Fisker SPAQ stock is touted to be the next Tesla. However a look at the financials and background reveals this is not the case.

Fisker Inc. (“Fisker”) and Spartan Energy Acquisition Corp.(NYSE:SPAQ), a special purpose acquisition company sponsored by an affiliate of Apollo Global Management, Inc. (NYSE:APO), announced they have entered into a definitive agreement for a business combination that would result in Fisker becoming a publicly listed company. The merger is expected to be approved by Spartan shareholders on the 28th of October, 2020.

The combined company will be listed on the New York Stock Exchange under the new ticker symbol “FSR”

Fisker Inc. Highlights

- The first flagship product will be the Fisker Ocean SUV.

- MOU to share the MEB electric vehicle platform from Volkwagen. This allows Fisker to enter the market in half the time with reduced costs.

- Asset light business model.

- Base price of $38,000 and goes up to $70,000 based on Add ons.

- Range of 250 to 300 miles on a single charge.

- Flexee App allows the customer to complete purchase, adding features, scheduling pickup for a complete digital experience.

Partnerships

- Battery supply contracts with Volkwagen. Built the first fully drivable prototype in 2019.

- Fisker is partnering with Pivet to provide storage and services for Fisker vehicles.

- The company is partnering with Electrify America to provide charging for its vehicles.

Merger Transaction details:

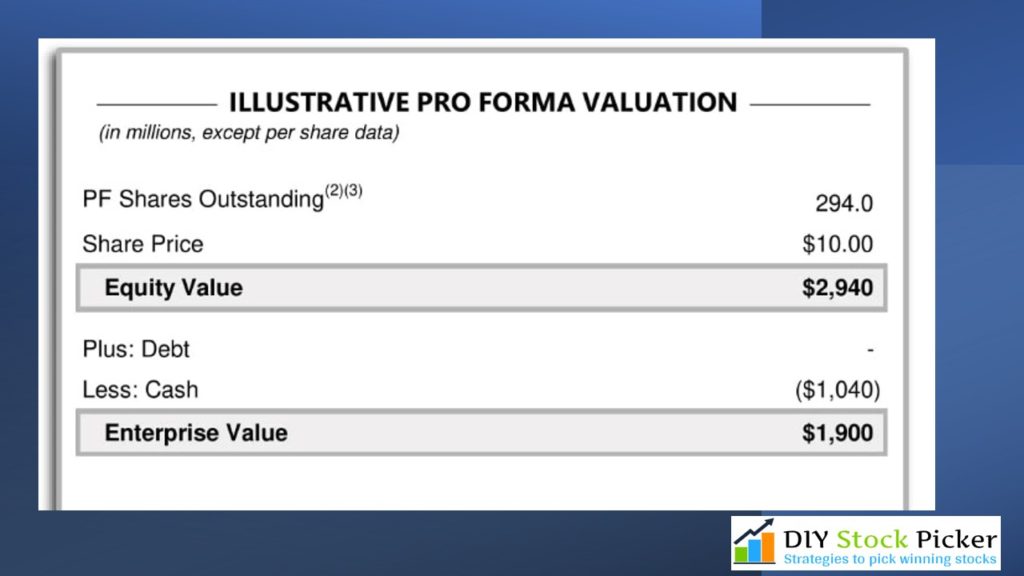

- Pro forma equity value of the merger is approximately $2.9 billion

- Transaction to provide more than $1 billion of gross proceeds to the Fisker company

- Proceeds to fully fund the development of the all-electric Fisker Ocean through start of production in 2022

- Combined company Board of Directors will be comprised of existing Fisker Board members and an Apollo designee

- $500 million fully committed common stock PIPE at $10.00 per share anchored by existing and new investors

