Lordstown Motors has entered into a definitive merger agreement with DiamondPeak Holdings Corp. (NASDAQ:DPHC Stock), a Special Purpose Acquisition Company; Upon closing, the combined company will remain listed on the NASDAQ under the new ticker symbol “RIDE”. The board members of both the companies have unanimously approved the transaction. President Trump’s excitement about the Lordstown Motors plant and the Endurance SUV, generated a lot of interest for the stock among investors.

Lordstown Motors Company Overview

Lordstown Motors’ full-size pickup truck, “Lordstown Endurance”, claims to deliver the equivalent of 75 miles per gallon. Its range is 250 miles on one charge. The towing capacity is estimated at 7,500 lbs. This was engineered to target the commercial fleet market, which include companies in contracting, utilities, transportation etc. Lordstown has received more than 27,000 pre-orders for the vehicle, representing $1.5 billion of potential revenue. The vehicle is eligible for the $7,500 instant tax rebate. So its price drops to $45,000.

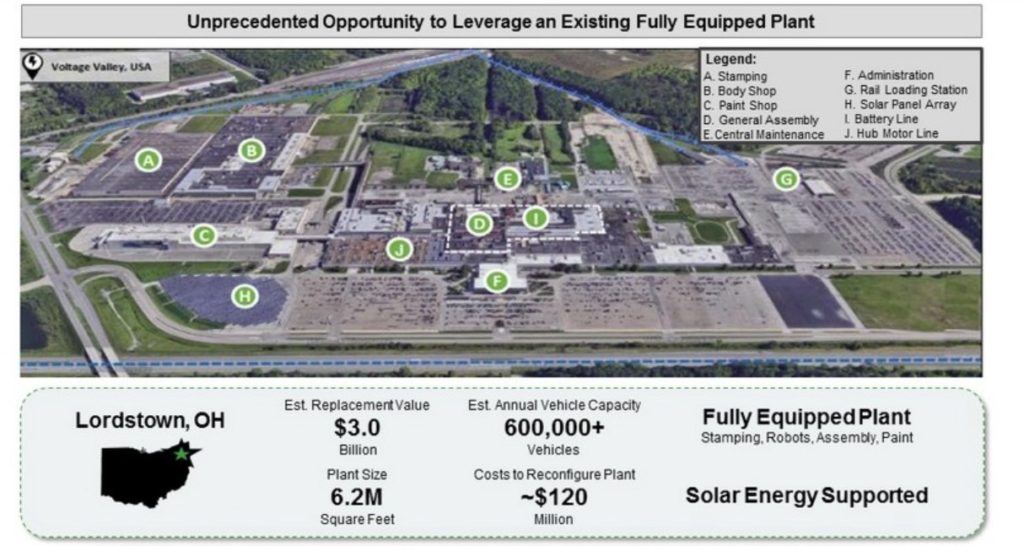

In November 2019, the company purchased the former General Motors Lordstown assembly plant, which is a 6.2 million square foot facility. The expected production capacity is about 600,000 electric vehicles per year. The plant was purchased for about $20 million. It is reported Lordstown raised $450 million to retool the plant.

Currently engineers are working in a secret studio designing the Endurance to be pre-production ready before December this year. They are also designing the production lines to build battery packs and in-wheel motors. This will be a vertically integrated ecosystem.

Lordstown Endurance is equipped with hub motors in each wheel that seamlessly integrate with its software system. This is equivalent to a motor and mind in each wheel. This design means that the Endurance has just four moving parts in the drivetrain, as compared to more than 2,000 in vehicles utilizing a traditional internal combustion engine. This in turn increases the reliability and reduces the cost of ownership.

