Workhorse stock analysis usually is done by revealing news about the upcoming contracts. But a deep dive workhorse stock analysis reveals huge dilution of existing shareholders. The cause of this are the financing deals executed in the form of convertible debt and preferred shares issued.

Here is what’s going well for the Workhorse stock.

- Workhorse has started delivery of the vans to Ryder Systems.

- The company is also among the 3 finalists selected for the USPS Contract to replace their postal delivery vans. The expected result is supposed to come out in the next couple of weeks.

- DiamondPeak (DPHC) is merging with Lordstown Motors. Workhorse owns 10% of Lordstown. Lordstown has an enterprise value of $1.6 billion, giving Workhorse a stake of around $160 million.

If Workhorse wins the USPS contract, the stock may see huge jumps in price. But do you know that you may be pocketing 20% and the lenders are pocketing 4000% profits? How is that even possible?

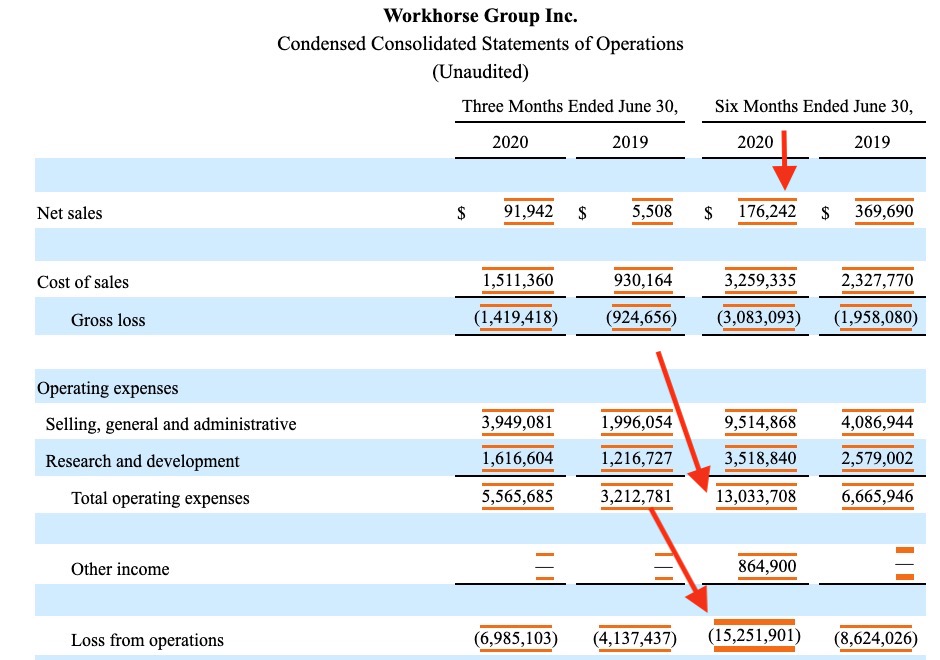

Workhorse Stock Income statement

These are the main highlights for the first six months of the year 2020:

- Net sales around 176 thousand dollars.

- Total expenses of $16 million dollars.

- Loss from operations of $15 million dollars.

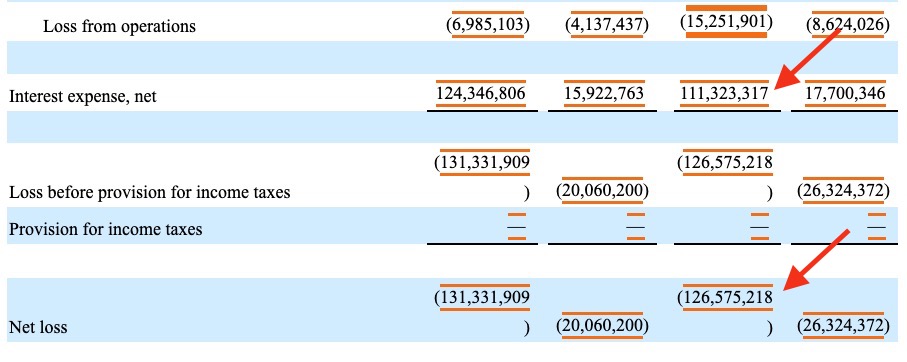

- Take a look at the interest expense and it is $111 million dollars!! Wait am I reading that correctly, how much is actually the debt of the company that its paying $111 million dollars in interest

To find that out, let’s take a look at the balance sheet:

The long-term debt is only $783,889 which is less than a million dollars. Wait, this does not make sense! Interest expense of over $100 million on debt less than a million dollars. Is this even real?

