Finding an EV SPAC that trades below $15 after a merger has been announced is very rare. FIII Stock SPAC (Forum Merger III Corp) is merging with Electric Last Mile, Inc. (“ELMS”) that has an EV production plant in the USA ready to go and 30,000 preorders for its vehicles. On top of that, the merger target is the only entrant in the Class 1 Commercial EV market, filling a huge void. The Class 1 Commercial EVs support the expected $1 trillion North American eCommerce market by 2025.

The Forum Merger III Corp SPAC was formed by experienced financiers with a solid track record. Their most recent SPAC deal was a merger of plant-based food company Tattooed Chef (TTCF) into Forum Merger II Corporation. This merger gave a return of 250% to the SPAC investors.

Company background

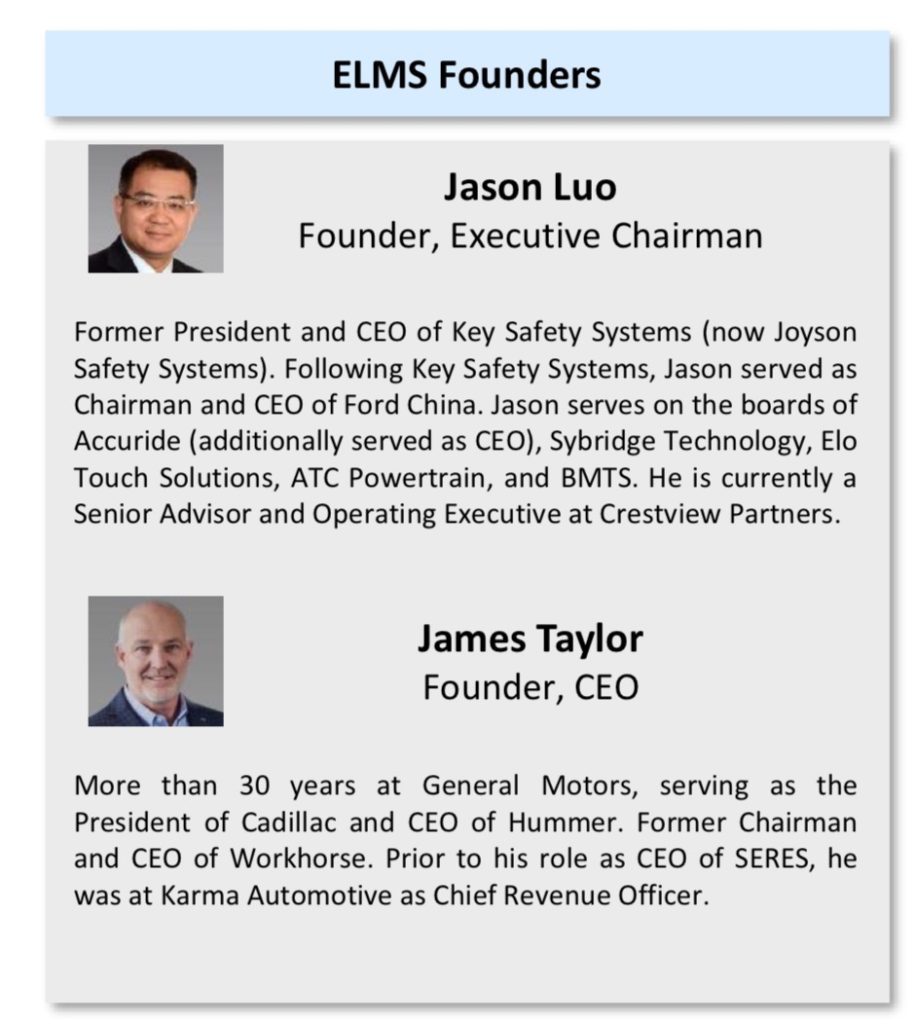

Founder and CEO of ELMS is James Taylor. He served more than 30 years at General Motors, as the President of Cadillac and CEO of Hummer. He was also the former Chairman and CEO of Workhorse.

The Executive Chairman is the former CEO of Key Safety Systems (recently renamed Joyson Safety Systems). This is a massive company competing in the automotive safety equipment space.

The company will be led by veterans of the automotive industry with deep connections with OEMs both in North America and China.

The ELMS deal involves two companies coming together with assets to put into the public vehicle Forum Merger III Corp. The new company Electric Last Mile Solutions (ELMS) is completely based in the USA, manufacturing vehicles in Indiana and employing American workers.

The first company is Sokon, based in China. This company is listed on the Shanghai exchange. Sokon has sold more than 35,000 EC-35 electric vans in China.

The EC-35 is the top-selling electric vehicle van in China. Sokon brings the following benefits to the table:

- Engineering Program in Place to Meet U.S. Regulatory Compliance

- Provide the body production parts

- Domestic Supply of EV Powertrain From Global Suppliers, With Long-Term Battery Supply From CATL

The second company is Seres, which is based in Santa Clara, California. The company was formed to develop electric powertrains and software. Seres invested $130M in Mishawaka, Indiana factory. It bought the plant from GM and fitted it for EV production. The powertrain manufacturer brings the following key components for ELMS:

- 100,000 Capacity Indiana Manufacturing Plant, that up until recently produced the Hummer H2 for AM General and the Mercedes R-Class

- Experienced Automotive and Software Team

- License Rights to EV Tech and Over-the-Air Patent Portfolio

The prototype van has already been produced at the plant. This is what differentiates the company from the other SPAC players. There is a van that is being driven for 1.4 million miles daily in China and a production plant ready for production.

