QuantumScape’s merger was completed with Kensington Capital Acquisition SPAC. The company produces lithium-ion batteries and is based in San Jose, California. The day the ticker symbol changed from “KCAC” to “QS” on the NYSE, the QuantumScape stock doubled. The valuation is $20 billion for a company. The irony is the first analyst to cover the QS stock gave a sell rating. The target market cap according to the analyst is $13 billion.

Company History

QuantumScape was founded in 2010 by Jagdeep Singh and Professor Fritz Prinz of Stanford University. The company has been working with Volkswagen since 2012. In 2018, Volkswagen invested $100 million in the company, becoming the largest shareholder. In 2020, Volkswagen invested another $200 million. Both companies announced the establishment of a joint production project. This project is to prepare for mass production of solid state batteries.

One of the big shot backers of the QS stock is none other than Bill Gates. Through his private investing venture, “Breakthrough Energy Ventures”. He has a video on his YouTube channel titled “How to build a better battery?” Bill Gates has shown the QuantumScape advantage in that video.

Compared with today’s lithium-ion batteries, solid-state batteries charge quicker and have a greater energy density, meaning vehicles can go farther with the same size battery pack. There is no liquid electrolyte inside the battery. However, the batteries are extremely costly to produce.

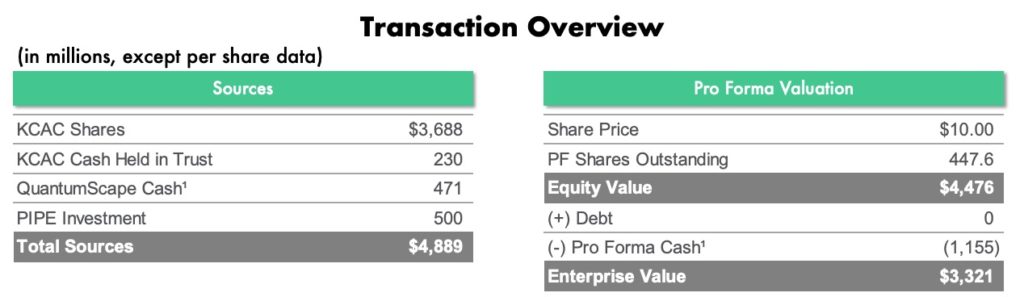

Merger Transaction details

- Pro forma implied enterprise value of approximately $3.3 billion.

- Transaction includes $230 million of cash held in KCAC trust account and an immediate $500 million financing through a fully committed private placement including investments from Volkswagen and Qatar State fund.

- QS had $471 million cash already from earlier private funding rounds.

- $1.15 billion cash to balance sheet to fund the growth of the company.

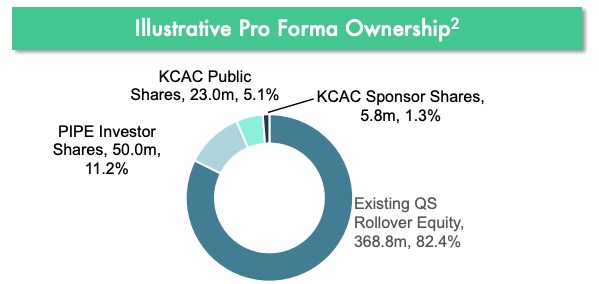

QuantumScape Stock Share count

- 447.6 million shares outstanding.

- 82% QuantumScape shareholders.

- 5.1% KCAC public shareholders and 1.3% founder shares.

- 11.2% PIPE investors.

Bull case Scenario

The requirements of a battery for mass market adoption are as follows:

- 300 miles or more range on a single charge.

- Lower cost of the battery pack.

- Fast charging of less than 15 minutes.

- Battery lifetime greater than 12 years.

- Safety of the vehicles as lithium batteries are prone to fire accidents.

Volkswagen targets to produce 22 million electric vehicles by 2029. They intend to have a solid-state battery line production ready by 2025. The total addressable market is 90 million vehicles. That would amount to about $450B potential battery sales annually.

If the solid-state battery technology is a game changer, QuantumScape will be positioned well to take advantage. The company has accumulated 10 years of R&D investment with more than 200 plus patents to date.

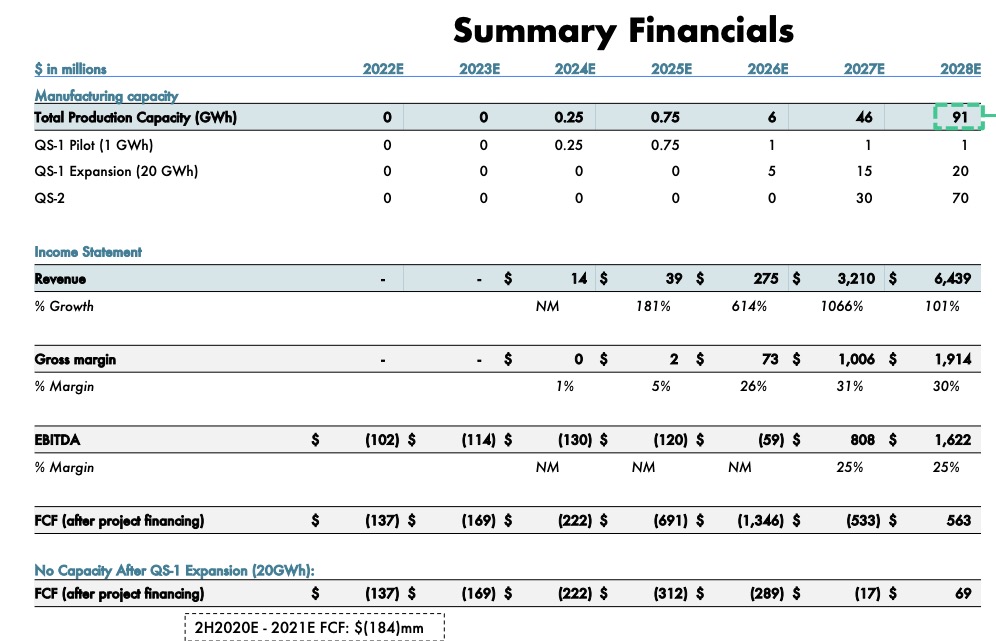

The management’s projections and the revenue would be $6B in 2029. If we use the multiple of 9 for the EV/Revenue, that would give the company an enterprise value of $72B in 2029. If we divide this by the share count of 447M, $72B / 447M = $161 per share in 2029.

Bear case Scenario

There is no revenue projection until 2025. Meaningful revenue generated starts in 2027. The company is expected to be FCF positive by 2028. The gross margin is 30% and the EBITDA margin is 25%. Established companies like Tesla are having margins of 14 to 16%. QS projections are overly optimistic.

One advantage here is that the SPAC transaction has infused enough liquidity to continue research and operations until the company starts generating revenue. However the execution error margin should be close to zero. Otherwise there will be significant periods of volatility ahead for the shareholders.

Conclusion

Bill Gates has backed QuantumScape. But Elon Musk is not in agreement, especially about Gates’ comments about long range electric trucks not being viable for EV vehicles.

For investors, it is a very risky bet. The company can do very well in the future, but that’s a long time away. Market conditions may change. The euphoria for EV stocks may die out in the future. EV vehicles and batteries may become a commodity.

Current Lithium Ion batteries are getting efficient and have a first to market advantage. They may capture the market share before QuantumScape shows up in the scene. This investment is definitely not for the weak of the heart and wallet!