Hennessy Capital Acquisition Corp (Ticker: HCAC), a Special purpose acquisition company, completed the merger with Canoo Holdings Ltd. Canoo Stock is a technology-driven company that develops electric mobility solutions to transform urban transportation. The combined company is listed on the Nasdaq as “GOEV”. The funny thing is when I showed the Canoo vehicles to my kids, they thought they were Legos. But behind these unique looking vehicles, there is a great company offering a unique proposition for the EV manufacturers and OEMs.

Company background

Canoo Holdings was launched in 2018 in Los Angeles, CA. The company was previously known as “Evelozcity” and was founded by former BMW executives, Stefan Krause and Ulrich Kranz. The following are the highlights:

- $250M investment and 19 months to design, engineer and manufacture Beta vehicle

- Over $450M capital raised before SPAC merger

- 250 miles per charge

- 90K Sq. Ft. R&D Center

- Patented skateboard architecture, drivetrain, battery systems, and suspensions

- Level 2.5 Autonomous capability

- 300 employees

- 32 beta and 13 driving prototypes

- Over 50 physical crash tests completed

- B2C and B2B offerings on the cards

The company has developed proprietary EV skateboard technology. This allows for a wide range of applicability. A skateboard chassis is a self-contained platform, with the electronic motors, battery, and driving components integrated to it. This allows for different sizes of vehicles to be topped onto it.

The battery is long and wide. This gives the vehicle a low center of gravity. The skateboard also includes the electric motor. The software powers the motors. The automakers can use the same skateboard chassis and fit different vehicles on top of it. Also since the major components are on the skateboard, this frees up a lot of room for usage.

Canoo Vehicle Offerings

Canoo currently has 3 vehicle offerings

- B2C Lifestyle Vehicle (LV)

- B2B Delivery Vehicle (DV)

- B2C Sport Vehicle (SV)

All 3 vehicles will be available by a subscription model without cost of ownership.

Canoo Subscription Model

The company offers a unique subscription model. There is no down payment and no time commitment. The fee includes the DMV and insurance costs. This is the “Transportation-as-a-service” model. The minimum term commitment is 1 month only. The Canoo App provides a one stop place for managing all these details.

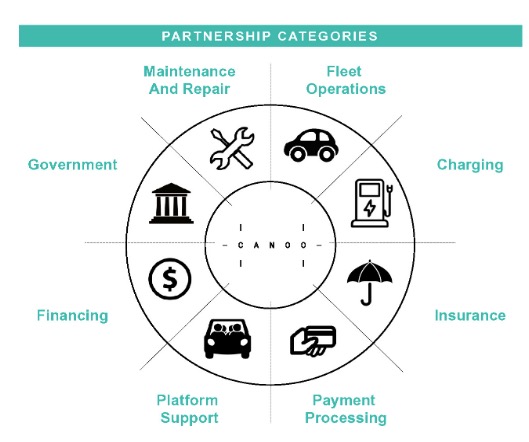

Canoo is targeting 13 key U.S. metropolitan areas initially. They will expand the service gradually. The company has formed key partnerships to be asset light. They plan to use blockchain technology to secure the subscription services.

Manufacturing partnerships

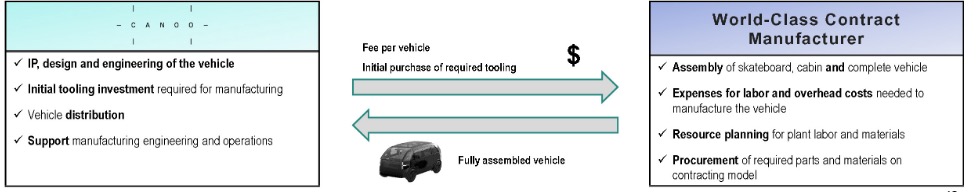

Canoo has established a strategic relationship with a world-class contract manufacturer. The investor presentation does not specify the manufacturer name. Canoo comes up with the Intellectual Property, design and engineering of the vehicle. They also provide the initial tooling investment and support manufacturing and engineering operations.

The Contract manufacturer assembles the skateboard, cabin and complete vehicle. They take care of the procurement of the parts and material. This reduces the cash and capital requirements. They can quickly scale up or down based on the demand.

