Romeo Power (RMO Stock) to combine with RMG Acquisition Corp. (NYSE: RMG), a publicly listed special purpose acquisition company with $234mm cash held in trust and a focus on disruptive technologies in the energy and industrial areas. Romeo has a lucrative order book with Customers Representing 68% Market Share of the Class 8 Truck Market in North America. There is also a significant upside from a Joint Venture with BorgWagner, the global tier 1 automotive supplier.

Is Romeo Power the next QuantumScape? We all know where the QS stock has ended up giving investors a 10X return in a span of a few months. Romeo CEO referred to his company as the “Electrification ETF”. No matter which sector of the EV market a company is in, ultimately the battery technology is the holy grail!

Company background

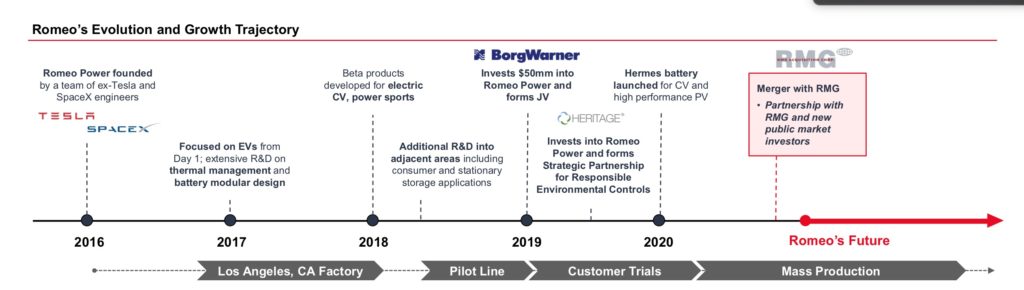

- Romeo Power was founded in 2016 by former leaders from Tesla, SpaceX, Amazon, Apple, and Samsung

- 60+ battery-specific engineers and 100 dedicated employees across all core engineering disciplines including electrical, thermal, chemical, mechanical, electrochemistry

- 113,000 square feet North American Headquarters, strategically located in Los Angeles to attract the best industry talent

- Factory is designed to allow for cost effective expansion of productions lines to 7 GWh / year capability

- Strategic investor and joint venture partner in BorgWagner (BWA). BWA is a global tier-1 automotive supplier.

- $544M contracted revenue booked and $2.4B revenue under advanced negotiation.

- Ideally Situated to lead Electrification of the Global Commercial Vehicles Market. The market size is $665B (17 million vehicles sold annually).

- The EV sector is expected to grow at a rate of 19% CAGR. The combustible engine sector is expected to decline 5% CAGR.

- Highest energy density and fast time to charge. 80% charge can be accomplished in 20 minutes.

- Rigorously tested battery packs for thermal safety.

- Battery recycling is the hidden moat in this business. There is expected to be a huge wastage from all the batteries and the recycling will be a big industry. Romeo Power in partnership with Heritage is developing a battery recycling and reuse factory in return for 30% of net profits.

