Proterra is North America’s number one EV bus original equipment manufacturer, boasting over a decade of experience in the industry. The California-based firm also develops world-class electric charging systems. Proterra to combine with ArcLight Clean Transition Corp. (ACTC Stock), a publicly listed special purpose acquisition company with ~$278MM cash currently held in trust.

ArcLight Clean Transition Corp. due diligence on Proterra includes:

- In-depth strategy reviews of the company’s strategy across each business unit

- Discussions with key customers

- Multiple site visits to the Burlingame and Los Angeles factories

- Independent review of Proterra’s battery technology by The Battery Lab

Company background

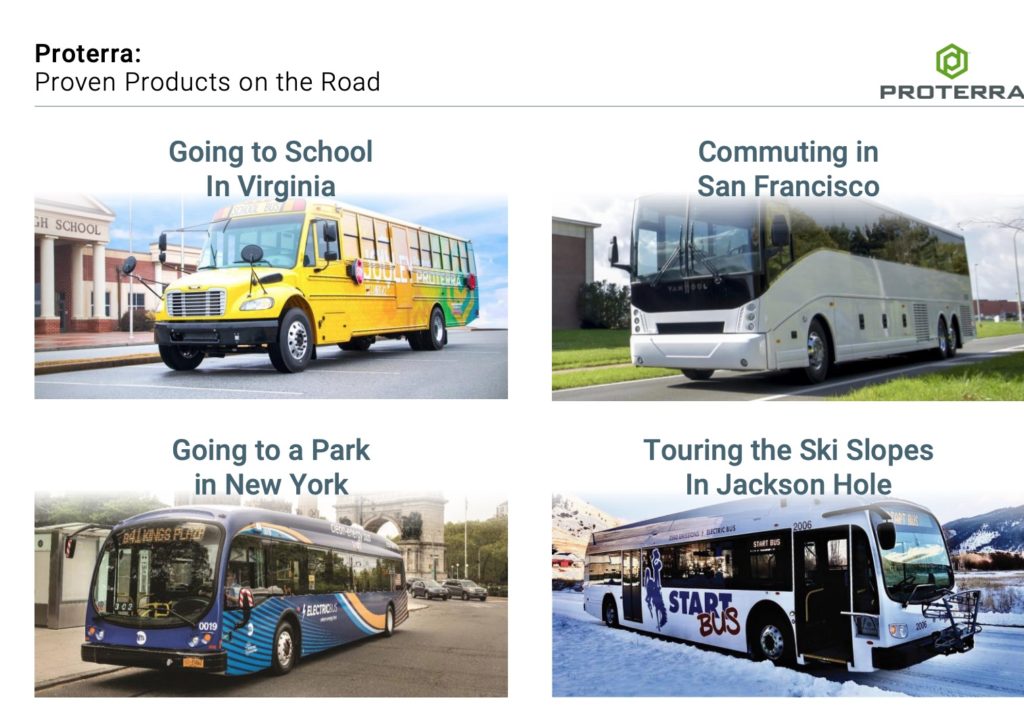

Proterra was founded by Dale Hill in Golden Colorado in 2004. By 2013, the company sold more than 50 buses. It also has an autonomous bus program at the University of Nevada. The Proterra Catalyst bus set a world record in 2017 by driving for 1100 miles on a single charge. The company later landed contracts with airports, federal agencies, and big bus transit companies. In 2018, the world’s largest commercial vehicle manufacturer Daimler made an investment. The company then launched ventures to navigate into manufacturing electric powertrains, the business that XL Fleet is into and EV charging infrastructure like ChargePoint and Blink. The company also has a battery leasing program like Romeo and QuantumScape.

