantir as we saw earlier in the consumer sector example.

The company has $1.8 billion in cash and can invest heavily in future growth. The company is also working to reduce the time required to get its software installed and running. As you can imagine, it is a pretty complex software running on multiple nodes and servers. That makes it for easy adoption.

The company is projected to grow between 30 to 40% per year for the next 5 years.

A hidden opportunity here is to provide its software as a service. Right now, it is installed on premises due to its sensitive nature. But the cloud has evolved so much that sensitive information could be handled in compliance with the security standards. That will pivot the way the market views Palantir.

Another catalyst may be that it may be an acquisition target in the market by big data analytics companies. They usually pay a premium price for acquisitions.

Palantir Technologies Stock Valuation

The year 2020 revenue is expected to be $1 billion. If the revenue grows at a compound rate of 30%, it will be $4.5 billion in 4 years. If the stock is valued using a price-to-sales multiple of 20, that will give the company a valuation of $90 billion in 4 years.

The number of shares outstanding are 2.5B. Divide $90B by 2.5B shares, gives a share price target of $36 in 4 years.

So I believe Palantir is still a buy at the current price of $16 as it has a long runway of growth ahead.