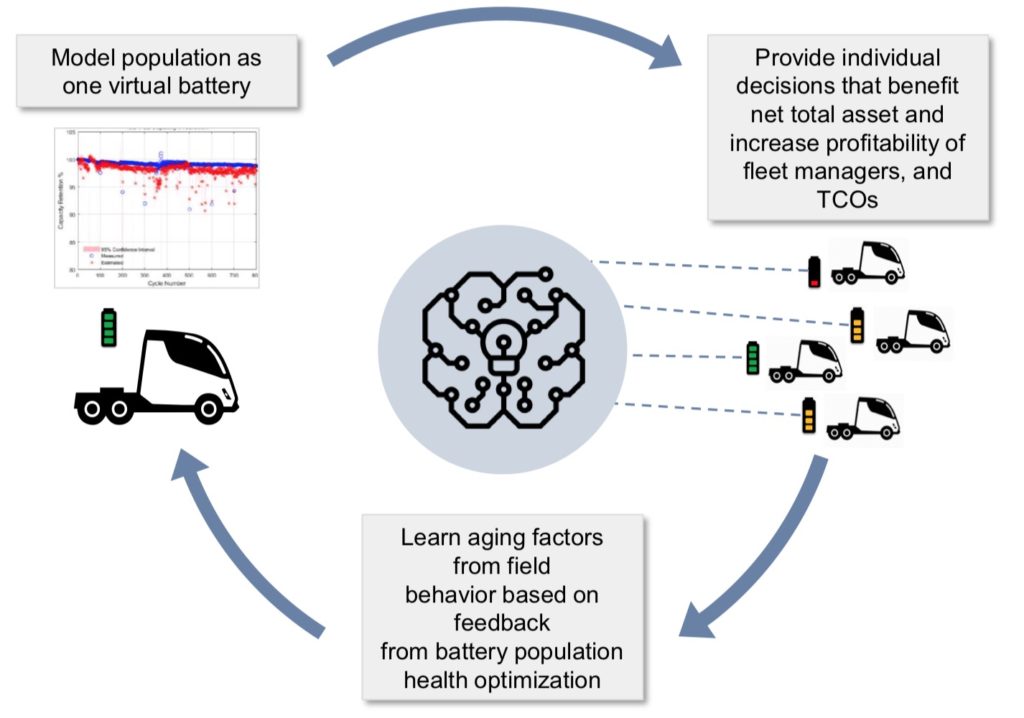

- Machine learning algorithms embedded onboard in the battery packs for Fleet Management solutions.

Battery technology overview

There is a 4-step process currently in place. This starts from testing and validating individual cells until the assembly into the Battery Management System (BMS).

- Cell Science

Romeo’s extensive cell selection process allows the company to rigorously test hundreds of cells and choose only the best for each application, based on energy density, quality and safety standards. The testing process is manufacturer agnostic. The biggest suppliers of Cells are LG and Samsung.

