EVgo is the nation’s largest public fast charging network for electric vehicles and the first to be powered by 100% renewable electricity. With more than 800 fast charging locations in 67 major metropolitan markets across 34 states, EVgo owns and operates the most public fast charging locations in the U.S. and serves more than 220,000 customers. The fast EV charging company has entered into a definitive business combination agreement with Climate Real Impact Solutions (“CLII” Stock). Upon closing, the combined entity is expected to be listed under the new ticker symbol “EVGO”.

The transportation sector is among the largest engines of the global economy and is undergoing a massive transformation with the transition from conventional vehicles to electric. Hundreds of billions of dollars of OEM investment is being retooled to deliver EVs to market. Additionally, fleets for rideshare, delivery, municipal, autonomous and other market segments are transitioning to electric. Together, this is creating a massive rising tide for the sector.

EV Industry growth

The industry experts forecast a 100-fold growth between 2019 and 2040. Even at this pace and trajectory, it is estimated that just 28% of cars on the road by 2040 will be EVs, reflecting the huge runway to come. In 2019, fast charging represented just 5% of charging demand. By 2027, fast charging is expected to grow to about one-third of demand, and by 2040 will be over 40%, a near-exponential market growth.

EVgo’s primary focus is on the fast charging part of the ecosystem. While there will continue to be a significant role for Level 2 at-home or at-work charging – where vehicles stay in place for long durations to charge – to be successful, EVgo does not have to steal share from those markets. Further, with fleets increasingly adopting EVs, those cars are going to drive hundreds of miles a day, not 200 miles a week like a retail driver, and they will require access to fast charging.

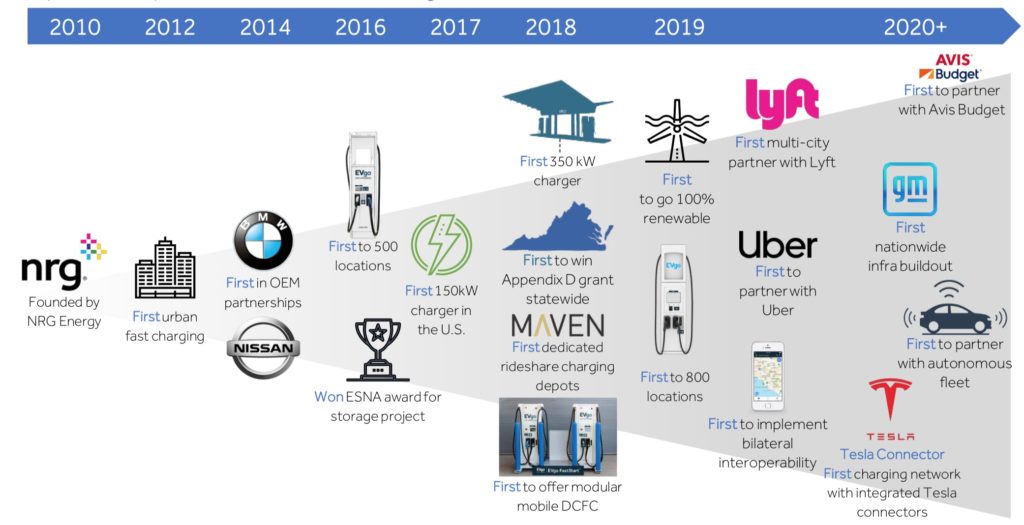

Company Background

Founded in 2010, EVgo is a leader in the transportation electrification space. The company has partnerships with market-leading automakers, fleet and rideshare operators, retail and other site hosts, utilities, governments, and other stakeholders. EVgo has steadily expanded over the last decade to become the largest platform for EV public fast charging in the U.S.

As a technology first-mover, EVgo has accelerated the adoption of EVs by providing a reliable and convenient charging experience, close to where drivers live, work and play, for both daily commuters and commercial fleets.

EVgo’s ongoing ownership of its charging network enables the company to deliver superior customer service, as evidenced by its industry-leading uptime of approximately 98%.

The extensive network of EVgo is powered 100% by renewable electricity. EVgo makes it easier for all U.S. drivers to take advantage of the benefits of driving an electric vehicle and reduce greenhouse gas emissions from the transportation sector.

- The company has more than 800 locations in 67 major metropolitan markets across 34 states.

- EVgo’s network serves a rapidly expanding customer base that currently exceeds 220,000 customers.

Investors in the transaction

- LS Power is a leading investment firm focused on power, energy infrastructure and energy innovation. They bought NRG who founded the EVgo business.

- CRIS is co-sponsored by private funds affiliated with PIMCO, which has more than $640 billion in sustainability investments across its portfolios.