Product Offerings

ELMS is strategically positioning their first two entries in the market across all three classes of commercial utility vehicle. The company is targeting the Class 1 through Class 3 commercial EV market. The product offerings are the Urban Delivery vehicle and the Urban Utility vehicle.

The Urban Delivery vehicle is the only EV offering in the Class 1 segment. It is expected to cost the same as a regular gas vehicle, which is the icing on the cake. No competitor in sight and lowest cost provider! What else can you ask for? The delivery vehicle offers 30% more cargo space and 35% less TCO than the leading Class 1 provider.

The Urban Utility vehicle is in the Class 2/3 segment of Commercial vehicles. This vehicle will be competing with gas OEMs like GM and Ford and the EV offerings in the pipeline like Rivian and Workhorse.

Capital efficient business model

Management estimates the costs to build and launch a new vehicle (including plant) in the North American market from scratch would be $1.6 Billion. Sokon has already put an estimate of $570M in building the EC-35 electric vehicle, which would be the ELMS EV vehicle in the USA. Seres estimates over $130 million invested in the plant including the work already done to adapt the plant for EVs. So at a fraction of a cost of about $160M, the electric van can be launched giving ELMS a huge advantage over other EV players in the commercial market.

Delivery market and use cases

The Last mile vehicles take the goods from distribution warehouses to the customer. This is usually the most costly piece of the whole eCommerce supply chain. ELMS plans to reduce the Total Cost of Ownership (TCO) by 35%. This is by providing more cargo space, reducing the maintenance and fuel costs.

ELMS poised to deliver First Class 1 Electric Vehicle in Q3 2021. The company has Over-The-Air Data systems and a partnership with Industry leader Geotab to provide Digital Solutions to Fleet Customers.

The current commercial vehicle manufacturing process is in 2 stages. The OEMs provide the base vehicle. The upfitters fit it with a custom body in the second stage. This results in a delay of the delivery of the vehicles due to different players involved in the manufacturing process. ELMS has integrated this process into one. The upfitting is available inside the production plant itself. This reduces the time to delivery for the EV vehicles by 25%.

Approximately 30,000 pre-orders are in hand or in process, and customers include some of the largest fleet operators around. This includes companies like IKEA, Best Buy, WalMart, FedEx and Disney.

Merger Transaction Details

- Pro forma implied equity value of approximately $1.196 billion.

- $379 million cash to balance sheet to fund the growth. The company plans to use this cash to expand into the European, Canada, and Mexico markets.

- Transaction includes $250 million of cash held in trust and an immediate $155 million financing through a fully committed PIPE.

- The deal is expected to close in the first quarter of 2021.

- All ELMS existing shareholders retain equity in the company and are not paid any cash.

Share Structure

- Total shares outstanding of 142.5 million

- 66.7% existing ELMS shareholders

- 17.6% Forum Merger III public shareholders

- 4.8% Forum Merger III Sponsor shareholders

- 10.9% PIPE Investors

ELMS Valuation

ELMS operates in 2 main segments. First is the Urban delivery segment and second is the Urban utility segment. The company conservatively estimates that it will be able to capture 5% of these markets. The Urban delivery segment is expected to grow at a compound rate of 13% from 633,000 vehicles sold in 2021E to 1 billion in 2025E. On the other hand, the Urban utility segment is expected to grow at a compound rate of 8% from 378,000 vehicles sold in 2021E to 476,000 vehicles sold in 2025E.

- ELMS expects to sell 83,000 Units by 2025, representing about 5% of U.S. Market.

- This translates to a revenue of $3B and an EBITDA of $791M by the end of 2025.

Bull Case Valuation

- $3B and an EBITDA of $791M by the end of 2025.

- Valuation multiple of EV/Revenue of 5. That gives an EV of $15B.

- Divide $15B EV by the 142.5M Shares outstanding. This gives a valuation of $105 per share in 2025 estimated.

Conservative Valuation

- For a conservative estimation, we will assume that ELMS will penetrate a market share of 3%.

- This will translate to 35,000 sold by 2025E.

- $1.177B revenue and $248M EBITDA expected by 2025.

- Valuation multiple of EV/Revenue of 5. $5.885B Valuation.

- Divide $5.885B by the 142.5M Shares outstanding. This gives a valuation of $41 per share in 2025 estimated.

Risk Factors

- The company is trying to be vertically integrated wearing multiple hats of an OEM and an Upfitter at the same time. As the production ramps up, it will be interesting to see how many use cases they would be able to fulfill. The Class 1 delivery vehicles need to be upfitted for different delivery scenarios. It would have been better to have an Upfitting partner so this work could have been offloaded to an experienced player.

- The Class 1 market is not crowded but the Class 3 market is definitely crowded with experienced EV players and OEMs like Workhorse and Rivian. If the Urban utility vehicles want to downgrade and compete in Class 2, it will run into Ford and GMC electric offerings.

- There is always the risk of the SPAC merger not going through. At this price point, I think it’s a risk worth taking since there is nothing much to lose.

I think the management really knows the advantage they bring to the table. They have the commercial Class 1 van as the top-seller in the China market. They have got a production plant ready and fitted for EV vehicle production. That takes away a huge chunk of capital expenditures. They can produce a delivery van which comes at a price of a gas vehicle after tax credits. This van reduces the Total Cost of Ownership (TCO) for fleet owners. And to top it all, this is the cheapest commercial vehicle in this class.

This is a rare undervalued jewel among the EV SPACs that can be grabbed before the market wakes up and pays attention.