In a nutshell, the growth has been tremendous with innovation leading the way. The following are the key highlights:

- 130+ Communities in 43 States and Provinces Choose Proterra

- 1,000+ Vehicles and 50%+ Electric Transit Bus Market Share

- 16MM Real-World Service Miles

- $193MM 2020E Revenue

- $750MM+ Orders and Backlog

- 54MW Charging Installations

- Over a decade of experience with ~350k sq. ft. of advanced manufacturing capacity

- Advanced R&D and has 81 Patents

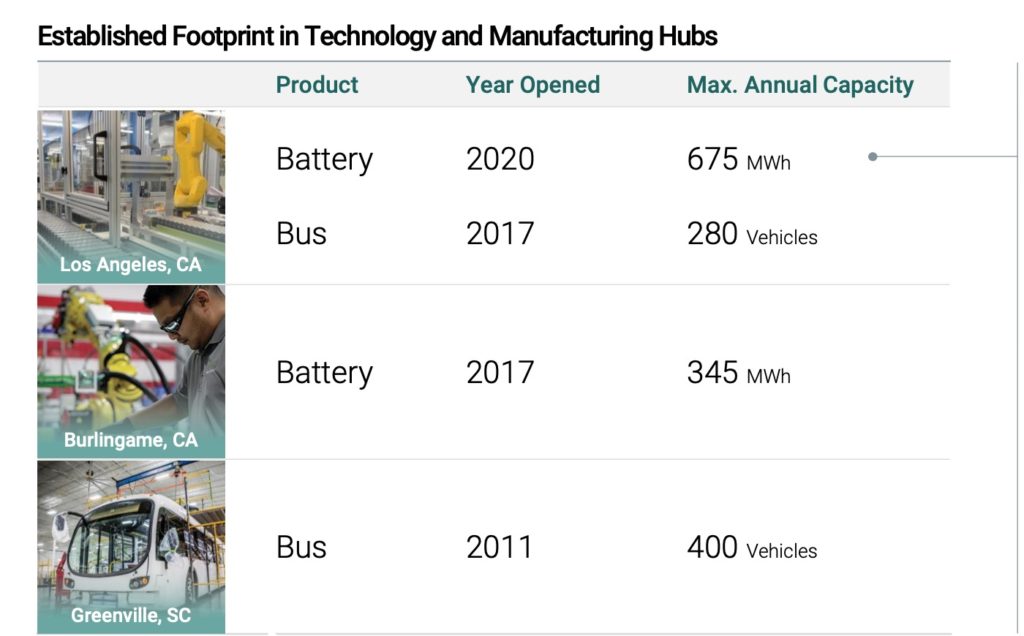

Proterra has 2 bus manufacturing facilities, one at Los Angeles, California and the other at Greenville, SC.

The company also has 2 battery manufacturing facilities in California at Burlingame and Los Angeles.

Proterra Transit

The transit industry is rapidly transitioning to battery-electric vehicles, with more and more cities across the continent making commitments to 100% zero-emission transportation. Purpose-built to be electric, the Proterra ZX5 bus enables transit agencies to significantly reduce operating costs while delivering clean, quiet transportation to local communities across North America. With the greatest range and efficiency of any battery-electric bus in its class, the ZX5 is designed to serve the daily mileage needs of nearly every transit route on a single charge.

Proterra Energy

Proterra Energy enables the electrification of Commercial Vehicles. $37Bn of annual investment expected in global charging infrastructure by the end of the decade. 54 MW of charging infrastructure installed at 450+ charge points across North America. This is what ChargePoint and Blink are trying to dominate. Proterra Energy has a complete lifecycle solution available. They have charging infrastructure, energy management solutions, and recycling in place. The Apex software allows for the complete management of fleet solutions. The fleet operators can monitor the remaining charge on their vehicles, using a single software interface.

Proterra Powered

esigned in house specifically for heavy-duty usage, Proterra’s high-performance drivetrains deliver industry-leading efficiency for the longest range. Proterra Powered vehicles, including Proterra’s electric transit buses, are powered by our popular ProDrive drivetrain and the DuoPower drivetrain, which offer maximum efficiency and effortlessly propel heavy-duty electric vehicles up steep hills. With less moving parts than a combustion engine, Proterra’s electric drivetrains have the added benefit of simplified maintenance for reduced operating costs.

With expertise in designing and manufacturing heavy-duty commercial vehicles, Proterra can do more than supply batteries and drivetrains. The Proterra Powered team helps OEMs seamlessly integrate complete high-voltage systems for any vehicle architecture or chassis, including components such as Junction Boxes, Thermal Management Systems, Telematics Gateways, and Charge Controllers.

