Airbnb, Inc. the American vacation rental online marketplace company based in San Francisco, California has filed to go public. Wall Street Journal reports the AirBnB IPO will be valued at $30 billion. This is a huge comeback from the $18 billion valuation it had earlier this year. The reason the valuation was so low was that the company’s bookings fell due to the pandemic. It went into survival mode, trying to raise money to stay in business and cutting costs.

AirBnB is going public following the IPO filing by DoorDash and Roblox.

AirBnB business

The company began in 2008 when two designers who had space to share hosted three travelers looking for a place to stay. Now, millions of hosts and travelers choose to create a free Airbnb account so they can list their space and book unique accommodations anywhere in the world. Airbnb experience hosts share their passions and interests with both travelers and locals.

AirBnB is a global platform. The company has hosts in more than 220 countries and regions and approximately 100,000 cities, and a global guest community. It has offices in 24 cities and has approximately 2,390 employees located internationally. It has 4 million hosts and 7.4 million listings of home rentals.

Leadership of CEO Brian Chesky

CEO Brian Chesky showed exceptional leadership during the pandemic. He scrambled to raise capital to keep the business afloat. He also redesigned the App and website so people can take vacation from their crowded urban apartments to less crowded suburban homes.

- All discretionary spending has been suspended.

- Reduced full-time employee headcount by 25%.

- Suspending all facilities build-outs and significantly reducing capital expenditures.

- No employee bonuses in 2020 and reducing executive team member salaries for six months.

AirBnb IPO Share Structure

- 284 million Class A shares with 1 vote per share.

- 250 million Class B shares with 20 votes per share.

- 9.2 million shares of Class H Stock with no voting rights. These are held in an endowment wholly-owned by AirBnB.

Key Financial Metrics

- $2.8B working capital and $4.5B cash on the balance sheet.

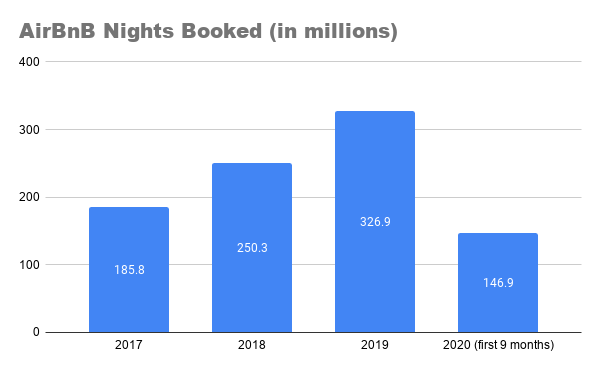

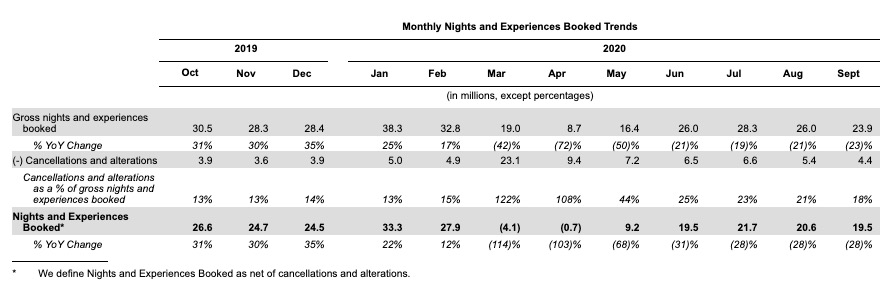

- Nights and experiences booked had been increasing at a steady pace as more hosts and guests started to use the platform.