Detailed Transaction Overview

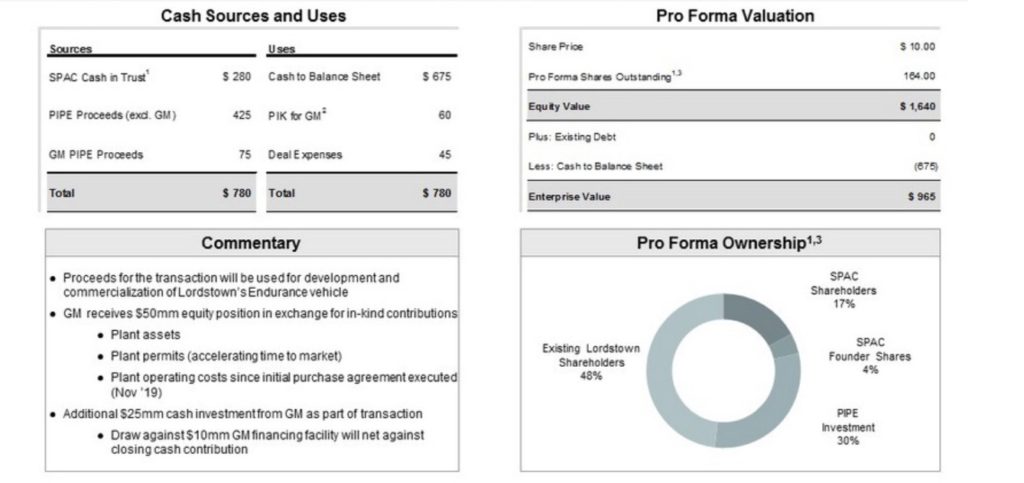

- SPAC Cash in Trust of $280 million, PIPE funding of $500 million. Total proceeds of $780 million. PIK for GM of $60 million and Deal expenses of $45 million.

- Approximately $675 million of gross proceeds that are expected from the transaction will be used to fund production of the Endurance and its innovative in-wheel electric hub motor design

- Transaction includes a $500 million fully committed PIPE, which includes $75 million of investments by General Motors in addition to investments from institutional investors, including Fidelity Management & Research Company LLC, Wellington Management Company LLP, Federated Hermes Kaufmann Small Cap Fund, and funds and accounts managed by BlackRock, among others

- Pro forma implied equity value of the combined company is approximately $1.6 billion and Enterprise value of $965 million.

- Total shares outstanding 164 million. Lordstown shareholders have 48%, SPAC shareholders 17%, SPAC founder shares 4% and PIPE investors have 30% shares.

- Combined company Board of Directors will include Steve Burns, Founder and CEO of Lordstown, and David Hamamoto, Chairman and CEO of DiamondPeak

- Transaction is expected to close in the fourth quarter of 2020

Advantages

- There are tailwinds for both Electric vehicles and Trucks.

- The Endurance may be the first to market, all electric SUV, thus giving it a head start in capturing market share.

- Even though the current target market is fleet owners, they have a plan to pivot to the regular pickup trucks.

- Pickup trucks usually have a larger margin.

- Management has built some strategic relationships in the industry especially with General Motors. So the backing of heavyweights is always present.

Risks

- No revenue established yet. The estimated figures are given in the prospects of the business. There is no track record of execution, so cannot say for sure how well the strategic plan will be executed.

- The Pre-Production ready vehicles are expected to come out in December. That is when the actual rubber meets the road literally.

- There is only $2 million cash on the balance sheet currently for Lordstown.

- There is a risk of unionization of the workers at the plant, which may change the pay structure and alter the bottom line margins for the company.

- Workhorse retains a 10% stake in Lordstown Motors.

- Total shares outstanding 164 million do not represent the 14.4 million warrants with a strike price of $11.50. This will result in further dilution of the shares.

Conclusion

Lordstown Motors DPHC Stock offers an attractive opportunity for the retail investors to get a piece of action in the hottest sectors of the Stock Market – Electric vehicle pickup trucks. There is an advantage of first to market and capturing of the market share. However, there is not much to show here other than a Beta Pickup truck. We also do not have more details of the pre orders from customers. These may not transform into actual revenues, these are just projections.

The stock is already trading at more than $20 a share, which is a 100% upside from the SPAC share price. This is a huge hype for the stock with little to show for.

Investing in a company which has no revenue to show for and a product that is not production ready is risky to say the least.