Fisker Stock Share count

- 294 million total shares

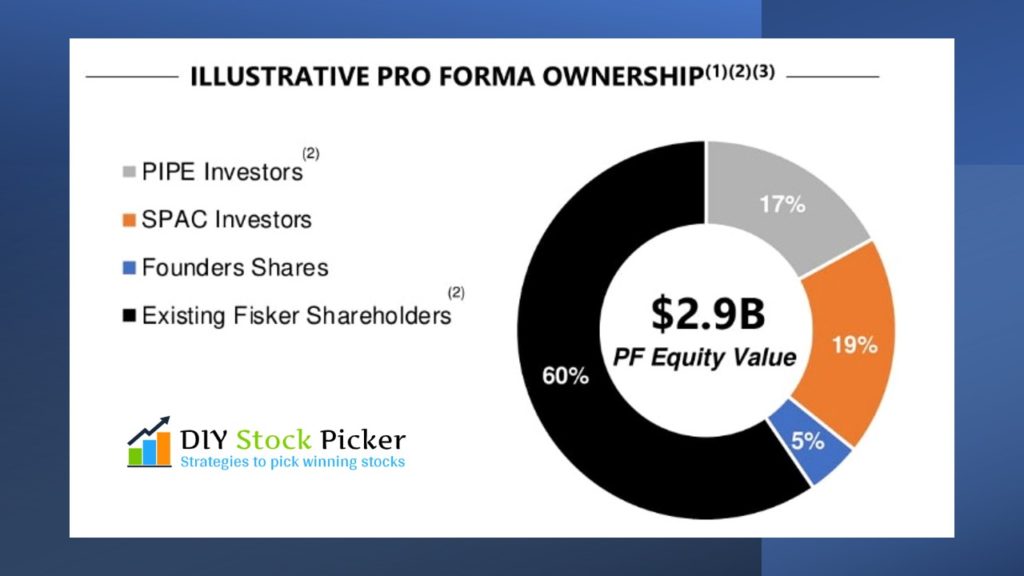

- 60% existing Fisker Shareholders (175 million shares)

- 17% PIPE Investors (50 million shares)

- 19% SPAC Investors (55.2 million shares)

- 5% Founder Shares (13.8 million shares)

Comparison with Tesla

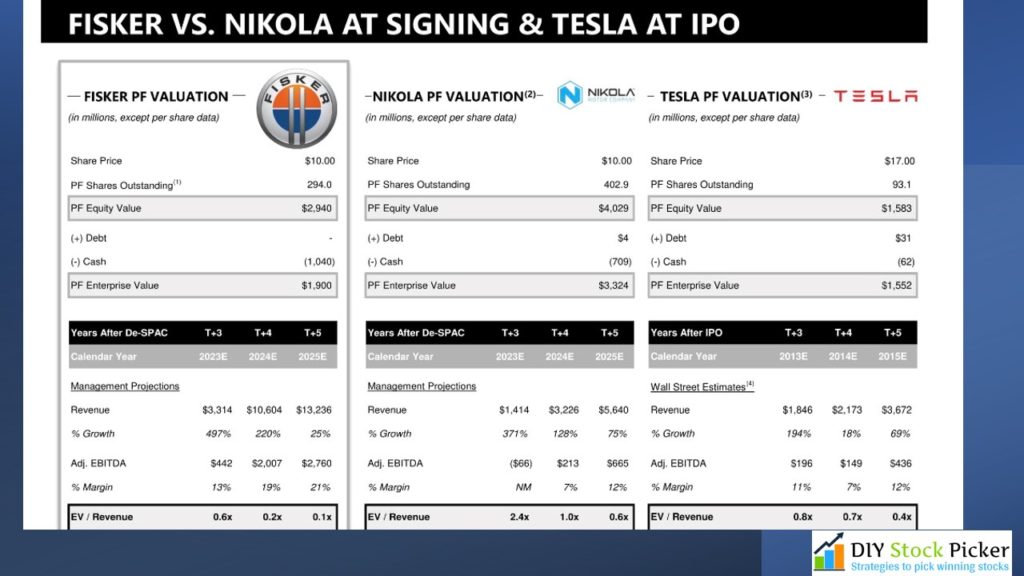

- Some of the biggest assumptions are the expected revenues and the revenue growth. 497% revenue growth sounds like a fairy tale for a vehicle that is not even expected to see the light of the day until 2022.

- If you look at the expected margins, it’s growing from 13% to 19% to 21%. Just the quarter 3 recent Tesla earnings showed margins of 7 to 9% for a completely vertically

- integrated company that manufactures everything from its battery packs to the software platforms.

- Expected FCF positive 2023

- When Tesla started out, it was a novel idea to have electric vehicles. But with the success of Tesla, the space is now crowded with companies trying to get a piece of the action. Agreed there is a huge growth prospect for the EV industry, but winning in this space is not going to be easy.

Some red flags

- Very exaggerated projections in the financial statements as it’s a SPAC transaction that can issue forward looking statements. An IPO cannot do that.

- Mr. Fisker’s wife is the CFO of the company. It would be very difficult to go past regulators if it were an IPO.

- Mr. Fisker has a past failure to his record. He took $200 million in government funding and built the only model Fisker Karma. Then he took in orders at $100,000 a piece. About 2000 vehicles were delivered but were having so many software and parts problems. The company went bankrupt and the public money went to waste.