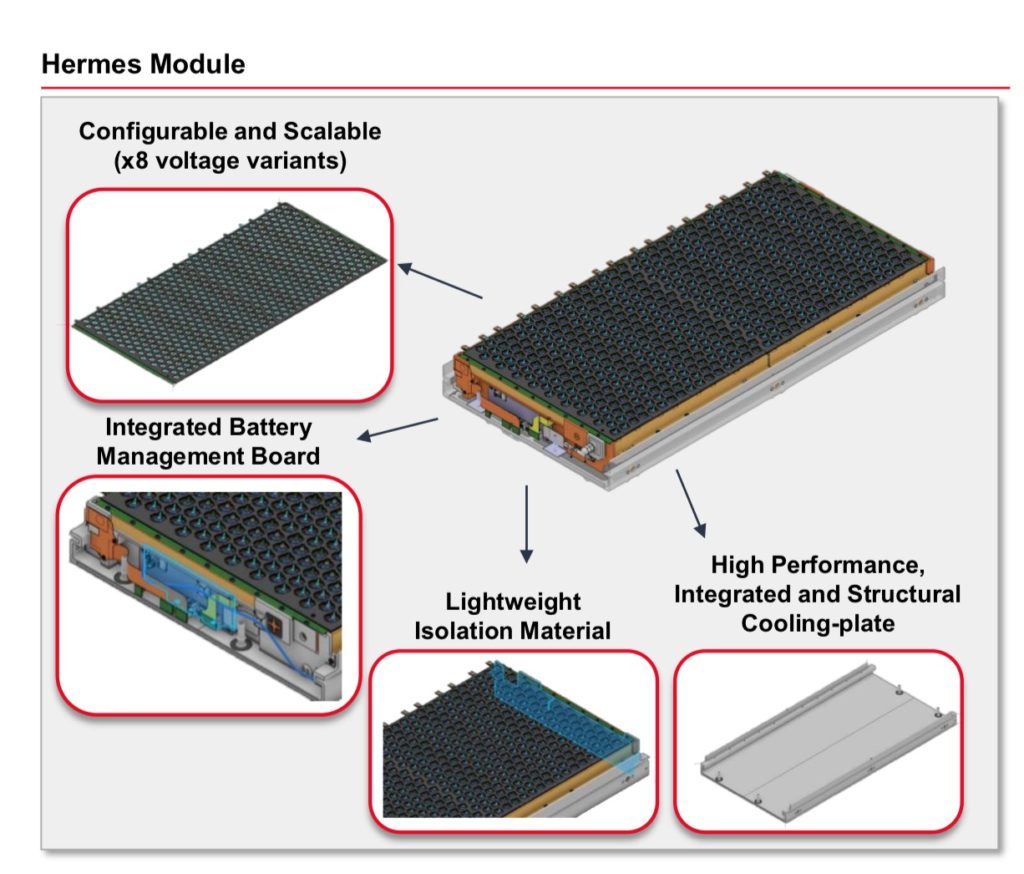

- Module Technology

The Hermes Module is a configurable and scalable building block. It packs 20% to 30% more energy density. It’s chargeable to 80% in 20 minutes. The cells are thermally isolated. This means that if a cell catches fire, the thermal reaction is restricted to that particular cell without propagation. This increases the safety of the battery pack.

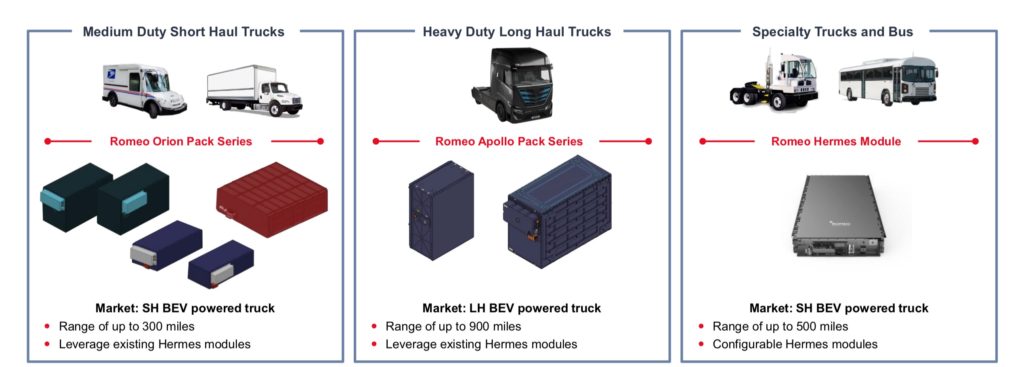

3. Pack Technology

Using the same Hermes Module, Romeo is able to create 192 different products. These battery packs serve a variety of use cases from Class 1 through Class 8 vehicles.

4. Battery Management System

The BMS provides the complete solution for monitoring and controlling complex battery systems for automotive applications. The pack has onboard models that provide accurate battery health estimation and faster charging times. The unit is operable with every vehicle engine control unit. There are machine learning algorithms embedded for Fleet Battery management.

Manufacturing Partnership with BorgWarner

BorgWarner Inc. (BWA) is a global tier 1 automotive supplier with world-class manufacturing, engineering and technology development expertise. The company had 2019 pro forma annual sales of approximately $14.5Bn including the acquisition of Delphi Technologies, and deep relationships across the global vehicle customer universe and supply chain. BorgWarner has a rapidly growing alternative propulsion portfolio including industry leading power electronics and EV drivetrain components.

BWA made an equity Investment in Romeo of $50M in 2019 in return for a 20% equity stake and representation on Romeo’s Board. They helped Romeo build the current production facility. With deep relationships with OEMs, BWA will help expedite the time to market for Romeo’s battery pack solutions. The partnership also provides significant third-party validation of Romeo’s technological leadership and massive market opportunity.

In conjunction with equity investment, BWA and Romeo formed a joint venture to pursue opportunities globally in light vehicles and in HD/MD CVs outside of North America. BWA holds 60% JV equity ownership to Romeo’s 40%. We will see how the finances work when we come to the valuation part.

Strategic partnership with Heritage for Responsible Environmental Controls

Heritage is a leader in the environmental, waste management and recycling services industry with an extensive history of managing / recycling all battery types for thousands of customers. The Heritage Group and affiliates also own 31.6% of Heritage Crystal Clean (NASDAQ:HCCI).