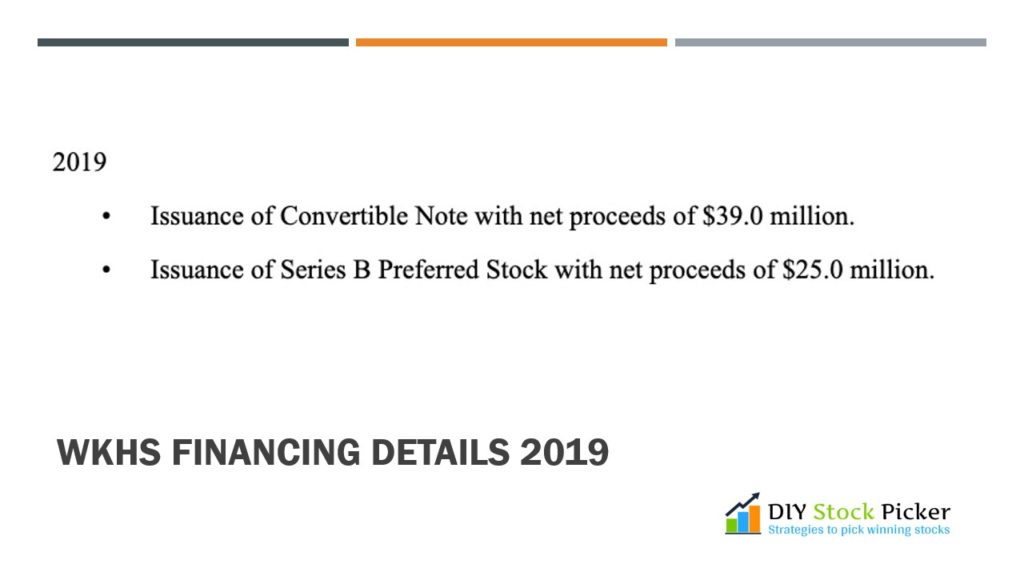

Workhorse Stock Financing deals

Take a look at the two critical financing activities that took place in 2019

The maturities of the convertible note are as follows:

- $19.5 million in 2020

- $18 million in 2021

- $3 million in 2022

These notes can either be paid in cash or in common stock based on the discretion of the Workhorse. However, there is no cash generated from operations, so the only way to pay is to issue common stock to the debt holders. The per share price is $3 and they have to issue as much common stock as to match the debt covenants. As the share price is in the 20 dollar range, it’s a really great deal for the debt holders as they are getting $20 a share at the price of $3.

Workhorse Stock Preferred shares

In June 2019, the company sold 1.25 million Preferred shares of Series B raising $25 million dollars. The annual dividends are 8% and these are payable in common stock and not cash. Do you want to guess what the share price is for these dividends? $1.62!!

So the shareholders are receiving 1.2 million shares at $1.62 each for these dividends. If we take the share price to be $20, they are making 12 times profit at each dividend payment. For the $25 million investment, they get back the full $25 million in June 2023 when the shares have to be redeemed. In addition to that, they are getting $24 million in dividends. And they also receive warrants for each share to purchase 7.4 common shares. Isn’t that a sweet deal??

Shareholder dilution

Take a look at the shares outstanding for the Workhorse stock

- 38 million shares in 2017

- 50 million shares in 2018

- 64 million shares in 2019

- 89 million shares already outstanding this year as of June 30, 2020

The company filed an amendment to its Articles of Incorporation to increase the authorized number of shares of common stock from 100 million to 250 million!

High Trail Convertible Note

The Company entered into a securities purchase agreement, with HT Investments pursuant to which the Company agreed to issue and sell a senior secured convertible note for the principal amount of $70.0 million. The closing of the offering took place on July 16, 2020.

The Note will be due on July 1, 2023. Interest is payable quarterly beginning October 1, 2020 at a rate of 4.5% per annum. The Note is initially convertible at a rate of $19.00 per share. This looks a bit reasonable now, but if the share prices pops higher, the lenders are again scooping up the shares at a great discount price!