- The PIPE is anchored by institutional investors including private funds affiliated with Pacific Investment Management Company LLC (PIMCO), accounts managed by BlackRock, Wellington Management, Neuberger Berman Funds and Van Eck Associates Corporation.

EVgo Partnerships

Evgo has a strategic relationship with General Motors. GM selected EVgo for a nationwide EV charging infrastructure buildout in 2020, whereby EVgo expects to add more than 2,700 additional fast chargers to its network over the next 5 years.

Additionally, EVgo was the first third-party charging company to have native Tesla fast-charging, allowing Tesla drivers to charge at EVgo without an adapter, and to find our locations with this capability conveniently in the Tesla dashboard navigation system.

The company entered the Nissan2.0 contract in 2019 to continue profitably expanding charging services, customer base,and network size. In 2.0 contract, EVgo is the preferred provider of charging services and $250 in charging credit to customers.

Corporate partners also include Uber and Lyft, which selected EVgo as one of their first charging providers. EVgo has also worked with Tesla, to enable native fast charging on EVgo’s network. Additionally, EVgo partners with governments and utilities across the U.S., enhancing the nation’s infrastructure and supporting job creation.

The company also has a partnership with an autonomous fleet company whose name has not been disclosed.

EVgo competitive moat

The company has developed proprietary software that allows it to forecast on a zip code level what year-one utilization will look like in a network. The site development team identifies locations based on analytical tools and network design principles. The detailed costs, including those for permitting, construction, rent, and electricity are computed. All of this information is input into a proprietary model that spits out the IRR for each buildout.

This approach to growth helps ensure that we’re making smart decisions to maximize capital efficiency and the value of our network.

On top of this, EVgo is layering on proprietary network and customer management software that can provide everything our customers need to find the charging locations, assess the real-time availability of chargers, obtain free access to parking lots and garages, reserve chargers if desired, obtain coupons for host and near-by retailers, and collect rewards for frequent charging.

EVgo comparison with ChargePoint

The main difference between the business model of EVgo and ChargePoint is that EVgo is an owner operator while ChargePoint helps hosts set up the charging infrastructure, but does not own the network. ChargePoint is capital light in that respect. EVgo has the advantage of collective cash through the life of its charging network, but it requires more capital for network expansion. ChargePoint on the other hand, collects fees for its network use through its App but can scale out because it does not pay for setting up the infrastructure.

EVgo CLII Merger

- Pro forma implied equity value of approximately $2.631 billion.

- $575 million cash to balance sheet to fund the growth.

- Transaction includes $230 million of cash held in trust and $400 million PIPE.

- The deal is expected to close in the second half of 2021.

- All EVgo management and existing shareholders rolling their equity in the new company.

Share Structure

- Total shares outstanding of 263.1 million

- 74.4% existing EVgo shareholders

- 8.7% CRIS shareholders

- 1.6% CRIS Sponsor shareholders

- 15.2% PIPE investors

EVgo Stock Valuation

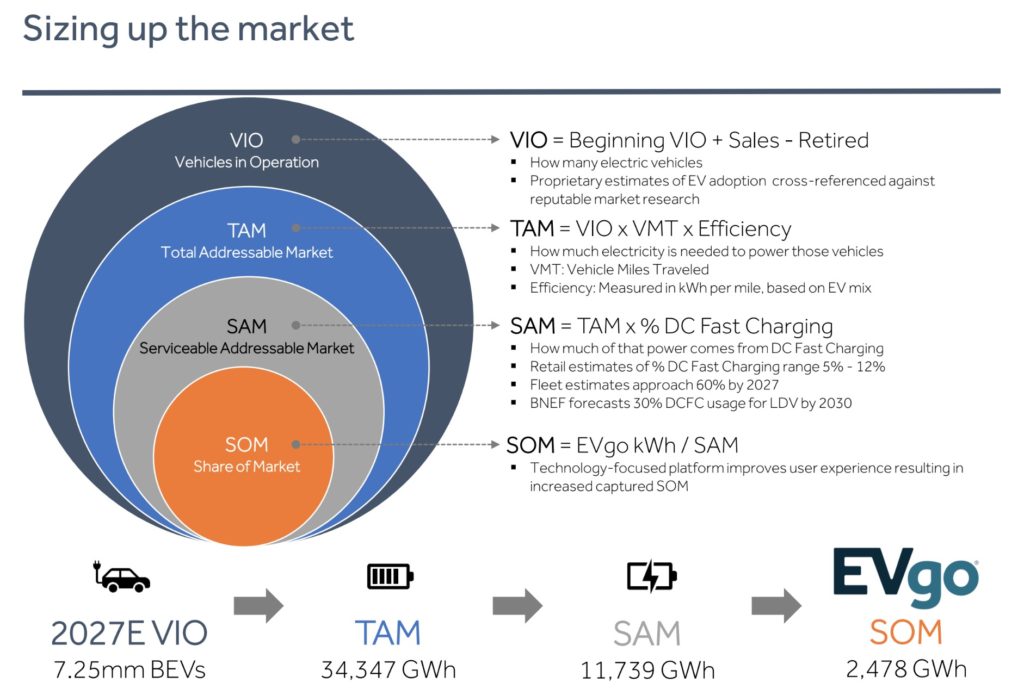

The EV charging market is still in its infancy. The success of the market greatly depends on the EV Vehicles In Operation (VIO). The demand for EV vehicles is expected to explode starting 2025.