Romeo will work with leading BEV OEM’s to convert 500 diesel trucks owned by Heritage and its affiliates to BEV

- 125 trucks per year 2021-2025

- Total estimated product sales of $54mm

- Projected ROI of 50% and IRR of 26%

Together Romeo and Heritage are developing a battery reuse and recycling facility with capacity to process Romeo’s lithium ion batteries at the end of life. Romeo first batteries will reach end of life between 2025 and 2027. In the interim, Heritage’s current recycling customers will provide the batteries for recycling. Romeo will contribute initial capital for the facility in return for a 30% share of net profits.

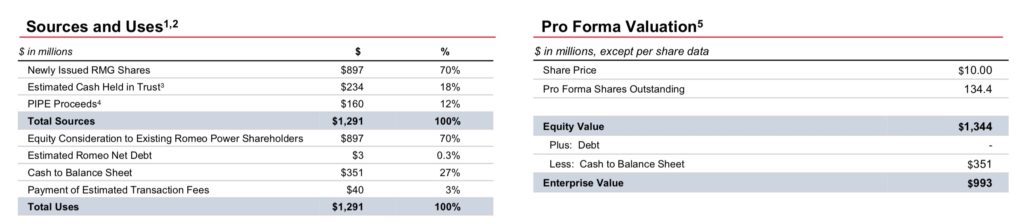

Merger Transaction Details

- Pro forma implied equity value of approximately $1.344 billion.

- $351 million cash to balance sheet to fund the growth. The company plans to use this cash to expand its manufacturing facility and fund the R&D.

- Transaction includes $234 million of cash held in trust and an immediate $160 million financing through a fully committed PIPE.

- The deal has been completed successfully.

- All Romeo Power existing shareholders retain equity in the company and are not paid any cash.