Merger Transaction Details

- Pro forma implied equity value of approximately $1.6 billion.

- $852 million cash on the balance sheet to fund the growth.

- Transaction includes $278 million of cash held in trust and an immediate $415 million financing through a fully committed PIPE.

- The deal is expected to close in the first quarter of 2021.

- All Proterra existing shareholders retain equity in the company and are not paid any cash.

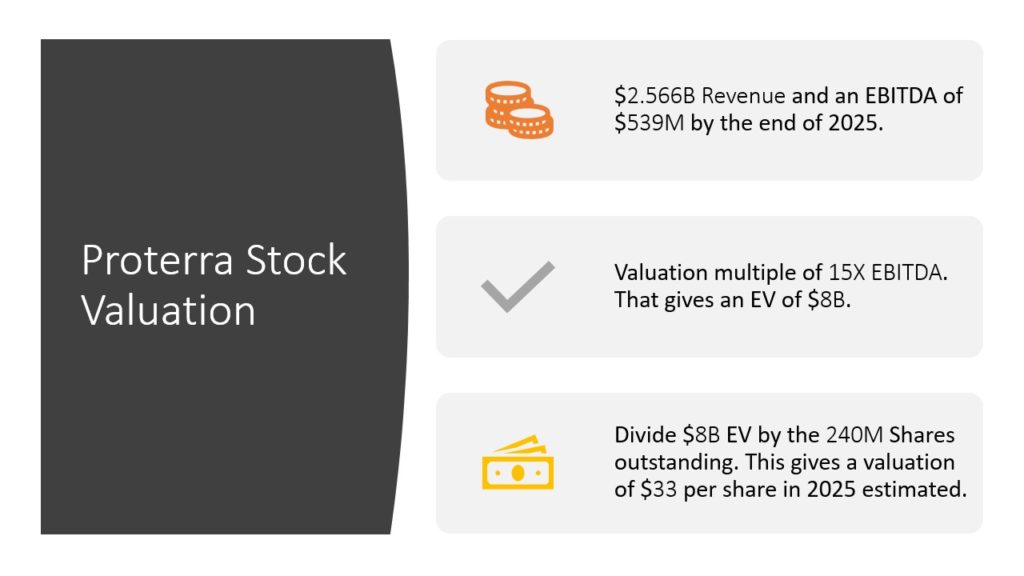

ACTC Stock Share Structure

- 240.1M shares outstanding

- 11.6% ArcLight Public Shareholders

- 2.6% ArcLight Founder Shares

- 17.3% PIPE Investor Shares

- 68.6% Existing Proterra Shareholders

Chamath’s Proterra valuation

Chamath Palihapitiya is a famous venture capitalist, engineer and the founder and CEO of Social Capital. Palihapitiya was an early senior executive at Facebook, joining the company in 2007 and leaving in 2011. He is looking to democratize the IPO process. He already closed 3 SPAC Mergers IPOA, IPOB and IPOC.

Chamath, an avid supporter of green policies, appeared on CNBC and argued the “world’s richest person should be somebody that’s fighting climate change.”

Palihapitiya gave a one-page investment thesis breakdown on Twitter that included some of his reasoning behind the Proterra move. He elaborated both qualitative and quantitative points about the validity of Proterra’s commercial EV business.

One thing to note here is that Chamath got the shares at $10. The stock is already trading at 2.5x right now. So all these valuations need to be changed from that perspective. To put it in words, the following are the new metrics of valuation for retail investors.

ACTC Stock Valuation

ACTC Stock Risks

- As we can see, Proterra is trying to wear many hats at once. In the Proterra Transit, it’s the undisputed leader. On the Proterra Energy side, it’s competing with ChargePoint, Blink, Romeo Power, and QuantumScape. In the Proterra Powered business, the company is competing with XL Fleet. It will be interesting to see how the company will be able to wrest the market share from these competitive and well funded companies that are focused on a specific niche.

- There is the risk of the merger not going through, but with such big financiers lined up, this is highly unlikely.

- Another risk I see is the market has already priced 70% of the growth story and is ready to pay forward multiples for the stock. Any future market contractions may have a huge downside for the stockholders.