Archer, a leading Urban Air Mobility company and developer of all-electric vertical take-off and landing (“eVTOL”) aircraft, and Atlas Crest Investment Corp. (NYSE: ACIC), a special purpose acquisition company, today announced they have entered into a definitive agreement for a business combination that would result in Archer becoming a publicly listed company. Archer, will be listed on the NYSE with ticker symbol “ACHR.” The transaction is expected to close in the second quarter of 2021.

The fully electric vertical takeoff and landing aircraft can travel distances of up to 60 miles at 150 mph using technology available today and will transform how people approach everyday life, work and adventure, while benefiting the environment and a future zero emissions world. United Airlines is purchasing $1 billion of Archer’s aircraft, with an option for an additional $500 million of aircraft.

Company Background

Based in Palo Alto and led by co-founders and co-CEOs Brett Adcock and Adam Goldstein, Archer’s mission is to advance the benefits of sustainable air mobility and become the leader in the new era of UAM. Morgan Stanley estimates Urban Air Mobility to be up to a $1.5 to approx $3.0 trillion industry by 2040.

Marc Lore is the first and the largest investor in Archer. He was the founder of Jet.com which Walmart acquired for $3.3B. Mr. Lore also the found Quidsi.com which Amazon acquired for $500M.

Archer is developing the world’s first commercially viable all-electric Urban Air Mobility platform. The aircraft can carry 4 passengers at a time.

The following are the strategic partnerships of Archer:

- United has placed an order, subject to United’s business and operating requirements, for $1 billion of Archer’s aircraft, with an option for an additional $500 million of aircraft. United, in partnership with Mesa Airlines, could give customers a quick, economic and low-emission way to get to airports within its major hubs by 2024.

- In January 2021, Archer announced it had entered into a strategic collaboration agreement with Stellantis, with a focus on accessing its low-cost supply chain, advanced composite material capabilities, and engineering and design experience. Stellantis is the 4th largest automotive manufacturer in the world by volume.

- The PIPE included participation from leading strategic and long-term financial investors including United Airlines, Stellantis and the venture arm of Exor, Baron Capital Group, the Federated Hermes Kaufmann Funds, Mubadala Capital, Putnam Investments and Access Industries.

Business model

Archer is looking to tap into two revenue streams.

- Archer Direct – This is the aircraft OEM business. The company is looking to be the next best U.S. based manufacturer. It is also the only eVTOL company to have a contract from a major U.S. airline. The company is looking further to diversify into cargo and DoD contracts.

- Archer UAM – This is the aerial ride sharing business aka the Uber of the skies. The company plans to launch initially in congested metropolitans like Los Angeles, Dallas-Fort Worth, and Orlando. Archer is looking to partner with developers to build vertiports across cities as the business scales up. This will lead to the addition of more routes.

Archer key highlights

- Archer is designing its aircraft for mass production. The company is planning to open a manufacturing facility in 2022. The capacity is expected to be 200 to 1000 aircrafts per year.

- Prime radiant is the data science program for Archer. This simulation software analyzes live trip data to determine optimal trip locations and save costs.

- The company is working towards an autonomous program to reduce costs and free up space in the aircraft for an additional passenger.

- Archer is certifying in the U.S. with the Federal Aviation Administration (FAA). The process started in 2020 and has been approved by an intake board. The type certificate is expected in 2024. This will be the certificate from the FAA approving the design of the aircraft and all component parts.

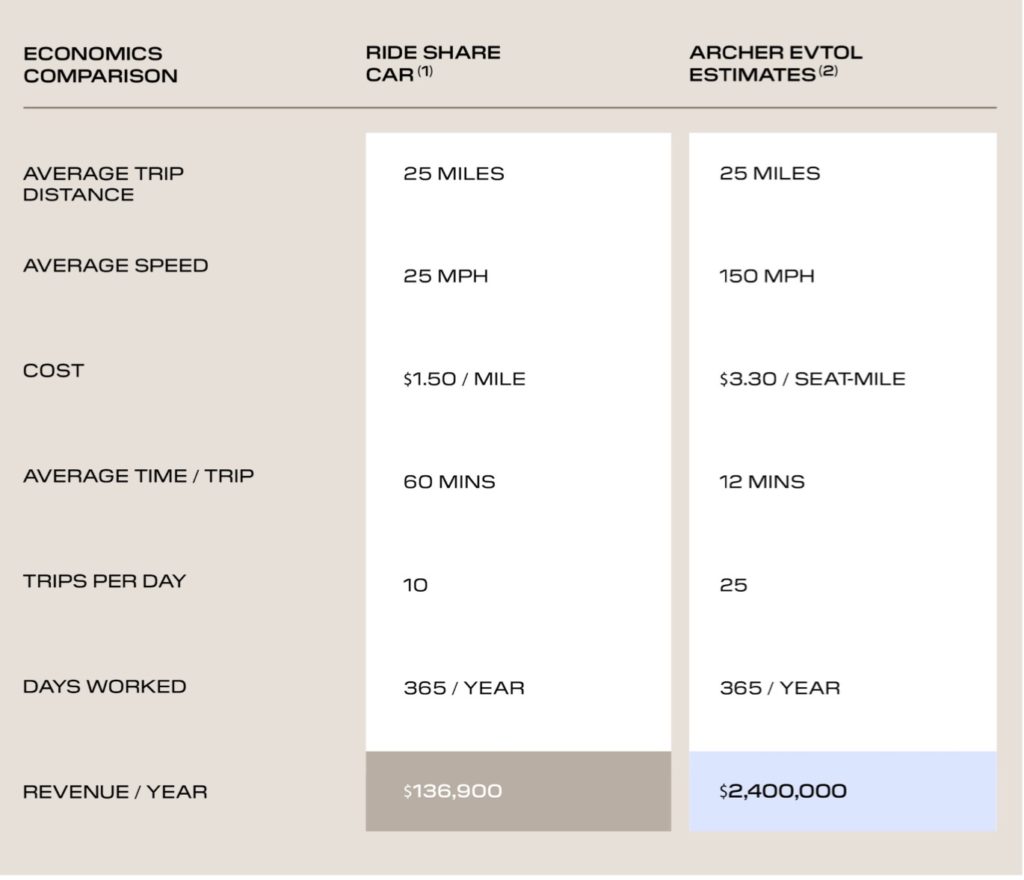

Archer stock advantage over rideshares

- The direct operating costs are expected to decline over time with advances in battery technology, and introduction of Autonomy to aircrafts.