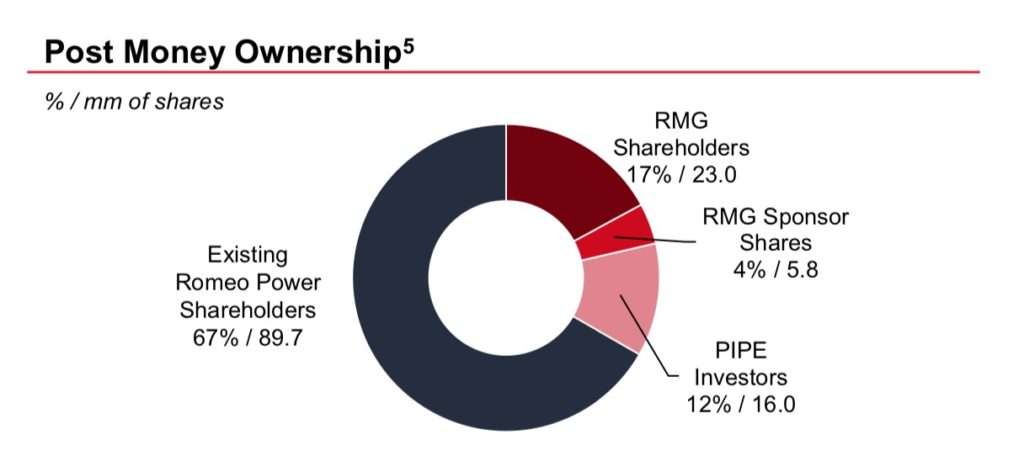

RMO Stock Share Structure

- Total shares outstanding of 134.4 million

- 67% existing Romeo Power shareholders

- 17% RMG shareholders

- 4% RMG Sponsor shareholders

- 12% PIPE Investors

Romeo Power Valuation

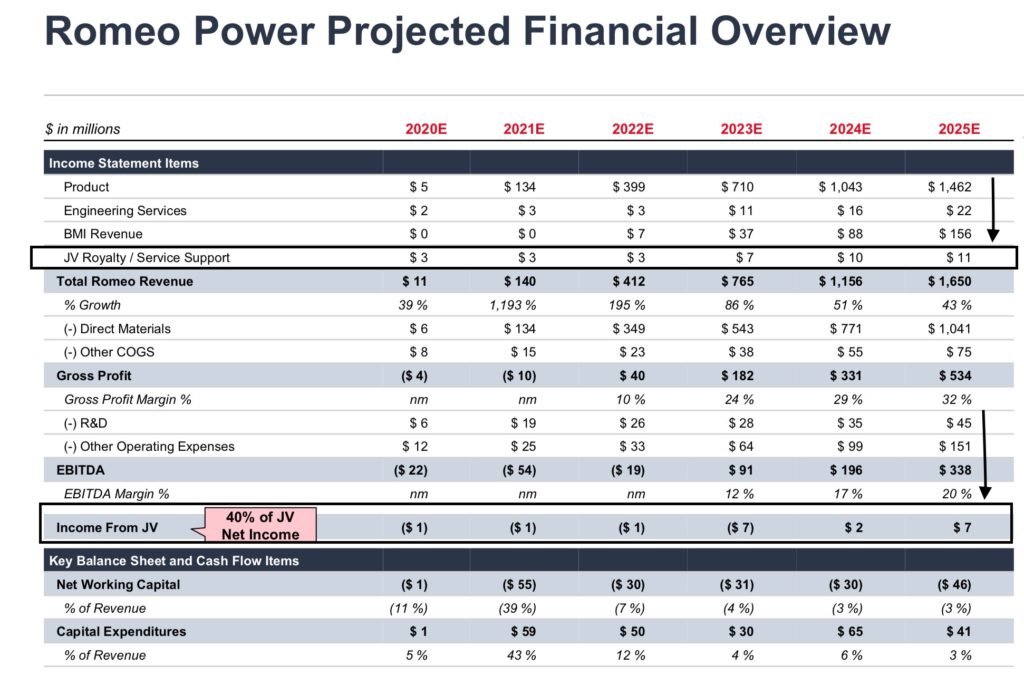

There are two sources of revenue.

- The first is from the main company selling battery pack solutions. The second is from the JV (Joint Venture) with BorgWarner. The company expects $412M Revenue in 2022 and $1.65B Revenue in 2025E at a 59% CAGR. EBITDA margin is projected to expand from 17% to 20%.

- The JV is expected to bring in $708M revenue in 2025 and $17M net income. The management is on the conservative side with regards to the JV projections. Romeo Power will get 40% of the net income from the JV as its share. In addition to that, the tiered IP license pays Romeo Power a $7M flat fee royalty and 0.75% of Revenue over $500M in 2025E. These calculations are also reflected in the revenue projections.

Bull Case Valuation

- $1.65B revenue and $338M EBITDA expected by 2025.

- Valuation multiple of EV/Revenue of 5. That gives an EV of $8.25B.

- Divide $8.25B EV by the 134.4M Shares outstanding. This gives a valuation of $61 per share in 2025 estimated.

Conservative Valuation

- $710M revenue and $91M EBITDA expected by 2025. We have discounted the management’s projections by 40%.

- Valuation multiple of EV/Revenue of 5. $3.55B Valuation.

- Divide $3.55B EV by the 134.4M Shares outstanding. This gives a valuation of $26 per share in 2025 estimated.

Risk Factors

- The battery technology is still to be tested in production capacity. Romeo Power has a thorough process to validate its technology. Ultimately, it will still need to pass with flying colors, once the rubber meets the road.

- The order book also includes approximately $200M orders from Nikola. Nikola is right now deep in controversy with GM cancelling its contract to manufacture the Badger. This part of revenue may not be realized.

- The commercial market is a huge opportunity. But the company should also try to use its partnership with BWA to tap into the OEMs in the consumer vehicle sector. That will allow for diversification for one. The other opportunity would be to invest in technologies like battery swaps for maximum customer satisfaction.

I think the management has been more on the conservative side unlike the other SPACs that I have analyzed. However what worries me is that the price has already run up so much. There may not be much upside left for investors in the next 3 years. The stock will definitely be volatile. It will be interesting to see if it goes up like the QuantumScape stock to the moon. The valuations are definitely sky high for companies in the stock market today. This is definitely true for great companies like Romeo Power.

If you have the stomach to navigate the volatility, hold onto this great stock for the long term. My recommendation is to book your profits after the merger. Wait patiently for any volatility and get into a position where you will have upside left in the future.