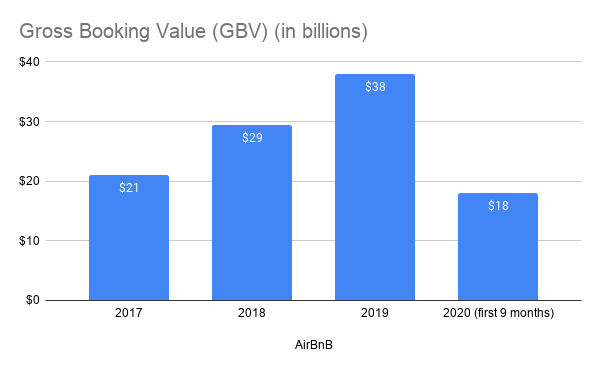

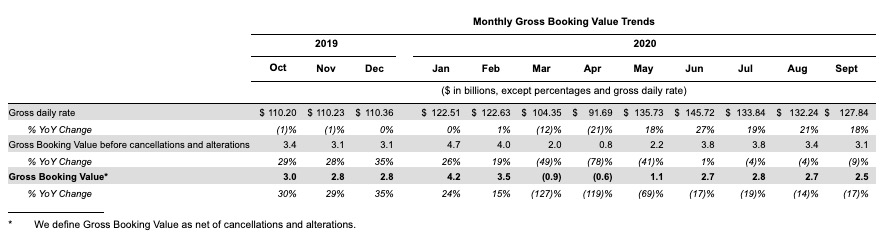

- Gross Booking Value has increased steadily at 45% growth rate until the pandemic hit.

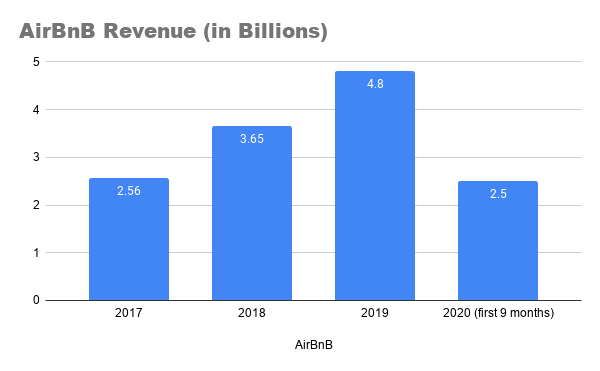

- Revenue was growing at a 35% rate pre pandemic. The revenue is about 13% of the GBV.

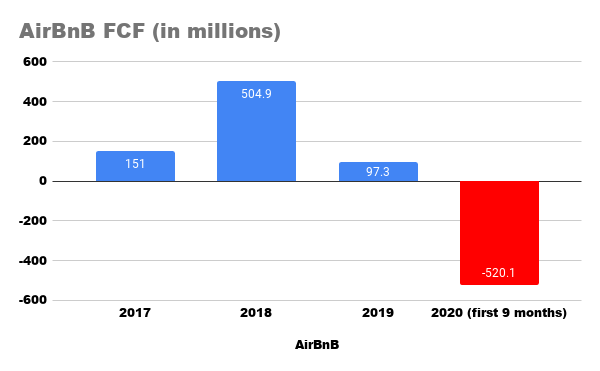

- Cumulative Free Cash Flow until year end 2019 was close to $750 million dollars. In 2020, it was negative $520 million.

Risk Factors

- Due to the COVID-19 outbreak related lockdowns in April 2020, the gross nights booked dropped 72%. From June, it stabilized and dropped 20% Year over year.

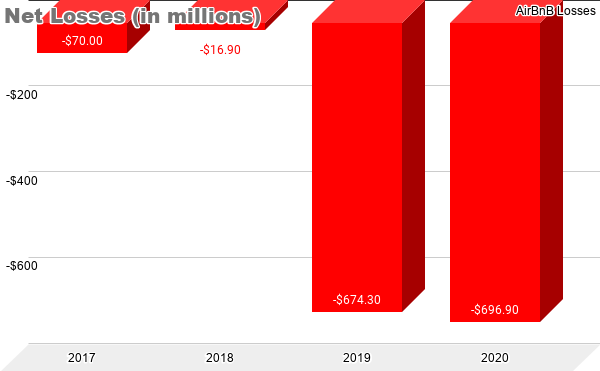

- The company is not profitable so far. The net losses keep getting larger and larger with each year.

- AirBnB has $2 billion debt outstanding on its balance sheet.

- Guest safety has been a concern. There were incidents of crime in the past on the properties booked on the platform.

- Cities may implement regulations putting restrictions on short-term rentals.

AirBnB Stock Valuation

The serviceable addressable market (“SAM”) is estimated to be $1.5 trillion, including $1.2 trillion for short-term stays and $239 billion for experiences. The total addressable market (“TAM”) to be $3.4 trillion, including $1.8 trillion for short-term stays, $210 billion for long-term stays, and $1.4 trillion for experiences.

The IPO valuation may be $30B and the shares outstanding are about 542 million. That puts the IPO share price at $55 per share. The ballpark range may be between $50 and $60 per share.