DoorDash Inc. which is backed by SoftBank, plans to list its shares on the NYSE. The ticker symbol will be “DASH”. The company seeks to join competitors GrubHub and Uber on the public market.

In the 3 months ending June, the company raked in $675 million in revenue and a profit of $23 million. The rival Uber has not turned in a profit yet since 2014. This has brought a lot of excitement among retail investors for the DoorDash stock.

DoorDash IPO Key Highlights

- DoorDash was founded in 2013, by Tony Xu to help brick and mortar businesses compete in the rapidly changing convenience economy.

- 18 million customers, who completed 900 million orders through the platform since founding..

- 390,000+ merchants, who generated $19 billion in sales.

- 1 million Dashers, who earned over $7 billion through the platform.

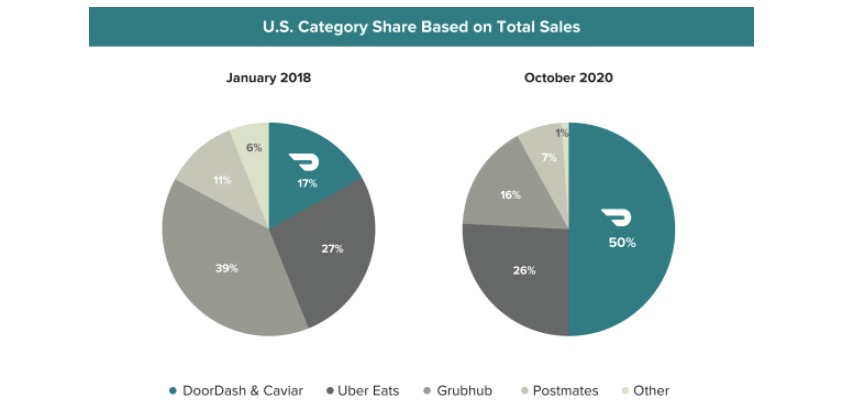

- #1 US Category share.

- Operates in the United States, Canada, and Australian markets.

- Revenue growth of 200% YoY since 2018.

Merchant Services

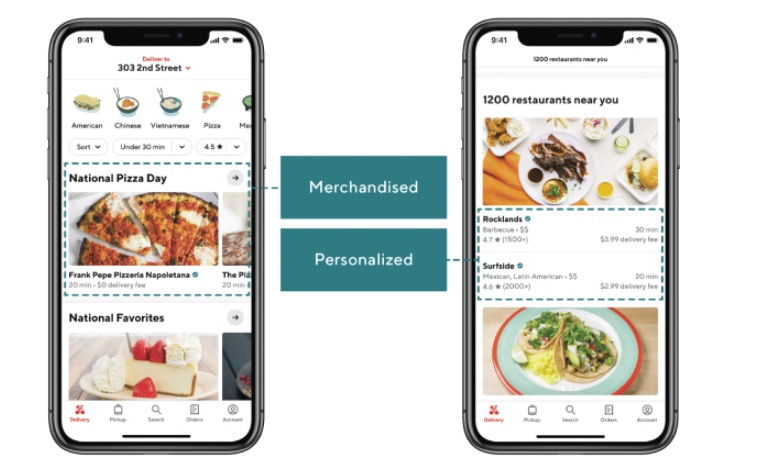

DoorDash connects merchants, consumers, and dashers by facilitating delivery. The company helps merchants in customer acquisition, delivery, insights and analytics, merchandising, payment process, and customer support.

Membership Program

DashPass membership program – customers can pay a monthly delivery fee of $9.99 and get unlimited deliveries from eligible merchants.

Company Values

- Be customer obsessed by solving their problems and delivering long-term value.

- Get 1% better every day.

- Executive management participates once a month in activities like delivery, customer support etc. This is to understand the business from a ground level detail.

- Launch products in new areas for growth.

- Operators are owners, they are compensated in equity. That incentivizes the management to deliver results for shareholders.

Delivery Market background

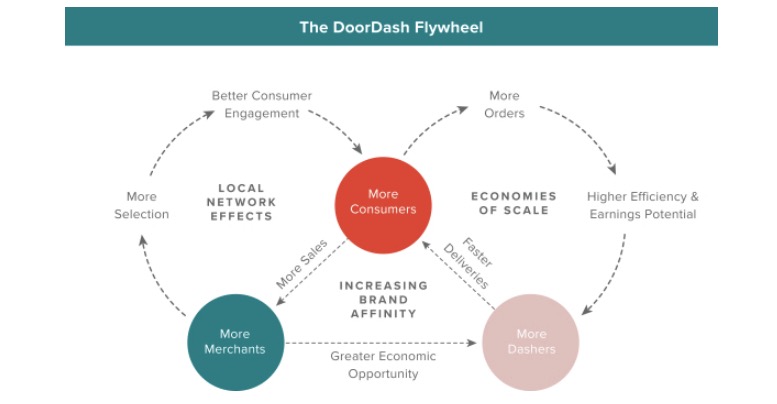

DoorDash had a GOV (Gross Order Value) of $8 billion in 2019. The same year, $302 billion was spent off-premise at restaurants and food services. So there is a huge market to capture ahead. The revenue generated in 2019 was $885 million. Hence the revenue was 11% of the GOV. In 2020, the revenue generated for the first nine months is $1.9 billion. This is a huge growth of revenue. The net loss reduced from $667 million to $149 million. The success comes from local network effects of attracting merchants. Then using the economies of scale to drive revenue. And increasing brand affinity by locking in businesses and consumers.

DoorDash IPO Share Structure

- 253 million shares of Class A common stock has one vote per share.

- 31.2 million shares of Class B common stock is entitled to 20 votes per share. This class of stock will be owned by the founders.

- 150 million shares of Class A stock are kept with the company. These shares will be used to issue stock based compensation to the management and employees.

Key Financial Metrics

- DoorDash had a revenue of $291 million in 2018, $885 million in 2019 and $1.91 billion for nine months ending September 2020.

- Net loss of $204 million in 2018, $667 million in 2019 and $147 million for the first nine months of 2020.

- $1.6B cash on the balance sheet and a working capital of $1.1B.

- The company has accumulated $780 million and $576 million of federal and state net operating loss carryforwards, or NOLs, respectively, available to reduce future taxable income.

- Marketplace GOV of $2.8B in 2018, $8B in 2019 and $16.4B for the first nine months of 2020.

Risk Factors

- If the Dashers are classified as employees, then the operational costs would increase. This is because the company has to provide its workers with benefits like paid time off and unemployment insurance. California recently passed Proposition 22, which classifies the workers as independent contractors. This is a huge win for companies like DoorDash.

- Intensely competitive industry with thin margins.

- Company is not yet profitable by GAAP standards.

- The company is classified as an “emerging growth company”. So the reporting requirements are not very extensive.

Company Valuation

We will try to come up with what the IPO price might be for DoorDash. Its last private valuation was $16 billion, and it has raised $2.5 billion. This was around the June 2020 timeframe. Now that the company has become profitable in its latest quarter, let us assume that they would now want to value the company at $25 billion. The total shares outstanding are 284 million. So dividing the market capitalization with the share count, $25B divided by 284 million, gives an IPO share price of $88. So the ballpark IPO share price may be in the range of $80 to $100. A lot depends on the numerator, what the company will be valued for.