- At 25 trips per day, and $3.30 per seat-mile, each aircraft is expected to generate $2.4M of revenue per year.

- Archer expects that over the life of the aircraft, the UAM business will be 3X more profitable than direct OEM sales.

- The company is preparing to launch in Europe, Middle East, and Asia.

Merger Transaction Details

- Pro forma implied enterprise value of approximately $2.7 billion.

- $1.05 billion cash to balance sheet to fund the building of aircraft and manufacturing facility.

- Transaction includes $500 million of cash held in trust and $600 million PIPE. The leading investors are United Airlines and Stellantis.

- The deal is expected to close by the end of second quarter, 2021.

Share Structure

- Total shares outstanding of 375 million

- 67% existing Archer shareholders

- 16% PIPE investors

- 13% ACIC SPAC shareholders

- 3% ACIC SPAC Sponsor shareholders

Archer Stock Valuation

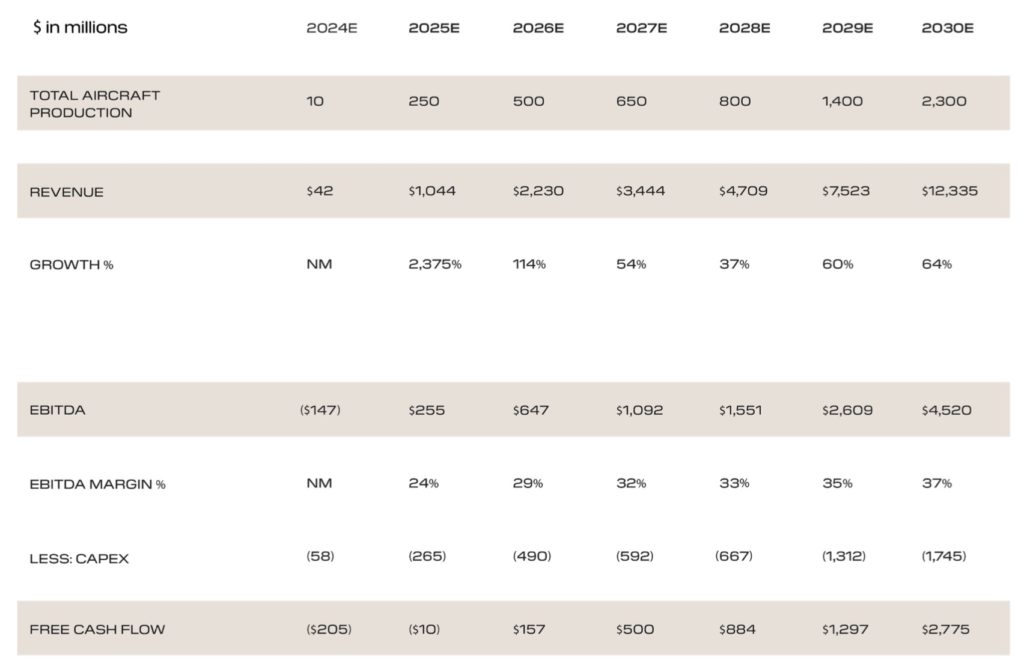

- The aircrafts are expected to start operation starting 2024. The manufacture and production will really ramp up starting 2025.

- The business model initially takes into account the OEM sales. This will result in a Capex light model.

- The management says the 2026 revenue estimate is only 0.15% of the TAM. They are estimating growth on the conservative side.

- The company is expected to be cash flow positive by the end of 2025.

- EBITDA margins are expected to be 30%.

Management Valuation for 2026

- $1B revenue and an EBITDA of $647M by the end of 2026.

- Valuation multiple of EV/EBITDA of 10. That gives an EV of $6.47B.

- Divide $6.47B EV by the 375M Shares outstanding. This gives a valuation of $17 per share in 2025 estimated.

- According to the management estimates, Archer is currently valued at 1.2X of EV/Revenue and 4.2X of EV/EBITDA for the year 2026.

Archer Stock Risk Factors

- The company has not manufactured or delivered any aircraft so far. This is a very early stage company. The business concept is novel as well. The market is new. Execution is the key. There is not enough company track record to arrive at an analysis for the business valuation.

- The contract with United Airlines is dependent on a few factors like ability to manufacture aircrafts within the budget requirements, pass the FAA certification. This is the make or break contract for the company. If this contract does not go through, the operations and cash flow of the company will be severely impacted.

- The business initially will be limited to a few metropolitan areas. It may be subjected to regulation by city authorities. The ability to operate the business will depend on obtaining approvals and permits from the local authorities.

- If there are any accidents involving the aircraft, that will result in negative publicity for the business.

- The key to success of Archer is in manufacturing the aircrafts within budget, building the Vertiport infrastructure after finding out the most efficient routes, getting the necessary regulatory approvals, and growing into new metropolitan areas.