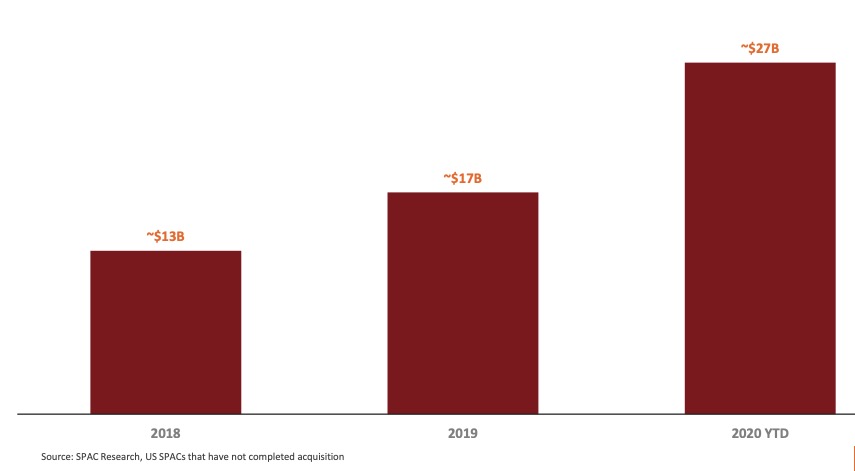

SPACs also known as “blank check companies” have been around for decades. But these are attracting a lot of interest from retail investors recently. In 2019, SPACs had about $17 billion cash in Trust accounts and that has increased to around $27 billion YTD in 2020.

A special purpose acquisition company (SPAC) is a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company.

SPACs are formed by investors or sponsors, with expertise in a particular field. They have an intention to pursue deals in their field. The sponsors usually have a few acquisition targets in mind. These are not disclosed at the time of the IPO. The money raised during the IPO is kept in an interest bearing trust account.

Constraints on an SPAC

The SPAC has two years time to complete a deal. Otherwise the trust is liquidated and the money is returned to the shareholders. An important caveat is that at least 80% of the funds have to be used for the deal. This is where SPACs differ from Private equity. A PE firm can have a portfolio of different companies, but SPAC needs to have one acquisition target.

SPACs can easily acquire targets of about 3.5 times the IPO proceeds. So the ratio of the Enterprise value of the target to the SPAC IPO proceeds can be 3.5. If it is less, the founder shares will have a dilutive effect. For example, a $200 million SPAC with a $50 million sponsor shares can easily merge with a $750 million acquisition target. A $400 million SPAC can merge with a $2 billion target with PIPE funding.

PIPE (Private Investment in Public Equity)

A PIPE transaction is a private investment in a public security. Companies that need to raise money quickly and do not want to pay the expenses for an underwritten secondary offering, often turn to PIPE transactions.

The principal advantage for the company is that it can raise money quickly and privately. The advantage for investors is that they get a discount on the shares, and they also receive warrants as part of the deal.

There are disadvantages to a PIPE transaction, such as dilution of a company’s stock, an immediate adverse impact on the stock price, and lack of immediate liquidity for an investor’s shares.

SPACs gain popularity

In 2020, Bill Ackman, the founder of Pershing Square Capital, who famously turned $27 million to $3 billion during the Coronavirus pandemic, formed his own SPAC. The “Pershing Square Tontine Holdings: raised $4 billion in its offering.

Venture capitalist Chamath Palihapitiya’s SPAC Social Capital Hedosophia Holdings bought a 49% stake in Richard Branson’s Virgin Galactic for $800 million before listing the company in 2019.

“This year has become a boom year for SPACs. Some post-merger returns have been stunning.”

Barron’s – July 6, 2020

“SPACs are essentially a risk-free investment with the potential for a significant upside call option if a strong acquisition target is identified.”

William Blair – July 2020

Robinhood App has reported a significant interest by retail investors in investing in the SPACs.

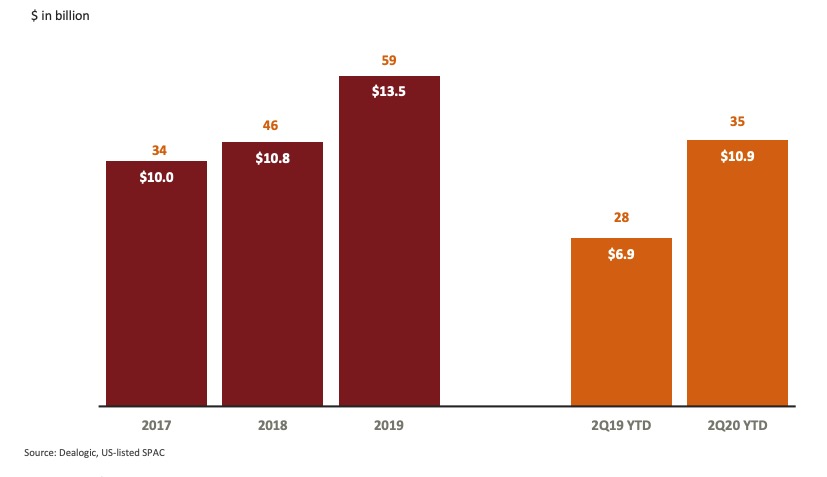

The following are the number of deals announced and the total funds raised in the US-listed SPAC IPOs