- There are expected to be 7.25M Battery Electric Vehicles on the road by 2027.

- The Total Addressable Market will be the amount of electricity needed to power the EVs.

- EVgo DC fast charging will be 30% of the TAM.

- EVgo’s share will be 25% of the DC Fast charging market based on the kWh energy its charging network supports.

EVgo stock Valuation until 2025

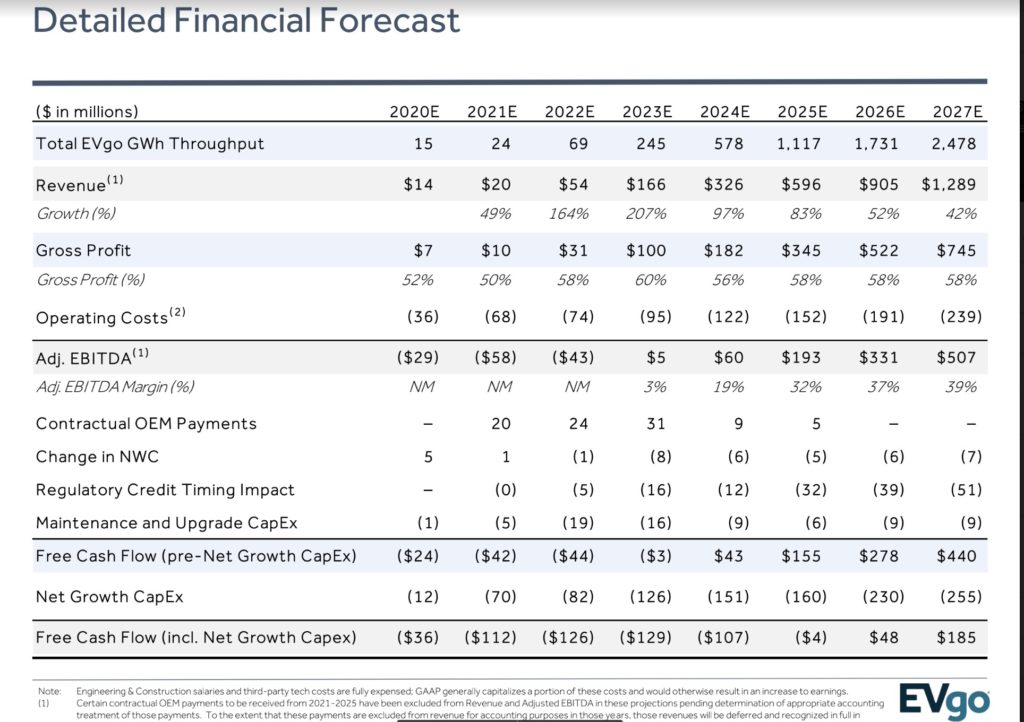

- $596M revenue and an EBITDA of $193M by the end of 2025.

- Valuation multiple of EV/Revenue of 10. That gives an EV of $5.96B.

- Divide $5.96B EV by the 263.1M Shares outstanding. This gives a valuation of $22.65 per share in 2025 estimated.

EVgo stock Valuation at 2027

- $1.289B revenue and an EBITDA of $507M by the end of 2027.

- Valuation multiple of EV/Revenue of 10. That gives an EV of $12.89B.

- Divide $12.89B EV by the 263.1M Shares outstanding. This gives a valuation of $49 per share in 2027 estimated.

Risk Factors

- EVgo’s has an owner/operator business model. This is a high Capital expenditure model. The reward is higher than a capital light model. But after the use of the initial capital raised during the SPAC, the company may need to issue further debt or equity in order to grow. The company is not cash flow positive according to management estimates until 2024 and meaningful FCF flows in starting 2026 onwards.

- The EV charging space is getting crowded with companies like ChargePoint, Blink, EVBox etc. The winning factor would be the partnerships with OEMs, Site hosts, Fleet partners. In that respect, EVgo has a good advantage over other charging providers. Also EVgo operates in a niche DC fast charging, which is ideal for Fleet and commercial vehicles.

- There is always the risk of the SPAC merger not going through. The price in that case would come back to $10. But big shot investors are behind the transaction, so this is not very likely to happen.