Industry partnerships

Hyundai Motor Group has engaged Canoo to jointly develop an electric vehicle (EV) platform for the upcoming Hyundai and Kia models. The Canoo skateboard platform will be used in a range of small-sized EVs to Purpose Built Vehicles (PBV). This will result in a reduced cost for Hyundai’s offerings and the savings will be passed to the customers. Hyundai is expected to invest $52B and Kia $25B in electrification and future mobility platforms and technologies. They plan to have 25% of their total sales in EVs by 2025.

Canoo Stock Merger Transaction

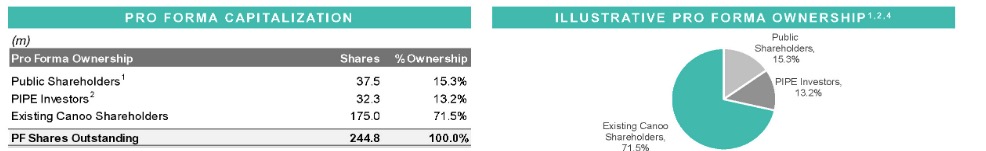

- Pro forma implied equity value of approximately $1.84 billion.

- $607 million cash to balance sheet to fund the production of the Canoo B2C Lifestyle vehicle(LV).

- Transaction includes $309 million of cash held in trust and an immediate $323 million financing through a fully committed private placement.

- The deal has been completed successfully.

- All Canoo existing shareholders retain stake in the company

Share Structure

- Total shares outstanding of 244.8 million

- 71.5% existing Canoo shareholders

- 15.3% Public SPAC and Sponsor shareholders

- 13.2% PIPE Investors

GOEV Stock Valuation

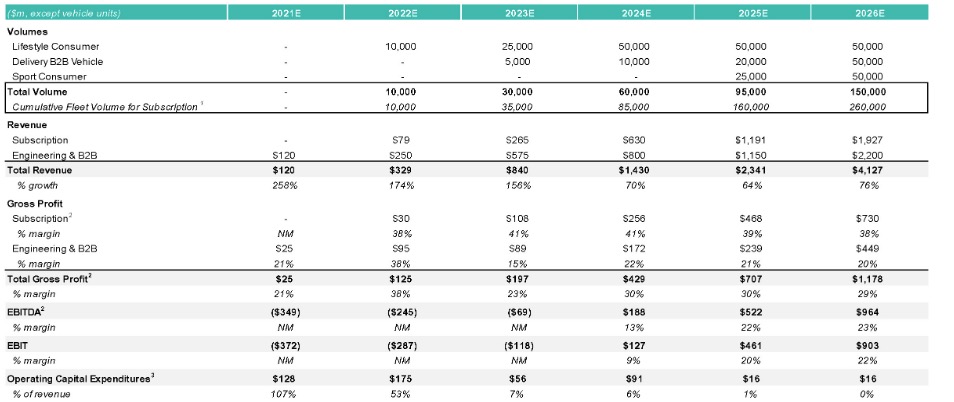

The following is a valuation model that the management has provided. This is based on gradual rolling of the B2C and B2B vehicles.

The expected revenue is $120M in 2021 and going up to $2.341B in 2025. If the company really transforms into a growth company, then a multiple of 10 could be applied to the revenue, which would give it a valuation of $23B. This would give a valuation of $93 per share in 2025.

If a multiple of 4 is applied to the revenue, that gives a valuation of $9.3B in 2025. Divide $9.3B by shares outstanding of 244.8M gives $38 per share.

Risk Factors

The following are a few risks of investing in the Canoo Stock.

- The subscription model is quite unique in the Auto industry. It remains to be seen how successful this model can be. There may be a lot dependent on the terms Canoo negotiates with its service partners. If it is able to get good deals on service, the gross margins will be good. Otherwise, though capital light, a lot of money could be spent on service and maintenance contracts with its partners.

- The Canoo vehicles have a distinct look. This can go both ways. People may really like them but it may turn off some people. This will reflect on the customer adoption.

- Canoo also has to find more partners other than Hyundai and Kia to succeed in its Skateboard Chassis adoption. Agreed there is a huge opportunity for its B2B model, but it’s B2C model’s success will largely reflect on the revenues realized.