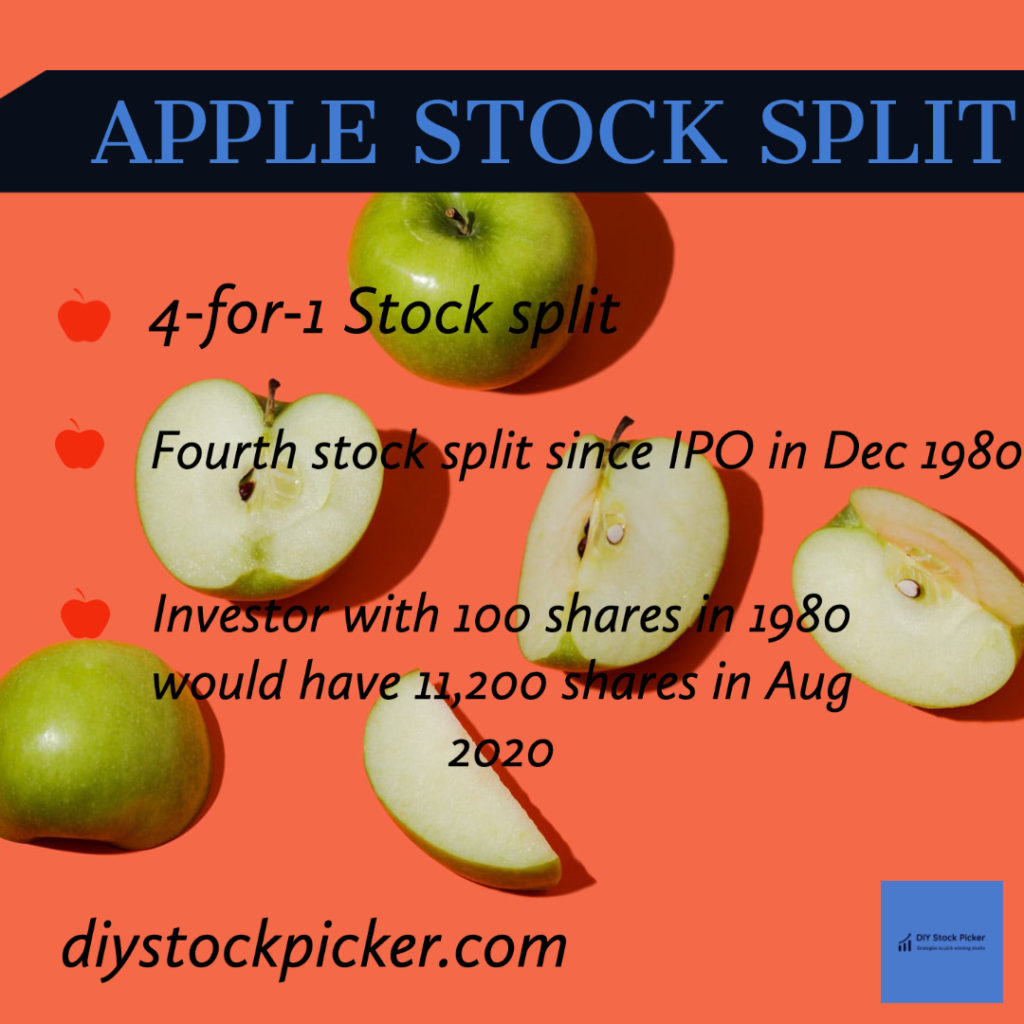

Apple’s Board of Directors approved a four-for-one stock split to make the stock more accessible to a broader base of investors. With the stock split, each Apple shareholder of record at the close of business on August 24, 2020 will receive three additional shares for every share. The trading on a split-adjusted basis will begin on August 31, 2020.

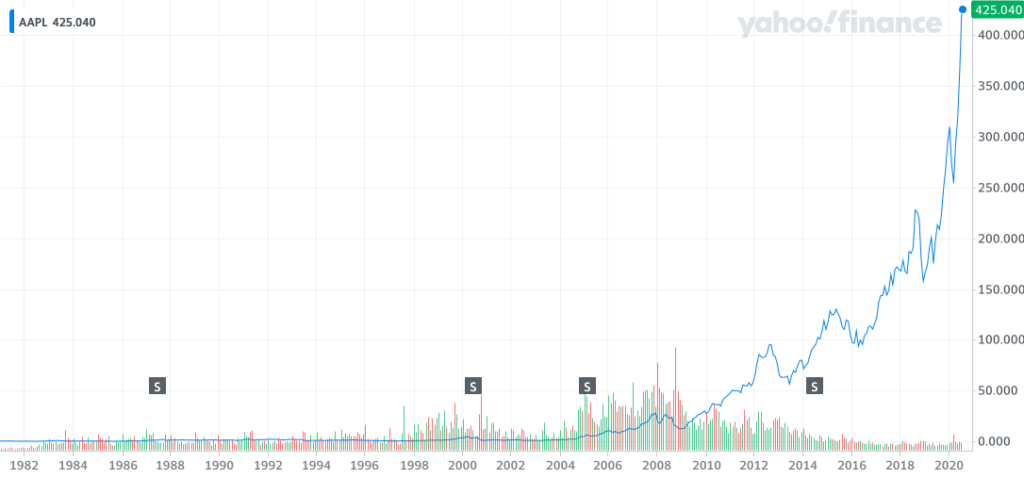

The following is the Apple stock split history after the company went public in December 1980:

| Date | Stock split basis |

| June 16, 1987 | 2-for-1 |

| February 28, 2005 | 2-for-1 |

| June 9, 2014 | 7-for-1 |

| August 31, 2020 | 4-for-1 |

What is a Stock split?

Companies split their stock so the market price of each share decreases. The total market capitalization (total number of shares outstanding multiplied by the market price of each share) however does not decrease. The reasoning usually is that if the individual share price is higher, lot of investors cannot buy the shares. But if the price is less, retail investors would be willing to purchase them.

For existing investors, they would be getting more shares based on the split factor. If the stock split 4-for-1 and an investor has 100 shares, he would be getting 400 shares. Over the long run, as the company’s business booms, these shares have more potential for growth. In the case of Apple, an investor who has 100 shares at the time of its IPO would have 11,200 shares after this latest split. Taking into account the split adjusted price, each share would have costed 47 cents in 1980.

Are stock splits still in vogue?

With zero commissions on stock purchases, stock splits are not very common. Berkshire A stock price is around $300,000 per share, Amazon is around $3000 and Google is around $1500 a share. Warren Buffet never split his stock and his reasoning is that he wants only long-term investors purchasing his stock.

With the arrival of fractional share investing brokerages, retail investors can buy fractional shares as well (as little as $5 or $10 of a stock in a single trade).

Do fundamentals change regarding investing?

Always keep in mind that stock splits do not change the fundamentals of a company. Always research a company’s prospects, its business model and all the due diligence before investing.

Apple stock split and price chart

Summary