Lifecycle of an SPAC

There are 3 important stages in an SPAC process

- Forming the SPAC and conducting an IPO, along with a road show.

- Identifying and successfully negotiating a deal with an acquisition target.

- The De-SPAC process along with arranging PIPE funding.

SPAC Process

- Founders or sponsors invest initial capital to form the SPAC. They are issued founder shares which are usually purchased for a nominal price.

- Warrants are issued to the founders as well, which vest as the SPAC hits the price targets designated beforehand.

- The SPAC IPOs consist of issuing shares and warrants to the shareholders.

- The investors do not know the acquisition target but they have limited downside because the funds are kept as cash. The shares usually are sold for $10 each and each public shareholder is issued a one-third warrant.

- The funds raised are kept in an interest bearing trust account. The interest could be used to fund the working capital of the SPAC.

- SPACs generally have two years to complete a deal and they have a requirement of using at least 80% of the Net assets.

- If a deal is not completed within this time frame, the SPAC is liquidated and the money is returned to the shareholders.

De-SPAC Process

- The de-SPAC process begins once the SPAC announces an acquisition and proceeds to closing.

- The acquisition process is similar to a public company merger. The key difference is that the deal has to be approved by the shareholders of the SPAC.

- The De-SPAC process usually takes four to five months to complete from the date a definitive agreement for the De-SPAC transaction is signed.

- If existing shareholders do not want to vote for the acquisition, they can redeem their initial investment which is usually $10 a share.

- If additional funding is needed to complete the deal, PIPE financing is arranged.

- SEC rules require that SPACs file a special Form 8-K within four business days following completion of a De-SPAC transaction. This Form 8-K is known as a “Super 8-K” and must contain all the information that would be required in a Form 10 registration statement.

SEC documents filed during the SPAC lifecycle

- S-1; S-1/A – General form for registration of securities under the Securities Act of 1933

- 8-A12B – Registration of securities

- 424B3 – Prospectus [Rule 424(b)(3)]

- 424B4 – Prospectus [Rule 424(b)(4)]

- 8-K – Current Report

- SC 13G – Statement of acquisition of beneficial ownership by individuals

- SC 13D – General statement of acquisition of beneficial ownership

- 10-Q – Quarterly report

- 10-K – Annual report

- 425- Prospectuses and communications, business combinations

- S-4 – Registration of securities, business combinations

- PRE 14A – Other preliminary proxy statements

- DEF 14A – Other definitive proxy statements

Super 8-K

Super 8-K material disclosure has the following information:

- Description of property

- Description of Business

- Risk Factors

- Three years of Audited financial statements

- Director and Executive officer Biographical information

- Executive compensation

- Security ownership of 5% Owners, Directors and Executive Officers

- Transactions with related functions

- Material Pending Legal Proceedings

- Description of the Registrant’s Securities

Advantages of SPAC

- The primary advantage for retail shareholders is the limited downside of their capital. As the money is kept as cash until an acquisition, they can wait until they find out the acquisition target and then make a decision whether to proceed further or liquidate their shares.

- Another advantage is a chance to buy into an IPO. Traditional IPO shares are not usually offered to retail investors. The big investment firms and insurance companies are alloted huge blocks of shares. By the time the shares show up in a retail brokerage account, the upside is usually missed. They are available at a huge premium to the IPO price.

- The founders or sponsors have an equity interest in the SPAC and warrants that vest if the SPAC hits the price targets. Thus the founders are motivated to find a great deal.

- The founders are not compensated prior to an acquisition. There is an audit committee and corporate governance structure available to ensure transparency.

- The SPAC IPO is a fairly simple process with standard paperwork. It usually takes a few weeks to get through the IPO.

- The target companies have lower costs to go public. They have an experienced partner who hand holds them and navigates through the regulatory requirements to go public.

- The proceeds available for the target companies could be put to use to fuel growth and improve their capital structure and balance sheet.

- Traditional IPOs cannot issue forward looking statements. Since SPACs are mergers, they can issue forward looking statements. Telling a growth story with future projections is much easier to sell in the market.