ABCL stock had its IPO in December and sold 23 million shares priced between $15 to $17 a share. It planned to raise about $380 million during the IPO. By the time the shares opened, they jumped to $60. The Nasdaq was making big moves during that time. With the recent sell off in Nasdaq due to rising treasury yields, the stock has been beaten up and is trading in the $25 a share range.

AbCellera Biologics Inc. was founded in 2012 and is headquartered in Vancouver, Canada. The company’s founder is Dr. Carl Hensen who is also a professor at University of British Columbia. The company is backed by the Bill & Melinda Gates Foundation, early Facebook investor Peter Thiel and DARPA.

Abcellera Technologies background

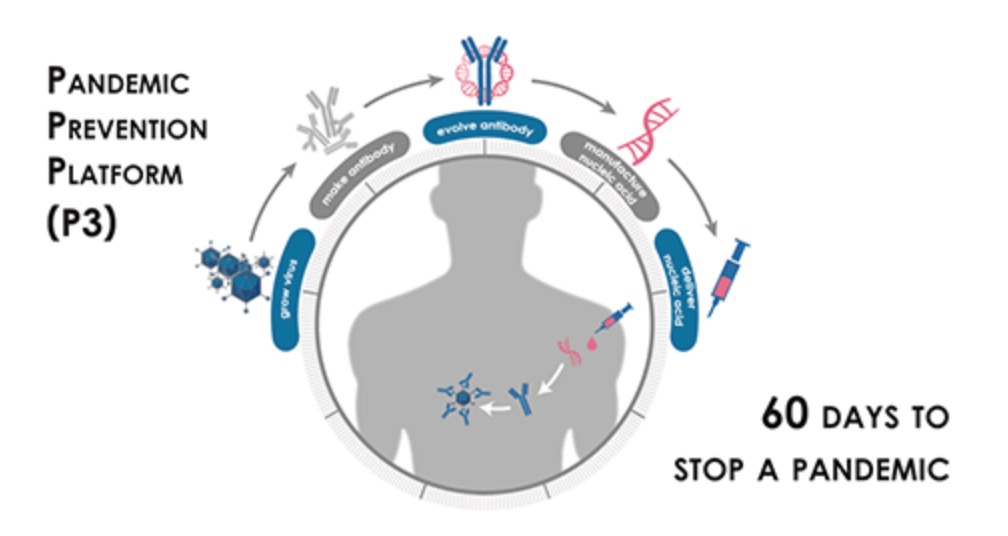

Much of the recent focus given to the company in the media has been in the world record time the company achieved its antibody therapy approval for COVID-19 in partnership with Eli Lilly. Bamlanivimab (LY-CoV555) 700 mg, a human antibody discovered by AbCellera and developed with Eli Lilly and Company (Lilly), administered with a second Lilly antibody, etesevimab (LY-CoV016) 1400 mg, has received Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration (FDA) for the treatment of mild to moderate COVID-19 in patients aged 12 and older who are at high risk for progressing to severe COVID-19 and/or hospitalization.

ABCL Stock fundamental analysis

ABCL stock has a market cap of $7 billion. The company has a Net zero debt. This is really healthy, especially if the interest rates go up in the future. The company has no debt payments to make. The Current ratio is 10. The current ratio is the current assets divided by the current liabilities. This gives an idea of the working capital. Anything about 1.5 is very healthy. The company has enough working capital and is flush with cash from the IPO proceeds.

ABCL has a price to earnings of 55. This is a bit expensive so I think fundamentally the company is still overvalued. The price to book is 7.33. A P/B of under 1.5 usually shows fundamentally cheap stocks.

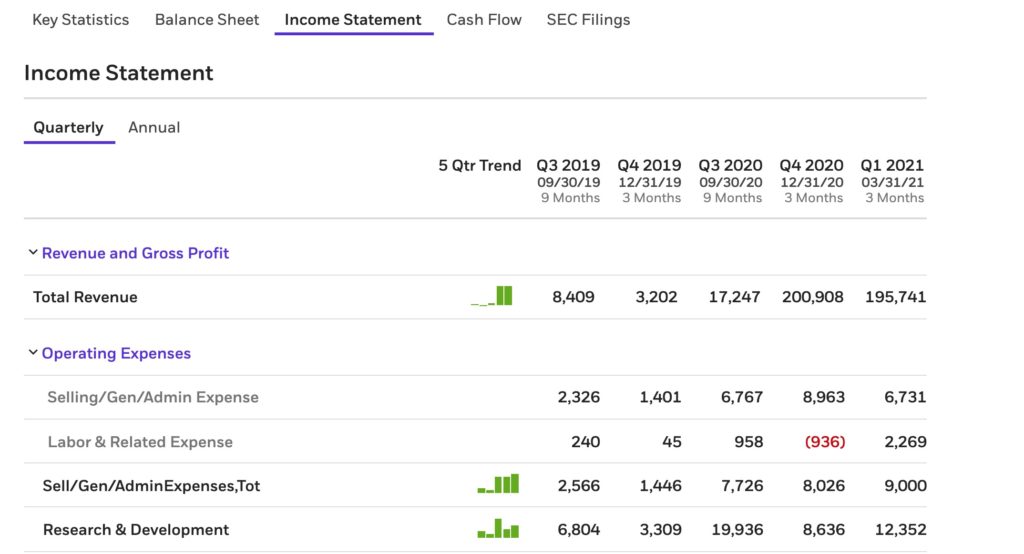

The company achieved exponential revenue growth compared to last year. This is due to the sale of the covid drug. The revenue of $195 million in the first quarter is almost the net revenue of the whole year 2020. The company may post a revenue of close to $1 billion this year.

For a 3 year valuation, let’s assume a growth rate of 50%. $1 billion revenue compounded over 3 years at 50% results in $3.2 billion. Since this is priced as a growth company, a multiple of 10 could be applied to the revenue. That gives it a $32B valuation. Divide by the shares outstanding of 270M, this gives $32B / 270M = $118 per share.

ABCL Stock technical analysis

On the daily chart, the stock has been in a downward trend. The 44-EMA has acted as a resistance. Each time there is an attempt to breakout, the stock price has failed to clear the resistance. From the chart, the price is again attempting the reverse. This is where the opportunity is. The gap between the current price and the EMA is where the swing trade comes in. The volume has been supporting the thesis of this attempt.

So here is the strategy I plan to use. If I have a portfolio of $1000 dollars and my risk tolerance is 2%. The maximum I can lose is $20. The current price is $25.90. If I have a stop loss at $25.25, then I can purchase 35 shares. This is the Iron triangle of Risk management.

Total Capital: $1000

ABCL: Buy 35 shares at $26 per share

Price: $910

Stop loss: $25.25

Sell at:

- When I get stopped out.

- When the price reaches a resistance at $28.11 on the daily chart.

- The MACD line reverses the trend and the gap between MACD and the signal line starts to increase again.

Price Target: $28.11

Risk: $0.75 * 35 = $26.25

Reward: $2.11 * 35 = $73.85

Risk to Reward: 1:3 approximately