HOW TO GET RICH AND STOP LIVING PAYCHECK TO PAYCHECK?

Background

I was always seeking advice on the internet for getting rich and maximize my savings, all I would hear often was “Live below your means and invest the savings”. This is a very valuable and true advice. I would always live below my means but the second part of investing would not make a lot of sense to me. Where should I put my hard earned money to work?

Then I got interested in the Stock market and watched a few videos on Warren Buffet. He would give the same advice of choosing investments within one’s circle of competence and holding for the long run. I then started researching about companies and understood the pricing of the stock market and the key difference between the price and the value. Very good, I opened my brokerage account and started investing my savings. A few of my investments did well and I made some money. Then at the year end, I got my 1099 and was shocked to learn how much of the gains I made had to be paid as taxes.

I started to think more and realized that everyone who made rich had chosen a vehicle for their riches. Buffet initially had his partnership but later, he chose Berkshire Hathaway as his vehicle. The corporate structure allowed him to make investments in such a manner as to minimize the tax impact. What vehicle should I choose? Is there any framework or a vehicle for the individual investor to take him on the path to riches?

Then I learnt about the FIRE movement (Financial Independence, Retire Early) and saw how its adherents would channel their earnings in such a way as to sock away the amount while minimizing the Tax man’s earnings. This made a lot of sense and I educated myself a lot on these strategies.

Then I read the book “The Millionaire next door” and I was shocked at the findings. I really wished this was the first book I read, as the strategies adopted by the millionaires was what I was looking for. I realized the big difference between Income and Net worth. High income does not always translate to high net worth. There are the PAWs (Prodigious accumulators of wealth) and the UAWs (Under accumulators of wealth). I also learned the concept of realized income and how it translates to the taxes one pays. For the first time in my life, I had the confidence that I can be a millionaire as well. I understood the framework and mindset of the rich in creating generational wealth. A person who earns a lot but spends all of it is still poor whereas a person who earns less but lives below his means and invests is rich!

Coming from a software engineering background, my mind was adapted to frameworks that would classify problems into patterns and solve them. This means that any problem would have a solution as a pattern. Complex problems can be solved by breaking them down into simpler components and applying patterns to each.

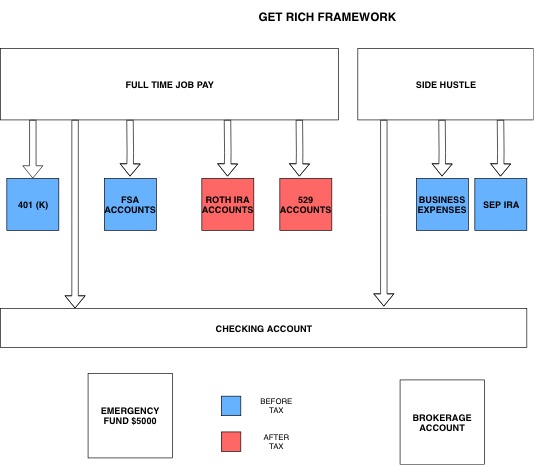

I was now aware of a framework that could be adopted by anyone, no matter what his income and over a period of time, can do very well financially. I put my thoughts into this and created the “Get Rich Framework”. The real mishaps on the road to riches happen due to greed and trying to get rich quickly. This is when rationality of thought gives way to irrational exuberance and destruction of the hard earned wealth. To paraphrase Buffet “Time is the friend of a cautious and intelligent investor and enemy of the irrational and get rich quick type”.

Get Rich Framework

The following are the components of the framework:

Full time job pay: For most of us, who still cling to the safety of the monthly paycheck, this is where the bulk of our income comes from. This is our typical 9 to 5 job. The income is taxed based on the tax bracket one falls in. The goal is to minimize taxable income.

Retirement accounts: Most of the employers offer 401 (k) accounts where employees can set aside their pre tax money for retirement. They also offer matching contribution. There is a limit of $19000 for the 2019 tax year that one can set aside. The employer contribution is an icing on the cake. The goal is to max out this account so that the taxable income gets reduced. Also the contributions grow tax free and all taxes are paid upon withdrawal. Start with a comfortable amount to be set aside and challenge yourself to increase your contributions till you reach the max limit.

FSA Accounts: These accounts are for out of pocket medical expenses and child care expenses that are set aside pre tax.

Roth IRA Accounts: These are investment accounts that are funded by after tax dollars and have a limit of $6000 for 2019 year. These grow tax free and after 59 ½ years, they can be withdrawn tax free as well.

529 Accounts: These are tax advantaged accounts to save for future education costs for dependents.

Side hustle pay: This is the best way to get the feet wet in entrepreneurship. The hobbies we have, the talents we acquire from our full time job can be leveraged to start and grow a side hustle that will supplement the regular income. Over time, this may grow into a business that allows one to quit the rat race of working for others and start working for oneself. From the onset, it’s a good idea to incorporate and start an LLC so as to keep the business separate from oneself.

Business expenses: All reasonable expenses during the operation of the business can be deducted from the income of the business. Home office deduction, internet and cell phone expenses, mileage expenses can be deducted.

SEP IRA: The Simplified Employee Pension Individual Retirement Arrangement (SEP IRA), is an arrangement to provide retirement benefits for business owners and their employees. The maximum one can contribute is 25% of business income or $56,000 for 2019. These contributions can be deducted as a business expense thus reducing the taxable income and serving as an excellent vehicle to stash away side income for retirement.

Checking Account: After filtering through all these, the pay reaches the checking account for spending on necessities. This is the take home pay for the individual. This is the account that will be used to pay rent, groceries, utilities and all other day to day expenses.

Brokerage Account: This is the money that is set aside for investing in individual stocks and any money put in this account is the one that should not be needed for at least 3 to 5 years.

Emergency Fund: This should be at least $5000 that should not be touched unless its a real emergency. It’s better to have about 6 months of expenses saved up here.

Conclusion:

It may be a bit overwhelming to implement this framework as can be seen. A lot of discipline and planning is required. Not all the components can be implemented from the onset. But with diligence, this can be achieved and the income will be channeled in a way that will maximize the investing and minimize the tax impact.

The recommendation is to start with at least the contribution to the 401 (k) Pre tax account that will get the employer’s match. Then redirect the money to pay off all consumer debts and loans. When the tax returns arrive, instead of spending it on the next impulse, have it redirect to the Roth IRA account.

Take the side hustle seriously and put your time and energy in growing it. There is a lot of time that everyone does not know exists but we waste it. Instead it can be redirected to achieve financial independence.

The underlying principle for this framework is the famous “Pay yourself first!”

I hope this helps, I would like to hear back from you on your experiences and any comments/feedback about this article.